What do you want to do?

10 Types of Investment in 2025

Table of Content

1. List of Types of Investment Plans in India

3. How Does an Investment Plan Work?

4. Why is investing better than saving?

7. Things to Keep in Mind While Investing

9. How Can Investing Grow My Money?

10. How to Buy the Right Investment Plan?

11. Identify Suitable Types of Investments for Your Goals

12. Conclusion

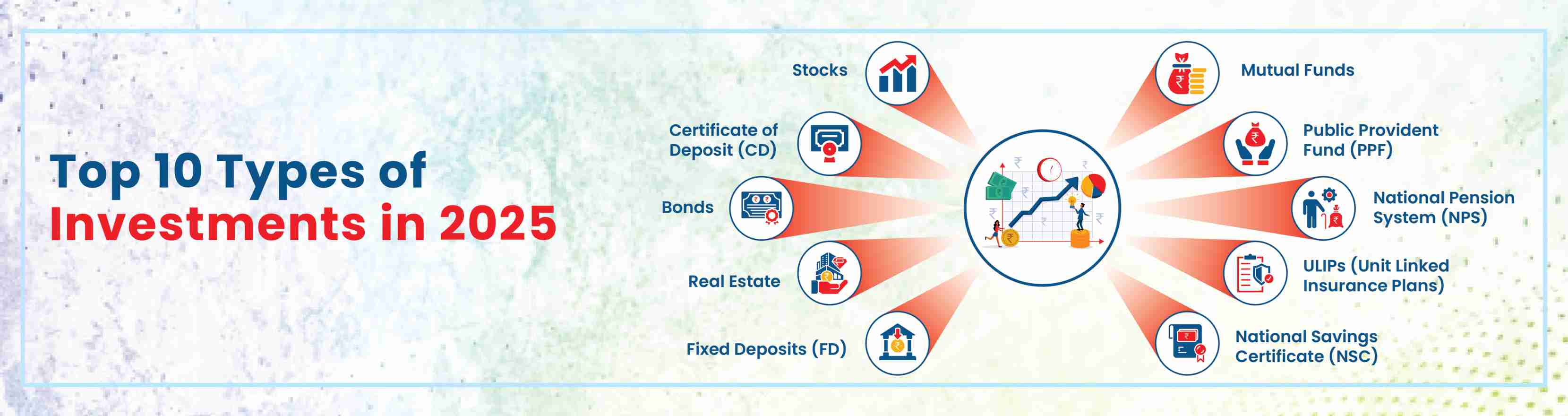

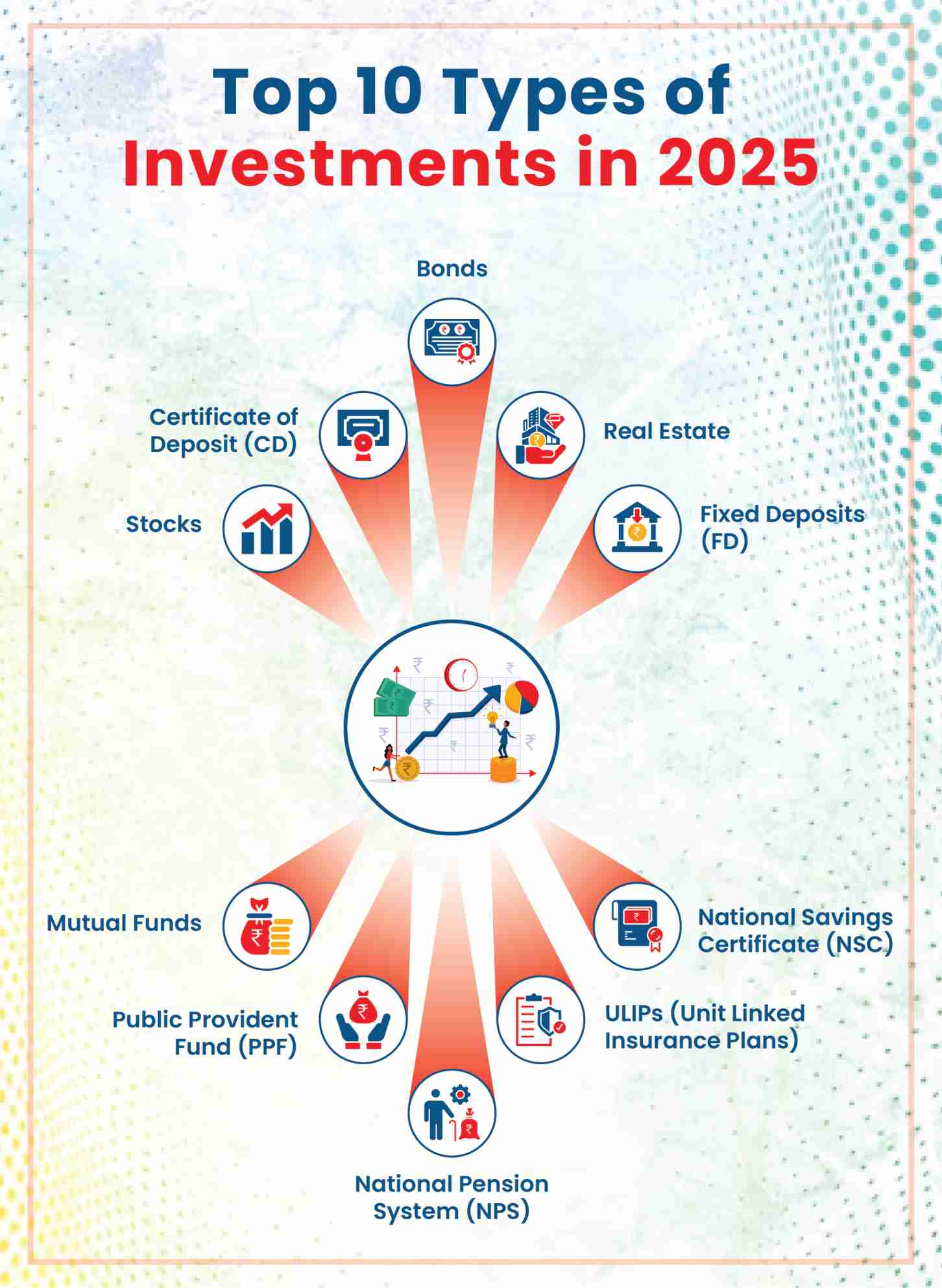

List of Types of Investment Plans in India

The 10 types of investment in India are:

Sl. No |

Type of Investment |

Returns |

Objective of Investment |

1. |

Stocks |

Returns are by way of capital gains and dividends and depend on market performance. |

Wealth accumulation over a period. |

2. |

Certificate of Deposits |

Returns are by way of fixed interest for a particular period |

Fixed returns with capital protection and liquidity. |

3. |

Bonds |

Returns via fixed or variable coupon rates. |

Stable returns, risk distribution, and capital protection. |

4. |

Real Estate |

Returns are by way of rental income or capital appreciation |

Regular income stream and capital appreciation. |

5. |

Fixed Deposit |

Interest rate locked in for a preferred tenure |

Guaranteed income and capital protection. |

6. |

Mutual Funds |

Returns by way of dividends, interest, and capital gains. |

Wealth accumulation over a period and creating a corpus with small and consistent investments via SIPs. |

7. |

Public Provident Fund (PPF) |

Returns by way of monthly interest compounded annually. |

Retirement planning, to create a corpus for a financially stable retired life |

8. |

National Pension System (NPS) |

