What do you want to do?

- Term Insurance

- What is Term Insurance?

- How does Term Insurance Work?

- Why Should I Buy Term Insurance in 2026?

- Real-Life Examples based on different Life Stages of Policyholders

- What are the benefits of buying a term insurance plan?

- What are the key features of term insurance?

- Who Should Buy Term Insurance Plan?

- When Should I Buy a Term Insurance Plan?

- What are the 5 important life stages to buy a Term life insurance?

- Types of Term Insurance Plan in India 2026

- Difference between term life insurance and whole life insurance

- What are the best term insurance plans in India 2026?

- Best Term Insurance Plans in India 2026 by HDFC Life

- How to choose the best term insurance in India?

- Choose the best term insurance plan as per my needs

- How Does a Term Plan Secure My Family’s Future?

- Hear from the expert on Term Life Insurance

- How to calculate my term insurance premium?

- Which Factors Affect Term Insurance Premiums?

- How does Age impact your term insurance premiums?

- How Smoking and Non-Smoking Affect Premiums at Different Ages?

- How Gender Affects Premiums Rates?

- How Much Term Insurance Cover Do I Need?

- Why Sum Assured is an Important Factor When it Comes to Term Insurance?

- What is the ideal duration of term life insurance?

- How to choose the right duration for my term insurance?

- Why Does Term Insurance Premium Increase with Age?

- How to reduce my term insurance premiums?

- What are the payout options available with term life insurance?

- What is term insurance riders?

- Some common types of term insurance riders

- Why are term insurance riders important?

- Why should you consider adding a critical illness rider to your term insurance plan?

- Our top riders with Term Insurance plan

- Why choose HDFC Life Term life insurance plan?

- Eligibility Criteria to Buy a Term Insurance

- What is covered and not covered in term life insurance?

- Common mistakes to avoid while buying Term Insurance Plan

- Why Should I Buy Term Life Insurance Online?

- How to Buy Term Insurance Plan Online?

- Documents Required to Buy Term Insurance Plan

- What is a Claim Process?

- How to Avoid Claim Rejection?

- Documents required to process a term insurance claim

- How Long Does It Take for the Claim Approval?

- Consistently High Claim Settlement Ratio of HDFC Life Insurance

- Terms Related To Term Insurance

- Some Common Queries on Term Insurance Answered

- Experiences of term insurance buyers

- Key takeaways for Term Insurance

- FAQ's on Term Insurance

- Customer Reviews

- Talk to an Advisor

- Term Insurance Related Articles

- Share your Valuable Feedback

- Submit your Feedback

- Popular Searches

- Buy Term Insurance in Popular Cities

- Disclaimers

What is Term Insurance?

Term Insurance is one of the most basic forms of life insurance that only offers financial cover for a specific number of years. A term insurance plan provides a financial benefit to your nominee in case of your death during the term of the policy.

A term insurance policy is a pure life insurance product that offers financial benefits only in case of the policyholder's death during the term, in return for the premiums paid. It does not return any financial value in case you survive the term of the policy. If you wish to get your premiums back after the term of the policy you can opt for term insurance with return of premium.

You can buy term insurance by paying regular premiums, in exchange for a financial benefit that goes to your nominee in case of your untimely death.

For example, a healthy 20-year-old non-smoker male would have to pay Rs. 765 per month over 30 years for 1 crore term insurance.

...Read More

Why Should I Buy Term Insurance in 2026?

There are several term insurance benefits that cater to your specific financial protection needs. Here are a few of its benefits:

To Financially Protect Your Family

If you earn and have financial dependents such as spouse, parents, and children, it’s important that you buy term insurance to protect their financial future. The sole purpose of a term insurance plan is to provide the death benefit amount to your dependent in case of your death. The death benefit amount ensures that they can fulfill their financial needs without any struggle.

To Protect Your Assets

If you have loans for things like a home or car, term insurance can protect your family from these debts after you pass away. This financial support ensures they can keep the assets you worked hard for, without the stress of outstanding payments.

To Cope with New Lifestyle Risks

When a family loses their main earner, it can be very challenging to manage finance. The best term insurance plan provides essential financial support to help your family during this tough time. It ensures that your loved ones can maintain their standard of living and manage daily expenses without the burden of financial stress. This financial support is crucial for helping them adjust and move forward without you.

Adequate death benefit at affordable premiums

Term insurance policy is the purest type of life insurance that primarily provides financial protection only in case of death. Since term insurance is the simplest type of life insurance you can avail adequate death benefit at very affordable premiums. You can buy the best term insurance plan for 1 crore at just Rs.19/day.

To Be Prepared for an Uncertainty

Life is unpredictable and full of uncertainties. In India road accidents killed 474 daily on average in 2023 (source: The Times of India16) and 8,89,742 cancer deaths were registered in 2022 (source: Global Cancer Observatory 2022 Data117). Although we cannot prevent unexpected tragic events we can reduce the adverse financial impact that it has. The primary objective of the best term life insurance is to provide financial protection against untimely death. The death benefit provided to a policyholder’s beneficiary helps prevent any financial struggle due to the policyholder’s absence.

Uncertainty arising due to lifestyle diseases

Lifestyle diseases have been one of the leading causes of deaths in India. Deaths due to heart attacks have increased by 12.5% in 2022 when compared to 2021 (source: National Crime Records Bureau). While it is important to live a healthy lifestyle, it is also wise to protect your family’s financial future.This is especially true if you face a serious illness. Opting for term insurance plans can ensure essential financial protection for your family in the event of a serious illness. To get the most comprehensive coverage, choose the best term insurance plans available.

Additional protection with Riders

Term insurance plans offers the option to add riders to enhance financial coverage, ensuring essential protection for your family in the event of a serious illness. The rider amount acts as a top-up to the base cover, and by choosing the best term insurance plans, you can benefit from added options like critical illness riders, accidental death cover, or even a return of premium on survival.

Tax exemptions

Premiums paid for term insurance plans are eligible of tax exemptions7 of up to Rs. 1, 50,000 under section 80C of the income tax act, 19617. The payout of a term insurance is also exempted from tax under section 10(10D) of the income tax act, 19617.

Real-Life Examples based on different Life Stages of Policyholders

These related examples tell you why getting the best term insurance plan is smartest decision at different stages in your life.

Mridul, 27 years - A new job joiner

When Mridul starts his first job in Mumbai, managing expenses becomes tough, and saving feels difficult. He wants to secure his family’s future but is unsure if he can afford insurance at this stage. That is when he comes across the HDFC Life Click 2 Protect Supreme Plus. As a salaried employee, he gets a 15% discount on his first-year premium29, making it easier to start early.

He also likes the flexibility the plan offers. It allows him to increase his life cover by up to 200% for major milestones like marriage, having a child, or buying a home. Moreover, if he ever loses his job, he can take a premium break35 for up to 12 months while the life cover continues. In the event of an unfortunate incident, his family will receive an immediate payout of up to ₹5 lakhs36 to cover urgent needs.

Now, Mridul feels confident that his family is financially protected as he builds his future.

What are the benefits of buying a term insurance plan?

Here are some of the top benefits of term insurance:

High Life Coverage at Affordable Premiums

Tax Benefits

Financial Protection for Your Family

Long-Term Peace of Mind

- You can generally get a coverage of up to 85 years

- Financial protection against life’s uncertainties is one of the key benefits offered by term insurance plans.Additional Coverage with riders

- You can get additional cover against 60 critical illness with our critical illness rider along with the base term plan

- You can get additional coverage against death by accident with our accidental death benefit rider along with the base term insurance policy

Return of Premium Benefit

Zero GST on term insurance

With term insurance plan get a life coverage of Rs. 1 Crore for just Rs.19 per day. For example, a 30 year old non-smoker can secure his family’s financial future for less than his spending on the cost of his daily coffee.

