What do you want to do?

- What is Retirement Planning? - Ultimate guide for retirement planning

- What is Retirement Planning?

- What is a Retirement Plan?

- Why Retirement Planning is important?

- How Retirement Planning Works?

- How Much Do You Need to Retire?

- How to start a retirement plan?

- Steps to Retirement Planning

- Other aspects of Retirement Planning

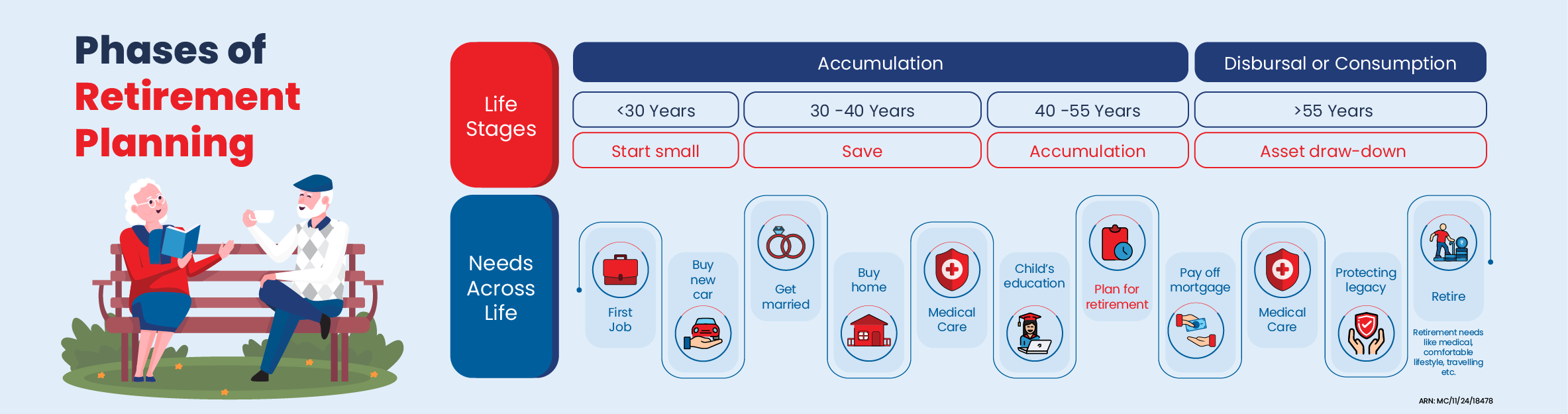

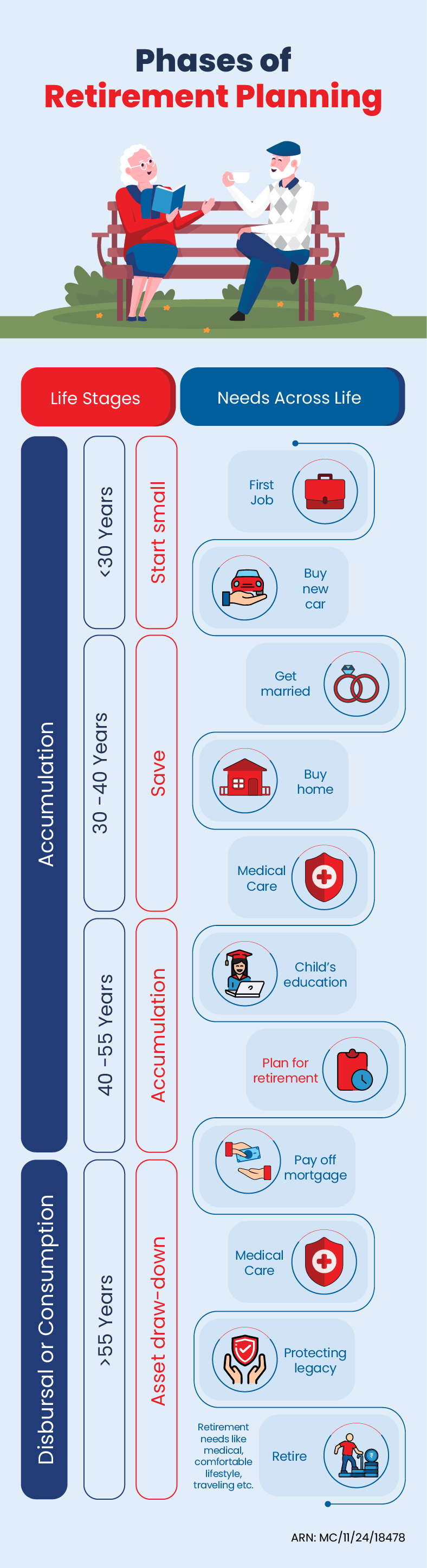

- What are the stages of Retirement Planning?