Variable returns-market linked and annuity. |

Retirement planning, creating a corpus and a regular income stream |

9. |

Unit-linked Investment Plans (ULIPs) |

Market-related |

Long-term wealth creation, life cover, and tax benefits. |

10. |

National Saving Certificates |

Fixed interest |

Guaranteed returns, capital protection, and tax benefits. |

1. Investing in Stocks

These are long term investments that are ideal for those who are aiming to grow their wealth over time. Investing in stocks requires thorough knowledge of market trends, and the returns depend on market performance. A prudent search is imperative to pick the right stock that aligns with risk tolerance. This is one of the types of investments where the purchase and sale have to be timed carefully.

Stocks are one of the types of asset classes wherein the time required for capital appreciation depends on market performance. In the long run, stocks have shown better inflation-adjusted returns when compared to other asset types.

2. Certificate of Deposit

A certificate of deposit is one of the best types of investment in India for investors seeking fixed returns. It is a money market instrument issued against the money invested. It is issued by the Federal Deposit Insurance Company and governed by the RBI. This is among the types of financial investments where funds are invested in a bank in a demat form for a specific tenure.

The minimum investment accepted under the certificate of deposit is Rs. 1.00 lakh and its multiples. The tenure for certificates of deposits issued by commercial banks is between 7 days to 1 year, whereas the tenure for the deposits issued by financial institutions ranges between 1 year to 3 years.

