What do you want to do?

What is Retirement Planning?

Retirement planning is a step-by-step process that involves evaluation of your financial goals, risk appetite, existing savings, current income & expenses and possible investment avenues that can help you achieve you financial goals post retirement.

In India, retirement planning typically involves contributions to pension schemes like the Employee Provident Fund (EPF) or the National Pension System (NPS), along with personal savings and investments. Real estate, fixed deposits, and mutual funds are a few examples of these investments.

When putting together a retirement plan, it's critical to take your lifestyle, anticipated retirement age, and medical expenses into account. Overall, retirement planning is creating financial plans that will enable you to save, invest, and spend in later life following your long-term objectives.

...Read More

Secure Your Retirement with Our Pension Plans

How Retirement Planning Works?

The objective of retirement planning is to prepare you and your loved ones for a stress-free retired life. Robust retirement planning will ensure that you are able to generate a steady flow of income to meet your regular expenses and fulfill your financial goals post retirement. Ideally retirement planning is a continuous process which evolves over time:

Early years

When you are young and starting out, your contributions towards your savings for your retirement may be limited but to reap the benefits of retirement plan you should start early.

Middle years

When you have established a sizeable source of income you are recommended to increase your contributions to your retirement plan. This approach will help you boost your savings.

Later years

Close to your retirement you set yourself to reap the benefits of savings for decades. This is the time when your start receiving the rewards to live a stress-free retirement.

What are other aspects of retirement planning?

Along with the amount you save it’s also important to take the complete financial scenario into consideration:

Medical insurance

Health insurance needs increases with your age. It is recommended that you get adequate medical insurance coverage well before your retire as premiums are higher at an older age.

Home

While getting a home we often end up taking high amount of liability in order to secure our home. It is recommended that you completely pay off your home loan amount before your retirement so that you don’t have to bear the burden of the liability.

Estate planning

We should plan the distribution of your wealth and assets in our absence well in advance to avoid any hassle during your retirement

How Much Do You Need to Retire?

The amount you would need for retirement is very personal depending on your financial needs and wants post retirement. Ideally, you should start investing in a retirement plan as early as possible. This will give you enough time to create a retirement corpus for a financially secure future in the long run. Once accumulation is done, the corpus can be used to purchase annuities for monthly income post-retirement. Furthermore, even after being converted to annuities, the retirement corpus can continue to grow. The annuity payouts can either be lifelong or for a certain period of time post-retirement.

Take the following things into consideration while calculating your retirement corpus –

Monthly expenses

Existing savings

Systematic investments

Inflation rate

With the above values you can use the retirement calculator to calculate your retirement corpus.

A Step-by-Step Guide to Retirement Planning Process

Planning for retirement involves the following steps:

-

01

Determine Your Retirement Date

Crafting a successful retirement plan hinges on knowing your target. This initial step involves pinpointing your ideal retirement age. Consider factors like desired lifestyle, financial security needs, and health expectations. While traditional retirement falls around age 60, you may envision retiring earlier or later. This crucial decision will set the timeline for your saving and investment strategies.

-

02

Define Your Post-Retirement Goals

After you have determined your expected retirement age, envision your ideal lifestyle for retirement planning. Consider your desired living situation, travel aspirations, and hobbies you wish to pursue. Do you dream of volunteering or starting a passion project? Outlining these goals will help determine the financial resources needed to bring your vision to life.

Be as specific as possible to create a roadmap for a fulfilling and financially secure retirement. Note that the more expensive lifestyle you wish to live, the higher will be the sum you need to accumulate. -

03

Assess Post-Retirement Expenses

Understanding your anticipated expenses in retirement is crucial for setting realistic financial goals. Meticulously track your current spending across various categories like housing, utilities, groceries, and healthcare. Factor in potential changes like reduced commuting costs, increased medical needs, etc.

Also, don't forget to account for inflation's impact on your future purchasing power. This comprehensive assessment will form the foundation for determining the retirement nest egg you will need to maintain your desired lifestyle. -

04

Estimate Costs of Your Retirement Goals

Now that you have envisioned your ideal retirement lifestyle, it's crucial to translate those dreams into a concrete financial plan. In this step of retirement planning, meticulously estimate the expenses associated with your desired retirement. This includes regular living costs, healthcare needs, and any special aspirations like travel or hobbies.

By understanding the total sum you'll require, you can establish a realistic savings target and investment strategy for a secure and fulfilling retirement. -

05

Plan for an Emergency Fund

Life can be unpredictable, even in retirement. An emergency fund acts as a financial safety net to cover unexpected expenses like medical bills, appliance repairs, or home emergencies. This step encourages the creation of a separate savings account specifically for these unforeseen circumstances, ensuring peace of mind and continued financial security throughout your golden years.

-

06

Calculate the Amount and Add Inflation

Account for inflation's impact on your retirement savings. Use a long-term inflation estimate (typically 6-8%) and adjust your desired retirement corpus to ensure its purchasing power maintains pace with rising prices. This step safeguards your financial security throughout your golden years.