- Types of Retirement Plans

- Best Retirement Plan in India 2025

- Factors to Consider When Choosing a Retirement Plan

- Retirement Plans by HDFC Life

- Secure Your Retirement with Our Pension Plans

- FAQs Retirement Planning

- Heres all you should know about Retirement Plans.

- Popular Searches

What is Retirement Planning?

Retirement planning is the process of preparing your finances today in order to ensure a secure and comfortable life after you stop working. It involves estimating your future expenditures, considering the impact of inflation and building a mix of savings and investments that will generate a steady income in the course of your retirement years.

Key factors to consider include your lifestyle goals, medical needs, inflation and reliable income sources such as pension schemes or retirement funds.

For instance@, if you anticipate your month-on-month expenditures to be ₹50,000 today, you will need to plan for a higher amount. Say ₹80,000 or more, 20 years later, due to inflation.

@ - NOTE - The values shown are for illustrative purpose only.

Retirement planning in India assists you in creating a retirement corpus that ensures financial independence, meeting post-retirement goals and protecting you from financial worries in old age.

...Read More

What is a Retirement Plan?

A retirement plan is a financial strategy tailored to assist you in building a corpus that supports you after your active working years. It is essentially a way to ensure that your lifestyle and financial requirements are taken good care of when regular income from work stops.

During your career, a retirement plan involves saving and investing systematically, via financial options like pension funds, mutual funds or other investment avenues, so that you accumulate sufficient to sustain yourself later on.

Once you retire, such savings can be converted into a regular income stream through annuity plans, which provide consistent payouts to cover daily expenditures, medical care and leisure activities. The main goal of a retirement plan is to maintain your lifestyle, manage unforeseen expenditures and secure mental peace during your golden years.

Planning out early and understanding your future requirements is crucial. Go through and know how you can compute your retirement corpus, zero in on the apt retirement or annuity plan and make informed decisions to enjoy financial independence long after your working life ends.

Why Retirement Planning is important?

Plan for Uncertain Economic Conditions

Lower Dependence on Social Security or Government Schemes

Enable Wealth Transfer and Legacy Planning

Take Advantage of Retirement-Specific Tax Benefits

Achieve Peace of Mind and Financial Confidence

Retirement planning is not just about saving funds; it is, in fact, associated with building financial security, stability and mental peace for your future. Here are the reasons why it matters.

The economy might change in ways that are not expected. Recessions, inflation or instability in the job market can impact your savings as well as investments. For instance, in the course of COVID-19, many witnessed income disruptions while their expenses continued.

A prudent retirement plan comes across as a safety net. This makes sure that even if the economy shifts, your future lifestyle remains secure.

While schemes such as EPF, pensions or other government allowances endow great support, they might not be adequate to cover all post-retirement expenditures. For example, the month-on-month pension from EPF might fall short of mitigating rising healthcare or lifestyle costs.

By building your own retirement corpus, you gain more control, flexibility and great confidence that your needs will be met.

Retirement planning is not just about mitigating your needs; it is even about securing the future of your family. Through estate planning tools such as wills, trusts and beneficiary designations, you can ensure your wealth is passed on in a smooth manner to your chosen heirs.

Early planning prevents disputes, safeguards your assets and permits you to decide how and when your wealth must be transferred.

Investing in retirement plans also brings tax benefits. Contributions as per Section 80C# , Section 80CCC and Section 80CCD(1) (of up to ₹1.5 lakh). In addition, Section 80CCD(1B) (an additional ₹50,000 for NPS) can lower your taxable income^^.

Using such benefits early not just lowers your tax liability but also assists your corpus in growing faster through the long-term compounding effect.

Perhaps the greatest importance of retirement planning lies in the emotional security it provides. Knowing that your future is funded reduces stress and allows you to make better life decisions.

For example, a couple who began planning in their 30s can now travel, pursue hobbies, and support their children without financial worry, proving that peace of mind is the real return on investment.

How Retirement Planning Works?

The objective of retirement planning is to prepare you and your loved ones for a stress-free retired life. Robust retirement planning will ensure that you are able to generate a steady flow of income to meet your regular expenses and fulfill your financial goals post retirement. Ideally retirement planning is a continuous process which evolves over time:

Early years

When you are young and starting out, your contributions towards your savings for your retirement may be limited but to reap the benefits of retirement plan you should start early.

Middle years

When you have established a sizeable source of income you are recommended to increase your contributions to your retirement plan. This approach will help you boost your savings.

Later years

Close to your retirement you set yourself to reap the benefits of savings for decades. This is the time when your start receiving the rewards to live a stress-free retirement.

How Much Do You Need to Retire?

