What do you want to do?

Term Insurance Meaning and Definition

Table of Content

1. Why is Term Insurance Important?

2. Why is Term Insurance Better?

3. Key Features of Term Insurance Plans

5. How Term Life Insurance Works?

6. Why Is Sum Assured Important in Term Insurance?

7. How much Term Cover do I need?

8. Who should buy Term Insurance plans?

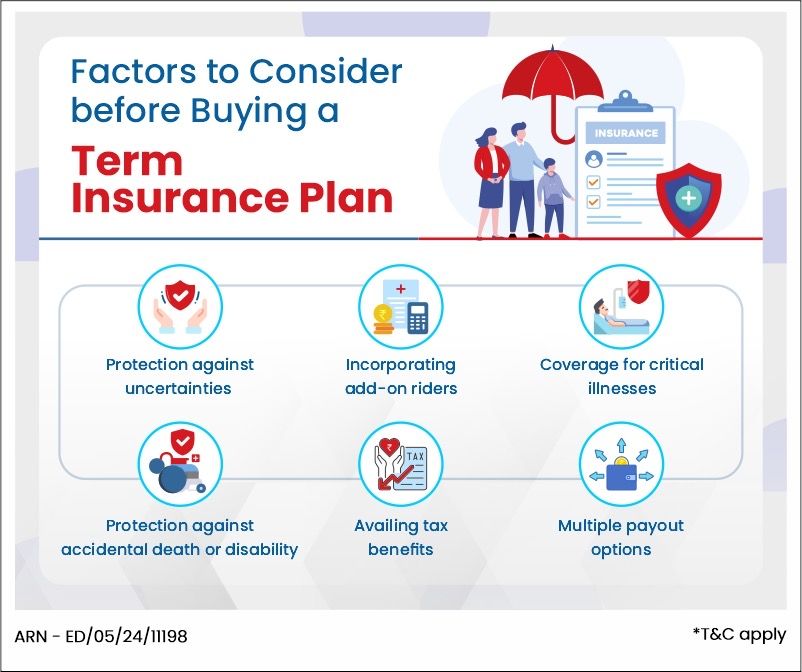

9. Factors to Consider before Buying a Term Insurance Plan

10. How to Buy Term Insurance Online?

11. Benefits of HDFC LIFE Click 2 Protect Super

12. Conclusion

13. FAQs on What is Term Insurance

Why is Term Insurance Important?

Once you learn what term insurance is, you must understand why it is important to be able to make informed decisions. Here are some of the reasons why term insurance is important and why opting for a basic life insurance plan is a wise decision:

Financial protection for your family:

A pure life cover primarily aims to provide financial support to your family in your absence so that they can maintain their lifestyle and meet their future financial needs seamlessly. This includes paying off debts and/or covering expenses requiring significant investments like education and healthcare.

Protect Your Assets:

When a bread-earner of a family passes away, it often strains the household financially. It can also jeopardise assets like property, vehicles, businesses, etc., that may have outstanding loans against them. A level term policy covers these debts and assists your family in retaining their assets/investments. It, therefore, prevents the emotional distress associated with losing one’s hard-earned possessions during difficult times.

Lifestyle-related risks:

There is always a higher risk of getting lifestyle diseases as we start to age. However, there are many affordable life insurance plans that offer riders with critical illness benefits. These bring the much-needed financial protection against life-threatening ailments. If you get yourself a term life insurance policy with critical illness riders you can ensure your family’s security during uncertain times. Besides, with term plan riders, you are also able to safeguard yourself during your lifetime with coverage for critical illnesses.

Why is Term Insurance Better?

Term Insurance is a better option for the majority of people because it provides comprehensive coverage at an affordable cost. It also offers financial security for your family during your sudden demise. Since there is no investment or savings component, the premium amount is also comparatively low. Hence, policyholders can avail themselves of a significant assured sum at a reasonable price.

