What do you want to do?

- Whole Life Insurance

- What Is Whole Life Insurance

- Types Of Policies

- Benefits Of Buying A Plan

- Why Sum Assured is an Important Factor When it Comes to Term Insurance?

- Features Of Buying A Plan Coverage

- How Does it Work?

- Difference Between Term & Whole Life Insurance

- What Are Riders

- Is a Whole Life Insurance Plan Right for You?

- Who Should Purchase a Plan

- Eligibility Criteria For Buying

- How To Buy A Plan Online?

- Factors To Consider When Choosing a Plan

- Summary

- FAQs

- Related Articles

- Popular Searches

- Disclaimers

What Is Whole Life Insurance?

A whole life insurance plan provides coverage for the entire life of the policyholder, extending up to 99 years of age. It guarantees a death benefit for the policyholder's beneficiaries when they pass away, ensuring financial support for their dependents.

This type of insurance not only offers coverage but also acts as a savings option, helping with tax exemptions. It provides both death and maturity benefits, allowing individuals to build a growing fund that can be used to achieve financial goals.

Whole life insurance is a great choice for those looking to create a legacy for future generations and encourages saving habits among policyholders. Life insurance for NRI offers similar benefits, giving financial security and potential tax advantages for those working abroad.

Types Of Whole Life Insurance Policies

Whole life insurance policies can be further categorised into the following categories:

Limited payment of whole life insurance

In this type of life insurance, you need a premium amount for limited or certain years, let's say 15 or 20 years. After that, you can enjoy policy coverage for the entire lifetime. However, the premium charged may be higher as compared to other plans as the time span to pay premiums is limited.

...Read More

Single premium whole life insurance policy

In this whole life plan, you pay the premium in a single lump sum amount. For a one-time payment of a premium, you can enjoy financial coverage for the rest of your life. It can be an ideal option for those with extra funds to park and look for insurance, as well as an investment avenue.

...Read More

Modified whole life insurance

It is a type of whole life plan in which you pay low premium amounts for a few initial years. The premiums to be paid increase with time, and the coverage remains the same through the policy. This type of policy is advisable only if you are confident to pay high premiums in the future.

...Read More

Variable whole life insurance

This type of whole life insurance plan allows policyholders to invest money through premiums paid and meet investment goals. It offers tax deductions, wealth creation, cash value growth and financial protection for loved ones.

...Read More

Joint whole life insurance

This type of plan provides coverage to two individuals jointly under one plan. If one of the policies passes away, the other one can claim the benefit. These plans usually don’t offer survival benefits.

...Read More

Participating in a whole life insurance policy

Along with benefits, this type of policy offers variable bonuses that are linked to the company's profits. The benefits can be in the form of dividends or bonuses. The dividends can be used to offset future premiums or to earn interest.

...Read More

Non-participating whole life insurance policy

These policies do not offer an opportunity to participate in the company’s profits or earn dividends. It offers guaranteed maturity benefits irrespective of the amount of profits earned by the company.

...Read More

Pure whole life plan

Under this policy, you have to pay premiums, and in return, you receive financial coverage for your whole life. Upon your demise, beneficiaries or nominees can avail of death benefits.

...Read More

Level premium whole life insurance

In this, the amount of premiums remains the same throughout the policy tenure and doesn’t change for any reason. Upon the policyholder’s demise, the guaranteed sum assured is given to the nominee/beneficiary.

...Read More

Indeterminate premium

In this, there is no fixed premium amount across the policy term. The companies may change the premium amounts according to the costs.

...Read More

Why Sum Assured is an Important Factor When it Comes to Term Insurance?

Choosing the right sum assured in your term insurance plans is essential for your family's financial security. This sum provides crucial protection in case of unexpected events, giving you peace of mind. A higher sum ensures your loved ones are well-supported, covering debts, education costs, and income replacement. Selecting the right amount is key to ensuring their future is secure. To explore the best term life insurance options and find the ideal sum assured for your needs, click the tabs below.