- When you buy term insurance, your premium payments are eligible for tax deduction under Section80C of the Income Tax Act, 19617 up to Rs 1.5 lakhs

- Death benefit amount is completely tax-free under Section 10(10D) of the Income Tax Act, 19617

For example, at 30% tax bracket, you can save up to Rs.46,800 annually for the premiums paid under the old regime of the Income Tax Act, 19617

- In term insurance plans, the death benefit amount acts as a replacement for the income of the primary earner in the family helping to maintain the family’s lifestyle

- The death benefit amount helps cover outstanding loans and major expenses such as children’s education cost

For example, a death benefit amount of Rs.1 Crore would help pay off your home loan (if any) and fund children’s higher education in case of your untimely death

- If you opt for the term insurance return of premium option along with your base term insurance you will get all your premiums on survival back at the end of the policy term

GST on term insurance premiums has been reduced from 18% to 0%. This makes individual term plans affordable.

What are the key features of term insurance?

Term insurance is straightforward type of life insurance that provides the death benefit to the nominee in case of death of the policyholder during the policy term. There are several features of term insurance that makes it a suitable choice for financial protection:

Pure protection :

Term life insurance unlike other life insurance plans (endowment plan, ULIP, and others) only provides death benefit. It doesn’t have a savings or investment component to build wealth.

Affordable premiums :

Since term insurance plans lack any cash component and only provides financial protection in form of death benefit its premiums are lower in comparison to other forms of life insurance (endowment policy, whole life insurance, ULIP and others).

Fixed premiums

Term plan premiums are fixed throughout the entire premium paying term. This helps you predict the amount you need to set aside for the premium every month/year.

Death benefit

The essence of a term insurance is the death benefit (sum assured) that is provided to the beneficiary in case of demise of the policyholder during the policy term.

Desired policy term

You can choose the policy term of your term insurance as per your coverage needs depending on your liabilities, providing for your children, supporting financial dependents till retirement etc. Policy term can range from 5 years to till you turn 85 years.

Flexible coverage amount

The required sum assured in term insurance plans can be arrived at with the help of D.I.M.E. -

Payout options

While the prevalent payout option for the death benefit is a lump sum, term insurance plans offer other options such as monthly installments or a combination of lump sum and monthly payouts. This flexibility helps your nominee or family manage the funds effectively. You can also use a lumpsum calculator to estimate the lump sum amount and plan better for your family's financial needs.

Riders (add-ons)

The coverage of your term insurance can be enhanced with the help of add-on riders such as:

Critical illness rider :

You get an upfront payment in case you are diagnosed with any of the critical illnesses (heart attack, cancer etc.) covered by your term policy.

Accidental death benefit rider :

In case of death due to accident the beneficiary receives additional sum assured along with the death benefit of the base term plan.

Waiver of premium rider :

In case of critical illness or permanent/temporary disability during the policy term, the insurer waives off future premiums, but the term policy continues.

Maturity benefits

Maturity benefits from term insurance depend on the option you have selected:

Standard term plan :

There are no maturity benefits offered by a term insurance in case you survive the policy term.

Term insurance with return of premium :

If you opt for the term return of premium option along with your base term plan, then you will be eligible to get your premiums back on surviving the policy term.

Tax savings

You can save tax under the following sections when you invest in a term plan:

Debt :

Consider the total liabilities you have currently. For example, let’s consider liabilities such as personal loans and credit card bills worth Rs. 5 lakhs.

Income :

Let’s consider the annual income to be Rs. 15 lakhs.

Mortgage :

Home loan amount of Rs. 1 crore.

Education :

Estimated education cost for your children is Rs.25 lakhs.

Desired coverage amount :

5+15+100+25 = Rs. 1.45 crore. Considering the debt, income, mortgage and education, a Rs. 1.5 crore term insurance for the above scenario, would be adequate.

Section 80C :

Premiums paid for term insurance are eligible for tax deductions under section 80C7.

Section 80D :

Premiums paid for health riders under a term insurance plan are eligible for tax deductions under Section 80D.

Section 10(10D) :

Death benefit of a term policy is tax-free under deductions under section 10(10D) 7.

Who Should Buy Term Insurance Plan?

As term insurance is a pure life insurance that provides financial protection, understanding what is term insurance, becomes crucial for making informed decisions. It is ideal for those who have financial dependents and significant liabilities. Here is a further breakdown of who should buy a term insurance:

Individuals with financial dependents

If your family depends on you to provide for them financially then you should definitely buy a term insurance plan. Term insurance is a must if you belong to any of following groups:

Parent with young children :

The sum assured (death benefit) of a term plan ensures that your children’s education, daily expenses and future goals are all covered, even in your absence. As per a report by LocalCircles, 44% of the parents surveyed say their children’s schools have increased fees by 50-80% or more between 2022 and 2025. Year-on-year education inflation rate for the month of May, 2025 is 4.12% in India. Term insurance for parents ensures that in their absence their children don’t have to compromise on their education even with its rising cost in India.

Newly married couples :

The sum assured (death benefit) of a term plan protects your spouse from financial hardship and covers shared financial goals such as a home loan. To find the best fit for your needs, It's advisable to do a term insurance comparison to choose the best term plan.

Individuals with elderly parents or siblings :

If you financially support your parents or younger siblings, a term insurance plan will provide them with a financial cushion in the event of your death.

Family's primary earner

If you are the main income provider for your family then the death benefit of the term insurance acts as a replacement of your salary/income in case of your death. The payout will help your family maintain their standard of living cover daily expenses preventing financial distress in your absence.

Individuals with significant outstanding debt

Home loan borrowers :

Home loan EMIs really take a significant bite out of your income. The sum assured of the term plan ensures that your family doesn't face any financial burden and are able pay the EMIs in your absence.

Individuals with car loan, personal loan and credit card debt :

To ensure that your family doesn't come under the financial stress of repaying loans in your absence, you should opt for the best term insurance plan that provides comprehensive coverage.

Young working professionals

Being young has its perks when it comes to buying a term insurance. At a young age you can lock-in lower premiums for a high sum assured. Premiums tend to increase with age as your mortality risk also increases. For example20, premium for a healthy male of 25 years is Rs.8,071 annually for a Rs. 1 crore sum assured whereas if he delays till the age of 35 years his premium would increase by ~38% to Rs.13,031 per annum (for policy tenure & premium paying term of 20 years).Proactively getting a term insurance plan at a young age secures your financial future as your responsibilities grow in the future.

Working women and housewives

Working woman :

If you contribute to household income and have financial dependents then you should buy a term insurance irrespective of your gender.A term insurance for women ensures that her dependents don't face financial hardship in her absence.

Housewife :

Even though homemakers might not have a direct income, their contribution to how well a household functions is significant. Term insurance for housewife ensures that expenses such as child care, household management and other daily expenses will be covered in their absence. Housewives eligibility of term life insurance depends on the income of their spouse and their spouse meeting some criteria which vary from insurer to insurer.

Tax payers

Term insurance can you help save tax7 -

Section 80C :

You can save tax of up to Rs.46,800/- on the term insurance premiums you pay as deductions under section 80C of the Income Tax Act, 1961.

Section 10(10D) :

The sum assured that the nominee receives is also tax-free under section 10(10D) of the Income Tax Act, 1961.

Section 80D :

You can save tax of up to Rs.7,800/- on the premiums you pay towards health related riders (critical illness rider) as deductions under section 80D of the Income Tax Act, 1961.

Self-employed and entrepreneurs

Term insurance is even more critical for self-employed individuals and entrepreneurs than salaried employees because –

Absence of employer benefit :

Unlike salaried employees, self-employed individuals have no safety net of a group life insurance. Also, self-employed individuals don't have the advantage of employee provident fund or gratuity to secure their retirement.

Irregular income :

Income for self-employed individuals and entrepreneurs fluctuate quite a lot and their untimely death will cause financial stress to their family.

High business debt :

Entrepreneurs often borrow significant loans to start, run and expand their business. In case of their death the financial burden of paying the loan back falls on the family of the entrepreneur.