Another reason is its flexibility. You can choose the duration of your policy, considering your needs and preferences. Many plans also offer rider facilities, such as critical illness coverage or accidental death benefits, for additional benefits.

Unlike other life insurance plans, term insurance plans are simple to understand. There are no hidden charges involved. Because financial security is crucial, term insurance ensures that your family maintains a decent standard of living and meets their needs.

Key Features of Term Insurance Plans

1. Larger life cover

Since term life insurance plans are more affordable it is possible for an individual to opt for a higher life cover for the same premium as an endowment plan. For e.g. a 30-year old can get a term plan with a cover of Rs 1 crore for a 30-year term by paying a premium.

The Rs 1 crore endowment plan would most likely be out of reach for most 30-year-olds. However, purchasing a term plan for a comparable coverage is more reasonable.

You can even avail life cover till the age of 100 years by opting for a whole life insurance.

2. Riders

The policyholder can attach riders to the term plan, thereby enhancing the utility of the policy. So by opting for a critical illness rider or a critical illness insurance, for instance, he is entitled to receive the sum assured on being diagnosed with the critical illness. This is in addition to the death benefit of an equal amount on death over the term of the policy. There are other riders to choose from like - loss of employment cover, disability cover, waiver of premium cover, among others. The policyholder should select riders based on his specific needs to make the life cover more suitable and meaningful.

3. Enhanced cover

Certain insurance companies provide the flexibility to enhance life insurance coverage throughout critical life stages of the policyholder's life. For instance, the policyholder may be permitted to enhance life cover by 50% at the time of marriage and by 25% when they become a parent. This flexibility allows the policyholder to start with a modest cover and increase it as their responsibilities grow, along with the ability to pay higher premiums. To better understand how much additional coverage you might need during these milestones, you can use a life insurance calculator. It helps you estimate the right amount of life insurance coverage based on your changing financial responsibilities.

4. Innovative features

While insurance companies have been quick to innovate in general, they have been most innovative with regards to what is term plans. For instance, companies have been quick and proactive in cutting premium rates even offering extra discounts to certain categories like non-smokers, for instance. Buying term plans is now quite convenient thanks to the internet. It is possible for a healthy individual, as defined by the insurer, to buy a term plan over the internet without taking medical tests for term insurance.

5. Tax Benefits

Buying term life insurance plan can also bring with it a host of tax benefits. As per section 10 (10D) of the Income Tax Act1, the sum assured that a policyholder receives after the maturity of the plan is tax-free; this also applies when the person insured surrenders their policy or loses their life. Furthermore, the bonuses that are received with this amount are also exempt from tax, under section 10 (10D).

6. Multiple Payout Options

When you sign up for a policy, you are required to pay a fixed amount to the chosen insurance provider to receive benefits. You can choose monthly, quarterly or annual payouts, as per your convenience. What this ensures is the death benefit to the beneficiary, in case of the demise of the policyholder. It could either be given out as a lump sum payout or in a staggered manner, which is equal to the sum assured.

7. Premium waiver

Premium waiver, as the term suggests, is a benefit that waives any future premiums in the event of an exceptional condition. For instance, this applies in cases where the insured policyholder is a victim of permanent disability due to an accident. This is applicable only if all the previous premiums have been paid.

8. Increasing Term Insurance

An increasing term insurance plan is the one where you have an option of increasing your coverage over time and in a flexible manner. It helps your sum assured grow over regular intervals, helping you keep pace with inflation, as well as, your changing financial needs. This way, you can provide better security for your family. However, the premiums for term insurance under these plans are often slightly higher than the standard plans.

9. Additional Add on

There are many riders that you can pick from as add-ons to go with your term insurance plan. These riders help you customise your insurance plan to meet your specific needs. Some of the popular add-on options include — critical illness riders, accidental death benefits, and the return of premium (TROP) feature. They increase the scope of your policy and offer financial protection during unexpected events.