ARN - ED/02/25/21047

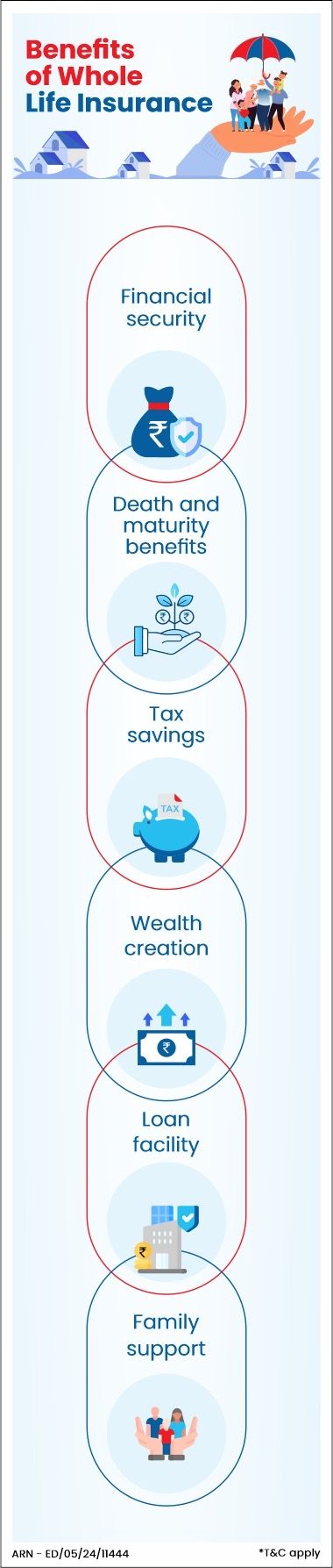

Benefits Of Buying A Whole Life Insurance Plan

The benefits of buying a plan for yourself are mentioned below:

Financial security

Whole life insurance policies provide financial coverage and bring comfort to life. In case of unfortunate events, your family is taken care of. This is similar to the benefits of term insurance.

...Read More

Death and maturity benefits

These plans ensure that at the end of the policy’s tenure, you get the sum assured. It builds a habit of saving and acts as an investment. Also, upon your sudden demise, it ensures your family’s life doesn’t get interrupted financially.

...Read More

Tax savings

Deductions under 80C and 10 (10D) of the Income Tax Act or ITA 1961 allow you to avail of tax benefits regarding whole life policy premium payments and payouts. Hence, it helps in long-term financial planning

...Read More

Wealth creation

Life insurance coverage plans accumulate wealth through the premiums you pay and thus help in wealth creation. You can use it to leave a legacy or fulfill retirement goals. To ensure that you choose the right coverage for your wealth creation and long-term financial goals, using a life insurance calculator can help you estimate the premium, sum assured, and potential benefits based on your specific needs.

...Read More

Loan facility

During emergencies, you can use these policies to avail of a loan facility. Hence, it comes in handy in unexpected situations.

...Read More

Family support

A whole life insurance policy provides financial support to your family in your absence. It helps your children continue their studies, and your parents live a stress-free life without working during their old age.

...Read More

Features Of Buying A Whole Life Insurance Plan Coverage

Here are some primary features of the whole life policy:

Provides Financial coverage

These policies provide financial coverage for the entire life of the policyholder. These can extend up to 99 years of age. Whole life insurance is a type of term insurance that provides cover till 99 years.

...Read More

Cash Value

Whole life insurance plans usually include a cash value component that grows with time. It can be used to fulfil financial goals such as buying a home, etc. For example if you have opted for a 2 crore term insurance then the amount of the sum assured will be used towards fulfillment of your family’s financial goals.

...Read More

Dividend Features

Certain types of policies allow individuals to participate in the profits of the company and earn dividends.

...Read More

Riders/ Add-ons

Riders/add-ons : Life plans usually allow individuals to enhance the policy’s coverage by adding riders to the policy. For example with the critical illness rider you can avail critical illness insurance along with your term insurance.

...Read More

How Does Whole Life Insurance Work?

Here’s a detailed description of how it works:

1. It offers lifelong protection and can extend up to 99 years of age. If something happens to you, your nominees receive a death benefit.

2. You pay premiums at regular intervals to get yourself insured. A portion of your premium goes towards savings. The amount grows over time, and you are eligible to access it later. It is also called cash value.

3. If you outlive the whole life policy, you are rewarded with a sum assured and bonuses that accumulate with time as a reward.

4. It provides financial security to your loved ones in case of your unexpected demise and helps them live a comfortable life. Also, it helps them pay off your debts, if any.