-

07

Evaluate Your Current Savings

Gather your financial statements and assess your current savings and investments. Consider factors like employer-sponsored retirement plans, personal retirement accounts, and any emergency funds. This crucial step provides a baseline for calculating the gap between your desired retirement lifestyle and your current financial track. By understanding this gap, you can make informed decisions about future contributions and investment strategies.

-

08

Determine Your Monthly Investment Contribution

This step of retirement planning involves calculating a monthly investment amount that fits comfortably within your budget while ensuring you reach your retirement goals. Factors to consider include your desired retirement lifestyle, remaining years until retirement, and existing retirement savings. Utilise online retirement calculators or consult a financial advisor to determine the optimal monthly contribution that balances affordability with long-term financial security.

-

09

Choose Your Investment Option

Once you have established your retirement goals and timeline, it is crucial to select suitable investment vehicles. This step involves understanding your risk tolerance and time horizon. A variety of options can be considered, such as stocks, bonds, mutual funds, and employer-sponsored plans.

Each of these options has varying risk-reward profiles. Carefully evaluate these options to build a well-diversified portfolio that aligns with your long-term retirement objectives. -

10

Decide on Regular Income or Lump Sum Payouts

Now that your retirement savings are in place, it is time to consider your preferred income stream. Choose between receiving regular payments, similar to a paycheck, or a one-time lump sum distribution. This decision will significantly impact your financial security and flexibility in retirement. Carefully evaluate your future expenses and risk tolerance to determine the approach that best suits your needs.

Best Retirement Plan in India 2025

Here are the some retirement plans you can choose and their features and benefits:

Sr. No. |

Best Retirement Plan in India |

Features |

Tax Benefits Offered |

1 |

Senior Citizens Savings Scheme |

a. Adjustments in Quarterly interest rates b. Stable and fixed rate of return c. Easy withdrawal and terms of account closure d. Many senior citizens prefer investing in this scheme for its low risk and relatively high returns. |

Deposits made under this scheme are eligible for tax deductions of up to Rs. 1.5 Lakhs under Section 80C of the Income Tax Act, 19612. |

2 |

Public Provident Fund (PPF) |

a. PPF is a well-known government-backed savings scheme offering a fixed rate of interest. b. Consumers can experience partial withdrawal. |

Investments made in this scheme qualify for tax deductions of up to Rs. 1.5 Lakh under Section 80C of the Income Tax Act, 19612. The interest accrued and the maturity amount are tax-free. |

3 |

National Savings Certificate (NSC) |

a. The National Savings Certificate is a popular fixed-income investment plan initiated by the government. b. It has a maturity period of mainly 5 years. c. It offers a relatively high interest rate that is regularly revised by the government. |

Investment made of up to Rs. 1.5 Lakh are eligible for tax deductions covered by Section 80C of the Income Tax Act, 19612. |

4 |

National Pension Scheme (NPS) |

a. Regulated by the Pension Fund Regulatory and Development Authority, the National Pension Scheme allows investing in equities, government securities and corporate bonds. b. The minimum amount of contribution to start with is Rs. 500 per month. |

Contributions made in this scheme of up to Rs. 1.5 Lakh are eligible for deductions under the provisions of Section 80C of Income Tax Act, 19612. An additional amount of deduction of Rs. 50,000 is also available under Section 80CCD(1B) of the Income Tax Act, 19612. |

5 |

Debt Mutual Funds |

a. Debt mutual funds invest primarily in fixed-income securities such as treasury bills and bonds. b. The returns derived from these funds are market-linked and outperform the fixed deposits. |

The Income arises from Debt mutual funds are considered as “Income from Capital Gain” taxable at slab rate irrespective of the holding period. No tax deductions or exemptions are applicable. |

Note - It is essential to note that the total deduction available under section 80C considering all the above investments allowed under this section should not exceed Rs.1,50,000 per year. Individuals and HUFs are both eligible for Section 80C deductions.

Types of Retirement Plans

Retirement planning in India can be done by investing in a range of retirement plans that can help ensure a steady stream of income to maintain a certain lifestyle post-retirement. Currently, the retirement plans in India include annuity plans, retirement funds, Unit-Linked Investment Plans and the National Pension System.

Immediate annuity plans

Annuity plans help a retired individual with regular monthly payments. How does this retirement plan work? After one has made a single lump sum investment, the annuity payout begins within a year. This option is particularly helpful for those who are nearing their retirement and require a feasible option.

...Read More

Deferred annuity plans

As the name suggests, this kind of annuity plan works differently than the one mentioned above. Here, the investor decides the time period over which they want to receive the annuity payouts. In this case, an individual makes small payments over a period of time to create a large corpus for retirement.

...Read More

Senior citizen savings scheme

This government-backed scheme offers regular income to individuals post-retirement. This type of plan can be availed by retired persons who are over 60 years or above, or even by those who fall between the range of 55 and 60 years.

