What do you want to do?

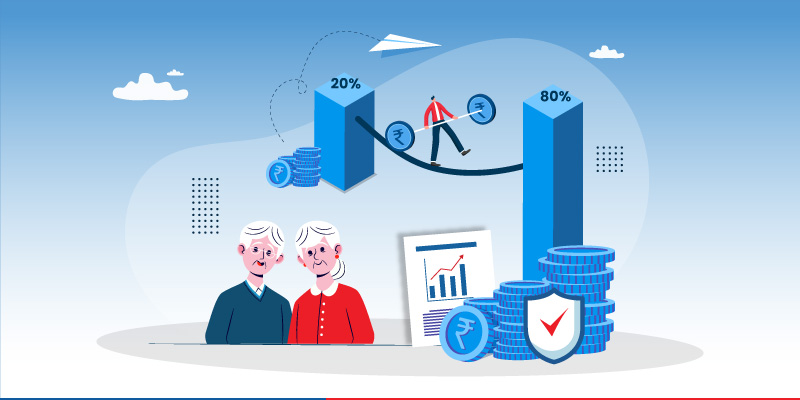

The 80/20 Rule for Retirement

Table of Content

Planning for retirement can be overwhelming, but the 80/20 rule offers a simple and effective strategy to ensure financial security in your golden years. By focusing on the key areas that yield the most significant results, you can maximise your savings and investments while minimising unnecessary expenses. In this article, we will explore the concept of the 80/20 rule for retirement and its potential benefits in maximising wealth and achieving retirement goals.

What Is the 80/20 Retirement Plan?

The 80/20 retirement plan, also known as the Pareto Principle, is an effective approach to retirement planning. It is based on the idea that 80% of your retirement outcomes are driven by 20% of your efforts. This concept encourages individuals to focus on the crucial factors that have the most significant impact on their financial well-being during retirement.

By identifying and prioritising these key elements, individuals can effectively optimise their savings plans and investments for retirement. This approach can help ensure that the vital few factors that will ultimately determine their financial success are given the attention they deserve.

The 80/20 retirement plan is a well-crafted strategy that aims to divide your retirement savings into two distinct categories. The first category, which constitutes 80% of your funds, is invested in conservative assets that carry lower risks. The other category, which accounts for 20% of your portfolio, is allocated to assets that come with higher risks but potentially offer higher returns.

This approach is designed to strike a balance between security and growth potential in your retirement investments. By allocating a smaller portion to higher-risk investment plans, you can potentially earn higher returns while still maintaining a significant portion of your funds in safer options.

How Does the 80/20 Rule Work?

The 80/20 rule for retirement is a concept that can help you achieve maximum efficiency and success in building wealth for your retirement. It works by identifying the most critical factors that drive your investment and savings success, allowing you to concentrate on the few assets that generate most of your returns.

By focusing on the crucial factors that have the most significant impact on your retirement savings, you can streamline your efforts and prioritise your time, resources, and energy towards what truly matters. This principle helps you to avoid distractions and time-wasting activities, enabling you to achieve your retirement goals with ease and efficiency. By following the 80/20 rule for retirement, you can achieve a better financial future and enjoy a comfortable retirement.

How Can the 80/20 Rule Benefit Retirement Planning?

The 80/20 rule can benefit retirement planning by helping you identify the most impactful strategies for saving and investing. By focusing on the vital few aspects that drive the majority of your financial outcomes, you can optimise your retirement plan for maximum success.

This approach allows you to allocate your resources effectively and make informed decisions that align with your long-term goals. The benefits of implementing the 80/20 rule for retirement planning are as follows:

- Firstly, it allows you to strike a balance between growth and security. By diversifying your retirement funds across different investment options, you can potentially benefit from market growth while also minimising risks.

- Moreover, the rule helps in maintaining a disciplined investment approach and avoiding impulsive decisions based on momentary market fluctuations.

Benefits of the 80/20 Money Rule for Retirement Savings and Investment

1. Increased Savings Rate: Utilising the Pareto Principle for your retirement savings can lead to a notable increase in your savings, which is one of its most significant advantages. In comparison to saving only 10% or 5% of your income, saving 20% can result in a much higher savings rate.