5. You can use the cash value to fulfil your financial goals, like buying a home, marrying your children, etc.

What Is The Difference Between Term Insurance & Whole Life Insurance?

Parameters |

Term Insurance |

Whole Life Plan |

Time period |

Term insurance plan covers for a specific duration. |

Whole life insurance plan provides coverage for the whole life and can extend up to 99 years of age. |

Premium amount |

The premium amount is usually low. |

The premium amount is comparatively higher as it provides life-long coverage. |

Cash value |

It usually does not offer any cash value. |

It offers cash value that grows with time. |

Wealth creation |

It does not assist in building wealth. |

It helps in wealth creation. |

Suitability |

It is ideal for individuals who only want insurance. |

It is suitable for individuals wishing for insurance along with investment/savings. |

Lapse of policy |

The policy expires after a certain time period. |

The policy doesn’t expire as long as you keep paying premium amounts. |

Legacy |

It may not be an ideal option for building/leaving a legacy for your children. |

It is an ideal option to build a legacy and create wealth for your children. |

Who Should Purchase A Whole Life Insurance Plan?

Read the following pointers to understand who should purchase a whole life insurance policy:

Individuals Who Want to Leave a Legacy

People can leave a financial legacy for their loved ones or charitable causes by purchasing whole life insurance. In addition to offering financial stability and achieving charitable objectives, the tax-free death benefit guarantees asset transfer throughout generations. It provides beneficiaries with money for business, education, or other necessities, ensuring a long-lasting effect.

Individuals Seeking Wealth Creation

For people who want to build money over the long term, whole life insurance is perfect. The insurance provides a secure, market-independent savings alternative as its cash value increases gradually over time. By borrowing against this cash value, policyholders may maintain liquidity and accumulate assets that will help them meet their immediate requirements and future financial objectives.

People with Financial Dependents

Whole life insurance should be taken into consideration by those who have dependents, such as elderly parents, spouses, or children. In the event of an untimely death, it guarantees that their loved ones would get financial support. The death benefit covers essential expenses like daily living costs, education, and debts, securing their dependents’ financial future.

Individuals Planning for Retirement

Whole life insurance builds up cash value over time, making it a useful tool for retirement planning. In order to generate an extra source of income in retirement, policyholders have the option to withdraw or borrow against their savings. In addition to pensions, investments, or other retirement savings programs, this guarantees stability and financial independence.

People Looking for Tax Savings

The tax benefits of whole life insurance are substantial. The cash value of the insurance increases tax-deferred, which means that no taxes are due on profits until they are taken out. Beneficiaries are likewise exempt from paying taxes on the death payment. It is a desirable choice for anyone looking for long-term financial stability and effective tax planning because of these tax advantages.

Is a Whole Life Insurance Plan Right for You?

Buying a whole life insurance policy would be the right choice for you in the following cases/situations:

- If you want to leave a legacy for your children in the future

- If you want your term insurance coverage to continue even after retirement

- If you want a lifetime coverage against life-threatening diseases

- If you are planning to either get married or start a family soon

- If you want the twin benefits of investment and life insurance coverage

- If you want additional liquidity at the time of retirement

Eligibility Chart for Whole Life Insurance

However, insurers may have differences in specific terms, conditions, and the flexibility they offer. Common criteria include:

Parameters |

Minimum |

Maximum |

Entry Age |

18 years |

65 years |

Maturity Age |

23 years |

99/100 years |

Policy Term |

5 years |

(100 - entry age) years |

Sum Assured |

Rs 25 Lakh |

Rs 20 Crore |

Whole Life Insurance Premium Payment |

Monthly, Yearly, Quarterly, or Semi-Annually |

|

How To Buy A Whole Life Insurance Plan Online?

1. Give Key Details

When purchasing a whole life insurance policy online, you first need to fill out an online form with details such as your contact number, email- ID, name, gender, smoking habits, and other required information that would be required to calculate the premium and play a role in approval/rejection of your application.

2. Determine the Coverage Amount

You need to finalize the sum assured amount that would be enough for your family's current as well as future financial needs. Factor in your income, expenses, etc., when deciding the amount.