3. Bonds

Bonds are investment vehicles that provide returns at a pre-defined rate till maturity. The investors lend money to the issuer, who pays interest at a pre-defined coupon rate until maturity. On maturity, the investor receives the principal amount back. Generally, bonds in India are on a fixed interest rate.

However, floating coupon rates and zero coupon rates have gained popularity over the years. At present, bond investments can be made directly or through debt mutual funds.

4. Investing in Real Estate

Investing in real estate involves purchasing either a residential or commercial property. Among the types of investments, real estate is for capital appreciation or a steady income stream through rent.

Investing in real estate is not restricted to the purchase of property. It can also be done by buying units of Real Estate Investment Trusts. These Trusts focus on purchasing commercial properties, and the returns are commensurate with the rental income from these properties.

5. Fixed Deposits (FD)

Fixed deposits are ideal for risk-averse investors seeking guaranteed returns. Fixed deposits can be opened in banks or other financial institutions. They accept a one-time lumpsum amount for a pre-determined tenure.

While the principal amount remains secure, you earn interest till the maturity date at a pre-determined interest rate. This is among the types of investments that are popular owing to returns, capital security, and liquidity. You can opt for tenure to align with your financial goals.

6. Mutual Funds (MFs)

Mutual funds are ideal for investors who aim to allot funds to various types of investments to balance the risk. Mutual funds invest funds in equity, bonds, or both. Individuals can choose between debt funds, equity funds, or balanced funds depending on what their risk appetite is. Additionally, one can opt to invest small amounts regularly in mutual funds through Systematic Investment Plans (SIPs).

Assess your risk appetite and consider what your financial goals are before you invest in mutual funds. With the option to choose among different types of investments in India, you can invest in equity funds if you want to be an aggressive investor. Debt instruments work well if you are a conservative investor.

Further, if you want to save on overall tax liability, you can invest in tax-saving schemes like ELSS.

7. Public Provident Fund (PPF)

Considered a tax-efficient retirement planning tool, Public Provident Fund is one of the safest among the types of investments. It is a Government of India-backed investment option and you can invest in it by opening an account in any bank with a minimum amount specific to the bank. The maximum permitted investment in a financial year ranges between Rs. 500 to Rs.1.50 lakhs.

This investment option has a lock-in period of 15 years. and qualifies for deduction under Section 80C~of the Income Tax Act 1961.

The benefits of compounding in PPF enable you to create a huge corpus. The interest is applied to the minimum balance in your account as is between the 5th and the end of the month. It is recommended to deposit funds into the account before the 5th of every month. Also, be sure to open a PPF account in a bank with digital transfers for the convenience of regular contributions.

8. National Pension System (NPS)

The National Pension System is an investment option backed by the government. It is considered one of the safest investment options that focuses on long-term savings, and i4*- t is a preferred retirement plan. Investors can diversify their investments in NPS by allocating the funds to Equity, Government and Corporate Bonds, and Alternative Investment Funds.

The subscribers, upon attaining 60 years of age, are permitted to withdraw a portion of the corpus in lumpsum while the remaining has to be utilised to purchase an annuity that provides a regular income stream. However, investors can now continue to invest in the scheme till they attain 75 years without superannuation.

You have two investment choices under NPS, i.e., active choice and auto choice. The asset allocation is predetermined in auto choice. Active choice is ideal for financially literate investors, and the portfolio can be as per their understanding.

9. ULIPs (Unit Linked Insurance Plans)

ULIPs offer the dual benefit of insurance and investment. Clubbed with tax benefits, they are among the preferred investment options. A portion of the premiums paid towards the plan provides life cover, and the remaining is invested in market-linked assets.

These types of investments attract various charges like premium allocation charges, administrative charges, fund manager charges, etc. Look for a provider that collects minimum charges to maximise returns. You can use a ULIP Calculator to get a clearer understanding of these charges and how they may impact your overall returns.

While selecting a suitable plan, focus on flexibility in premium payments and customisation of plans with different fund options. ULIP gives the option to switch funds depending on market conditions, risk appetite, and changing financial plans.

10. National Savings Certificate (NSC)

National Savings Certificate is a Government of India initiative to encourage small and mid-income investors. It is a safe investment option for individuals looking for guaranteed returns, capital protection, and tax benefits. You can purchase a National Savings Certificate from any post office branch.