2. Reducing Expenses: The principle of 80/20 in investing can aid in recognising the 20% of costs that generate 80% of your earnings. You can redirect the other money towards investments that perform better. Concentrating on decreasing these expenses can help you save more money.

3. More Money for Retirement: Applying the 80/20 percent financial rule can be a useful approach to increasing your retirement savings. By saving 20% of your income, you can potentially benefit from the compounding effect over the long run, resulting in a larger savings pool for your retirement.

4. Better Investment Choices: The principle of Pareto Investment proposes that a majority, specifically 80%, of returns on investments can be anticipated from a minority, which is 20% of investments. By focusing on the 20% of investments that have the potential to generate the largest returns, you may be able to accelerate the growth of your savings.

5. Guard Against Risk: Mitigating risk is possible by using the 80/20 investing rule. This means allocating 80% of one's savings into safe investments, while the remaining 20% is put into riskier growth stocks. Such a strategy can act as a cushion against uncertainties in the market.

Maximising Wealth Using the 80/20 Rule of Retirement

The few ways to maximise wealth using the 80/20 rule for retirement are as follows:

- Focus on the Vital Few: By concentrating on the 20% of factors that contribute to 80% of your retirement savings and investment results, you can prioritise your efforts for maximum impact. Concentrating on a selected group of investments allows for better management and tracking of their performance, ultimately leading to enhanced returns. This approach helps avoid spreading investments too thinly, which can dilute potential gains.

- Smart Investment Strategy: By following the 80/20 rule for retirement, you can focus on strategic investment opportunities that offer the highest potential returns. The 80/20 rule encourages you to analyse investment options carefully and prioritise those that offer the most potential returns. By adopting a strategic investment strategy, and diversifying your investments by purchasing, Stocks or Bonds, Life Insurance policy or buying ULIPs you can potentially maximise your retirement savings funds.

- Reduce Unnecessary Expenses: Retirement planning demands cost-efficiency. Identifying and eliminating unnecessary expenses can free up more resources to boost your retirement savings and investment growth. Focusing on essential investments can help minimise unnecessary fees, charges, and expenses associated with managing multiple investment options.

- Maximise Income Streams: Diversifying your income sources and focusing on high-yield opportunities can help accelerate your retirement savings growth. By focusing on the essentials, individuals can potentially maximise their income streams during retirement. Prioritising investments with steady income generation allows for a reliable and stable cash flow to support retirement expenses.

- Keep an Eye on Tax Efficiency: By prioritising tax-efficient investment strategies, you can minimise tax liabilities and maximise your savings. Efficient tax planning is crucial for retirees. By streamlining your investments and optimising tax benefits, you can potentially minimise tax liabilities, thereby maximising your retirement income.

- Continuously Assess and Adjust: Retirement planning is an ongoing process. Regularly assessing and adjusting your investment portfolio based on market trends and a personal circumstance is vital for long-term success. The 80/20 rule encourages a proactive approach to retirement planning which ensures that you stay on track to meet your financial goals.

- Streamline Your Retirement Goals: The 80/20 rule promotes clarity and focus when setting retirement goals. By identifying and prioritising your financial objectives, you can streamline your efforts and pursue strategies that align with your desired outcomes.

- Leverage Time: Time is a valuable asset for retirement planning. The 80/20 rule emphasises the importance of starting early and leveraging the power of compounding over time. By starting early and leveraging the power of compounding, you can maximise the growth potential of your retirement savings over time.

- Plan for the Long Term: Retirement planning involves a considerably long time horizon. The 80/20 rule encourages individuals to incorporate long-term investment options, such as retirement accounts and diversified portfolios, to ensure sustainable income throughout retirement. By adopting a long-term perspective and aligning your retirement plan with your future financial goals, you can secure a stable and comfortable retirement lifestyle.

Conclusion

The 80/20 rule for retirement offers a powerful framework for optimising your retirement plan and achieving financial security in your golden years. By focusing on the vital few factors that drive the most significant results, you can streamline your efforts, maximise your savings and investments.

