What do you want to do?

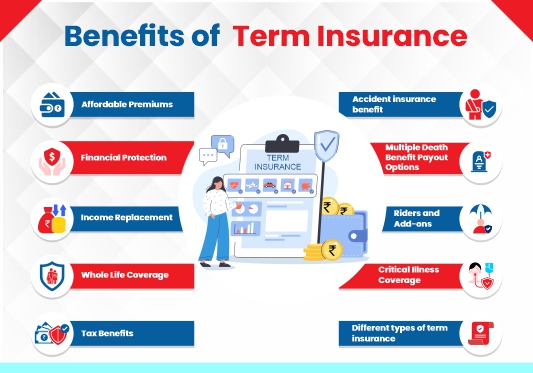

What are the benefits of term insurance?

Table of Content

- Affordable Premiums

- Financial Protection

- Income Replacement

- Whole Life Coverage

- Tax Benefits

- Accident insurance benefit

- Multiple Death Benefit Payout Options

- Riders and Add-ons

- Critical Illness Coverage

- Different types of term insurance

1. Affordable Premiums

You can get a high-quality term life insurance policy by paying very low premiums. Payments for premiums can be made on a monthly, semi-annual, quarterly or on an annual basis. The amount of the premium you need to pay for a term insurance plan depends on your age, cover amount, tenure and other factors. You can use a term insurance calculator to calculate the applicable premium for your desired life cover.

2. Financial Protection

One of the most critical term insurance benefits is the peace of mind it gives to the policyholder, knowing that your family and loved ones’ financial future is secured in your absence.

3. Income Replacement

Term insurance's maturity benefit in the form of cover amount acts as income replacement for the policyholder's family/other nominees. With the help of that cover amount as survivor support, whether it's in lakhs or crores, the financial needs and future of your family remain secure. Given that you can choose to get the maturity amount in parts as well instead of lumpsum, it acts as an income replacement and does not let the financial future get jeopardised. The big cover also helps in wealth preservation and estate planning for the nominees' future.

4. Whole Life Coverage

Term insurance plans offer coverage for as high as 99 years known as whole life insurance. Technically giving whole life coverage for the policyholders.

5. Tax Benefits

Another added bonus of buying term life insurance is the availability of income tax benefit. Premium that you pay for term insurance is eligible for tax deductions under 80C of Income Tax Act. Also the maturity amount received is tax free.

6. Accident insurance benefit

Another advantage among the term insurance benefits is accident insurance rider. You can upgrade your term insurance policy to include the Accidental Death Benefit Rider. This will provide a defence against future accidents through the sum assured.

7. Multiple Death Benefit Payout Options

The policyholder may select a lump sum payout, a monthly, quarterly or yearly income, a combination of lump sum & income, or an increasing income at the beginning of the payout.

8. Riders and Add-ons

There are riders available for term insurance plans that allow you to increase the term life insurance benefits of the basic coverage. For a small extra premium, you can include these riders in your term insurance policy.

Certain insurers offer a waiver of all future premiums in the event of dismemberment or diagnosis of one of the designated critical illnesses, for instance.

9. Critical Illness Coverage

If your term insurance plan has an optional Critical Illness Rider, you will receive a lump sum payment upon the diagnosis of any covered critical illness.

10. Different types of term insurance

There are various types of term insurance: Level Term Plans, Increasing Term Insurance Plans, Decreasing Term Insurance, Term Insurance with Return of Premium, and Convertible Term Plans.

What are the Major Benefits of Term Insurance When Purchased Early in Life?

Low Premium

One of the biggest term insurance benefits is this. The earlier you buy term insurance in life, the lesser amount of premium you need to pay for that cover. That is why it is recommended to buy it at an early age, like in your 20s. With a term insurance for housewife, housewives can avail term insurance at cheaper premiums.

Long Coverage Period

Another benefit of purchasing term insurance plan early is that you get higher possibility of longer coverage period, since your current age is lower. For example, a person aged 25 may get a higher cover of say 80-90 years, whereas a person buying term insurance aged 40 may not get such a long coverage. Also, the longer the cover tenure is, the longer is the risk coverage of your plan.