3. Personalize Your Policy

Most whole life insurance policies offer a degree of flexibility in choosing the policy tenure and premium payment options. So be wise and customize your policy, if needed, by adding optional riders, such as personal accidental death benefit, to enhance your coverage by paying a bit higher premium.

4. Make the Premium Payment

While checking out during the whole life insurance purchase process, you would be required to pay the first premium instalment in order to complete the policy purchase. You can choose any online payment option, such as UPI, Netbanking, etc., to complete the policy purchase, after which you shall get an email notification regarding the confirmation.

How To Buy A Whole Life Insurance Plan From HDFC Life?

Purchasing a whole life insurance plan from HDFC Life involves a straightforward process:

1. Research Available Plans: Visit HDFC Life's official website to explore their whole life insurance offerings, such as the HDFC Life Sampoorn Samridhi Plus plan, which provides life cover up to 100 years of age and additional benefits.

2. Assess Your Needs: Determine the coverage amount and premium payment term that align with your financial goals and obligations.

3. Use Online Tools: Utilise online calculators available on HDFC Life's website to estimate premiums and understand policy benefits.

4. Consult with Advisors: For personalised guidance, contact HDFC Life's financial advisors who can assist in selecting the most suitable plan based on your requirements.

5. Application Process: Complete the application form online or offline, providing necessary personal and medical information.

6. Medical Examination: Undergo any required medical tests as part of the underwriting process.

7. Policy Issuance: Upon approval, review the policy document thoroughly to understand the terms and conditions before making the initial premium payment.

By following these steps, you can secure a whole life insurance policy from HDFC Life that aligns with your financial planning objectives.

What Are The Factors To Consider When Choosing A Whole Life Insurance Plan?

Certain pointers you must keep in mind before buying a permanent life insurance policy are:

Coverage amount

It is a must to calculate life coverage after assessing family needs, expenses, and goals to choose the right coverage amount. Opting for a 1 crore term insurance policy can ensure the amount is sufficient to fulfill the family’s financial obligations and responsibilities.

...Read More

Inflation

Potential inflation, rising living costs and expenses must be considered while choosing a plan. For example, Rs 2 cores might be sufficient to live a comfortable life today, but after 25 years, it will lose its value.

...Read More

Early investments

It is crucial to note that early investments can buy you policies at much lower premiums. Hence, it is advisable to buy a plan while you’re young and healthy and have long years to pay premiums.

...Read More

Select add-ons

Add-ons are a great way to enhance the coverage of a permanent life policy. Hence, you can choose certain add-ons depending on your needs and requirements.

...Read More

Go through the policy document.

You must understand and go through the policy document to understand the terms, conditions, coverage and other details. Inclusions and exclusions must be carefully analysed to avoid chaos in the future.

...Read More

Pick the right insurance provider

India's insurance regulatory body, the IRDAI or Insurance Regulatory and Development Authority of India, publish an annual report every financial year that mentions the CSR (claim settlement ratio) of each insurer. Claim Settlement Ratio is the percentage of claims that an insurance company settles in comparison to the total number of claims it received over a specific period of time, like one year.

When picking an insurer for your whole life insurance policy, compare the Claim Settlement Ratio

of various insurers and ideally go for the one having a higher Claim Settlement Ratio, such as HDFC Life, as it ensures the likelihood of your family’s claim being settled in your absence.

...Read More

Summary

A whole life insurance policy provides you the twin benefits of investment as well as life insurance coverage (for your entire life span). With the policy offering coverage for as long as 99-100 years of the policyholder's age, you can live a financially stress-free life without thinking of what would happen to your family in case of your demise. But make sure you pick the right insurer that offers maximum coverage, benefits, and features at a lower premium.

FAQs On Whole Life Insurance

1 Is it good to invest in a whole life insurance plan?

Whole or permanent life insurance is worth investing in when you have dependents who rely on you financially. It ensures that your loved ones are taken care of when you are no more.

2 Should I buy a whole life insurance plan for my child?

It is a great option for your child as it protects them for your entire life span. The savings component grows over time and safeguards your child’s future in case of any unfortunate event. If you believe your child may need financial support in the future, you can designate them as your nominee. This makes it one of the best policy for child, ensuring long-term financial security and peace of mind for you and your family.