The amount you would need for retirement is very personal depending on your financial needs and wants post retirement. Ideally, you should start investing in a retirement plan as early as possible. This will give you enough time to create a retirement corpus for a financially secure future in the long run. Once accumulation is done, the corpus can be used to purchase annuities for monthly income post-retirement. Furthermore, even after being converted to annuities, the retirement corpus can continue to grow. The annuity payouts can either be lifelong or for a certain period of time post-retirement.

Take the following things into consideration while calculating your retirement corpus –

Monthly expenses

Existing savings

Systematic investments

Inflation rate

With the above values you can use the retirement calculator to calculate your retirement corpus.

How to start a retirement plan?

Planning for retirement is a significant task. But it is about taking a few prudent, structured steps and beginning early. Let's go through an easy roadmap to assist you in starting your retirement journey with utter confidence.

Define your retirement vision and age

Calculate Your Target Corpus

Evaluate Your Current Financial Reality

Choose the Right Investment Vehicles

Firstly, picture what retirement looks like for you. Would you like to retire early and travel? Or do you prefer a slower and relaxed lifestyle with family around? Knowing what life you want assists you in figuring out how much money you will need. Next, decide when you would like to retire, say at the age of 60 or 65. This endows you with a clear time frame to plan and save accordingly.

Tip: Utilise an online Retirement Calculator to figure out how much you will need to fund your desired lifestyle. It’s a great starting point to view where you stand today.

Now that you have a vision, it is time to put a number to it. A thumb rule is to aim for a retirement corpus that replaces 70–80 per cent** of your pre-retirement income. For instance, if your month-on-month expenditure today is ₹1 lakh, you might require ₹70,000 to ₹80,000 every month after retirement to maintain the same lifestyle.

Another simple guide is the “4% Rule^” it suggests withdrawing 4 per cent of your total savings each year to cover up expenditures without running out of funds too soon.

Do not forget to factor in inflation; your ₹1 today will not purchase the same things 20 years later on. So, plan with future expenditures in mind.

Before planning, take a swift look at where you stand now. List all your savings, Employee Provident Fund (EPF), Public Provident Fund (PPF), mutual funds or any prevailing retirement accounts. Then, assess your month-on-month income and expenditure to view how much you can realistically set aside for retirement.

If you have high-interest debt (such as credit cards or personal loans), make paying that off an important priority before you begin investing heavily for retirement. It will free up more money for your future.

Your savings can grow faster when invested in a wise manner. Based on your comfort with risk and your investment horizon, consider financial options like:

- Employer-sponsored retirement plans

- Pension or annuity plans

- Mutual funds or Unit-Linked Insurance Plans (ULIPs) for long-term growth

- PPF or National Pension System (NPS) for tax-efficient savings

The key here is to begin investing early. Even small investments can grow considerably over a long time period, thanks to the compounding effect.

Create an Action Plan and Automate

Once you are aware of your target and have selected your investments, set up automatic month-on-month contributions. This ensures consistency and removes the temptation to skip saving.

Make it a habit to evaluate your retirement plan on an annual basis. Life events like promotions, expenditure or market changes might require adjustments.

Finally, if you are unsure where to begin, don’t hesitate to consult a financial advisor or try a retirement planning tool. It can help you create a personalised plan that fits your goals perfectly.

Steps to Retirement Planning

Retirement planning becomes easier when you follow a properly structured approach. Go through the 10-step retirement planning process that you must consider using:

Decide Your Target Retirement Age

Choose when you want to retire, whether that’s 55, 60, or later. The earlier you retire, the more years your savings and investments must support you.

...Read More

Define Your Retirement Lifestyle & Goals

Think about how you want to live after retirement, whether it’s living comfortably at home, travelling often or spending time on hobbies. This will assist you in figuring out how much money you will require.

...Read More

Estimate Monthly Expenses in Today’s Terms

Compute your present month-on-month spending, including household bills, healthcare, and leisure. For instance, if you spend ₹50,000 per month today, then note this figure.

...Read More

Adjust for Inflation

Make sure to factor in rising costs. With India’s inflation averaging 6–7%, your ₹50,000 today may equal ₹1 lakh in the upcoming 20 years.

...Read More

Calculate the Retirement Corpus You Need

Multiply your future monthly expenses by the number of years you expect to live after retirement. For instance, ₹1 lakh x 20 years = ₹2.4 crore. Make use of a retirement calculator to refine this figure.

...Read More

Assess Your Current Savings and Investments

Make sure to take a thorough stock of your existing savings, Employee Provident Fund (EPF), Public Provident Fund (PPF), mutual funds or pension plans.

...Read More

Identify the Gap Between Corpus Needed and Current Savings

Deduct your current assets from the required corpus. This shows the shortfall you must bridge.