Implementing the 80/20 rule in your retirement planning can lead to a more efficient and effective approach to building wealth for the future.

FAQs on the 80/20 Rule for Retirement

What is the 80/20 rule for retirement?

The 80/20 rule for retirement states that roughly 80% of a person’s total retirement income can be derived from 20% of the investments or assets. This rule encourages individuals to focus on a selected group of investments that offer the highest potential returns to maximise their retirement savings.

What are the 80/20 rules of retirement examples?

The 80/20 rule in retirement planning includes prioritising high-yield investment opportunities, minimising unnecessary expenses, and diversifying income sources for maximum growth. An example of the 80/20 rule for retirement is allocating 80% of your retirement funds to low-risk assets such as bonds or fixed deposits, while allocating the remaining 20% to higher-risk investments such as stocks or real estate.

What is the Pareto Chart?

A Pareto chart is a visual representation of data that follows the Pareto principle. It displays the relative frequency or impact of different factors, entities, or issues in descending order. This chart helps identify the vital few elements that contribute the most significant value or impact in a given context.

Is the Pareto Chart used for the 80-20 rule of retirement?

While the Pareto chart is not directly used for the 80/20 rule of retirement, it is a useful tool for analysing the performance and impact of different investment options within a retirement portfolio. It can help identify the investments that contribute the most significant returns and prioritise them accordingly.

How do you calculate the 80-20 rule of retirement?

To calculate the 80/20 rule of retirement, you need to assess the contribution of each investment to your overall retirement income. Identify the investments that generate approximately 80% of your retirement income. The remaining investments that contribute to the remaining 20% of your retirement income account for 80% of your portfolio. Regular reviews and adjustments may be necessary to maintain the balance.

Related Articles

- 30-30-30-10 Rule for Retirement Planning

- Retirement Planning Guide

- Investment Options For Retirement In India

- Retirement Planning Checklist for Young Entrepreneurs

- How can Annuity Plans Financially Secure your Retirement

Source-

https://www.investopedia.com/terms/p/paretoprinciple.asp

https://www.nerdwallet.com/article/investing/how-to-save-for-retirement

https://interactive-wealth.com/80-20-pareto-rule-for-retirement

ARN - ED/03/24/10391

Term Plan Articles

Term Plan Articles

Investment Articles

Investment Articles

Savings Articles

Savings Articles

Life Insurance Articles

Life Insurance Articles

Tax Articles

Tax Articles

Retirement Articles

Retirement Articles

ULIP Articles

ULIP Articles

Subscribe to get the latest articles directly in your inbox

Health Plans Articles

Health Plans Articles

Child Plans Articles

Child Plans Articles

Popular Calculators

Popular Calculators

Here's all you should know about life insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

#Tax benefits are subject to conditions under Sections 80C, 80D, Section 10(10D) and other provisions of the Income Tax Act, 1961.

This material has been prepared for information purposes only and should not be relied on for financial advice. You should consult your own financial advisor for any queries

Popular Searches

- Term Insurance Calculator

- Investment Plans

- Investment Calculator

- Investment for Beginners

- Best Short Term Investments

- Best Long Term Investments

- 5 year Investment Plan

- savings plan

- ulip plan

- retirement plans

- health plans

- child insurance plans

- group insurance plans

- income tax calculator

- bmi calculator

- compound interest calculator

- income tax slab

- Income Tax Return

- what is term insurance

- Ulip vs SIP

- tax planning for salaried employees

- HRA Calculator

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- nps vs ppf

- short term investment plans

- safest investment options

- one time investment plans

- types of investments

- best investment options

- best investment options in India

- Term Insurance for Housewife

- Money Back Policy

- 1 Crore Term Insurance

- life Insurance policy

- NPS Calculator

- Savings Calculator

- life Insurance

- Gratuity Calculator

- Zero Cost Term Insurance

- critical illness insurance

- itc claim

- deductions under 80C

- section 80d

- Whole Life Insurance

- benefits of term insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Best Term Insurance Plan for 1 Crore

- personal accident insurance

- Annuity Calculator

- Life Insurance Calculator