10. Age of entry

There is a flexible age of entry for most online term insurance plans. As a result, people as young as 18 and those as old as 65 can opt for coverage — making term insurance highly accessible to people from different life stages. What works best is when you are an early entrant with lower premiums and greater financial stability. However, older applicants can still enjoy flexible coverage that is tailored to their specific needs.

Types of Term Insurance

In India, term insurance has become a popular and cost-effective option for life insurance, guaranteeing financial security for policyholders and their families. Here are the different types of term insurance available in India:

1. Level Term Insurance:

The most common type of policy, providing a fixed sum assured throughout the life of the policy. Policyholders benefit from a predictable cost structure because premiums are constant.

2. Increasing Term Insurance:

To offset the effects of inflation, this variant sees the sum assured gradually increase over the policy term. Despite slightly higher premiums than level term insurance, the policy is a robust hedge against the rising cost of living.

3. Decreasing Term Insurance:

This type of policy is tailored to individuals with specific financial obligations, like loans, to ensure that the sum assured declines with time, in line with the decreasing financial obligations. In the meantime, premiums remain constant, ensuring stable coverage.

4. Term Insurance with Return of Premium (TROP):

In this policy, if the policyholder survives the policy term, the total premiums paid will be refunded. Although term insurance plan with return of premium (TROP) premiums are higher than traditional term plans, TROP offers a savings component, making it an appealing option for some.

5. Convertible Term Insurance:

In addition to offering adaptability, this type allows policyholders to convert their term plan into an endowment or whole life policy at a later stage. Individuals whose needs may evolve over time benefit from this flexibility.

It is crucial for Indian individuals to understand the nuances of these term insurance options in order to make well-informed decisions based on their unique financial goals and family needs. In order to ensure financial stability and comprehensive coverage in the face of life's uncertainties, assess your personal circumstances and choose a policy aligned with your long-term goals.

How Term Life Insurance Works?

Level term policies are policies with level premiums for specific durations like 10, 20, or 30 years, commonly referred to as "level term" policies. Insurance companies charge policyholders a premium, typically paid monthly, in order to provide them with the benefits they are entitled to.

Premiums are calculated by insurance companies based on factors such as health, age, and life expectancy. There might be a need for a medical exam based on your health and your family's medical history, depending on the policy you choose.

Generally, premiums are fixed and paid throughout the term. The insurance company pays the death benefit to the beneficiaries if the insured person dies before the policy expires. In the event the term ends and the individual dies afterward, there is no coverage or payout. The insurance can be renewed or extended, but the new monthly premium is determined by the person's age at the time of renewal.

Most term life insurance policies are convertible, allowing them to be converted into permanent life insurance policies within a specified period of time. Premiums increase when term life insurance is converted to permanent life insurance.

Why Is Sum Assured Important in Term Insurance?

Choosing the right sum assured in your term insurance plans is essential for your family's financial security. This sum provides crucial protection in case of unexpected events, giving you peace of mind. A higher sum ensures your loved ones are well-supported, covering debts, education costs, and income replacement. Selecting the right amount is key to ensuring their future is secure. To explore the best term life insurance options and find the ideal sum assured for your needs, click the tabs below.

ARN - ED/02/25/21047

How much Term Cover do I need?

Calculating your Human Life Value or HLV is a simple, quick, and clear way to answer this question. A life insurance cover calculator, like the HLV, provides an easy-to-use method of estimating how much term insurance do I need. Here is a basic rule to determine your HLV:

Age In Years |

Income Multiple |

18-35 |

25 times of your annual income |

36-45 |

20 times of your annual income |

46-50 |

15 times of your annual income |

51-60 |

10 times of your annual income |

For instance, if a 32-year-old man has an annual income of 10 lakh, the recommended Life Cover for him would be 25 times his income, totaling 2.5 crores.

Who should buy Term Insurance plans?

Term insurance plans are affordable life cover options for everyone, whether they are business persons or salaried employees. These plans protect against life's uncertainties at any age.