...Read More

Decide Your Monthly Contribution and Asset Allocation

Set up a realistic investment amount every month and split it across equity, debt or hybrid instruments, based on your risk tolerance level.

...Read More

Select the Right Retirement Plans & Investment Vehicles

Select from options like National Pension Scheme (NPS), Unit-Linked Insurance Plans (ULIPs), pension schemes or mutual funds to build long-term wealth and generate retirement income.

...Read More

Review and Rebalance Annually

Keep a thorough track of your progress. Adjust your contributions year-on-year to remain on course. You can even consult a financial advisor for expert guidance.

...Read More

Other Aspects of Retirement Planning in India

Retirement planning goes beyond just calculating investment returns. It involves a comprehensive approach that involves health insurance, tax-saving strategies, estate planning, inflation protection and contingency funds.

Considering these aspects ensures long-term financial stability, helping individuals enjoy a secure and worry-free retirement in line with India’s financial and regulatory framework.

Your Home: An Asset or a Social Obligation?

For most, the family home is more than bricks and mortar; it represents security, legacy and emotional roots. Financially, property is the single largest asset in a retirement portfolio. But it can also be a social obligation, with many selecting to preserve ancestral homes for the next generation instead of monetising them.

Retirees must make a decision on whether to downsize for liquidity, rent out or even explore a Reverse Mortgage. Note that Reverse Mortgage, though it is a niche, is a beneficial option that permits homeowners to convert their property’s value into a steady income stream. Balancing emotional ties with financial practicality is essential here.

Succession Planning: Wills, Nominations, and Legacy

A sound and prudent retirement plan goes beyond wealth accumulation; it ensures a smooth transfer of wealth. Succession planning is usually overlooked until it is too late.

Creating a Will on time, updating nominations across bank, insurance and investment accounts, and assigning a proper Power of Attorney are essential steps. Doing so prevents disputes, avoids legal delays and ensures your loved and dear ones get their rightful assets without hassle.

While India abolished the inheritance/estate tax in the year 1985 through the Estate Duty (Abolition) Act, 1985(6), i.e., assets inherited do not face any direct tax burden under the Income Tax Act, 1961, delays or disputes in asset transfer can erode wealth and family harmony. Clear documentation ensures that one’s legacy is preserved with zero need for legal hurdles for heirs.

At the time of inheritance: Under Section 56(2)(x) of the Income Tax Act, 1961, any sum of money or property received without consideration (that is, as a gift) and valued at more than ₹50,000 is generally treated as taxable income in the hands of the recipient. However, the law provides a clear exemption for inheritances. Proviso to this section specifically excludes any amount or property received “under a will or by way of inheritance” from being taxed.

Therefore, assets inherited from a deceased person—whether movable or immovable—are completely exempt from income tax at the time of transfer, ensuring that inheritance itself does not attract any tax liability under the Income Tax Act.

However, any income generated from inherited assets, i.e., rent, dividend or interest, is taxable in the hands of the heir under respective tax head. In case of sale of Inherited/assets (if capital Assets other than Section 112A of the Income Tax Act, 1961,capital gains tax is charged Here, long-term capital gains are taxed at 20% (excluding surcharge and cess) post-indexation or 12.5% rate without indexation if held for more than 24 months.

In case of Short-term Capital gains, tax treatment is depending on type of asset. Short term capital gains are taxed as per the income tax slab rate for assets other than section 111A.

Taxation in Retirement: Understanding EPF, NPS, and Mutual Fund Withdrawals

Retirement is not just associated with saving taxes in the course of your earning years; it is equally about how you manage your withdrawals after retirement. Contributions to the Employee Provident Fund (EPF) and the Public Provident Fund (PPF) allow withdrawals that are tax-free after 5 years. The National Pension Scheme (NPS) endows partial tax exemption, with annuity income being taxable.

Mutual fund withdrawals, especially through Systematic Withdrawal Plans (SWPs), can help manage both cash flow and tax liability, as only the gains portion of each withdrawal is taxed. A well-thought-out tax strategy ensures that retirees maximise post-tax income while extending the longevity of their savings.

Health Security: The Need for Comprehensive Health Insurance

Healthcare expenditures are rising faster than inflation, which makes medical expenses a threat to retirement savings. Relying on government schemes or employer-provided insurance entirely is risky. This is because the coverage offered by such products often tends to minimise or end post-retirement.

A holistic health plan, supported by super top-up plan or critical illness cover, is essential. These safeguards assist in protecting your savings from unanticipated medical bills that could otherwise erode years of disciplined financial planning. In retirement, robust health cover is just as important as having a steady income.