What is Investing?

Putting money to work is referred to as an investment, which involves allocating resources to generate profits, income, or gains over a period of time. Investing can be done through various endeavours, such as starting a business or buying a property with the intention of either renting it out or reselling it later. Unlike saving, investing carries the risk of potential losses if the project does not turn out as expected. It is also different from speculation, which is based on betting on short-term price movements.

How Does an Investment Plan Work?

An investment plan is a guide to growing your money wisely. Before drawing a plan, you should be certain about your current financial status, the room available in your budget for savings, financial goals, risk tolerance, etc.

To begin with, you should evaluate your income and expenditure and eliminate unnecessary expenses, if required, to create space for savings. Knowing why and when you need funds, i.e., financial goals with timelines and your risk tolerance level, helps you determine the right investment plan. You can choose to invest in stocks, mutual funds, fixed deposits, PPF, NPS, real estate, etc., accordingly.

Creating an emergency fund for unforeseen expenses should be an integral part of an investment plan. Diversifying your investment portfolio is imperative to balance risks with returns. Finally, reviewing and readjusting your portfolio according to market conditions is critical to achieving adequate returns and fulfilling your financial goals.

Why is investing better than saving?

A person's future is determined by the investments he or she makes. By doing so, they can bridge the gap between their dreams and reality. Investing is better than savings in the following ways:

1. Achieving your financial goals:

You can invest to meet your financial goals, whether it is to buy a houseor a car, pay for your child's education or marriage, or even plan for your retirement. The best way to reach your long-term goals is by investing your capital.

2. To overcome inflation:

One of the best money saving tips is to invest your money. Inflation can reduce the value of your money over time if you leave it in a regular savings account. To protect your money's worth, consider investing in financial options that offer returns higher than inflation.

3. For significant returns:

Investing in stocks or mutual funds, or a good investment or pension plan has the potential to yield higher returns than keeping money in a savings account or bank fixed deposits.

Benefits of Investing

The following are some of the key benefits of investing:

1. The growth of money

You can achieve your financial goals by investing money in the right plan. By investing, you not only grow your money but also remain financially prepared for the future.

2. The impact of inflation

Inflation is a rise in prices over time. Due to this, you will have to pay more for goods and services. To buy the same amount of goods or services in the future, you would need more money. By investing money, you can factor inflation into your lifestyle and achieve your goals without having to worry about future inflation.

3. Income from other sources

You can earn an additional income by investing in the right plan. You can use this money to cover your financial needs, pursue a hobby, or fulfil your aspirations.

4. A disciplined approach to finances

Regularly investing in a plan helps you develop a habit of setting aside money for the future. Additionally, this discipline will help you stay on top of your finances and reduce unnecessary expenses.

5. Tax Advantages

Future financial stability is one of the benefits of investing. Apart from this, you also derive tax benefits from some investments such as NPS, PPF, ULIPs, FDs, etc. Individuals can claim tax deductions against the investments and reduce their overall tax liability. You can also derive tax benefits on maturity and insurance payouts in some investments.

6. Long-term Financial Security

Investments help you create a corpus that provides long-term financial security. You can be financially independent even after retirement when the regular income ceases. Some types of investments are designed to secure you financially so that you can achieve your short-term and long-term financial goals.

How to Invest?

The Do-It-Yourself Investor

Investments managed by professionals

A Roboadvisor for Investing

Start Investing in Small Amounts

Deciding how to invest money can be a difficult choice. DIY investors often take advantage of the low commissions and easy trading offered by discount and online brokerages. This type of investing requires a good understanding of the stock market, emotional intelligence, and a commitment of time. Additionally, those who feel they do not possess these skills may wish to employ a professional to manage their investments.

Individuals who prefer to have their investments managed by a professional can seek the services of a wealth manager. Wealth managers typically charge their clients a percentage of their Assets Under Management (AUM) as a fee for their services. Although professional money management can be more expensive than managing one's investments alone, many investors are willing to pay for the convenience of having an experienced expert make the research, investment decisions, and trades on their behalf. The SEC's Office of Investor Education and Advocacy recommends that investors confirm that their investment professional is licensed and registered.

Some investors choose to invest based on the advice of automated financial advisors. Roboadvisors, which use algorithms and AI, collect information about the investor and their risk profile to make recommendations. This process is cost-effective and offers services similar to that of a human investment advisor. As technology advances, roboadvisors can do more than just select investments; they can assist in creating retirement plans, as well as managing trusts and other retirement accounts.