High Sum Assured

By buying term life insurance while you’re young, you can meet the term insurance eligibility criteria for a higher sum insured. Since age is on your side, insurers may see you as a lower-risk customer, offering a higher coverage amount, which is one of the key benefits of term insurance.

How can Term Insurance Safeguard Your Family’s Future?

Term insurance is an affordable method for protecting your family. Let us explore how term insurance safeguards your family’s future:

Replacing Lost Income

Your family generally depends on your income if you are the only earning member. Otherwise, they might struggle to meet daily expenses. By opting for term insurance, you can avail yourself of a lump sum amount after your sudden demise. This money can further replace your lost income and assist your family in paying necessities such as rent, food, and education. It also ensures leading them to a decent standard of living even when you are not around.

Covering Your Debts

The majority of people opt for loans such as car loans, home loans and personal loans. Under your sudden demise, your family might struggle to repay these debts. Term insurance here comes to a rescue and eases your financial burden. The pay-out from the policy helps to pay off outstanding loans and prevents financial stress on your loved ones. This way, your family does not need to sell assets or be involved in borrowing money to cover debts.

Summary

Term insurance is a great way of protecting your family’s future. It provides financial security when needed the most. If you have a sudden death, your family receives the lump sum amount. This thereby helps in managing daily expenses, paying off debts, and maintaining their lifestyle, ensuring they do not face any financial struggles during difficult times.

Term insurance is affordable and provides comprehensive coverage at a comparatively low cost. It is a crucial step towards a stress-free future for your loved ones.

How to Select the Best Term Insurance with the Right Sum Assured Option?

As a rule of thumb, purchase a term insurance policy which has all the features and benefits that you need, coupled with a lower premium. The coverage in the form of an insured sum should ideally be equal to or greater than 10-15 times your yearly income. For instance, to get the most out of a term insurance plan, you should choose an adequate life cover of at least Rs 1.5 crore- 2.25 crore if your annual income is currently Rs 15 lakh.

Why to Choose the Right Term Insurance Plan?

Term insurance policies offer financial assistance to the family of policyholders at an affordable rate within the mentioned period. Moreover, life insurance of this kind provides comprehensive life coverage at low premium rates. Thus, if the policyholder dies during the policy term, the nominee receives an assured sum as a death benefit.

To gain a thorough understanding of term insurance, make sure to check its features and benefits before you opt for the plan. A term insurance comparison can also help you identify the best options available.

Insurance Coverage Against Uncertainties

Opting for a term insurance plan provides financial assistance to family members under certain unforeseen circumstances like the policyholder’s death or disability due to an accident. One can however easily opt for significant life coverage for a small premium payable with a term plan.Provides Coverage for Critical Illness

As you age, you have a higher chance of being affected by critical illnesses such as cancer, heart attack, and cardiovascular disease. All these disease treatments are not only time-consuming but are also expensive. Opting for a term insurance plan provides you coverage with a critical illness rider.

A critical illness rider offers you additional benefits when you apply for it with a regular-term insurance plan. Under this rider, if you are diagnosed with an illness, you will be paid a lump sum amount for treatment without exhausting your savings.Provides Add-on Riders

When choosing to opt for a term insurance plan, you can add on riders with the plan. Choosing a rider will let you avail additional premium benefits with comprehensive coverage.Offers Tax Benefits

There are several tax benefits available on life insurance, including tax deductions on premiums under Section 80C of the Income Tax Act 1961 of up to Rs. 1.5 lakh. Moreover, with critical illness coverage, you can avail tax benefits under Section 80D of the Income Tax Act on the premium paid.

The death benefits received by a policyholder's family members are also completely tax-free as per the provisions of Section 10 (10D) of the Income Tax Act.Offers Multiple Payout Options

When you opt for any term life insurance plan, it is necessary to pay a fixed amount at the beginning to avail benefits. Here, you can choose monthly, yearly, or quarterly payouts. This provides you with the maximum flexibility of paying premiums.

FAQs on Term Insurance Benefits

Q: What are the benefits of term insurance plan?

Below are the top 10 term insurance benefits:

- Affordable Premiums

- Financial Protection

- Income Replacement

- Whole Life Coverage

- Tax Benefits

- Accident insurance benefit

- Multiple Death Benefit Payout Options

- Riders and Add-ons

- Critical Illness Coverage

- Different types of term insurance

Q: What is covered in term insurance?