Business continuity :

Businesses that are primarily dependent on their owners can collapse in case of their sudden demise. The payout of the term insurance will help run the business temporarily and payout any outstanding debts.

Due to the above reasons a term insurance for self-employed is essential for the financial protection of their family and business.

Non-Resident Indians (NRIs)

NRIs should consider buying a term insurance with the primary objective of financial protection for their dependents back here in India. There are several advantages of getting a term insurance for NRI from India instead of their country of residence –

Affordable premiums :

Term insurance plans in India are cheaper than many developed counties like US, UK or UAE due to the highly competitive insurance market in India. NRIs also get 18% GST waiver on premiums paid via NRE (Non-Residential External) accounts that support freely convertible currency.

Worldwide coverage :

Most NRI term insurance plans have global coverage. Irrespective of where the policyholder travels or resides the policy remains active and death benefit is payable.

Peace of mind :

When you are away from your family in a foreign country, it's natural to worry about their financial security in case of your demise. A term insurance plan ensures that you can pursue your dreams with peace of mind about our family's financial future.

Senior citizens and retirees

Although term insurance should be bought at a young age but it can be beneficial of senior citizens who have financial dependents or want to leave a legacy behind.

Continued support for spouse :

To ensure the financial security of dependents like spouse or children term insurance for senior citizen is essential in the absence of the senior citizen.

Cover for significant outstanding loans :

In the absence of the senior citizen the family might face financial hardship to pay back big loans such as home loan. The sum assured from a term plan will ensure that the loan can be paid without any financial stress.

Financial legacy :

For those who plan to leave a sizeable inheritance for their children, the tax-free sum assured of a term insurance plan will help them do so.

When Should I Buy a Term Insurance Plan?

Starting a term insurance early can save you a lot of money. Since the term insurance premium increases with age, signing up now helps you lock in a lower rate. This is even more advantageous for non-smokers. Get ahead of the curve and ensure financial protection for your loved ones while keeping costs manageable. Don’t wait—take a look at the table below to see how premiums rise over time and make the wise choice to start your term insurance today!

Age |

Base Policy Premium (Life Cover ₹ 1 Crore) |

With Critical Illness Cover (₹ 10 Lakh) |

With Accidental Death Cover (₹ 25 Lakh) |

20 years |

Rs.772 |

Rs.875 |

Rs.895 |

30 years |

Rs.992 |

Rs.1333 |

Rs.1115 |

40 years |

Rs.1951 |

Rs.2890 |

Rs.2074 |

50 years |

Rs.4288 |

Rs.7416 |

Rs.4411 |

Disclaimer – Read More...

What are the 5 important life stages to buy a Term life insurance?

While it is advisable to buy term insurance as early as possible to lock-in lower premiums for the entire premium paying term. There are certain important life stages in which you should consider buying a term life insurance:

01 When You Start Earning

When you start earning a steady income in the form of your salary or from your business it is essential that you get term life insurance and take the first step towards financial protection for your loved ones. Early on in your career you will have the advantage of lower term insurance premiums.

02 When You Get Married

When you get married and start a family, financial responsibilities might increase if you are the sole earner. In case of your untimely death, your spouse might have to undergo financial distress if not financially protected with a term plan.

03 When You become a Parent

Becoming a parent is a life-changing event in most of our lives. Along with the joy it also brings the responsibility of your child’s financial future. Your child will be financially dependent on you thus it is crucial that you protect your child’s financial future with a term insurance policy in your absence.

04 When You Take a Loan

Opting for substantial liabilities such as home loans can bring a financial burden on your family in your absence. The life cover of the term life insurance plan should be adequate to help your family pay off the debt in case of your demise.

05 When You Move to a New Country

Life as we all know can be really challenging and unpredictable when you move to a new country. To financially secure your loved ones with you in a foreign country and the ones in India it is a necessity. Life insurers in India provide term insurance for NRIs.

Tip: With HDFC Life Click 2 Supreme Plus you have the option to increase death benefit up to 200% based on life stage changes such as getting married, birth of child and buying a home.

Types of Term Insurance Plan in India 2026

There are several types of term insurance plan available to cater to particular needs for financial protection:

Level Premium Term Insurance Plan

In this term insurance plan the basic sum assured or life cover remains same for the entire tenure of the policy against a fixed monthly or annual premium.

...Read More

Year Renewable Term Insurance

This term insurance needs to be renewed every year and the premium increase every year since your age increase too.

...Read More

Decreasing Death Benefit Term Insurance Plan

The death benefit of this term insurance plan decreases as per a fixed schedule. This term insurance is opt along with a home loan. As the principal amount of the loan decrease with time the life cover of the term life insurance also decreases.

...Read More

Increasing Death Benefit Term Insurance Plan

The death benefit in this term insurance increases every year for the entire tenure of the policy on account of increasing inflation.

...Read More

Convertible Term Insurance Plan

This type of term insurance plan gives you the option to convert your term insurance into a permanent insurance during the conversion period. The duration of the conversion period depends of the length of your term insurance plan.

...Read More

Joint Life Term Insurance

As the name suggests, joint life-term insurance covers you and your spouse under a single plan. You, as the primary life assured, and your spouse, as the secondary life assured, both can experience a shared or separate coverage amount.

...Read More

Term insurance with return of premium (TROP)

If the policy holder survives the term of the policy then the premiums are returned and the policy is terminated.

...Read More

Difference between term life insurance and whole life insurance

Let’s understand the difference between term life insurance and whole life insurance

Features |

Term Life Insurance |

Whole Life Insurance |

Coverage Duration (policy term) |

Term insurance provides financial protection during the most crucial years. The policy term depends on how long you will have financial dependents and responsibilities (mortgage payments, children’s education). You can opt for a term life insurance up to 85 years of age, but the policy term depends on your financial needs. |

Whole life insurance, also known as permanent life insurance, provides financial protection till the age of 100 years. The longer policy term ensures that you can secure your financial responsibilities even if there are unexpected delays in your mortgage payments or your children are dependent on you for longer than expected. |

Purpose |

The purpose of term life insurance is to provide financial protection to your dependents in case of your untimely demise. |

The purpose of whole life insurance is to provide financial protection to your dependents till you are 100 years old. The longer policy term gives you the opportunity to leave a financial legacy behind for your family. |

Premiums |

Term life insurance is the cheapest form of life insurance as it only provides pure financial protection in case of your death. |

Whole life insurance tends to be more expensive than term life insurance because of its longer policy term (till 100 years of age), you can use a life insurance calculator to estimate the costs based on your age, health, and coverage needs. |

Payout on Survival |

Term life insurance doesn’t provide survival benefits as it provides only life coverage. |

Whole life insurance covers till the age of 100 years thus there are no survival payouts. |

Investment Component |

Term life insurance only provides death benefit. The premiums paid go towards providing only life coverage during the predefined policy term. Unlike traditional life insurance plans financial protection is not diluted due to absence of investment component in term life insurance. |

Whole life insurance does not include an investment component, meaning the entire premium is allocated solely to providing life coverage until the age of 100. It's important to note that GST on whole life insurance is currently 0%, which means there is no additional tax on the premiums, making it more affordable and straightforward for policyholders. |

Loan against policy |

Term life insurance is the simplest form of life insurance without the option to avail loan against policy. |

Due to lack of investment component in whole life insurance it doesn’t provide the facility to avail loan against policy. |

Conversion Option |

Term life insurance is typically not convertible to whole life insurance. However, certain term life insurance plans provide a conversion option. |

Since a whole life insurance offers life coverage till the age of 100 years it does not need to be converted. |

Policy Expiry |

Term life insurance expires after the end of the predefined policy term. |

Whole life insurance expires only once you turn 100 years old. |

What are the best term insurance plans in India 2026?

