A life insurance calculator is an easy-to-use online tool that calculates the life cover required to financially protect your loved ones in your absence. ...Read More

Life Cover of 1 Crore @ Rs 19/day***

A life insurance premium calculator is a tool devised to give accurate premium readings by considering your age, income, number of dependents, life stage, sum assured, current financial obligations, various benefits, etc. It helps to do away with time-consuming manual calculations You also have the advantage of comparing plans from different insurance companies and choosing a plan that suits you and your pocket the best. The input that the life insurance payment calculator requires is the age, tenure of the plan, sum assured, premium payment option, rate of returns expected, lifestyle, medical history, gender, and income.

Various types of life insurance calculators with unique features are available. For instance, with a pension calculator, you can easily choose high-return investments as you get an estimate of future returns.

ULIPs invest premiums in market-linked assets so market volatility can affect the outcome. Investors who choose ULIP plans can use the ULIP calculator to identify risky financial assets vis-a-vis their risk tolerance. The life insurance rate calculator also allows entry of rates of return on alternative investments to understand the impact of market volatility on their investments.

The usage instructions vary with the type of life insurance calculator. Follow the step-by-step guide given against each type of life insurance policy calculator. In some tools, you may also be asked whether you are an NRI user. This helps in giving more accurate results for those considering NRI life insurance.

You can use the term insurance calculator as given below:

Step 1: Enter Your Name.

Step 2: Mention your age & gender.

Step 3: Fill in the required details.

Step 4: Enter your Annual Income.

Step 5: Get Free Quote and Calculated Premium.

After filling out all the details, click the "Get Free Quote" button. This will display the calculated premium along with suitable plan options.

You can use the ULIP calculator the following way:

Step 1: Provide your name and birth date.

Step 2: Provide the life cover required and the premium payment option.

Step 3: Select the tenure of the plan. The minimum period is 5 years and goes upto 25 years.

Step 4: Enter the anticipated return rate.

Step 5: Choose the fund you want to invest in. Avoid volatile investments if your risk tolerance is low.

Step 6: Hit the calculate button.

This life insurance calculator gives you an estimate of potential returns depending on the asset you have chosen.

The steps for using the pension calculator are:

Step 1: Fill in your Personal Information.

Step 2: Enter Income details.

Step 3: Fill in your Current Savings for Retirement.

Step 4: Enter your Monthly Expenses.

Step 5: Based on the details provided you will get an Idea how much you are supposed to save.

You can use the savings calculator to identify your guaranteed returns on your investments in the following manner:

Step 1: Enter Your Name.

Step 2: Mention your age & gender.

Step 3: Enter your date of birth.

Step 4: Enter the desired frequency and time period of investment.

Step 5: Enter estimated rate of return% and amount of investment.

Step 6: Click on ‘Calculate’.

The retirement calculator helps you calculate the retirement corpus that you can accumulate with a periodic or one time investment in the following way:

Step 1: Enter Your Personal details.

Step 2: Enter your income details.

Step 3: Enter your savings and investment details.

Step 4: Enter your expenses.

Step 5: Click on ‘Check returns'.