3 Is buying a whole life insurance plan expensive?

If you compare the premiums or costs involved with other policies like term insurance, then it is certainly costlier. But when you compare the benefits and features, you will find that it helps you leave a legacy for your dependents, which might make the investment worth it.

4 How much coverage should I consider while buying a whole life insurance plan?

You must assess your family’s future living costs, inflation, debts, cost of living, financial goals, etc., to calculate the exact coverage amount. Or you can multiply your annual income by 10 for a rough estimate. Certain online calculators can also make your job easy.

5 What are the 4 main types of whole-life insurance policies?

Whole life plans usually have various options such as single premium, variable, limited payment and modified whole life.

6 Can you develop a financial legacy with a whole life policy?

Yes, it is one of the reasons why individuals opt for a whole-life policy. Along with providing coverage for your whole life, which can extend to 99 years of age, it helps in wealth creation and leaving a legacy for your loved ones.

7 What is the right age to buy a whole life insurance plan?

The general rule of thumb is the earlier, the better. Hence, today is the right age to buy any permanent life insurance policy.

8 Which is better: a whole life insurance plan or a term life insurance plan?

While making a choice between the two, it is crucial to consider certain factors like your financial condition, goals, coverage, premium amounts, age, purpose, etc. Hence, there is no single policy that is suitable for everyone.

9 What is the death benefit under the whole life insurance policy?

The death benefit of a permanent life insurance policy is a predetermined amount or sum assured that is paid to the beneficiaries of the policyholder upon his demise.

Related Articles to Whole Life Insurance

Popular Searches

- term insurance

- Term Insurance Calculator

- Investment Plans

- savings plan

- ulip plan

- retirement plans

- health insurance plans

- child insurance plans

- group insurance plans

- saral jeevan bima yojana

- income tax calculator

- bmi calculator

- compound interest calculator

- income tax slab

- Income Tax Return

- benefits of term insurance calculator

- what is term insurance

- why to invest in life insurance

- Ulip vs SIP

- tax planning for salaried employees

- how to choose best child insurance plan

- tips for buying retirement plan

- 1 crore term insurance

- HRA Calculator

- Annuity From NPS

- 2 crore term insurance

- 5 crore term insurance

- 1.5 crore term insurance

- Retirement Calculator

- Pension Calculator

- What is Investment

- Best Investment Plans

- Term Insurance for Housewife

- Money Back Policy

- life Insurance policy

- life Insurance

- Zero Cost Term Insurance

- critical illness insurance

- features of term insurance

- Best Term Insurance Plan for 1 Crore

- personal accident insurance

#Provided we have received all the relevant and required documents and no further investigation is required. Claim settlement process would be completed within stipulated timelines once the claim request is approved

##Individual claim settlement ratio by number of policies as per audited annual statistics for FY 23-24

^ Available under Life & Life Plus plan options

@As per integrated annual report FY23-24, available on www.hdfclife.com. As of May 2024

***Online Premium for Life Option for HDFC Life Click 2 Protect Super (UIN: 101N145V07), Male Life Assured, Non-Smoker, 20 years of age, Policy term of 25 years, Regular pay, Annual frequency, exclusive of taxes and levies as applicable. (Monthly Premium of 622/30=20.7).

**7% online discount available on 1st year premium only

~Tax benefits of ₹ 54,600 (₹ 46,800 u/s 80C & ₹ 7,800 u/s 80D) is calculated at highest tax slab rate of 30% on life insurance premium u/s 80C of ₹ 1,50,000 and health premium (Critical illness rider) u/s 80D of ₹ 25,000. Tax benefits are subject to conditions under section 80C, 80D, 10(10D) as per Income Tax Act, 1961. Please consult your tax advisor for more information.

*Online Premium for Life Option, Male Life Assured, Non-Smoker, 20 years of age, Policy term of 40 years, Regular pay, Monthly frequency, exclusive of taxes and levies as applicable.

HDFC Life Sampoorn Samridhi Plus (UIN:101N102V06) is a Non-Linked, Participating, Life Insurance Plan. Life Insurance Coverage is available in this product.

1. The risk factors of the bonuses projected under the product are not guaranteed

2. Past performance doesn't construe any indication of future bonuses

3. These products are subject to the overall performance of the insurer in terms of investments, management of expenses, mortality and lapses

ARN- ED/04/25/22806