Indentifying the best term insurance in India out of the various options available can be a challenging task. The easiest way to identify the best term insurance in India is to check for the claim settlement ratio of the insurer, brand trust of the insurer, affordability of the term insurance and ease of claim settlement process. Here are some options for one of the best term insurance plans in India:

Term Plan |

Benefits |

Term Insurance |

This policy offers financial security and protection to your dependents and beneficiaries at affordable premium rates, ensuring they’re supported if something happens to you. |

Term Insurance with Critical Illness rider |

This policy ensures your family’s financial security if you pass away unexpectedly. The lump sum payout can help cover your family’s financial needs and goals. Additionally, you can add a Critical Illness rider for extra protection against a range of serious illnesses, depending on the plan you select. |

This type of term insurance offers financial security to dependents at a low premium if the policyholder dies. If the policyholder outlives the policy term, all premiums paid are returned. |

|

Term Insurance with Waiver of Premium Waiver |

Under this plan, all future premiums are waivered in case there is a covered dismemberment or a critical illness diagnosis. Such a plan eases the stress of financial security in the face of unexpected situations and health concerns. |

Term Insurance with Accidental Disability & Death Cover |

In case you avail additional financial protection in form of accidental disability and death cover along with your base term insurance, your nominee will receive the additional cover in case of your death due to accident |

Term Insurance with Monthly Income |

This insurance plan features payout in the form of monthly income to help ensure a regular inflow of money besides the lump sum received as a death benefit. |

This is an insurance plan offered by employers to their employees to lend financial security to their families. It is an affordable insurance cover for death or disability caused by illness or accident. |

|

Increasing sum assured plan |

In this plan, the sum assured increases by a certain percentage, typically capped to a multiple of the original sum assured. The premiums are higher than a level plan as the benefit amount increases with each passing year. |

It is a type of term insurance that does not have a definite policy term and the policy terminates on death of the life assured or provides coverage at least up to attainment of age 80 years if all premiums are paid as per the premium paying term. |

Best Term Insurance Plans in India 2026 by HDFC Life

Here are the best term insurance plans offered by HDFC Life:

Term Insurance Plans |

Customer profile |

Sum assured |

Premium amount9 |

Action |

HDFC Life Click 2 Protect Supreme Plus (Life option) (UIN:101N189V01) |

For all between 18-65 years |

1 Crore |

Rs.70619 |

|

HDFC Life Click 2 Protect Elite Plus (UIN:101N182V01) |

Salaried segment |

2 Crore |

Rs.115311 |

|

HDFC Life Click 2 Protect Life (UIN – 101N139V08) |

Salaried segment |

1 Crore |

Rs.119121 |

|

HDFC Life Click 2 Protect Ultimate (UIN: 101N179V01) |

Annual income >Rs.10 Lakhs |

2 Crore |

Rs.140015 |

|

HDFC Life Sanchay Legacy (Life option)12 (UIN:101N177V04) |

Mature HNI segment |

1.2 Crore |

Rs.1,00,00018 |

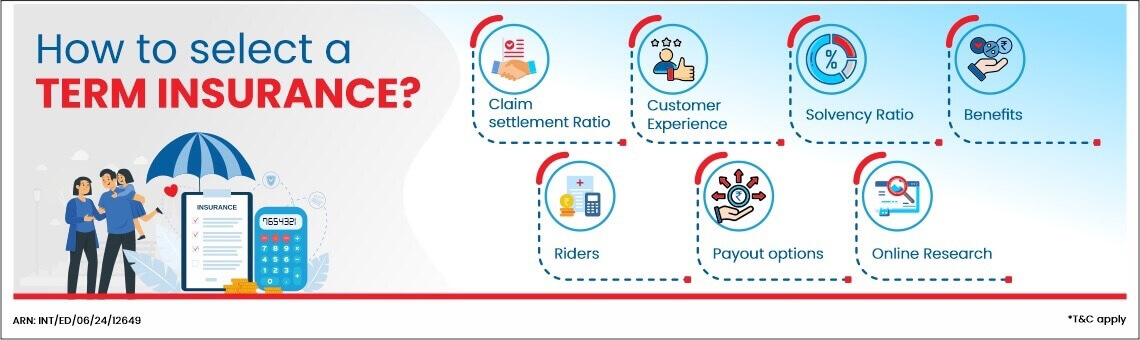

How to choose the best term insurance in India?

To ensure you choose the best term insurance in India, you should:

Evaluate your and your family’s financial needs

While selecting a term insurance plan, it is essential to map the benefits carefully. Your term plan should help your family maintain a healthy standard of living, cover all liabilities, and meet future expenses. Choosing from the best term insurance plans can ensure you get a plan that offers adequate coverage and aligns with your family’s financial needs.

Look at the Claim-Settlement Ratio

When evaluating term insurance plans, it is important to consider an insurance company’s Individual Death Claim Settlement Ratio, as it indicates how likely they are to settle your nominee’s claim. You can check a company’s Individual Death Claim Settlement Ratio online. HDFC Life has a Individual Death Claim Settlement Ratio (CSR) of 99.68%##

Understand the Customer Experience

Ask people you trust about their experience with the insurance company you prefer. You can also check online reviews from customers to understand whether individuals enjoy a pleasant experience with the company or not. Remember, your term plan could continue for the rest of your life, so you need to build a lasting relationship with the company.

Check the Solvency Ratio

The solvency ratio refers to a company’s ability to financially fulfill the insurance obligations. The IRDAI mandates that all insurance companies should have a solvency ratio of at least 150%, making it an important factor to consider when selecting a term plan. HDFC Life's solvency ratio is 194% for FY25.

Consider the Benefits

Not all term insurance plans are equal. You should look for policies that offer higher benefits than others. Try and find policies that offer maturity benefits as well as flexible payment and payout options.

Choose Riders

Term plans offer more than just life cover. You can opt for riders that provide coverage for critical illnesses and accidental disability as well. The payouts from these add-ons can go a long way in offering financial stability to you and your loved ones at a difficult time.

Find Flexible Payout Options

When you purchase a term plan, you often have specific financial goals in mind. Most term insurance plans offer lump-sum payouts to nominees. Often, these individuals get overwhelmed by the large sum and do not know how to manage it. You should consider policies that offer monthly payouts instead. Your nominee will be better equipped to deal with smaller amounts every month that can help them with immediate financial needs.

Research Online Availability

Before finalizing a term insurance plan, ensure that your insurer is accessible both online and offline. Most companies today have 24x7 chat features on their website so you can get quick answers to your queries. You should also look for companies that offer online filing of claims for quick processing.

Choose the best term insurance plan as per my needs

Below are the important factors of choosing the best term insurance plan in India for your family’s financial security.

Best Term Insurance Plan as Per Policy Term

One of the important factors while buying a term insurance is to decide on the correct term of your policy. Below are some of the commonly availed policy terms that you can explore in details –

...Read More

Best Term Insurance Plan as per your Age

Age is an essential factor that is taken into consideration while calculating your term insurance premium. Also, depending on age your life cover amount might change basis your financial needs. The more your age the will be your term insurance premiums. You can explore term insurance plans basis your age in details -

...Read More

Best Term Insurance Plan basis your Salary

Your income or salary is an important factor to decide the amount of sum assured you would need in case of a term insurance. Here are few term insurance plans which you can explore basis on salaries -

...Read More

Best Term Insurance Plan for All

Term insurance needs might vary based on your residential status, family and age. You can explore the below term insurance options to identify the best term insurance plan in India that answers your needs –

...Read More

How Does a Term Plan Secure My Family’s Future?

A term insurance plan offers death benefits to the beneficiaries for a specific period. Even in your absence, your family gets financial assistance during the policy tenure if you have opted for a term plan.

Let's look into details about how a term plan can assist in securing the future of your family:

...Read More

Education Expenses

If there is a sudden death of a primary breadwinner, meeting educational expenses becomes quite difficult. The costs of tuition are rising, and meeting educational expenses in this scenario can create a massive financial burden for families.

A term plan will let you meet your child's educational expenses without facing any financial constraints. Whether it is the college fees, school fees, or meeting higher education, the payout received from the term plan enables your child to meet these expenses with ease.