The investment can be as low as Rs 1,000 in a year while the maximum investment goes up to Rs 15 lakh. The initial time period for investment is five years that can go up to an additional three years after maturity. The current interest rate for such plans is 8.2% per annum for 2023-24.

...Read More

National Pension System

NPS can be extended to individuals who fall between the range of 18 and 70 years. The tax benefits under this plan can go up to Rs 2 lakhs in a financial year and works best for those who have a moderate to high risk appetite. This is because investments are largely in market-linked instruments including equities and debt funds. Investors can also opt for corporate, government bonds and alternative investment funds. The National Pension Scheme account matures after the investor turns 60 years old.

...Read More

Importance of Retirement Planning

Prepare for Medical Emergencies

Retirement plans provide you with regular income to help take care of your financial obligations once you retire. As you grow older, you may face certain health concerns or medical emergencies that require urgent care. The payouts can help you take care of hospital and medical bills, leaving you free to focus on your health instead of worrying about your finances.

...Read More

Remain Financially Independent

Nobody wishes to be dependent on others, especially not people who have worked hard for several years. Your retirement plan helps you maintain your financial independence once you retire. The payouts help you look after your bills and other financial obligations without relying on loved ones.

...Read More

Help Your Family

Your retirement plan enables you to support your family financially. The payouts allow you to maintain your independence and look after your finances. Depending on the corpus you grow, you can also help your loved ones with their various goals and dreams. Retirement plans also have a life insurance component and provide a payout to your beneficiary if something happens to you. The life cover ensures your loved ones do not have to struggle financially.

...Read More

Meet Your Financial Goals

Retirement plans provide you with the regular payments you need to fulfil your financial goals. The amount helps you maintain your standard of living and protect your finances from inflation. Additionally, the amount helps you build an emergency fund and repay any pending debt.

...Read More

Advantages of Retirement Planning

Life expectancy

The average life expectancy today is 70-75 years, so if you retire at 60 years, you will still have many years of retirement where you need regular income. That’s where a comprehensive retirement plan helps. You can start your retirement planning as early as 20 years or 30 years or 40 years of age.

...Read More

Medical costs

As costs of medical treatments rise, it is important to have a corpus for emergencies. While a sound health insurance plan can help you tide over such emergencies during your work life, it’s better to factor in medical expenses that arise in old age as well. That’s because spending from your own pocket is not practical particularly during old age, when an individual is more susceptible to illnesses.

...Read More

Tax benefits

Investing in a retirement plan can help reduce tax liability and maximise savings. You can claim a deduction of up to Rs 1.5 lakh for the premiums paid towards the plan under Section 80C of the Income Tax Act, 1961.

...Read More

Peace of mind

It may sometimes get very challenging to manage money, both for short-term and long-term needs. Sometimes, health issues may crop up without notice and it’s bound to hurt your pocket, especially if you are old and do not have a regular income. With retirement planning, you can stay happy and healthy without being stressed.