In case of your untimely demise, the life cover amount of term insurance plan will provide a predetermined sum to your loved ones named as nominees. Besides term insurance benefits such as death benefit, term insurance plans can also cover critical illness and accident insurance.

Q: Does term insurance have maturity benefits?

Given that the very nature of term insurance is to cover your nominees for the tenure of the plan, term insurance does not usually offer maturity benefits. But survival benefits can be there if you choose the return of premium option which nowadays is available in term insurance plans.

Q: What is the best age to buy term insurance?

The simple answer is, as early as you can. The earlier you buy, like in your 20s, the lower your premium can turn out to be. One of benefits of term insurance is its affordability through such low premiums.

Q: What is the best amount for term insurance?

A term insurance plan should ideally cover at least 10-15 times your annual income.

Q: Can I purchase multiple-term insurance plans?

Yes, you can purchase multiple-term insurance plans considering your respective insurance requirements.

Q: What are the optional term plan benefits?

Riders are optional add-on benefits you can include with your term insurance plan. At an affordable premium rate, you can opt for riders for financial security against any accidental death, critical illnesses, costs of hospitalisation, and others.

Q: What is the difference between the benefits of term insurance and life insurance?

There are some differences between the benefits of term insurance and life insurance. With a term insurance plan, you can avail simple life coverage. On the other hand, there are many types of life insurance plans, which provide additional benefits, such as return of premium, guaranteed returns and substantial profits via investment.

Q. Should NRIs get a Term Plan?

Term insurance for NRIs is an excellent solution for individuals living abroad because it offers the same affordability, income replacement, and comprehensive coverage as it does for locals. NRIs can rest assured that their family in India is financially secure in the event of their untimely death, with no restrictions or exclusions based on their international status.

Not sure which insurance to buy?

Talk to an

Advisor right away

Advisor right away

We help you to choose best insurance plan based on your needs

Here are a few more articles about Term Insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- Best Investment Plans

- What is Term Insurance

- 1 Crore Term Insurance

- Short term saving plan

- Term insurance

- Saving plans

- ULIP Plan

- Health Plans

- Child Insurance Plans

- Group Insurance Plans

- Long Term Savings Plan

- Fixed Maturity Plan

- Monthly Income Advantage Plan

- Pension Calculator

- BMI Calculator

- Compound Interest Calculator

- Term insurance Calculator

- Tax Savings Investment Options

- 2 crore term insurance

- 50 lakhs term insurance

- annuity plans

- Investment Calculator

- get pension of 30000 per month

- ULIP Returns in 5 Years

- investment plan for 5 years

- investment plan for 10 years

- 50 Lakh Investment Plan

- guaranteed returns plans

- sanchay plans

- Pension plans

- term life insurance

- features of term insurance

- Best Term Insurance Plan for 1 Crore

- personal accident insurance

##Individual claim settlement ratio by number of policies as per audited annual statistics for FY 23-24

#Provided we have received all the relevant and required documents and no further investigation is required. Claim settlement process would be completed within stipulated timelines once the claim request is approved

^ Available under Life & Life Plus plan options

@As per integrated annual report FY23-24, available on www.hdfclife.com. As of May 2024

**7% online discount available on 1st year premium only

***Online Premium for Life Option for HDFC Life Click 2 Protect Super (UIN: 101N145V07), Male Life Assured, Non-Smoker, 20 years of age, Policy term of 25 years, Regular pay, Annual frequency, exclusive of taxes and levies as applicable. (Monthly Premium of 622/30=20.7).

~Tax benefits of ₹ 54,600 (₹ 46,800 u/s 80C & ₹ 7,800 u/s 80D) is calculated at highest tax slab rate of 30% on life insurance premium u/s 80C of ₹ 1,50,000 and health premium (Critical illness rider) u/s 80D of ₹ 25,000. Tax benefits are subject to conditions under section 80C, 80D, 10(10D) as per Income Tax Act, 1961. Please consult your tax advisor for more information.

*Online Premium for Life Option, Male Life Assured, Non-Smoker, 20 years of age, Policy term of 40 years, Regular pay, Monthly frequency, exclusive of taxes and levies as applicable.

ARN - ED/03/25/22720