What do you want to do?

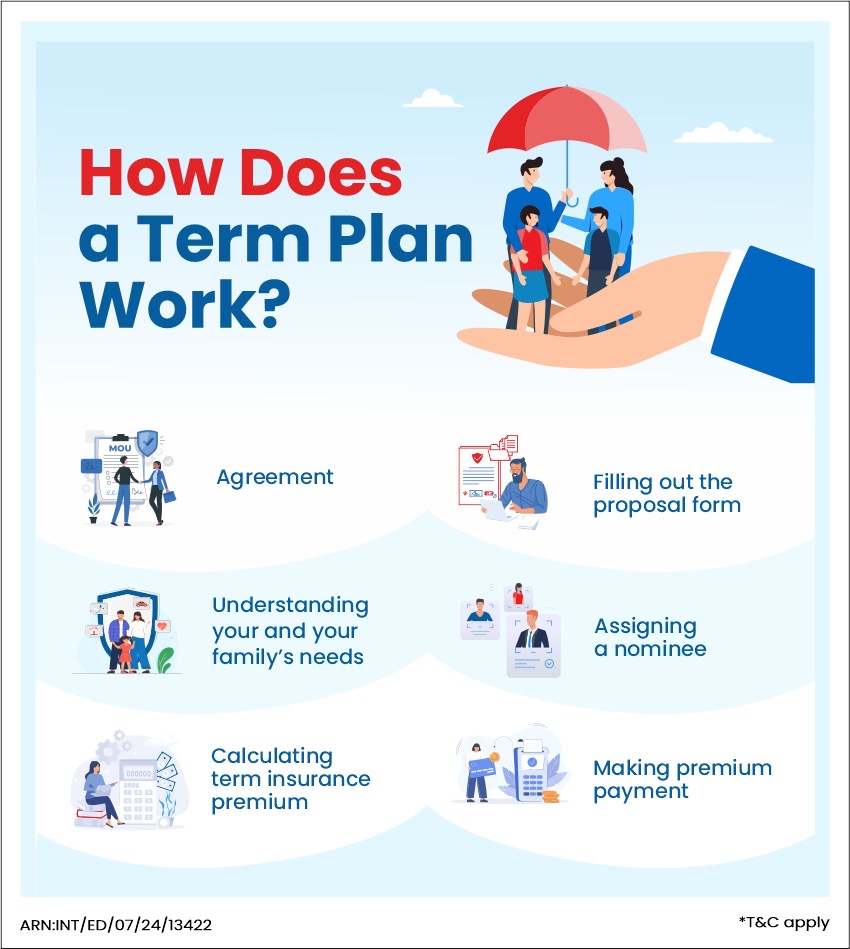

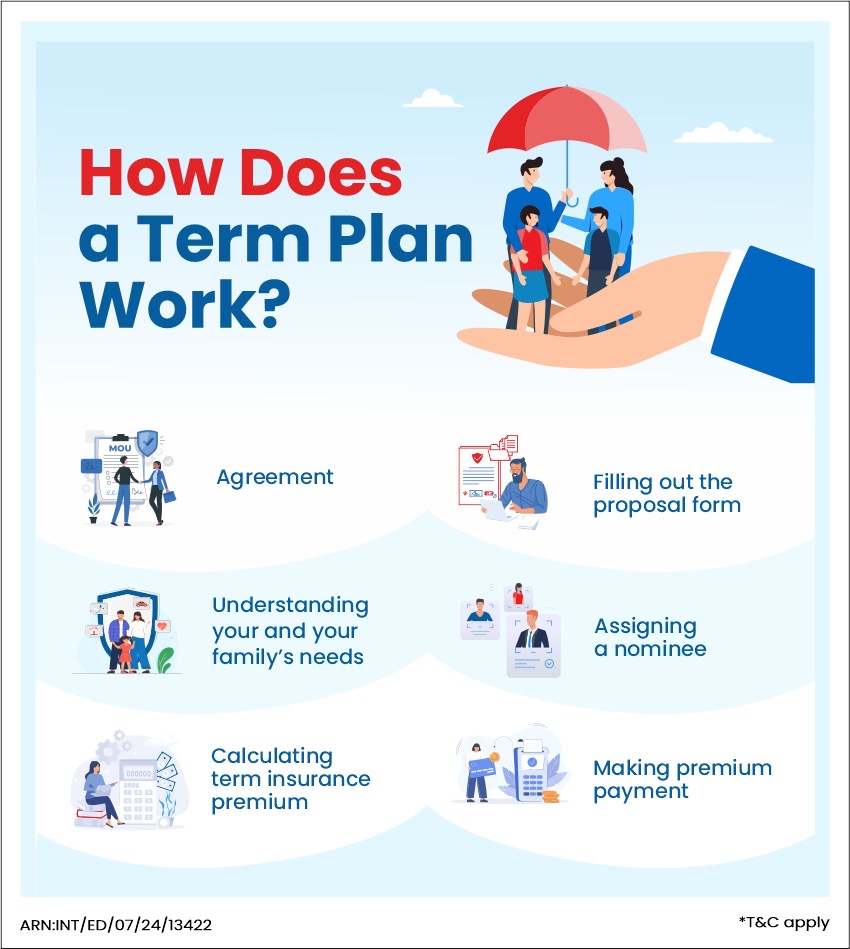

Steps on: How does Term Plan work?

Do you constantly think about your family’s financial future without you? A term insurance plan can help alleviate your fears. To understand the significance of term plan for your family and identify a plan that suits your needs, it is essential to know the significance of life insurance for your family, its role in providing financial security to ensure your family can cover regular expenses, child's education, and other responsibilities in your absence.

If the policyholder passes away unexpectedly during the policy tenure, the nominee receives, promised sum assured as the policy payout. To enhance family’s financial protection, one can also opt to purchase riders or add-ons.

Here are primary 6 steps as to how a term insurance plan actually work –

Here's all you should know about life insurance.

We help you to make informed insurance decisions for a lifetime.

Popular Searches

- Best Investment Plans

- What is Term Insurance

- Short term Investment options

- Term insurance

- Saving plans

- ULIP Plan

- Health Plans

- Child Insurance Plans

- Group Insurance Plans

- Long Term Savings Plan

- Fixed Maturity Plan

- Monthly Income Advantage Plan

- Pension Calculator

- BMI Calculator

- Compound Interest Calculator

- Term insurance Calculator

- Tax Savings Investment Options

- 2 crore term insurance

- 50 lakhs term insurance

- annuity plans

- Investment Calculator

- get pension of 30000 per month

- ULIP Returns in 5 Years

- investment plan for 5 years

- investment plan for 10 years

- 50-Lakh Investment Plan

- guaranteed returns plans

- sanchay plans

- Pension plans

- 1 Crore Term Insurance

- Gratuity Calculator

- Whole Life Insurance

- benefits of term insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for Women

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Best Term Insurance Plan for 1 Crore

- life insurance

- life insurance policy

- child investment plan