...Read More

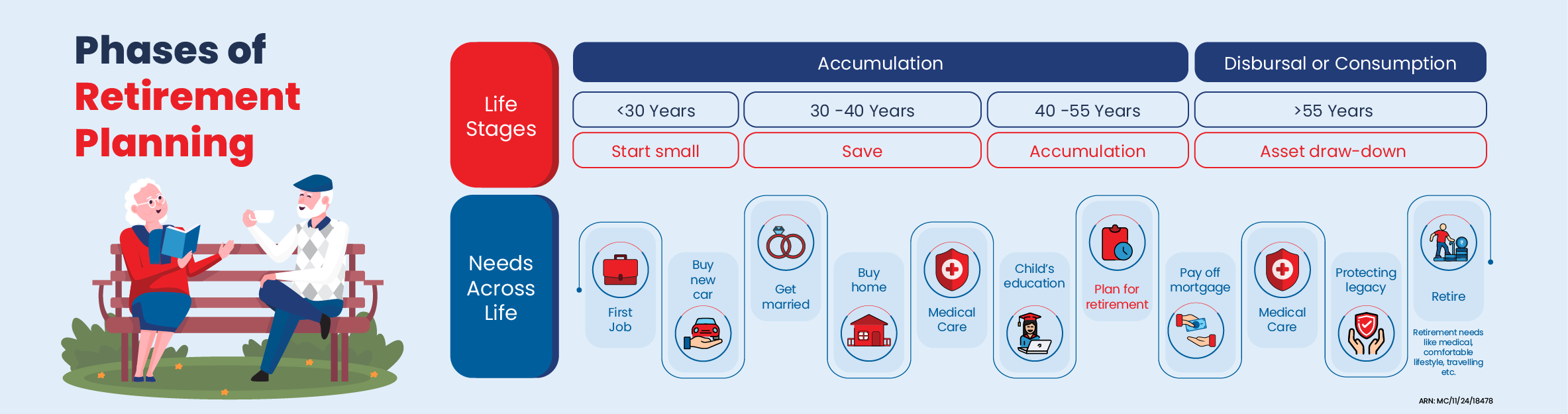

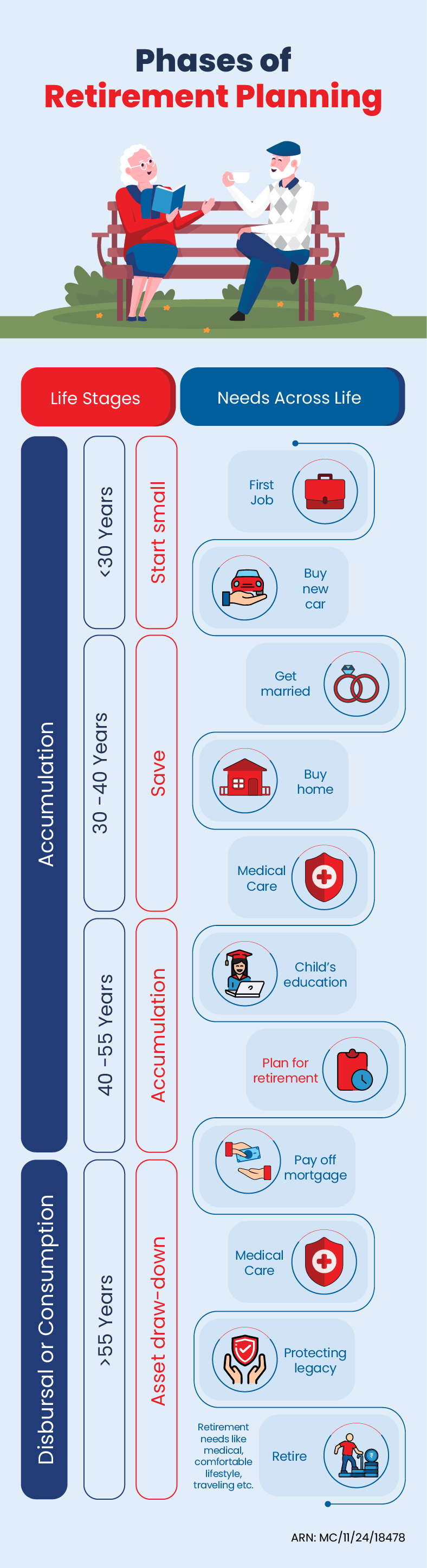

Stages of Retirement Planning

Retirement planning in India is a crucial aspect of financial security. It involves saving and investing for a comfortable post-retirement life. The journey can be divided into three primary stages as discussed below:

Young Adult (Ages 21–35)

This is the perfect time to begin saving for retirement. Make a thorough budget at first to comprehend your income and spending. Set aside some, even if it is a small percentage of your income for retirement savings. Think about making long-term investments in equities, mutual funds, or employer-sponsored retirement plans.

Examine retirement plans supported by the government, such as the National Pension System (NPS). Moreover, it is important to understand that compounding gives your investments more time to grow if you start them early.

...Read More

Early Midlife (Ages 36–50)

Your career should be well-established by this point, and your salary could have gone up. Analyse your retirement plan and make any required modifications. Boost the amount you contribute to your retirement funds. Start making contributions to the NPS (National Pension Scheme) if you have not already.

Understand that re-evaluating your investing plan and risk tolerance is also a smart idea at this point. To safeguard your funds as you get closer to retirement, you might wish to switch your investments to more conservative ones.

...Read More

Later Midlife (Ages 50–65)

Make sure to maintain and increase your retirement funds as you get closer to retirement. Regularly review your portfolio and make the necessary modifications to keep it in line with your time horizon and risk tolerance. To reduce risk, think about diversifying your investments. Look at possibilities to augment your retirement income, such as reverse mortgages or annuities.

It is crucial to budget for anticipated medical costs at this point. Take into account acquiring sufficient coverage for your health insurance. Examine long-term care choices as well to handle any future needs.

...Read More

Where should you invest for retirement?

There are many types of investments you can consider for retirement. While some options offer regular income with low risks, others take higher risks but offer higher potential income. You should pick an option based on your risk appetite, investment objectives, and the number of years left till your retirement.

Here are some of the best choices for different retirement objectives:

- For Regular Income after Retirement

Retirement annuity plans provide you with regular and assured returns for a certain number of years as per the stipulated terms. You can also invest in a government scheme like NPS (National Pension Scheme) to get a fixed annuity after retirement.

- Safe and Secure Investment without Market Volatility

Fixed deposits offered by banks and post offices offer fixed returns, which are not affected by changes in the market.

- Guaranteed Lifelong Income

Certain annuity plans provide an assured sum as a pension for a specific number of years as you choose. Senior Citizen Savings Schemes also provide assured income at fixed interest rates.