Funeral and Final Expenses

Funeral and cremation expenses are unexpectedly high. However, with a term insurance plan, these expenses can be lowered without worrying about the financial burden. The term insurance payout helps to cover medical bills, costs of funerals, and other outstanding debts, allowing your family to remain stress-free.

Business Continuity

If you are the owner of a business, your sudden death can cause your family members to face financial constraints. By opting for a term insurance plan, business continuity can be maintained by providing funds for managing operational costs and paying off bills, thereby facilitating a smooth transfer of your business.

Estate Planning

A term insurance plan plays an important role in estate planning, ensuring your financial assets are transferred to your beneficiaries without financial constraints. This insurance plan also assists in covering estate-related taxes and other costs, thereby eliminating the need for your family to sell off valuable assets to reach their desired financial goals and objectives.

By receiving the lump sum amount, you can manage your expenditure with ease and keep your loved and dear ones stress-free from financial obligations.

Debt Repayment

Nowadays, many people have several loans, such as car loans, personal loans, home loans, and others. These liabilities can become a great burden on families when the borrower is not around. Receiving the death benefits from a term insurance plan can assist your loved ones in settling these loans and prevent them from taking on additional debt burden.

Income Replacement

The lost income can be replaced through payouts from a term plan. For families with larger financial responsibilities, a 5 crore term insurance can help maintain their standard of living and support long-term goals. This ensures a decent lifestyle for the surviving family members and meets their respective financial needs even when the primary breadwinner is not around.

Death Benefits

The main objective of a term insurance plan is that it provides death benefits to your family members during your sudden demise. With this lump sum amount, your family can cover different financial obligations that include outstanding loans, daily expenses, rent payments, outstanding loans, and educational expenses and meet other financial goals and objectives.

Hear from the expert on Term Life Insurance

How to calculate my term insurance premium?

Calculating the premium for term insurance is often the first step in buying a term plan. You can easily calculate the premium using a term insurance calculator.

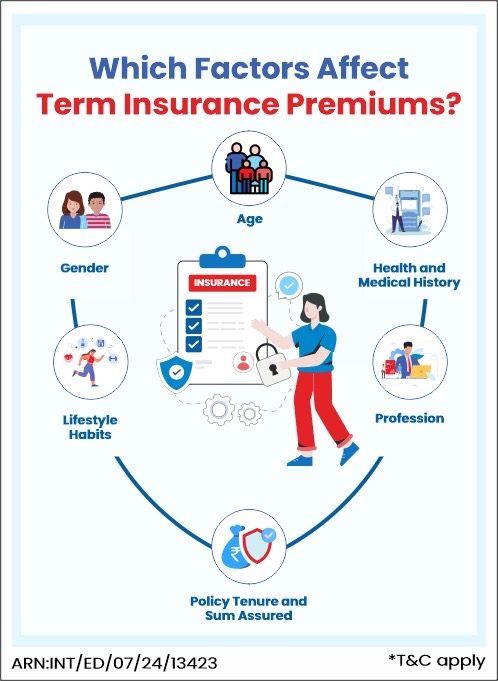

Which Factors Affect Term Insurance Premiums?

Your term insurance premium depends on several factors, including:

Age

In term insurance plans, younger and healthier individuals usually pay lower premiums because they’re considered lower risk. On the other hand, older individuals often face higher premiums due to potential health concerns.

Gender

Research indicates that women tend to live longer than men on average. As a result, insurance companies often offer women more favorable premium rates in term plans, since they’re likely to be insured for a longer period. It’s a way to reflect the longer life expectancy!

Health and Medical History

When you buy a term plan, you’ll need to share some details about your health and your family's medical history. Certain conditions, like heart disease or kidney issues, can run in families. If you or your family have a history of these health problems, it might affect your premium, potentially increasing it. But don’t worry—being open about your health can help you find the right coverage for your needs!

Lifestyle Habits

If you enjoy adventure sports, drink alcohol regularly, or smoke, you might be considered a higher risk for insurance companies. This can lead to a higher premium on your coverage. It's important to be honest about these habits when applying for term insurance. Being transparent helps ensure that your nominee won’t face issues when making a claim later on. It’s all about protecting your loved ones!

Profession

Certain individuals have jobs that place them in risky situations every day. People like sailors and pilots or those who work with hazardous materials may have to pay higher premiums for their term insurance plan than their friends with less dangerous jobs.

Rider Benefits

The type of benefits you are opting for through a rider along with your term insurance impacts the final premium amount you need to pay. Rider benefits such as cover against critical illness or accidental death are available at a nominal increase in premium of your base term plan.

Tobacco or alcohol consumption

Consumption of tobacco or alcohol as we all know impacts our health adversely and increases the chances of developing serious illnesses. Due to the increased risk of diseases that you might incur because of consumption of tobacco or alcohol, your premiums will be higher than usual for a term insurance plan.

Life cover or Sum assured

The life cover or sum assured amount you choose in your term insurance plays a crucial role in determining the term insurance premium. It should be financially adequate to support your loved ones in your absence, as a higher sum assured will lead to a higher premium, keeping all other factors constant.

Policy Term

The tenure of your term insurance plan is also a crucial factor considered while calculating the premium. Of course deciding on the term of the policy should be a personal choice depending on your financial situation. Among term insurance buyers the most commonly opted policy term is till the age of 85 years. Higher the policy term higher will be the premium keeping all other factors constant.

Premium Paying Term

There are several options available to pay your premium for a term insurance plan. You have the option to opt for a one time premium payment, limited term premium payment or a regular term premium payment. Of course the premium amount will be different in the 3 scenarios and should be selected as per your convenience.

How Gender Affects Premiums Rates?

Studies show women generally have longer life expectancy, resulting in lower insurance premiums compared to men.

Age |

Coverage |

Male (Non-smoker) |

Female (Non-smoker) |

Savings for Women |

% Difference |

25 |

₹1 crore (30-yr) |

₹ 8,0341c |

₹ 6,8292c |

₹1,205/year = ₹36,150 lifetime |

18% |

30 |

₹1 crore (30-yr) |

₹ 10,2943c |

₹ 8,7504c |

₹1,544/year = ₹46,320 lifetime |

18% |

35 |

₹1 crore (25-yr) |

₹ 12,6585c |

₹ 10,7606c |

₹1,898/year = ₹22,776 lifetime |

18% |

40 |

₹1 crore (20-yr) |

₹ 17,0027c |

₹ 14,4518c |

₹2,551/year = ₹30,612 lifetime |

18% |

Disclaimer ...Read More

How Much Term Insurance Cover Do I Need?

In case you have a young family or have parents who are financially dependent it becomes essentially to secure their financial future in case of an uncertainty. To ensure that all their financial needs are taken care of you need to get term insurance with an adequate amount of sum assured. There are some basic rules that people follow to decide on the life cover they would need:

01 Expense Replacement

In this approach you are recommended to add up all your current daily expenses and future expenses of yourself and your family. Once you have calculated the expenditure amount deduct the present value of your saving, investments and any life cover you have. The final value gives an estimation of the amount of life cover you need from your term insurance.

02 Income Replacement

When any family loses its primary breadwinner, a considerable financial gap is left behind and this financial deficit creates a lot of problems for the family. In this approach the idea is to replace the lost income due to the death of the primary breadwinner with the life cover of the term insurance.

03 10-15X your annual income

One of the simplest ways to determine the adequate sum assured is to multiply your annual income by 10-15. This is a very simple and widely accepted approach to decide on the sum assured of a term life insurance plan.

04 D.I.M.E formula

There is a unique approach based on the 4 fundamental financial needs to calculate the sum assured for your term insurance known as D.I.M.E (Debt, Income, Mortgage and Education).