In their 20s, opting for a plan with high coverage and low premiums is a wise decision. In their 30s, term insurance helps protect growing families and manage increasing financial responsibilities. Even in their late 40s and 50s, it provides enough coverage for major expenses like children's education and weddings, while also aiding in retirement planning. It’s also crucial to secure the financial future of homemakers with the help of term insurance for housewife.

Here are some of the people who stand to benefit from buying term insurance plans:

Young Professionals:

When you have just started working, you have fewer financial responsibilities and may have the funds available to purchase a term plan at a much cheaper premium. This is because, at a young age, you are most likely to be healthy and free from the risk of diseases. As a result, young professionals get high coverage at cheaper rates and can easily protect their family’s financial future through a sensible investment.

Newly Married:

Those who are newly married have newer, shared responsibilities as well. With term insurance you can safeguard the financial future of your spice while catering for expenses like a home loan or family planning needs.

Working Women:

As more and more women become financially independent, their roles in shaping the financial standing of their families cannot be ignored. Women term insurance allows working women with dependents to secure their family’s financial future through a comprehensive term plan.

Housewives:

Homemakers and housewives, even though they do not contribute directly to the family income, play a significant role in ensuring financial savings and security. Their passing away can strain a family financially in a significant manner, simply finding replacements for childcare and home management services.

Taxpayers:

If you are a taxpayer, you can opt for a term insurance plan — a practical way of saving on taxes and gaining financial protection at the same time. This dual benefit comes from Section 80 C of the Income Tax Act1, which provides tax benefits on term insurance.

Parents:

Parents who have young, dependent children must consider investing in a term insurance policy to safeguard their kids’ future. The maturity benefits from the policy can help meet the financial needs related to education, healthcare, and other essentials in case the parent passes away.

Self-Employed People:

Self-employed professionals and entrepreneurs do not enjoy any employer-related benefits. Hence, term insurance is one of the natural and sensible investments for them — helping safeguard the financial well-being of their family and loved ones in their absence.

Non-Residents Indians (NRIs):

NRIs can opt for a term insurance plan to provide financial security to their families back home. These plans ensure financial support to loved ones in India, covering loans or other obligations in their absence.

Factors to Consider before Buying a Term Insurance Plan

Some of the key features and benefits of term insurance plans include:

1. Protection against uncertainties:

Term insurance plans offer protection against uncertainties, ensuring the financial well-being of your family. With affordable premiums, you can provide substantial coverage and ensure a worry-free future for your loved ones.

2. Incorporating add-on riders:

Add-on riders like the Accidental Death and Dismemberment Rider and the Waiver of Premium Plus Rider. These riders come at an extra cost but provide additional benefits, giving you comprehensive coverage and peace of mind.

3. Coverage for critical illnesses:

While critical illnesses may feel distant in your 20s and 30s, their impact can be devastating. To address this, consider adding a critical illness rider to your term insurance plan. This additional coverage provides financial support in the event of covered illnesses, protecting your savings.

4. Protection against accidental death or disability:

Term insurance is crucial for protecting against the financial burdens of unpredictable accidents. Acting promptly to secure an accidental death or disability rider ensures comprehensive coverage for accidental dismemberment and death.

5. Availing tax benefits1:

Term insurance plans provide tax relief up to Rs. 1.5 lakh under Section 80C, while critical illness covers offer additional tax benefits under Section 80D.

6. Multiple payout options:

Term insurance plans provide multiple payout options, allowing your family to receive financial assistance in a structured manner that meets their specific needs during unexpected situations.

How to Buy Term Insurance Online?