If you feel achieving certain financial goals is out of your reach, you can start investing small amounts that help fill the gap for future big purchases. Consistent savings combined with compounding can bring dramatic changes to your financial health.

Things to Keep in Mind While Investing

Investing in India can be challenging for beginners who have little to no experience with money management. To help you identify suitable investment plans, you might benefit from sound financial advice.

Listed below are a few investment tips you may find useful:

Identifying your tolerance for risk is crucial because there are many types of investors in India. You will need to consider your risk tolerance when choosing investments.

Calculate the return of the instruments you are planning to invest in using an investment calculator. Online investment calculators are available for free.

Choose investments that align with your short-term and long-term financial goals.

You should diversify your investment portfolio so that it has a balance between high-risk and low-risk investments.

Plan ahead for your retirement by investing, because saving for your golden years is important.

Make sure that the investments in your portfolio continue to align with your personal objectives on a regular basis.

How Can I Start Investing?

Taking the DIY route, or opting for a professional investment advisor, are both viable options when it comes to investing. Consider your risk tolerance and develop a strategy that outlines how much you will invest, how often, and in what, based on your goals and preferences. Research the chosen investment to ensure it is in line with your strategy and has the potential to bring the desired results. It's important to remember that you don't need a lot of money to start, and you can adjust as your needs change.

How Can Investing Grow My Money?

Investing is not reserved for the wealthy. You can invest nominal amounts. Stocks can be purchased at low prices, small amounts can be deposited into an interest-bearing savings account, or you can save until you reach a target investment amount. Consider investing small amounts from your pay until you are able to increase your investment. A matching program offered by your employer may double your investment.

You can also invest in stocks, bonds, mutual funds, or even open an IRA. Getting started with Rs 1,000 is not a bad start. A Rs 1,000 investment in Amazon's IPO in 1997 would yield millions today. It was largely due to stock splits, but it doesn't matter, the results were monumental.

Most financial institutions offer savings accounts, which do not require a large investment. Savings accounts don't typically boast high interest rates; so, do your research to find one with the best features and most competitive rates. Believe it or not, you can invest in real estate with Rs 1,000. Investing in a company that produces income may be easier than buying an income-producing property. A Real Estate Investment Trust (REIT) invests in and manages real estate to generate income and profit. With Rs 1,000, you can invest in REIT stocks, mutual funds, or exchange-traded funds.

How to Buy the Right Investment Plan?

Given the multiple types of investment in India, finding the ideal investment plan can seem overwhelming. Let’s take a look at how you can buy the right investment plan for your needs:

Understand Time Constraints

Think About Your Budget

Decide on Your Risk Appetite

Most people think about how long they need to invest for or when they’d like to enjoy the returns from their investment. Sadly, many forget that making investments and keeping track of them can take a lot of time. You need to think about how much time you have today to do your research and invest regularly. If you don’t have too much time, you can opt for a ULIP, where somebody else invests the money for you. If you have the time and capability, you can invest money by yourself.

Many people think they need to save up a significant amount to start investing. The ideal way to build a significant corpus is by investing smaller amounts regularly. Putting away INR 1,000 per month works just as well as investing INR 20,000 once in five years. Depending on how you save, you should find a policy that either allows you to make lump-sum investments or systematic investments.

Before you pick an investment, you need to think about the risk. Some investments pose a higher risk than others. If you have the capacity to manage high risk investments, you can opt for them. If you prefer safe investments that offer lower but guaranteed returns, look for plans that fulfil your needs.

Identify Suitable Types of Investments for Your Goals

With this guide, you can get started creating your financial plan for different types of investments in India. Investing your money in various types of investments can ensure that your funds are placed in instruments that can help you achieve your short-term and long-term financial objectives. Financial planning is also an excellent way to prepare for retirement, so you can eventually step away from the daily grind and find time to pursue your dreams in your retirement years, whether it's something as simple as picking up a new hobby or something as grand as travelling the world. There are several forms of investment plans you can choose from as per your financial goals –

- Savings Plan

- Retirement Plan

- Pension Plan

- Child Investment Plan

Conclusion

When it comes to investing, there are a variety of options available - ranging from low-risk, low-reward investments geared towards beginners, to high-risk, high-reward investments that require more experience and research. Be sure to assess each type of investment before deciding how to allocate your assets according to your overall financial goals.