In this approach you are required to add up your debt, mortgage and college expenses, and your salary for the number of years your family needs financial protection and that’s the life cover you will need. Let’s understand with the help of an example, suppose someone has debt of Rs. 20 lacs, home loan of Rs. 2 crore estimated education expenses of his children is Rs. 50 lacs and his salary is Rs. 20 lacs per annum. He has assessed and decided that his family needs financial cover till the time his children get a job and that will take another 10 years.

For the above scenario the estimated life cover needed as per the D.I.M.E approach is 0.2+2+0.5+ (0.2X10) = Rs. 4.7 Cr

Home loan amount in metros cities can be really high so you can opt for higher coverage with a 5 crore term insurance.

05 Human Live Value (HLV)

Another popular approach is the HLV philosophy. To calculate your HLV you need simply to multiply a variable to your annual income depending on factors such as current income, working years, age etc. The HLV calculator comes in handy to calculate your HLV and take a decision accordingly. Steps involved in calculating your HLV –

Step 1: Input your current age and desired retirement age

Step 2: Input your annual income

Step 3: Input your monthly expenses

Step 4: Input your existing life insurance

Step 5: Input your liabilities

If the calculation of HLV seems complicated, then you can use the following thumb rule:

Age (in Years) |

Approximate Human Life |

20-30 |

25 times of your annual income |

30-40 |

20 times of your annual income |

40-50 |

15 times of your annual income |

50-60 |

10 times of your annual income |

Why Sum Assured is an Important Factor When it Comes to Term Insurance?

Choosing the right sum assured in your term insurance plans is essential for your family's financial security. This sum provides crucial protection in case of unexpected events, giving you peace of mind. A higher sum ensures your loved ones are well-supported, covering debts, education costs, and income replacement. Selecting the right amount is key to ensuring their future is secure. To explore the best term life insurance options and find the ideal sum assured for your needs, click the tabs below.

What is the ideal duration of term life insurance?

The duration of a term insurance depends on your retirement age, time to pay off your debts, age till which you will have financial dependents and life expectancy. The ideal duration for your term plan could be 30 years considering you are in your thirties so that you are done with your financial obligations by time you are in your sixties.

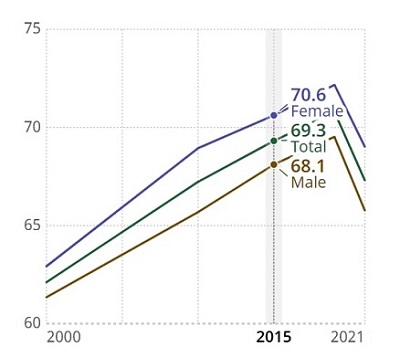

With improved standards of living our life expectancy will improve. Life expectancy at birth is basically the average number of years a newborn is expected to live. As per World Health Organization the life expectancy at birth for India stood at 67.3 years in 2021. Refer to the graphical representation of how life expectancy has changed from 2000 to 2021 in India. Thus it is important that we get term insurance with adequate duration.

Source: World Health Organization

How to choose the right duration for my term insurance?

In case if you are wondering how long your policy term should be, you can consider the following factors:

Financial independence of your children

Providing for your children financial can be really expensive speacially in the urban world. There are various expenses that your kids incur like education, clothing, food and extra-curriculars. When selecting term insurance plans, you should consider for how many years you are planning to provide for your kids, as the expenses might increase if you are paying for their college.

Time period of your loans and liabilities

Often repayments of our liabilities are a big part of our monthly expenses and thus it becomes imperative that we take a term insurance. Now if you want your term life insurance plan to cover your mortgage, consider the number of years you have left untill you pay off the loans. You would want to avoid the scenario where your term policy expires after 10 years but your liabilities continues for another decade.

Your desired retirement age

Under an ideal scenario you would live off you savings post your retirement. Now if you are getting a term life insurance plan to replace your income, you might not need it post retirement. Once your major expenses like home loan and child’s education are taken care of and you are living your retired life with your savings, you wouldn’t ideally need a term insurance anymore.

Current Age

You should take your current age into consideration while deciding the adequate length of your term insurance policy. Depending on your age and current financial situation you will be able to decide on how long you should take a term plan for.

Financial support for spouse

Financial protection of your spouse is one of the key responsibilities when your spouse is financially dependent on you. In case of your death the policy tenure along with the life cover of your term insurance plan should be adequate enough to ensure your spouse’s financial security.

Extent of financial dependency

In case if you have financial dependents like your parents, siblings, spouse and children it comes essential that your term insurance tenure is adequate enough to ensure their financial protection in case of your death.

Why Does Term Insurance Premium Increase with Age?

Term insurance premium increases with age due to the increase in mortality risk. Simply put the risk of death increases with age and so does the premium. Life insurance companies finalise the premium basis their assessment of risk to cover you. As you grow old the statistical likelihood of insurers paying the death benefit also increase. Here are the key reasons of higher premium:

Increased mortality risk

A younger person has a longer life expectancy thus is likely to pay the premiums for term insurance plans for more years before the risk of a claim. Older the individual lesser will be the number of years to pay premium thus a higher premium is needed to cover for the same death benefit.

Increased likelihood of health issues

The older you are, the higher the likelihood of developing diseases such as diabetes, hypertension, heart issues, cancer and others. When seeking term insurance for diabetes or other pre-existing conditions, insurers consider these higher risk factors, which can lead to higher premiums.

Cost of Reinsurance

When you buy term insurance, it’s important to know that life insurance companies transfer a portion of their risk to other companies known as reinsurers. Reinsurers also increase the cost of reinsurance with age thus the increased costs translate into higher premiums for the policyholder.

How to reduce my term insurance premiums?

Here are smart ways to reduce your term insurance premium:

Buy Early

Maintain a healthy lifestyle

The younger and healthier you are when you buy a term plan, the lower your premiums will be because you are considered to be at a lower risk by the insurer. Premiums tend to increase significantly as you age, especially after your 30s and 40s. For example20, term insurance premium for a healthy male of 25 years is Rs.9524 annually for a 1 crore sum assured whereas if he delays till the age of 35 years his premium would increase by 35% to Rs.15377 per annum (for policy tenure & premium paying term of 20 years).

Life insurers assess your health and lifestyle habits to understand your risk profile. Here are ways to reduce health related risks:

Avoid smoking and excessive drinking :

Term insurance premiums are significantly higher for smokers and heavy drinkers due to increased health risks. For example4, term insurance premium for a 30 year old healthy male with 1 crore sum assured increases by 100% if he is a smoker (for policy tenure & premium paying term of 30 years).

Manage pre-existing conditions :

If you have pre-existing health conditions like diabetes, hypertension or obesity your premiums will be significantly higher. Those looking to buy term insurance can lower their costs by maintaining good health through regular exercise, a balanced diet, and other preventive measures.

Medical tests :

Be well prepared for medical tests, as the results directly impact your term insurance premiums.

Choose the right sum assured, tenure and premium paying term

Optimal Sum Assured :

Choosing the most appropriate sum assured as per your financial needs will ensure that you keep your premiums in check. The best way to identify the ideal sum assured for the best term insurance plan is to use a term insurance calculator, considering your financial obligations such as home loans, children’s education, and daily expenses. For example, a 2 crore term insurance can cost as little as ₹35/day5, while a 1 crore term insurance may cost ₹19/day

Appropriate Policy Tenure :

Choose tenure that covers your dependents’ financial needs till the time you retire or until your children are financially dependent. For example22, monthly premium for a 30 year old healthy male with 1 crore sum assured and cover till the age of 60 and premium pay for 30 years will be 40% higher than a cover till the age of 50 and premium pay for 20 years.

Appropriate Premium paying Term :

Shorter the premium paying term higher will be your monthly/annual premium for the same policy tenure. Monthly premium for a 30 year old healthy male23 with 1 crore sum assured and cover till the age of 60 will increase by 22% if he chooses to pay for 20 years instead of 30 years.

Buy Online

Life insurance companies provide an additional discount if you choose to buy your term plan online. With HDFC Life term insurance you can avail a 5% discount6 in your first year premium if bought online.