The online term insurance buying process is simple and hassle-free. Here is a step-by-step guide on buying your term insurance online. It is a seamless and simple process that can be completed with a click of just a few buttons:

1. Evaluate Your Financial Needs Before Buying Term Insurance

To start with, make sure that you have thoroughly assessed your future financial needs, as well as your present financial obligations. Consider family needs and future goals while contemplating factors such as - kids’ education, outstanding loans, and living expenses. Such an evaluation always helps to come up with the most suitable sum assured you need in order to secure your loved ones adequately. Also, it works particularly when you have a clear understanding of term insurance meaning and benefits.

2. Estimate the Premium of a Term Insurance Policy Before Investing

It is always best to use a premium calculator and get an estimate of the most suitable premium you can opt for on the basis of inputs like the selected sum assured, policy tenure, and age. A term insurance calculator is a great tool to assess the affordability of a policy, as it provides a clear estimate of the premium you need to pay. Such an estimate is also useful in helping you budget for the policy in an effective manner, ensuring that you choose a plan that aligns with your financial goals.

3. Check the Term Insurance Claim Settlement Ratio (CSR) of the Insurer

It is very important to check the CSR of the selected insurer you want to go with. It reflects the percentage of claims the insurer settled in a given year. A high CSR is an unsaid assurance suggesting that your family’s claims will be honoured and processed smoothly and in a timely fashion.

4. Choose Riders for Extra Coverage

Once you have decided which term insurance to go with, you can opt for riders to boost the coverage. Some of these could be critical illness cover, or an accidental death benefit, or a waiver of premium. These add-ons are a great way to increase your financial security and offer comprehensive protection against unforeseen events.

5. Pay Your Term Insurance Premium Online

You can finally complete your purchase by paying the premium. These transactions are secure, and most insurers offer an array of payment options. These include credit card payment, netbanking and even UPI payment. Check the ones available and opt for the most convenient one.

Benefits of HDFC LIFE Click 2 Protect Super

HDFC LIFE Click 2 Protect Super^^ is a versatile term insurance plan that offers comprehensive coverage to safeguard your loved ones in unexpected events. It provides the flexibility to customise coverage according to your individual requirements, ensuring financial stability for your family. With unique features like life stage protection, the plan allows you to adjust coverage as your life progresses. In addition to its robust protection, HDFC LIFE Click 2 Protect Super offers the convenience of online purchasing and the option to enhance coverage with riders. Combining affordability, flexibility, and reliable protection, this plan provides a secure future for you and your family.

Conclusion

Term insurance is a type of life insurance that provides coverage for a specific period of time. Beneficiaries receive a death benefit if the insured person dies during the policy term. This type of insurance typically offers the choice between level premiums, where the premium remains the same for the entire term, or increasing premiums, where the premium gradually rises over time. Additionally, some term policies may allow for conversion to permanent insurance, providing the insured with the option to extend coverage beyond the initial term. For those seeking significant protection, the best term insurance plan for 1 crore can offer valuable financial security for loved ones.

FAQs on What is Term Insurance

1. What is term insurance, and how does it work?

A term insurance is a life insurance policy that offers insurance coverage for a pre-decided period of time called the ‘term’ and hence the name. In case the insured dies during the term of the policy, their nominees can claim the death benefit. But, if the insured survives the term there is no payout unless the policy includes a return of premium (TROP) feature.

2. Who is eligible for term insurance?

In most cases, any person who is 18 or above can get a term insurance policy, while the maximum age limit goes up to 65 years. Please check with your chosen insurance provider to see if there are any term insurance eligibility criteria to fulfill.

3. What are the factors that affect the term insurance premium?

Before your premium is decided, your insurance provider will evaluate certain factors like your age, gender, medical history, location, occupation, lifestyle, and more.

4. Can I buy term insurance for a spouse?

Yes, that option is available if you want to go for it. There are joint-term insurance plans that provide coverage to both you and your spouse, as part of the same policy.

5. How much term insurance do I need?

As per the best practice, the sum assured should always be a minimum of 10 times your annual income; if you choose a higher range, that’s even better. While this is the norm, make your own judgment, based on your individual needs and preferences.

