What do you want to do?

How Does BMI Affect Your Term Insurance Premium?

Table of Contents

BMI is not the only factory that affect the premium of the policy, it depends on the underwriting policy of the insurer.

Compared to other insurance plans, term insurance comes with much lower premiums. This is because these plans only provide a death benefit and have no investment element in them. However, even with term insurance, the health of the policyholder plays a major role in determining the premium. A person with health issues may need to pay a higher premium, depending on the insurers underwriting policy, simply because they are more prone to diseases and have a higher probability of dying prematurely. Body mass index (BMI) is an indicator of health and can be used by insurers to assess the risk of death. Therefore, the best term plan is the one that offers you the best possible premium based on your BMI. But before you can choose a term plan, you need to understand what BMI is.

Know your BMI

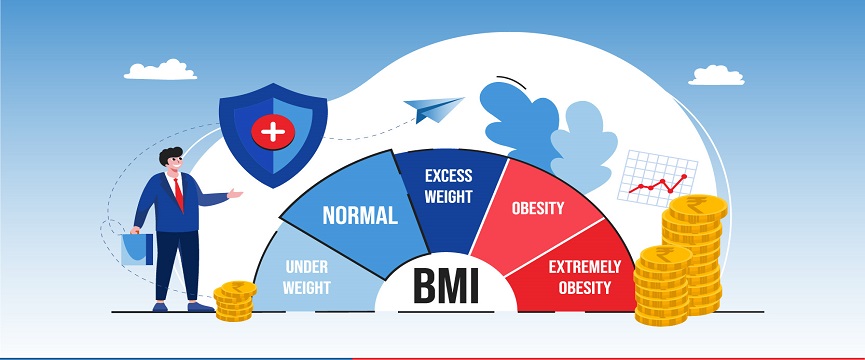

The body mass index (BMI) refers to a person’s weight relative to his height and aims to reflect a person’s health condition. A good BMI indicator is based on age, gender, height and weight to arrive at a BMI score. This score is therefore affected by the, lifestyle, Certain medical conditions,, Diet, Exercise & Sleep Routine. . A BMI score within the range of 18.5-24.9 is considered normal, indicating his weight and height are proportional.

By formulae, a BMI score is calculated as body weight divided by the square of height. One can always use a BMI calculator to know his BMI score.

Alternatively, a BMI chart is useful, which is as follows—

- BMI between 18.5-24.9 is Normal

- BMI between 25 and 29.9 is Overweight

- BMI > 30 is Obese

- BMI < 18.5 is Underweight

So, a person with a BMI score higher than 25 may consider having relatively higher health issues than those with a score less than 24.9.

How to use a BMI calculator?

BMI calculators are available online and are easy to use. All you need is to submit your gender, age, height and weight in the scheduled spaces. Once the figures are provided, the online BMI calculator automatically arrives at your BMI score and suggests if you are normal, underweight, overweight or obese.

How does your BMI score affect term insurance premiums?

BMI is considered a reflection of one’s health status and indicates whether you fall into a high-risk or low-risk category. Accordingly, the premiums are decided for your term insurance. An applicant with a BMI score greater than 25 indicates he/she is an overweight. Based on this aspect, the insurer also tends to believe he’s more likely to get health issues shortly which might lead to an untimely demise and payment of the death benefit thereby.

Thus, a higher amount of premium is charged, compared to a person with a lesser BMI score. So, if you fall in the overweight or obese category, you may have to bear increased premiums

Nonetheless, the financial security of your loved ones remains intact. That’s what you need, right?

Related Articles:

- Make Your Online Term Plan Your Family's Monthly Pay Cheque

- Calculate and See for Yourself How Starting Young Gives You Lower Premiums

- What is the Age Limit to Buy a Term Insurance Policy?

- How to make the workplace a happier place with Group Term Insurance Plans?

- A Comprehensive Guide for Term Insurance Riders

- Benefits of Term Insurance

Not sure which insurance to buy?

Talk to an

Advisor right away

Advisor right away

We help you to choose best insurance plan based on your needs

Here's all you should know about ULIP insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- Term Insurance Calculator

- Investment Plans

- Investment Calculator

- Investment for Beginners

- Best Short Term Investments

- Best Long Term Investments

- 5 year Investment Plan

- savings plan

- ulip plan

- retirement plans

- health plans

- child insurance plans

- group insurance plans

- income tax calculator

- bmi calculator

- compound interest calculator

- income tax slab

- Income Tax Return

- what is term insurance

- Ulip vs SIP

- tax planning for salaried employees

- HRA Calculator

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- nps vs ppf

- short term investment plans

- safest investment options

- one time investment plans

- types of investments

- best investment options

- best investment options in India

- Term Insurance for Housewife

- Money Back Policy

- 1 Crore Term Insurance

- life Insurance policy

- NPS Calculator

- Savings Calculator

- life Insurance

- Gratuity Calculator

- Zero Cost Term Insurance

- critical illness insurance

- itc claim

- deductions under 80C

- section 80d

- Whole Life Insurance

- benefits of term insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

^ Available under Life & Life Plus plan options

#Provided we have received all the relevant and required documents and no further investigation is required. Claim settlement process would be completed within stipulated timelines once the claim request is approved

##Individual claim settlement ratio by number of policies as per audited annual statistics for FY 23-24

***Online Premium for Life Option for HDFC Life Click 2 Protect Super (UIN: 101N145V07), Male Life Assured, Non-Smoker, 20 years of age, Policy term of 25 years, Regular pay, Annual frequency, exclusive of taxes and levies as applicable. (Monthly Premium of 622/30=20.7).

**7% online discount available on 1st year premium only

@As per integrated annual report FY23-24, available on www.hdfclife.com. As of May 2024

~Tax benefits of ₹ 54,600 (₹ 46,800 u/s 80C & ₹ 7,800 u/s 80D) is calculated at highest tax slab rate of 30% on life insurance premium u/s 80C of ₹ 1,50,000 and health premium (Critical illness rider) u/s 80D of ₹ 25,000. Tax benefits are subject to conditions under section 80C, 80D, 10(10D) as per Income Tax Act, 1961. Please consult your tax advisor for more information.

ARN - ED/08/23/3728