What are the payout options available with term life insurance?

Term life insurance provides flexible payout options with term insurance. Here are the different payout options:

Monthly Income

The nominee receives a monthly payout in installments to take care of the monthly financial needs of the family.

...Read More

Lump sum

Under this option, comprehensive life coverage is paid out in fixed amounts to the nominee during the sudden demise of the policyholder at unexpected times

...Read More

Increasing Monthly Income

This payout option is like the income option except that the monthly installment keeps increasing by a fixed amount every year.

...Read More

Lump-sum + Monthly Income

This option is a combination of the income and lump sum options.

...Read More

What is term insurance riders?

Term insurance riders are optional add-ons that you can buy along with your basic term insurance. They provide additional financial coverage under specific situations beyond just the death benefit of a term plan. To avail riders you need to pay a small extra premium.

Think of your term insurance as a basic smartphone plan giving you the primary benefit of calling and internet. Riders are like additional packs - top-ups, OTT subscription, roaming etc. that enhance the benefits as per your needs.

Some common types of term insurance riders

Critical illness rider :

You get upfront payment in case you are diagnosed with any of the critical illnesses (heart attack, cancer etc.) covered by your policy. The payout will you pre and post hospitalisation expenses. For example, Trisha is a 33-year-old female, gets a term plan of ₹1 crore along with a critical illness rider cover of ₹20 lakhs, policy term for 20 years and premium paying term for 20 years. She starts paying a monthly premium of ₹1,511. After 8 years, she is diagnosed with breast cancer. The amount of ₹20 lakhs is paid out to cover the cost of treatment, and the term plan cover of ₹1 crore continues.

Accidental death benefit rider :

You nominee will receive an additional sum assured over and above the death benefit of the term insurance plan.

Waiver of premium rider :

In case you become critically ill or permanently disabled during the policy term then the insurer waives off all future premiums and your term insurance policy continues.

Accidental total and permanent disability rider :

If you suffer a total and permanent disability due to an accident and it impacts your ability to earn then you receive a certain sum assured.

Terminal illness rider :

If you are diagnosed with a terminal illness then you receive a payout which will help you with treatment costs and other financial needs.

Live well rider :

This is a unique rider that provides dual benefits of financial protection and wellness. Along with a death benefit this rider also provides wellness benefits (OPD consultation, preventive health checkup and others).

Why are term insurance riders important?

Adding riders to the term insurance plans help you get extensive financial protection. Here are few benefits of adding rider to your term insurance:

Enhanced Financial Cover

Riders are convenient to expand your base insurance policy’s coverage in terms of risks that regular coverage cannot necessarily cover. A good example**** is a critical illness rider, which provides financial assistance when you are diagnosed with severe diseases like cancer or heart disease. Imagine a 35-year-old person with a term plan diagnosed with cancer. A critical illness rider of ₹20 lakh ensures immediate funds for treatment, without dipping into savings.

You can relieve yourself of the burden of paying urgent medical bills while recovering. Similarly, an accidental death rider increases the coverage amount for your loved ones if an accident causes death.

Another helpful option is the permanent disability rider. It offers periodic income or a lump sum if an accident renders you incapable of working, assisting with future costs.

By adding these riders, your policy becomes a more robust safety net. It provides wider protection against the financial shocks of life’s unforeseen circumstances. This increased coverage offers peace of mind. You can be confident that you and your loved ones are better protected in the event of an emergency.

...Read More

Customisation

Riders in term insurance enable you to personalise your policy to suit your individual lifestyle and risk conditions. For instance, if you drive a lot, a rider for accidental death will pay your family additional money in the event of a car accident.

If your family has a history of serious illnesses, opting for a critical illness rider can help cover both medical expenses and recovery costs. Similarly, if you work in a physically demanding occupation, a permanent disability rider ensures income replacement in case an accident prevents you from working.

You can select the combination of riders that suits your circumstances and needs. This way, you pay less for coverage you will not be using, yet you enhance protection in the areas you need most. Customising your policy with riders enables you to obtain adequate and targeted coverage, ensuring the financial stability of your loved ones.

...Read More

Affordable

Riders provide additional coverage at a minimal premium. Hence, one of the most economical means of adding value to your term insurance policy. Rather than buying distinct policies for critical illness, accidental death, or disability, riders enable you to bundle these covers with your current plan at a lower cost.

For instance****, incorporating a critical illness rider provides a financial buffer against severe medical costs without the increased premium of single-premium health insurance. A ₹50 lakh term plan might cost ₹8,000 annually, but adding a critical illness rider may increase the premium to only ₹9,000, providing significantly broader protection.

Similarly, an accidental death rider increases your family's payment in the event of an accident, all at a modest additional premium. This cost-effectiveness makes riders a suitable option, particularly for individuals who desire broader cover at affordable premiums.

By using more than one protection in the same policy, you eliminate duplication, reduce administration, and save money. Therefore, riders provide strong financial protection without stressing your budget.

...Read More

Additional Tax Benefit

One of the lesser-known benefits of riders on term life insurance is the possibility of additional tax benefits7. The premiums paid towards the basic term plan qualify for tax deduction under Section 80C of the Income Tax Act.

However, when you add specific health-related riders like a critical illness rider or a hospital care rider, the premiums for these add-ons also qualify for a deduction under Section 80D. This provides you with double tax-saving benefits and greater financial security.

Only health-related riders are eligible under Section 80D. The choice of rider will determine the eligibility of the deduction. Other riders, such as accidental disability or death, are excluded.

By intelligently investing in your policy, you not only protect your family's financial well-being but also optimise tax efficiency. Hence, riders give you the benefit of extending your insurance coverage and providing other tax-saving benefits under current tax rules. Furthermore, the GST on life insurance premiums including term insurance premiums, has been reduced from the existing 18% to 0%, with the change proposed to be effective from September 22, 2025.

...Read More

Peace of Mind

Term life insurance riders offer you more than a financial safety net. They provide peace of mind by protecting you and your loved ones from various risks and threats. Life's uncertainties, including serious illness, accidents, or permanent disability, can significantly impact your family's financial situation.

By adding riders such as a critical illness rider, accidental death rider, or permanent disability rider, you protect your family's future from the unexpected. Having peace of mind that these risks are protected makes it easy to prioritise life without constantly worrying.

Consider a family**** where the breadwinner becomes permanently disabled after an accident. A disability rider provides a standard monthly income, helping the family maintain financial stability. This blending of reassurance and security helps to keep your family safe and secure. Therefore, riders turn an existing term insurance policy into an integrated safety net, which provides you with confidence and peace of mind, even in the face of uncertainty.

...Read More

Why should you consider adding a critical illness rider37 to your term insurance plan?

Health at Risk

Did you know?

In the period of 2018-2022 heart attack cases saw a jump of 26%.There were 32,457 incidents of heart attacks in India in 2022*.

*As per the annual report of ‘Accidental Deaths and Suicides in India’, the National Crime Records Bureau (NCRB).

Did you know?

...Read More

Diet-Driven Diseases

Did you know?

India has 100 million diabetes cases, and 1 in 4 individuals is diabetic, pre-diabetic, or obese. Rising junk food consumption and ultra-processed diets are major contributors, increasing the risk of heart disease and cancer.

Source: https://ijmr.icmr.org.in/article.asp?issn=0971-5916;year=2022;volume=156;issue=4;spage=381;epage=384

Did you know?

...Read More

Our top riders14 with Term Insurance plan

They help you deal with those additional risks life brings.

HDFC Life Income Benefit on Accidental Disability Rider – Non Linked

UIN: 101B041V01

Get additional income benefits over and above your Sum Assured in the event of total permanent disability due to an accident.

HDFC Life Critical Illness Plus Rider

UIN: 101B014V02

We pay a lump sum amount equal to Rider Sum Assured upfront if diagnosed with of any of the specified critical illnesses.