In addition to health insurance, life insurance plan plays an important role in protecting loved once future. It provides significant tax planning advantages under the Income Tax Act, 1961#. Premiums paid towards eligible life insurance policies can be claimed as a deduction under Section 80C up to overall ceiling limit of ₹1, 50,000 per financial year, thereby enhancing overall tax efficiency in retirement planning. Further, the maturity proceeds or death benefits received under a life insurance policy can be exempt under Section 10(10D) of the Income Tax Act, 1961#, provided the premium is within the prescribed threshold and premium-to-sum-assured ratio complies with statutory conditions. A well-structured life insurance policy ensures that your loved ones are financially supported in case of an untimely demise. It also provides an additional layer of financial security, helping your family manage expenses, including healthcare costs, during challenging times.

Some life insurance products even offer riders* that can cover medical and critical illness expenses, blending life protection with health coverage. Under Section 80D of the Income Tax Act, 1961#, the deduction limit is ₹25,000 per financial year (for self, spouse, and children), and an additional ₹25,000 for parents, which increases to ₹50,000 if the parents are senior citizens. Payments made for preventive health check-ups within these limits are also allowed.

Together, a solid health and life insurance plan ensures that you and your family are financially protected from health-related contingencies, safeguarding both your long-term health and financial well-being.

What are the stages of Retirement Planning?

Retirement planning in India is a crucial aspect of financial security. It involves saving and investing for a comfortable post-retirement life. The journey can be divided into three primary stages as discussed below:

Young Adult (Ages 21–35)

This is the perfect time to begin saving for retirement. Make an in-depth budget first. This will allow you to comprehend your income and spending. Set aside some, even if it is a small percentage of your income, for retirement savings. Think about making long-term investments in equities, mutual funds or employer-sponsored retirement plans.

Examine retirement plans supported by the government, such as the NPS. Moreover, it is important to understand that compounding gives your investments more time to grow if you start them early.

...Read More

Early Midlife (Ages 36–50)

Your career should be well-established by this point, and your salary could have gone up. Analyse your retirement plan and make any required modifications. Boost the amount you contribute to your retirement funds. Start making contributions to the NPS if you have not already.

Understand that re-evaluating your investing plan as well as risk tolerance level is also a prudent idea at this point. To safeguard your funds as you get closer to retirement, you might wish to switch your investments to more conservative ones.

...Read More

Later Midlife (Ages 50–65)

Make sure to maintain and increase your retirement funds as you get closer to retirement. Regularly review your portfolio and make the necessary modifications to keep it in line with your time horizon and risk tolerance. To reduce risk, think about diversifying your investments. Look at possibilities to augment your retirement income, such as reverse mortgages or annuities..

It is crucial to budget for anticipated medical costs at this point. Take into account acquiring sufficient coverage for your health insurance. Examine long-term care choices as well to handle any future needs.

...Read More

Types of Retirement Plans

Retirement planning in India can be done by investing in a range of retirement plans that can help ensure a steady stream of income to maintain a certain lifestyle post-retirement. Currently, the types of retirement plans in India include annuity plans, retirement funds, Unit-Linked Investment Plans, and the National Pension System.

Immediate annuity plans

Annuity plans help a retired individual with regular monthly payments. How does an immediate annuity plan work? After making a single lump sum investment, the annuity payout begins within a year. This option is particularly helpful for those who are nearing their retirement and require a feasible option.

...Read More

Deferred annuity plans

As the name suggests, this kind of annuity plan works differently than the one mentioned above. Here, the investor decides the time period over which they want to receive the annuity payouts. In this case, an individual makes small payments over a period of time to create a large corpus for retirement.

...Read More

Senior citizen savings scheme

This government-backed scheme offers regular income to individuals post-retirement. This type of plan can be availed by retired persons who are over 60 years or above, or even by those who fall between the range of 55 and 60 years.

The investment can be as low as Rs 1,000 in a year while the maximum investment goes up to Rs 15 lakh. The initial time period for investment is five years that can go up to an additional three years after maturity. The current interest rate for such plans is 8.2% per annum for 2023-24.

...Read More

National Pension System

NPS can be extended to individuals who fall between the range of 18 and 70 years. The tax benefits under this plan can go up to Rs 2 lakhs in a financial year and works best for those who have a moderate to high risk appetite. This is because investments are largely in market-linked instruments including equities and debt funds. Investors can also opt for corporate, government bonds and alternative investment funds. The National Pension Scheme account matures after the investor turns 60 years old.

