3 Reasons You Need To Start Your Retirement Planning Today

By your mid-thirties, chances are that your standard of living has improved significantly since your twenties, when you first joined the workforce. But have you considered what will happen when you are no longer able to work for a living? Retirement planning is not something to worry about later; it’s something you need to act on today. Starting early on building your retirement nest egg can make a world of difference to the security of your financial future.

Conducting a pension plan comparison at this stage is also crucial, as it helps you evaluate different options and choose the best plan for long-term financial security. Here’s why you should start planning for your retirement today.

More Savings, More Earnings

We all know the burden of taxes can be a hard one to bear, especially when you have a family to provide for. With the weight of these financial burdens, it can be easy to neglect yourself and your future financial security. You tell yourself that you’ll start saving for retirement once you get that promotion, once you turn 40 or once your kids go off to college.

However, the sooner you begin the better. In fact, investing money in your retirement plan can even help you save on taxes. By investing in retirement schemes such as the Public Provident Fund (PPF) and New Pension Scheme (NPS), you can avail up to Rs.1.5 lakhs in tax deductions under Section 80C.

What’s more, the power of compounding in retirement plan has a lot to offer you. Say you begin investing Rs.300 per month at the age of 25. Assuming an interest rate of 8%, you’d have over Rs.1 million by the time you are 65. Now if you invested the same amount starting at the age of 35, you’d have only Rs.440,000 at 65. In this case, starting a decade earlier would more than double your final amount.

Maintaining Your Independence

When you’ve spent your life supporting and providing for your children, it’s likely that they will want to help you out financially in your old age. However, being too dependent on them could mean them delaying their own financial goals as young adults. Wouldn’t it be better instead for you to have your own source of income? The earlier you start on your retirement savings, the bigger corpus you’ll have to fall back on. Perhaps you will even be able to help your children as they get settled!

And should something happen to you, a retirement plan or a pension plan will help ensure that your spouse and children are looked after in your absence.

Sometimes it seems that the harder you work, the more inflation gets ahead of you. But what do you do about it? You save - not only for short-term goals and emergencies, but for your retirement as well. Even if it is only a small sum that you can manage to stash away at the end of the month, it’s better than nothing, and the small sum will grow eventually.

So don’t hesitate to start investing. Start small and let compounding do its job, so you don’t have to live small later in life. It’s possible to maintain your current standard of living after you retire or even go on that dream vacation. All it takes is the right approach.

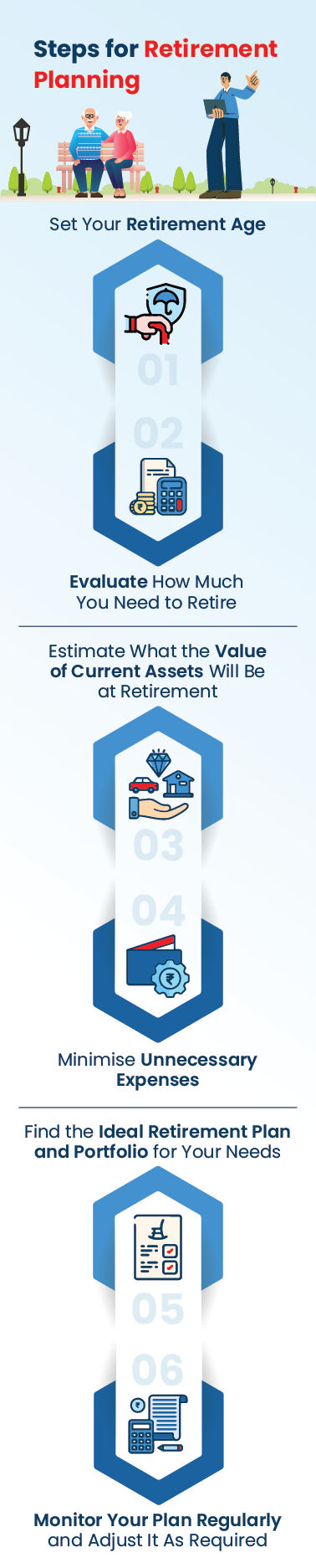

Now that you’ve seen how early retirement planning can help you continue to live life on your own terms even after you’ve stopped earning, your next step is to start investing in a retirement plan. With the abundance of options available in the market, it can be difficult to zero in on the retirement plan for you. At HDFC Life, we provide retirement plans to help you meet the high cost of living and rising inflation. Choose from our range of pension plan options to find the one that best suits your needs.

RETIREMENT PLANS BUYING GUIDE

RETIREMENT PLANS BUYING GUIDE