6. What are the minimum and the maximum age to buy a term insurance policy?

You can buy a term insurance policy from the age of 18 to 65 years. But there are exceptions too-certain insurance companies that offer plans to older people too.

7. What is a term insurance rider?

The rider is a benefit that a policyholder can opt for over and above their chosen policy. These provide added assurance in case of accidents, permanent disability, or even critical illnesses.

8. Does term insurance expire?

Yes, a term insurance policy does expire. It has a fixed duration of 10, 20 or 30 years, as was decided by the policyholder at the time of purchasing the policy. Once this term is over, the policy expires. Once it expires, the policyholder can renew the policy or let it lapse. Mostly, renewal comes at a higher premium due to an increase in age and health-related risks.

Similar Articles:

- 10 FAQs on Term Insurance

- Demystifying Traditional Term Plans

- Top Features of Term Plans that You Must Know About

- What Will Happen When a Term Life Insurance Policy Matures?

- 4 Simple Methods to Calculate : How Much Term Insurance You Need

- Factors to consider while buying a term insurance

- 5 Reasons Self Employed People Should Buy Term Insurance

Not sure which insurance to buy?

Talk to an

Advisor right away

Advisor right away

We help you to choose best insurance plan based on your needs

Here are a few more articles about Term Insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- Best Investment Plans

- What is Term Insurance

- 1 Crore Term Insurance

- Short term saving plan

- Term insurance

- Saving plans

- ULIP Plan

- Health Plans

- Child Insurance Plans

- Group Insurance Plans

- Long Term Savings Plan

- Fixed Maturity Plan

- Monthly Income Advantage Plan

- Pension Calculator

- BMI Calculator

- Compound Interest Calculator

- Term insurance Calculator

- Tax Savings Investment Options

- 2 crore term insurance

- 50 lakhs term insurance

- annuity plans

- Investment Calculator

- get pension of 30000 per month

- ULIP Returns in 5 Years

- investment plan for 5 years

- investment plan for 10 years

- 50 Lakh Investment Plan

- guaranteed returns plans

- sanchay plans

- Pension plans

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- term insurance plan

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Saving Schemes

- Life Insurance for NRI

- Investment Plans for NRI

- features of term insurance

- Best Term Insurance Plan for 1 Crore

- personal accident insurance

1. Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions. Tax Laws are subject to change from time to time. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

^^ HDFC Life Click 2 Protect Super (UIN: 101N145V07) is a Non-Linked, Non-Participating, Individual, Pure Risk Premium/ Savings Life Insurance Plan.

^ Available under Life & Life Plus plan options

@As per integrated annual report FY23-24, available on www.hdfclife.com. As of May 2024

#Provided we have received all the relevant and required documents and no further investigation is required. Claim settlement process would be completed within stipulated timelines once the claim request is approved

##Individual claim settlement ratio by number of policies as per audited annual statistics for FY 23-24

***Online Premium for Life Option for HDFC Life Click 2 Protect Super (UIN: 101N145V07), Male Life Assured, Non-Smoker, 20 years of age, Policy term of 25 years, Regular pay, Annual frequency, exclusive of taxes and levies as applicable. (Monthly Premium of 622/30=20.7).

**7% online discount available on 1st year premium only

~Tax benefits of ₹ 54,600 (₹ 46,800 u/s 80C & ₹ 7,800 u/s 80D) is calculated at highest tax slab rate of 30% on life insurance premium u/s 80C of ₹ 1,50,000 and health premium (Critical illness rider) u/s 80D of ₹ 25,000. Tax benefits are subject to conditions under section 80C, 80D, 10(10D) as per Income Tax Act, 1961. Please consult your tax advisor for more information.

*Online Premium for Life Option, Male Life Assured, Non-Smoker, 20 years of age, Policy term of 40 years, Regular pay, Monthly frequency, exclusive of taxes and levies as applicable.

ARN- DM/04/25/22752