...Read More

Best Retirement Plan in India 2025

Plan Name |

Category |

Interest/Return |

Tax Benefits# |

Eligibility |

Senior Citizen Savings Scheme |

Government-backed |

7.4% |

Deposit amount eligible for deduction under Section 80C#, interest is taxable. |

Age 60 plus (55-60 with retirement benefits) |

Public Provident Fund (PPF) |

Government-backed |

7.1% |

Contributions, the interest earned, and the maturity amount are tax free (EEE) |

Indian resident, Age 18+ |

Atal Pension Yojana (APY) |

Government-backed |

Market-linked to contributions |

Contribution amount eligible for deduction under Section 80CCD (1) |

Age 18-40 |

National Pension Scheme (NPS) |

Market-associated plan |

Market-linked (10-12% average, equity returns) |

Section 80C# + Section 80CCC + Section 80CCD(1) + Section 80CCD (1B) ₹50 lakh extra |

Age 18-70 |

Unit-Linked Insurance Plans (ULIPs) |

Market-associated plan |

Market-linked (varies by fund) |

Section 80C; Maturity tax-free subject to conditions prescribed |

As per insurer terms |

Retirement Mutual Funds |

Market-associated plan |

Market-linked (varies by fund) |

Long Term Capital Gains (LTCG)/Short Term Capital Gains (STCG) tax based on holding |

Age 18+ |

Immediate Annuity Plans |

Guaranteed pension |

5-7% typically |

Pension taxable as per the income slab rate |

As per the insurer’s terms and conditions |

Deferred Annuity Plans |

Assured pension |

Based on the annuity rate at the time of purchase |

Pension taxable as per the income slab rate |

As per the insurer’s terms and conditions |

Factors to Consider When Choosing a Retirement Plan

When selecting a retirement plan, factor in parameters like tax benefits, withdrawal rules, risk level and assured returns. Compare options such as EPF, PPF and NPS to match your income stability, long-term goals and risk appetite level within the Indian financial and regulatory framework.

Account Type: Statutory vs. Voluntary Schemes (EPF, NPS, PPF)

Retirement planning offers both mandatory and voluntary options. The EPF is compulsory for most salaried employees in the organised sector, offering a statutory retirement corpus. In contrast, PPF and NPS are voluntary schemes that are open to all citizens.

Mutual funds and Equity Linked Savings Schemes (ELSS) also serve as voluntary market-linked retirement vehicles, suitable for those who want higher returns with some risk.

Tax Benefits: Section 80C, 80CCD, and Withdrawal Status

Tax efficiency is one of the biggest decision points. Investments in EPF, PPF, and ELSS qualify under Section 80C (₹1.5 lakh limit) of the Income Tax Act, 1961 per financial year. The NPS offers an extra ₹50,000 deduction under Section 80CCD(1B) of the Income Tax Act, 1961#, over and above Section 80C of the Income Tax Act, 1961#. Hence, the total deduction permissible under Section 80CCE is capped at ₹2 lakh per financial year when combined with the additional limit available under Section 80CCD(1B) of the Income Tax Act, 1961#.Tax treatment differs based on maturity: EPF and PPF follow the Exempt-Exempt-Exempt (EEE) model, which makes them highly enticing. NPS withdrawals are partly taxable as annuity income is taxed under the head “Income From Other Sources” as per Section 56, while the lump-sum withdrawal up to 60% of the corpus is exempt under Section 10(12A) of the Income Tax Act#, 1961 while mutual fund withdrawals may be taxed based on the holding period and asset type.

Contribution Limits, Lock-in Periods and Flexibility

Flexibility differs across products. PPF has an annual cap of ₹1.5 lakh and a fixed lock-in of 15 years. ELSS endows the shortest lock-in of only three years. This makes it a popular choice as per Section 80C of the Income Tax Act, 1961#. EPF contributions are a must for eligible employees, with partial withdrawal options under particular conditions.

NPS requires investing until 60 years of age, with limited partial withdrawal flexibility. Mutual funds outside of ELSS have zero statutory lock-in, which offers liquidity for dynamic needs.

Employer Contribution and Expense Ratios (Fees)

A unique benefit of EPF is the employer’s matching contribution, which boosts retirement savings at zero extra cost to the employee. For voluntary plans, fees become essential. NPS has very low fund management charges (i.e. of 0.01%–0.09%), which makes it cost-efficient.

Mutual funds, by contrast, hold Total Expense Ratios (TERs) that can erode returns over time, so zeroing in on low-cost funds is important.

Investment Control: The Equity-Debt Spectrum

Risk appetite plays a central role in choosing the right plan. EPF and PPF provide safe and fixed income returns but limited growth potential. NPS endows flexibility via Active or Auto choice, balancing equity, corporate debt and government securities.

ELSS and other mutual funds provide maximum control and exposure to equity markets, but with higher volatility. Always remember, choosing the correct mix must be based on age, risk tolerance and retirement goals.

Note: If assessee has opted for Old tax regime, assessee shall be eligible to claim deduction under chapter VI-A (like Sections 80C, 80D, 80CCC, etc) of the Income Tax Act, 1961. If assessee has opted for New tax regime then only few deductions under Chapter VI-A such as Sections 80JJAA, 80CCD(2), 80CCH(2) of the Income Tax Act, 1961 are available.