- Tax Benefits on Investments

Many investment options, such as PPF (Public Provident Fund), ULIP (United Linked Insurance Plan), ELSS (Equity Linked Savings Scheme), NPS, etc., offer tax savings under Section 80C of the Income Tax Act.

- Customisable As Per Your Needs

Stocks, mutual funds, and ULIP plans come with market risks but offer greater incomes than traditional pension plans. If you have a long time till retirement, you can use these options to grow a substantial retirement corpus.

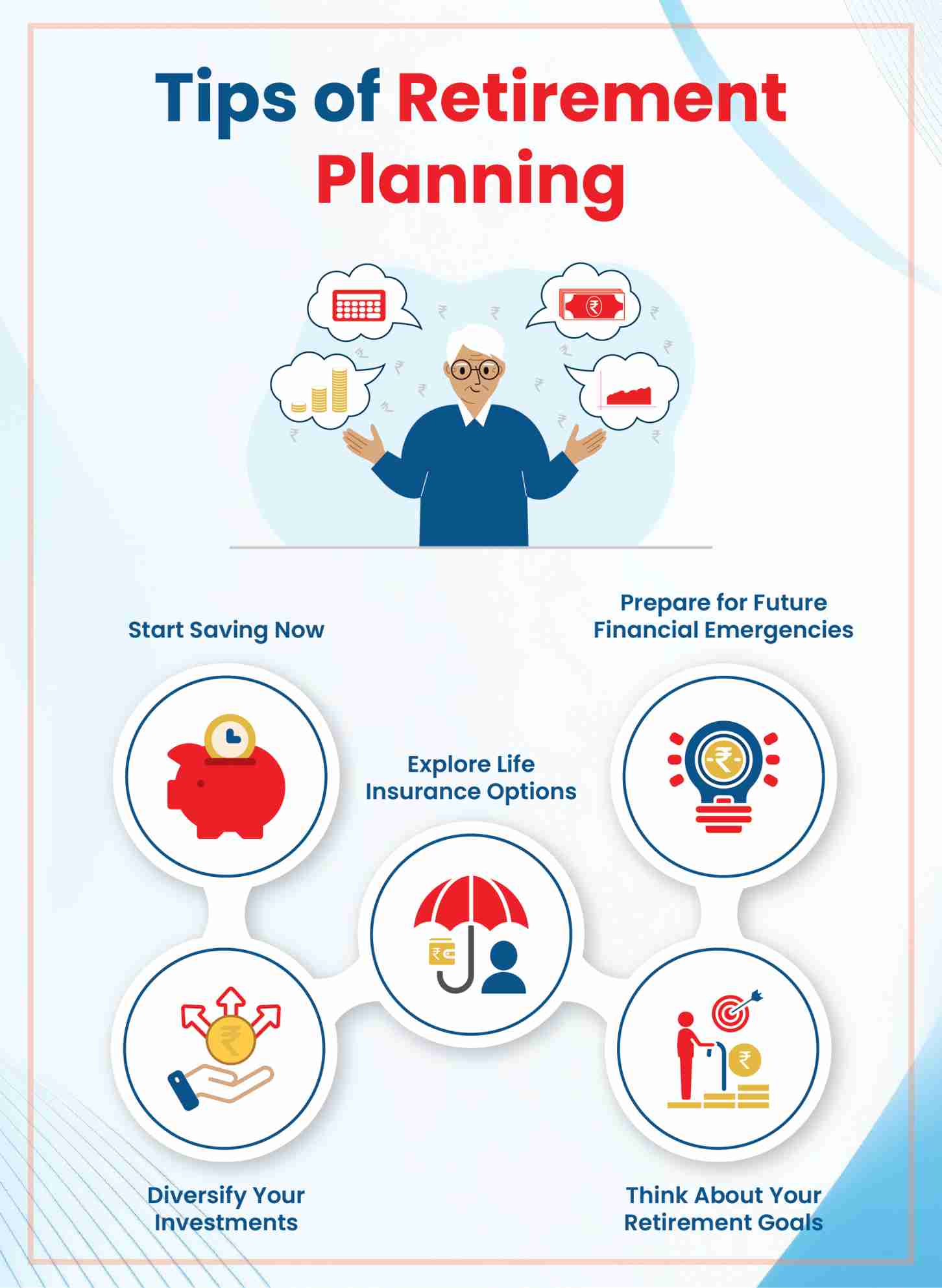

Tips for Retirement Planning

Start Saving Now

When it comes to planning for retirement, the earlier you start, the better. Starting early gives you more time to save a corpus that will grow steadily each year. The power of compounding works better the longer you stay invested, so purchasing one of the various types of pension plans in your 20s and 30s will help you enjoy a financially secure retired life.

...Read More

Prepare for Future Financial Emergencies

While planning your retirement, you must consider future financial emergencies. For example, purchasing a health insurance plan and setting up a contingency fund to help with medical costs or other emergencies helps you maintain your financial independence once you retire.