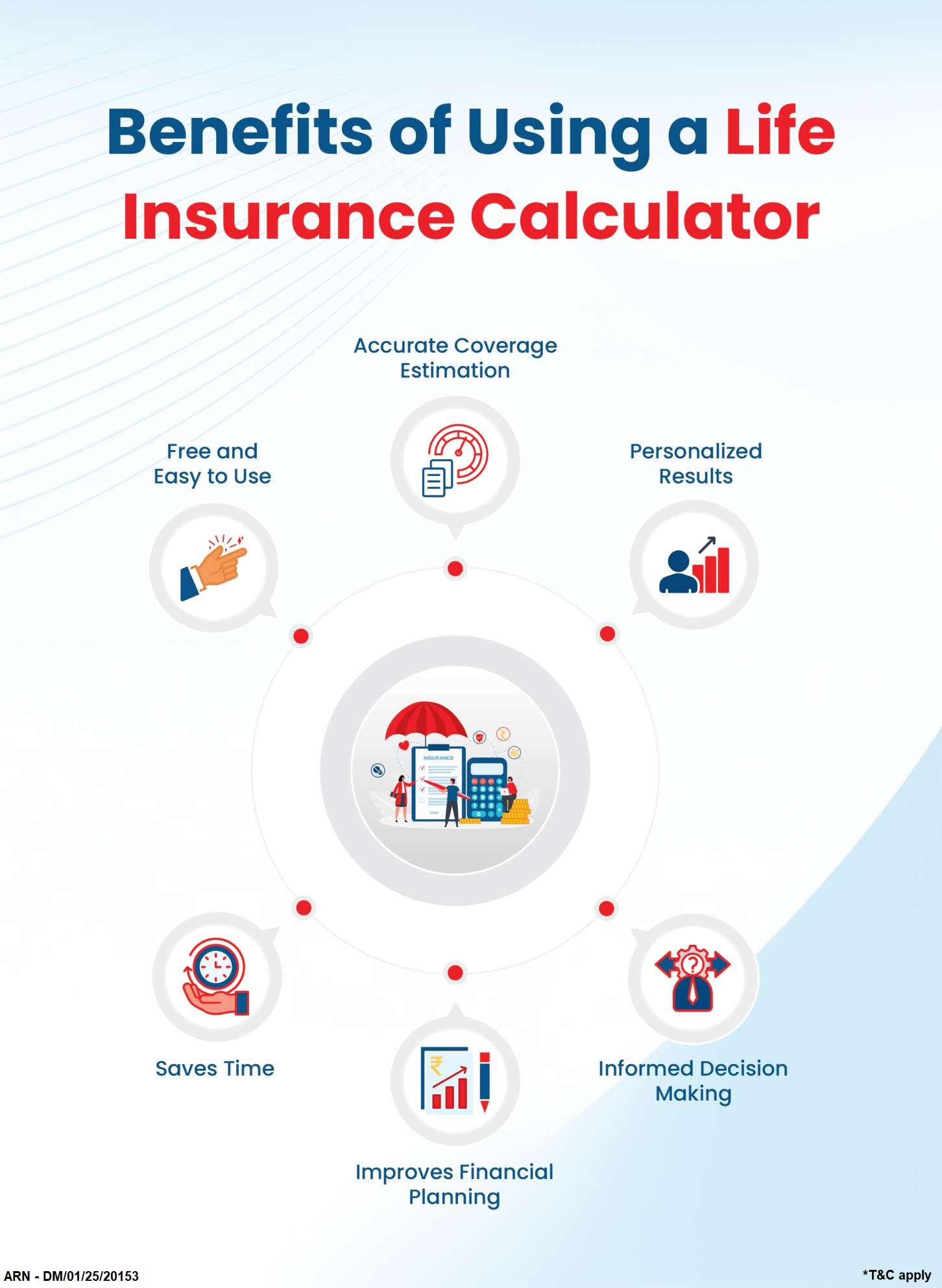

The benefits of a life insurance calculator are:

You need not be tech-savvy to use the life insurance rate calculator. Fill in the required fields and hit the calculate button. You can use it any number of times as it does not attract any charges.

...Read More

Manual calculation using a mathematical formula may not give accurate results. However, the life insurance calculator gives you accurate life cover estimation as there is very little scope for errors.

...Read More

The life insurance payment calculator considers your details like age, income, expenses, coverage amount, medical history, etc., and gives an estimate as per your specific requirements.

...Read More

The manual calculation for the estimated premium and the life cover required is time-consuming. The life insurance calculator gives the estimation within seconds of keying in the details.

...Read More

You can get an estimate of the life cover for a particular premium with the life insurance calculator. With this information, you can plan your finances meticulously. You can change the inputs many times until you arrive at an affordable premium providing higher coverage.

...Read More

Among the life insurance calculators, the ULIP and pension calculators help avoid certain speculative investments with the assessment of the impact of stock market volatility on the chosen assets. This is besides giving the life cover estimate for a particular premium,

...Read More

The types of life insurance calculators available are:

Types of Life Insurance Calculator |

Description |

Term Insurance Calculator |

It provides an estimate of the premium required for term insurance coverage, considering various factors such as income, age, lifestyle, medical history, and expenses. |

ULIP Calculator |

This is highly beneficial for individuals who prefer to invest in assets aligning with their investment risk tolerance. It mimics market trends to arrive at the return on investment. Using this calculator you can avoid high-risk assets if your risk appetite is low. |

Pension Calculator |

You can take advantage of investment opportunities with high returns as this calculator gives estimates of future returns for an investment. It also helps you choose the right type of pension plan based on your requirements. |

Human Life Value Calculator |

The HLV calculator an estimate of the life coverage required to fulfil your family’s existing and future financial requirements. It considers your income, expenditure, and financial obligations. |