Secure Your Retirement with Our Pension Plans

FAQ's about Retirement Planning

What is the 4% rule in retirement planning?

The 4% rule in retirement planning helps you make your funds last for 30 years. The rule states that you should withdraw only 4% of your corpus in the first year, and for every subsequent year, raise the withdrawal amount enough to keep up with inflation.

Why do you need retirement planning?

Retirement planning ensures financial security in your golden years. It helps bridge the gap between your working income and retirement expenses, fostering peace of mind and the freedom to pursue your post-workday dreams.

What are the 3 R’s of retirement?

The 3 R’s of retirement are:

1. Retirement Planning – It involves setting aside a portion of your income through your working years so you have enough to support you once you retire.

2. Regular Income – Once you retire, you should have the means to get a regular stream of income. For example, purchasing a pension plan or annuity helps you enjoy a regular income to cover your daily expenses and maintain your standard of living.

3. Risk Management – Once you retire, you must manage and mitigate risks as far as possible. You can invest in low-risk investment instruments that provide steady returns to combat the impact of inflation on your savings.

What are basic retirement plans?

India offers two types of retirement plans, Pension Plans and Annuity Plans. The two often work together to secure your finances once you retire. You can purchase a pension plan in your 20s and 30s. The money you put into the plan gets invested on your behalf and builds up a corpus for your retirement. You can then use the corpus to purchase an annuity that provides regular payouts for the rest of your life.

What are some effective ways to plan for retirement and achieve financial goals?

Strategic retirement planning involves setting realistic goals, understanding your time horizon, and choosing suitable investment vehicles. Early and consistent savings, along with regular portfolio reviews, are crucial for building a secure financial future.

What are the biggest mistakes to avoid when planning for retirement?

Common retirement planning mistakes include starting late, ignoring the impact of inflation, overexposing oneself to risky assets near retirement, relying solely on employer EPF or pension, and failing to maintain an emergency fund. Withdrawing retirement savings early also hurts financial security.

Instead, start early, diversify investments, and review plans regularly. These steps prevent inflation from eroding the impact, avoid setbacks from early withdrawals, and ensure the growth of the retirement corpus through proper diversification and risk management. Moreover, regular financial check-ups help identify and correct these mistakes before they worsen.

What is the retirement lifecycle?

The retirement lifecycle has three phases:

1. Pre-Retirement Stage – During this time, individuals are working and focusing on saving and investing for retirement.

2. Retirement Stage – Just after retirement, people in this stage rely on their investments to take care of their day-to-day expenses.

3. Post-Retirement Stage – At this stage, people may require additional support while dealing with age-related health concerns. Some individuals may require long-term care, which will only be possible through adequate financial planning in the pre-retirement stage.

How can I protect my retirement savings from market volatility and risk?

To protect retirement savings from market volatility and minimise risk, start by diversifying your portfolio across equity, debt, and hybrid funds. Gradually reduce equity exposure as retirement approaches and maintain a separate emergency fund covering 6–12 months of expenses.

Consider annuities to secure a guaranteed income portion and focus on safe investments for stability. Avoid panic withdrawals during market downturns, and adopt consistent risk management strategies to safeguard your long-term retirement corpus.

How does inflation affect my retirement savings, and what can I do about it?

Inflation and retirement savings are closely linked because rising prices erode purchasing power over time. A ₹50,000 monthly expense today may double in 12 years at an inflation rate of 6–7%. Therefore, build an inflation-adjusted corpus by investing in equities, balanced funds, and inflation-protected investments, such as increasing annuities or step-up SIPs.

Regularly review retirement plans every 3–5 years to ensure purchasing power protection and keep retirement savings aligned with real-world inflationary pressures. Moreover, planning for inflation ensures that you can maintain your lifestyle even in future years.

What is the legal retirement age in India?

The legal retirement age in India varies across sectors. The private sector does not have any stipulated age limit. For Central Government employees, the retirement age is 60, while State Government employees have to retire at 58. For Defence personnel, the retirement age depends on their rank. Soldiers in the army likely retire between 35 to 37, while officer’s can retire at 58.

What is the ideal income I need in retirement?

The amount you need once you retire depends on your standard of living and expected expenses. For example, individuals who live on rent will likely require more than those who have their own homes and only have to worry about maintenance and taxes. You can use an online retirement planning calculator to better understand how much you would require.

When is the right time to start planning for retirement and how much do I need to save to prepare?

The ideal time to begin retirement planning depends on your circumstances, but starting early maximises the effect of compounding. Determining your savings target involves factors like desired lifestyle and retirement income sources. Financial advisors can create a personalised plan.

What is deferment?