...Read More

Explore Life Insurance Options

Every good financial plan includes a life insurance policy. You can consider getting a term plan to secure your family’s financial future and help your spouse prepare for retired life. Ensure you evaluate your options and find a policy that provides enough support for your loved ones.

...Read More

Diversify Your Investments

When it comes to planning your finances for the future, never put all your eggs in one basket. You should find ways to diversify your investments to ensure good returns over the years. Ideally, look for investment options that allow you to lower your risk by investing in different types of funds. Evaluate the various investment and retirement plans available and pick one that suits your financial goals and risk appetite.

...Read More

Think About Your Retirement Goals

Finally, before you purchase a retirement plan, understand how much you would need to achieve your post-retirement goals. Consider the cost of travelling in the future or the cost of learning how to play an instrument or set up a consultancy. List your goals and carefully consider how much they would cost. Once you understand how much you need, you can work on a plan to help you achieve your target.

...Read More

Factors to Consider While Planning for Retirement

Estimate Retirement Age and Investment Horizon

It is important to evaluate your expected retirement age and accordingly plan your future. One must consider their current age, expected retirement age as well as the investment horizon to build a strategy for retirement.

...Read More

Risk appetite

If one starts retirement planning early on, their risk appetite is likely to be higher than someone who begins late. In that case, they can invest in assets like equities that may be risky but offer higher returns.

...Read More

Current financial situation

Another aspect that must be considered in retirement planning is an individual’s current financial situation–their expenses, lifestyle and any debts they have. This will help understand how much needs to be saved for retirement.

...Read More

Spending on retirement needs

This may sound like a far-fetched plan but it is imperative to account for several expenses including housing, healthcare and other expenses that may arise during old age. Determining these expenses may be a good idea to help build a comprehensive retirement strategy for the future.

...Read More

Asset allocation plan

Also, the returns earned from an investment may be lower, particularly in case of higher inflation. Once an individual has evaluated their investment goals, investment horizon, risk appetite and similar needs, they can consult an asset allocator for guidance.

...Read More

Change Investments Closer to Retirement

As you grow older, your risk appetite will become lower as you have less time to adjust your investments to changing market conditions. This means you should choose low-risk investments whose returns do not change much due to fluctuations and volatility in markets.

Debt mutual funds and fixed deposits are ideal options for individuals who are close to retirement age.

...Read More

Keep Paperwork Ready and Involve the Family

Any retirement plan should include one’s spouse, children and grandchildren to leave behind a legacy. That’s why it’s important for retirees to keep their closest family members prepared beforehand.

You will want your loved ones to know which plans they can redeem, what sources of funds you have created, how to claim insurance plans, and so on. In addition, you will want to go through all the necessary paperwork, including preparing a will to ensure that there are no disputes in your absence.

...Read More

Choose the Right Partner

If you need help, you should contact a retirement advisor to navigate the complex aspects of retirement planning. To choose the right person to lead you, ensure they have the necessary qualifications and certifications, such as Certified Financial Planner (CFP) or Associate Financial Planner (AFP) from FPSB India.

The next thing to look at is their past experience and area of speciality. For instance, if you want help managing your investment portfolio, choose someone with investment-related experience.

...Read More

Start as Early as Possible

Saving early gives you more time to contribute more to your retirement plan. It also gives your investments more time to grow and benefit from the power of compounding. The ideal time to get started is during your 20s, as you have substantially more time to accumulate more wealth.

Even a very small amount saved can give substantial returns over a long time. Moreover, with a longer time horizon, you can afford to take some risks and invest in high-potential assets.

...Read More

Invest First, Spend Later

When you start on your investment journey, you may initially find it difficult to save money. That’s why most retirement planning experts recommend that you prepare a budget and follow it diligently. You can follow the 50-30-20 rule of budgeting, where you can spend 50% of your income on essential expenses, 20% on savings, and the rest on things you want but don't need.

...Read More

Pay off Costly Debts First

Having multiple and substantial debts can hamper your ability to make regular savings. Therefore, if you are burdened with debt, your entire focus should be to clear it as soon as possible to avoid interest accumulation. Focus on the costliest debt first, i.e., the one with the highest rate of interest.

If possible, you consolidate your existing debt by taking a larger loan with a lower rate of interest to pay off multiple high-interest loans.

...Read More

Set Automatic Transfers

To ensure disciplined savings, you can opt for automatic fund transfers to make fixed and regular contributions to your retirement funds. There are multiple options, such as Systematic Investment Plans (SIPs), recurring deposits and automatic premium payments. Such automatic transfers make sure you keep investing regardless of market conditions.

...Read More

Set up Annuities

Annuity plans or annuities provide a fixed payment for a specific number of years. They are low-risk investment plans that offer you complete flexibility in choosing the pension amount and frequency and premium frequency. By investing in an annuity plan, you can attain financial security and supplement your income with regular returns. Some annuities provide regular income for the rest of your life.