HDFC Life Protect Plus Rider – Non Linked

UIN: 101B040V01

Get protected with a proportion of Rider Sum Assured in case of accidental death or partial/total disability due to accident or diagnosed with Cancer

HDFC Life Health Plus Rider – Non Linked

UIN: 101B031V02

Get lump sum benefit equivalent to Rider Sum Assured on diagnosis of any of the covered 60 Critical Illnesses or benefit as a proportionate of the Rider Sum Assured on diagnosis of Early Stage Cancer / Major Cancer depending on the plan option chosen.

Why choose HDFC Life Term life insurance plan?

Multiple Customisations

Pick from three plan options and riders to customize your cover and receive policy benefits based on your needs.

Accelerated Payout Option

If the policyholder gets diagnosed with a covered terminal illness, they receive the sum assured payout earlier. They can use the money to pay for medical treatments.

Increasing Death Benefit

Choose to increase your sum assured amount, up to 200% of the plan value, under the policy’s Life variant.

Critical Illness Benefit

Enhance your cover with the Critical Illness Plus Rider and receive the sum assured payout upfront after covered critical illness diagnosis.

Accidental Death and Disability Benefits

Receive an additional financial safety net with the HDFC Life Protect Plus rider2 after an accident leaves the insured permanently disabled or becomes fatal.

Maturity Benefits

Receive a maturity benefit equivalent to all premiums paid over the policy tenure when you choose the return of premium plan option and survive the policy term.

Cover for Your Spouse

Term insurance plans allow you to get additional coverage for your spouse, ensuring that your children remain financially secure, regardless of what happens.

Smart Cancellation Benefits

If you want to cancel your policy, you can use the Smart Exit option to receive an amount equivalent to all base premiums paid at the time of cancellation

Waiver of Premium Benefits

Future premiums of term insurance are waived after the diagnosis of a covered critical illness or after total and permanent disability.

High Claim Settlement Ratio

Claim settlement ratio is an important factor to decide on which term insurance plan you should go for. HDFC Life Insurance claim settlement ratio for FY24-25 is 99.68%.

Premium break benefit

Policyholders can avail premium break benefit13 under the term insurance policy for a period extending up to 12 months. During this premium break benefit period, the premium due and payable will be deferred but the risk cover of the term plan will continue as per the terms & conditions of the policy.

Immediate claim payout

In case of death of the life assured after completion of the waiting of 1 year, upon receipt of intimation of death claim an accelerated death benefit will be paid within 1 working day from the claim registration date. If the sum assured is between ₹1 crore and ₹2 crore, the immediate payout# will be ₹2 lakh. For a sum assured above ₹2 crore, the payout will be ₹5 lakh.

Special discounts

Salaried individuals can avail a discount28 of 10% on the first-year premium and women can avail a discount of 15% throughout the entire policy term of the term life insurance.

Eligibility Criteria to Buy a Term Insurance

Entry Age

The minimum entry age to get HDFC Life Click 2 Protect Supreme Plus a term insurance plan is 18 years.

The maximum entry age for HDFC Life Click 2 Protect Supreme Plus a term insurance is 65 years. The maximum entry age for the Life Variant of HDFC Life Click 2 Protect Supreme Plus is 84 years.

Maturity Age

The minimum maturity age for term insurance is 18 years for Life and Life Plus variants. The minimum maturity age for the Life Goal variant of HDFC Life Click 2 Protect Supreme Plus is 23 years.

The maximum maturity age for term insurance is 85 years.

Policy Term

The minimum policy term for term insurance for Life and Life Plus variant is:

1 month for single pay,

2 years for regular pay,

3 years for limited pay,

5 years for single pay and 7 years for limited pay (Life Goal variant of HDFC Life Click 2 Protect Supreme Plus)

Sum Assured

The minimum basic sum assured for term insurance is Rs. 10,000.

For entry ages above 65 years, the maximum sum assured is Rs. 50,000.

In all other cases, the maximum sum assured has no upper limit but is subject to the Board Approved Underwriting Policy (BAUP).

Premium paying term

Single, regular and limited pay options are available with term insurance plans.

Country of residence and citizenship

Following are eligible for term insurance from India:

NRI - An Indian Citizen who stays abroad for employment/ carrying on business or vacation outside India or stays abroad under circumstances indicating an intention for an uncertain duration of stay abroad is a non-resident.

PIO - includes a person, (other than a citizen of Pakistan or Bangladesh) is deemed to be of Indian Origin, if,

i. He/she, at any time, held an Indian passport,

ii. He/she or either of his/her parents or any of his grand parents was a citizen of India by virtue of the Constitution of India or Citizenship Act, 1956.

iii. He/she is a spouse of a citizen of India or a person of Indian origin covered under (i) or (ii) above.

OCI (Overseas Citizenship of India) - Persons of Indian Origin (PIOs) of certain category, who migrated from India and acquired citizenship of a foreign country other than Pakistan and Bangladesh, are eligible for grant of OCI as long as their home countries allow dual citizenship in some form or the other under their local laws.

Income

The insurers use the annual income to determine the maximum sum assured eligibility for term insurance.

Health & Medical History

The insurer determines eligibility for term insurance based on your health condition and past medical history. The eligibility norms are subject to the underwriting rules of the insurer.

What is covered and not covered in term life insurance?

Covered in term insurance |

Not covered in term insurance |

Death due to terminal illness |

Death due to suicide is not covered in the 1st year of the policy |

Death due to medical issues |

Misrepresentation of any information will lead to ineligibility of benefits |

Death due to COVID-19 |

|

Death due to natural calamities |

|

Death due to accident |

|

Disclaimer: The covered and non-covered points mentioned above will be as per the terms and conditions of the policy.

Common mistakes to avoid while buying Term Insurance Plan

Buying a term insurance is a crucial financial decision and thus we should be aware of some of the common mistakes to avoid while buying a term insurance:

Starting late

A term insurance premium keeps on increasing with your age. Often people make the mistake of delaying the purchase of a term insurance to their late 30s or early 40s. The premium amount in your late 30s or early 40s can be considerable higher than the premium amounts in your early 20s. It’s recommended that you buy a term plan as soon as you have a steady income to pay the premiums.

Inadequate life cover

People often commit the mistake of taking a life cover that is being sold to them instead of evaluating their financial situation and then taking a decision. There are several ways to conclude on the life cover amount but it is an individualistic decision so it is recommended to access you and your family’s financial needs before choosing a term insurance plan.

Ignoring riders

Term insurance plans come along with riders that provide a extensive financial cover for a nominal increase in premiums of base plan. There are various riders available to cover against different mishaps. People often end up ignoring riders perhaps due to lack of understanding of their purpose. Riders such and critical illness rider and accidental death benefit riders help you get a well rounded financial protection in case of unfortunate events.

Sharing inaccurate information

While buying a term plan people might end up providing inaccurate of incomplete information in order to save on premiums. It is highly recommended that you provide accurate and complete information to your life insurance provider others wise this might lead to rejection of claim. Insurers have very robust and stringent processes in place to identify inaccurate of incomplete information.

Opting for a short policy term

One common mistake is selecting shorter policy tenure in order to save on premiums. The decision on policy term should be to be taken on the basis of how long you want to financially protect your financial dependents in case you are not there. Suppose for example you believe that all your liabilities will be over, children will be financially independent and your spouse will have adequate savings to survive in case of your demise at a particular age then you should opt the term plan till that particular age.

Not buying term life insurance online

Not buying a term insurance online has few disadvantages such as not able to calculate and compare premiums easily and not gets discounts that some insurers provide to online customers. Buying term life insurance now a day is really convenient.

Why Should I Buy Term Life Insurance Online?

Buying term insurance plan online has several benefits:

Lower Premiums

Convenience

Transparency

Online Discount

Ease of premium calculation

In your journey to purchase a term insurance online you can take advantage of the term insurance premium calculator to calculate your premium. If you decide to buy the best term insurance plan for 2 crore then the premium of the same will be Rs.35/day5

Hassle-free document upload