Deferment refers to the strategy of delaying retirement and continuing to work beyond the traditional retirement age. The approach helps people boost their savings and delay the withdrawal of their retirement funds. It can also help people stay active and maintain their physical and mental well-being.

What is retirement planning?

Retirement planning is a process of setting aside assets for retirement, so that one can lead a comfortable life and be financially independent even after they stop earning regular income. In a nutshell, it is a savings programme that manages assets and risks post-retirement.

What are the steps in planning your retirement?

There are a few steps that you must keep in mind while planning your retirement. The first step is to define the financial goals and the amount that is required to meet those goals. Next, evaluate the retirement date to figure out the investment horizon. You can use a retirement planning calculator to understand how much is needed to grow your wealth before retirement. The last step is to purchase a retirement plan and pay regular premiums to create a large corpus for a financially secure future.

How is the Pension Amount Calculated in a Retirement Plan?

To calculate your pension amount accurately, you need to consider factors such as your age, current expenses, existing savings, and an estimation of your future expenses. Furthermore, to calculate returns from an annuity plan, factors such as the accumulated corpus, payout frequency, annuity rate and the selected annuity type (joint-life or lifetime) matter the most.

How Can I Ensure My Retirement Income Keeps Pace with Inflation?

Besides diversifying your portfolio, it is essential to choose inflation-adjusted or increasing annuity plans. Market-linked pension plans, such as ULPPs (Unit-Linked Pension Plans), enable holders to gain high returns and save taxes simultaneously. This helps maintain purchasing power over time, allowing you to eliminate inflation's impact easily.

What are the Advantages of Buying a Retirement Plan Early in Life?

Buying a retirement plan early in life allows you to generate a bigger corpus so you can spend your retirement days comfortably. This happens because the earlier you start, the more time your funds get to compound. Eventually, this compounding leads to a larger retirement fund. Buying early also means a lower premium outgo for the same cover. So, start early to ensure financial independence and a stress-free retirement in the future.

Here's all you should know about Retirement Plans.

We help you to make informed insurance decisions for a lifetime.

Popular Searches

- term insurance plan

- savings plan

- ulip plan

- Pension Plan

- health plans

- child insurance plans

- group insurance plans

- income tax calculator

- pension calculator

- bmi calculator

- compound interest calculator

- best investment plans

- what is term insurance

- HRA Calculator

- get pension of 30000 per month

- get pension of 50000 per month

- one crore retirement plan

- monthly pension of ₹1 lakh

- Investment Calculator

- annuity plans

- retirement planning

- 10 year retirement plan

- 20 year retirement plan

- investment plan for 5 years

- Capital Guarantee Solution Plans

- money back policy

- 1 crore term insurance

- NPS Calculator

- Savings Calculator

- Gratuity Calculator

- critical illness insurance

- Whole Life Insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- life insurance

- life insurance policy

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- best saving schemes

- NRI Retirement Plans

- Types of Retirement Plan

#Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions.

#Tax Laws are subject to change from time to time.

#Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

1. Amount of guaranteed income will depend upon premiums paid subject to applicable terms and conditions.

2. As per Income Tax Act, 1961. Tax benefits are subject to changes in tax laws. Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions.Tax Laws are subject to change from time to time. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

3. Lock in – Applicable if Variant 2 - With Guaranteed Income variant is chosen.

4. Guaranteed Benefit is paid on survival during policy term provided all due premiums are paid during the premium payment term.

5. Allowed only after completion of 3 years from commencement of policy, upto 3 times during policy term, maximum upto 25% of the total premiums paid, subject to receipt of all due past premiums or if Waiver of Premium (WOP) benefit has been triggered

^ Source – https://www.macrotrends.net/global-metrics/countries/ind/india/inflation-rate-cpi

^^ https://npscra.nsdl.co.in/tax-benefits-under-nps.php/all-citizens-faq.php#:~:text=Any%20individual%20who%20is%20Subscriber,lac%20under%20Sec%2080%20CCE.&text=An%20additional%20deduction%20for%20investment,under%20subsection%2080CCD%20(1B).

^#https://datacommons.org/place/country/IND?utm_medium=explore&mprop=lifeExpectancy&popt=Person&hl=en

^ https://www.nysdcp.com/rsc-preauth/learn-about-retirement/currently-saving/articles/four-percent-rule

** https://www.ssa.gov/policy/docs/ssb/v72n3/v72n3p37.html

7. Riders / Add-Ons can be availed upon payment of additional premium. Please refer the Rider / Add-On brochures for detailed terms and conditions.

6. https://www.getyellow.in/resources/inheritance-tax-in-india-its-implications-in-estate-planning

ARN - ED/10/25/27591

RETIREMENT PLANS BUYING GUIDE

RETIREMENT PLANS BUYING GUIDE