...Read More

Check for Tax Efficiency

If you don’t plan for tax savings, your income from capital gains, dividends, interest income, etc., can push you into higher income tax slabs. This can reduce your overall income for the rest of your life. To make sure this doesn’t happen, invest in tax-efficient assets such as NPS, PPF, ELSS, etc. By lowering your taxable income, you can get the most benefits out of your retirement savings.

...Read More

Monitor Regularly

Retirement planning requires you to carefully monitor your portfolio to meet your retirement goals. Check whether your investments are performing as expected by calculating their rate of return. If some assets are underperforming, adjust your portfolio mix to get sufficient returns. Experts recommend monitoring and rebalancing your portfolio at least once a year to make sure you can reach your long-term goals.

...Read More

Financial Independence, Retire Early (FIRE) – How does it work?

In the recent years we have observed an increasing urge to retire early. Financial Independence, Retire Early (FIRE) is a school of thought that encourages individuals to save and invest a major portion of their earnings with the objective to achieve financial independence.

Using FIRE as a means to achieve financial independence requires you to be frugal with your expenses and be very diligent with your investment allocation. Here are some ways by which you can plan for your FIRE:

Build an emergency fund

Before getting on with your journey of growing your wealth you should keep at least 3-6 months of your monthly expense aside as your emergency fund for the rainy day.

...Read More

Financial Protection

Before identifying suitable investment opportunities you should get a health insurance to curb the financial impact of a medical emergency and you should also get a term life insurance to protect the financial future of your loved ones in case of your death

...Read More

Invest wisely

It is imperative to have a very stringent investment approach and be disciplined towards the approach. The investment options you select should meet your financial goals.

...Read More

Reconsider your FIRE number

The basic approach to arrive to your FIRE number is 25 times of your annual expense and then withdraw 3-4% of your portfolio to manage your expenses post retirement.

...Read More

How do retirement plans work?

Ideally, you should start investing in a retirement plan as early as possible. This will give you enough time to create a retirement corpus for a financially secure future in the long run. Once accumulation is done, the corpus can be used to purchase annuities for monthly income post-retirement. Furthermore, even after being converted to annuities, the retirement corpus can continue to grow. The annuity payouts can either be lifelong or for a certain period of time post-retirement.

Eligibility Criteria for Retirement Plans in India

The eligibility criteria for retirement plans in India are discussed below:

- Entry Age: The minimum age to enroll for most retirement plans in India is 18 years old. This allows individuals to take charge of their financial future early and benefit from the power of compounding. There may be variations depending on the specific plan, with some having a higher entry age limit. Be sure to check the eligibility details of the plan you are considering.

- Premiums: The amount you contribute regularly towards your retirement plan is known as the premium. These contributions can typically be chosen based on your affordability and desired retirement income. Some plans offer flexible premium options, allowing you to adjust your contributions as your financial situation evolves.

- Vesting Age: Vesting age refers to the age at which you can begin receiving the retirement benefits accumulated in your plan. This age can vary depending on the specific plan you choose, but it typically falls between 40 and 80 years old.

Some plans offer immediate annuities, where payouts commence as soon as you purchase the plan. Understanding the right time to start receiving annuity is crucial for the retirement planning process, as it dictates when you will have access to your retirement savings.

Retirement Planning Mistakes to Avoid

When making a retirement plan, make sure to avoid the common mistakes listed below:

- Not Preparing for Emergencies: Your retirement savings should account for unforeseen emergencies, including medical treatments, accidents, etc. Most experts recommend keeping at least 6 months’ worth of income aside for emergencies.

- Not Planning Ahead: Your retirement plan should cover everything from budgeting and expense planning to investments and tax savings. Having a comprehensive plan helps you achieve your retirement goals.

- Carrying Debt into Your Retirement: You should avoiding have any debt when you no longer have a source of income. Before you retire, make sure to pay off all your existing debts and rely on your savings and investments later on.

- Underestimating Required Savings: Many people tend to only account for their current expenses and necessities when calculating their savings requirements. However, factors such as inflation, taxes, out-of-pocket medical costs, and emergencies can substantially increase your needs.

- Not Starting Early Enough: Many people don’t realise the importance of retirement planning at an early stage of their careers. To make the most of the benefits of compound interest, people should start their retirement plans, ideally in their 20s.

Retirement Planning with Life Insurance

A retirement or pension plan with life cover provides you with peace of mind as it ensures the financial safety of your loved ones in your absence. The insurance gives a large payout to your dependents in the event of your unfortunate demise, allowing them to live their lives and pursue goals like higher education and marriage. Moreover, if you have outstanding obligations like a home loan, it enables them to retain ownership of your home.

FAQ's about Retirement Planning

1 What is the 4% rule in retirement planning?

The 4% rule in retirement planning helps you make your funds last for 30 years. The rule states that you should withdraw only 4% of your corpus in the first year, and for every subsequent year, raise the withdrawal amount enough to keep up with inflation.