FAQs on Types of Investment

1. What is investment and its type?

Investment is allocating funds into various assets to generate yields over time. The various types of investments are equity, bonds, mutual funds, ULIPs, commodities (gold, silver, etc), Cryptocurrencies, real estate, fixed deposits, PPF, NPS, Certificate of Deposits, National Savings Certificate, etc.

2. What are the 7 types of investment?

Among the top 7 types of investments are stocks, bonds, mutual funds, property, money market funds, retirement plans, and insurance policies.

3. What are the four types of investing?

Bonds, stocks, Mutual Funds, and ULIPs are the four main types of investments.

4. What are the 6 classifications of investments?

Active versus passive management, growth versus value investing, and small or large companies are the 6 classifications of investments.

5. What are the three investment categories?

The three investment categories are:

1. Ownership such as investment in stocks of companies, real estate, and commodities like gold and silver.

2. Lending includes investment in bonds, which are loans to government entities or businesses.

3. Cash includes investments in liquid assets like treasury bills, money market accounts, savings accounts, etc.

6. What are the key points one should consider before investing in India?

- Your investment goal should be clear.

- Make sure you know how long you are planning to invest.

- Be aware of your risk tolerance.

- Allocation of assets is important.

- Make sure you know which product to invest in.

7. Which type of investment is best for beginners?

The best types of investment for beginners are high-yield savings accounts like fixed deposits and options with guaranteed returns such as PPF, NPS, etc.

Similar Articles

- Tax Saving Investment Options for Tax-Free Income in 2021

- Compare Investment and Savings Plans

- A Beginner's Guide to Investment Plans

- Safe investment with high returns in India

- Investment in Gold – viability and liquidity!

- Long Term Investment

- Short Term Investment

Not sure which insurance to buy?

Talk to an

Advisor right away

Advisor right away

We help you to choose best insurance plan based on your needs

Here's all you should know about life insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- Term Insurance Calculator

- Investment Plans

- Investment Calculator

- Investment for Beginners

- Best Short Term Investments

- Best Long Term Investments

- 5 year Investment Plan

- savings plan

- ulip plan

- retirement plans

- health plans

- child insurance plans

- group insurance plans

- income tax calculator

- bmi calculator

- compound interest calculator

- income tax slab

- Income Tax Return

- what is term insurance

- Ulip vs SIP

- tax planning for salaried employees

- HRA Calculator

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- nps vs ppf

- short term investment plans

- safest investment options

- one time investment plans

- types of investments

- best investment options

- best investment options in India

- Term Insurance for Housewife

- Money Back Policy

- 1 Crore Term Insurance

- life Insurance policy

- NPS Calculator

- Savings Calculator

- life Insurance

- Gratuity Calculator

- Zero Cost Term Insurance

- critical illness insurance

- itc claim

- deductions under 80C

- section 80d

- Whole Life Insurance

- benefits of term insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- term insurance

@Save 46,800 on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are a Regular Individual, Fall under 30% income tax slab having taxable income less than Rs. 50 lakh and Opt for Old tax regime.

@@Provided all due premiums have been paid and the policy is in force.

** The past 5 year fund performance of HDFC Life Discovery Fund (SFIN: ULIF06618/01/18DiscvryFnd101) as on 30th November 2024. The benchmark taken into consideration here is is Nifty Mid Cap 100 which as a return of 26.77% as on 30th November 2024. HDFC Life Discovery Fund is available with HDFC Life ULIPs which comes with a life cover. Please note past fund performance is not indicative of future performance.

This material has been prepared for information purposes only, should not be relied on for financial advice. You should consult your own financial consultant for any financial matters.

~ Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions. Tax Laws are subject to change from time to time. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

In unit linked policies, the investment risk in the investment portfolio is borne by the policyholder. The Unit Linked Insurance products do not offer any liquidity during the first five years of the contract. The policyholders will not be able to surrender/withdraw the monies invested in Unit Linked Insurance Products completely or partially till the end of fifth year. The name of the company, name of the brand and name of the contract does not in any way indicate the quality of the contract, its future prospects or returns.

Unit Linked Funds are subject to market risks and there is no assurance or guarantee that the objective of the investment fund will be achieved.

Unit Linked Insurance Products (ULIPS) are different from the traditional insurance products and are subject to the risk factors. The premium paid in the Unit Linked Life Insurance Policies is subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. Please know the associated risks and the applicable charges, from your insurance agent or the intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns.

ARN- MC/02/25/21312