Power of Compounding Calculator |

This calculator shows the impact of compounding and how it helps small investments grow over time. By changing the amount, timeline, and rate of return, you can compare various investment schemes to identify potentially profitable investments. |

Savings Calculator |

This gives you an estimate of the guaranteed returns you can generate by investing in safer investment plans for a predefined duration |

Retirement Calculator |

Calculating retirement corpus can be challenging at times but a retirement calculator helps you with the estimated corpus you would need to accumulate with a periodic or one time investment |

A systematic payment or a one-time payment made towards the policy you purchase is the premium for life insurance. To understand this better, it’s useful to revisit what is life insurance a financial tool that provides long-term protection for your loved ones while requiring regular premium contributions. Most insurance companies provide flexible premium payment options. You can choose among monthly, quarterly, half-yearly, yearly, or single premium payment options. Various factors like age, income, number of dependents, tenure, sum assured, etc., impact the premium. The premium for younger individuals is much less than that of older adults. Even lifestyle habits like smoking, consuming alcohol, etc., influence the premium calculation.

Since various parameters have to be considered to arrive at the premium, manual calculation can be tedious. A life insurance calculator makes the task simple, fast, and error-free.

The factors influencing premium rates are:

The premiums paid by the policyholder are used for settling death benefits. From the insurer’s point, the return on the investments made with the premiums is crucial and hence the life cover impacts the premium rates.

...Read More

The premium rate is calculated in proportion to the age. The reason is the younger the policyholder is the lesser the chances of claims. Older adults are more prone to health issues and the probability of claims is higher. The premium rates are lower if you are younger.

...Read More

Life cover is the death benefit that the insurer provides in case of the policyholder’s untimely death. The premium is fixed according to the insurer’s financial obligation i.e., the higher the life cover, the higher will be the premium and vice versa.

...Read More

Certain lifestyle habits like smoking can lead to health issues in the future. Some existing medical issues can lead to terminal illnesses. In both cases the chances of claims are higher and so is the premium.

...Read More

Individuals invest in life insurance plans to provide financial security for their families. To fulfil the purpose of insurance, assessing the exact life cover considering various factors is essential. A life insurance calculator makes this task easy. All you need to do is fill in the required fields and the estimate arrives in just a few seconds. ULIP and pension calculators are more precise. They help you choose lucrative investment options for higher returns and also help avoid unstable investments.

Life cover can be calculated using the formula life cover = annual salary x years left for retirement. If your annual income is 12 lakhs and the years left for retirement are 20 years, the life cover required will be 2.40 crores.

To arrive at the premium amount you will have to divide the sum insured by the sum assured. For instance, if the sum insured is 65000 and the sum assured is 10000, then the premium is 65000/10000 i.e., 6.5%.

The life insurance premium for a 45-year-old can be calculated only if the details like type of policy, tenure, coverage required, lifestyle habits, medical history, age of the policyholder, and the rides opted for are available.

The formula to calculate life insurance premiums is base rate i.e., the predefined for every unit of coverage x the rating factors for the individual.

The benefits of using a life insurance calculator are accuracy, ease of use, efficient financial planning, time-saving, and making informed decisions.

The life insurance premium calculator considers the mortality rate, life cover, return on investments, and lifestyle habits from the insurer’s perspective and calculates the premium depending on the financial obligation of the insurance company on issuing a particular policy.

We help you to make informed insurance decisions for a lifetime.

Reviewed by Life Insurance Experts

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance solutions - protection, pension, savings, investment, annuity and health.

***Online Premium for Life Option for HDFC Life Click 2 Protect Supreme(UIN:101N183V01), Male Life Assured, Non-Smoker, salaried, 20 years of age, Policy term of 25 years, Regular pay, Monthly frequency, inclusive of 15% online discount (applicable only for 1st year premium) & exclusive of taxes and levies as applicable. (Monthly Premium of 573/30=19).

~Save 46,800 on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are a Regular Individual, Fall under 30% income tax slab having taxable income less than Rs. 50 lakh and Opt for Old tax regime.

^ Available under Life & Life Plus plan options

#Provided we have received all the relevant and required documents and no further investigation is required. Claim settlement process would be completed within stipulated timelines once the claim request is approved

##Individual claim settlement ratio by number of policies as per audited annual statistics for FY 24-25

ARN - DM/12/24/19110