2 Why do you need retirement planning?

Retirement planning ensures financial security in your golden years. It helps bridge the gap between your working income and retirement expenses, fostering peace of mind and the freedom to pursue your post-workday dreams.

3 What are the 3 R’s of retirement?

The 3 R’s of retirement are:

1. Retirement Planning – It involves setting aside a portion of your income through your working years so you have enough to support you once you retire.

2. Regular Income – Once you retire, you should have the means to get a regular stream of income. For example, purchasing a pension plan or annuity helps you enjoy a regular income to cover your daily expenses and maintain your standard of living.

3. Risk Management – Once you retire, you must manage and mitigate risks as far as possible. You can invest in low-risk investment instruments that provide steady returns to combat the impact of inflation on your savings.

4 What are basic retirement plans?

India offers two types of retirement plans, Pension Plans and Annuity Plans. The two often work together to secure your finances once you retire. You can purchase a pension plan in your 20s and 30s. The money you put into the plan gets invested on your behalf and builds up a corpus for your retirement. You can then use the corpus to purchase an annuity that provides regular payouts for the rest of your life.

5 What are some effective ways to plan for retirement and achieve financial goals?

Strategic retirement planning involves setting realistic goals, understanding your time horizon, and choosing suitable investment vehicles. Early and consistent savings, along with regular portfolio reviews, are crucial for building a secure financial future.

6 What is the retirement lifecycle?

The retirement lifecycle has three phases:

1. Pre-Retirement Stage – During this time, individuals are working and focusing on saving and investing for retirement.

2. Retirement Stage – Just after retirement, people in this stage rely on their investments to take care of their day-to-day expenses.

3. Post-Retirement Stage – At this stage, people may require additional support while dealing with age-related health concerns. Some individuals may require long-term care, which will only be possible through adequate financial planning in the pre-retirement stage.

7 What is the legal retirement age in India?

The legal retirement age in India varies across sectors. The private sector does not have any stipulated age limit. For Central Government employees, the retirement age is 60, while State Government employees have to retire at 58. For Defence personnel, the retirement age depends on their rank. Soldiers in the army likely retire between 35 to 37, while officer’s can retire at 58.

8 What is the ideal income I need in retirement?

The amount you need once you retire depends on your standard of living and expected expenses. For example, individuals who live on rent will likely require more than those who have their own homes and only have to worry about maintenance and taxes. You can use an online retirement planning calculator to better understand how much you would require.

9 When is the right time to start planning for retirement and how much do I need to save to prepare?

The ideal time to begin retirement planning depends on your circumstances, but starting early maximises the effect of compounding. Determining your savings target involves factors like desired lifestyle and retirement income sources. Financial advisors can create a personalised plan.

10 What is deferment?

Deferment refers to the strategy of delaying retirement and continuing to work beyond the traditional retirement age. The approach helps people boost their savings and delay the withdrawal of their retirement funds. It can also help people stay active and maintain their physical and mental well-being.

11 What is retirement planning?

Retirement planning is a process of setting aside assets for retirement, so that one can lead a comfortable life and be financially independent even after they stop earning regular income. In a nutshell, it is a savings programme that manages assets and risks post-retirement.

12 What are the steps in planning your retirement?

There are a few steps that you must keep in mind while planning your retirement. The first step is to define the financial goals and the amount that is required to meet those goals. Next, evaluate the retirement date to figure out the investment horizon. You can use a retirement planning calculator to understand how much is needed to grow your wealth before retirement. The last step is to purchase a retirement plan and pay regular premiums to create a large corpus for a financially secure future.

Here's all you should know about Retirement Plans.

We help you to make informed insurance decisions for a lifetime.

Popular Searches

- term insurance plan

- savings plan

- ulip plan

- Pension Plan

- health plans

- child insurance plans

- group insurance plans

- income tax calculator

- pension calculator

- bmi calculator

- compound interest calculator

- best investment plans

- what is term insurance

- HRA Calculator

- get pension of 30000 per month

- get pension of 50000 per month

- one crore retirement plan

- monthly pension of ₹1 lakh

- Investment Calculator

- annuity plans

- retirement planning

- 10 year retirement plan

- 20 year retirement plan

- investment plan for 5 years

- Capital Guarantee Solution Plans

- money back policy

- 1 crore term insurance

- NPS Calculator

- Savings Calculator

- Gratuity Calculator

- critical illness insurance

- Whole Life Insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- life insurance

- life insurance policy

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- best saving schemes

- NRI Retirement Plans

1. Amount of guaranteed income will depend upon premiums paid subject to applicable terms and conditions.

2. As per Income Tax Act, 1961. Tax benefits are subject to changes in tax laws. Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions.Tax Laws are subject to change from time to time. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

ARN - ED/01/25/20582

RETIREMENT PLANS BUYING GUIDE

RETIREMENT PLANS BUYING GUIDE