How Does Retirement Calculator Work?

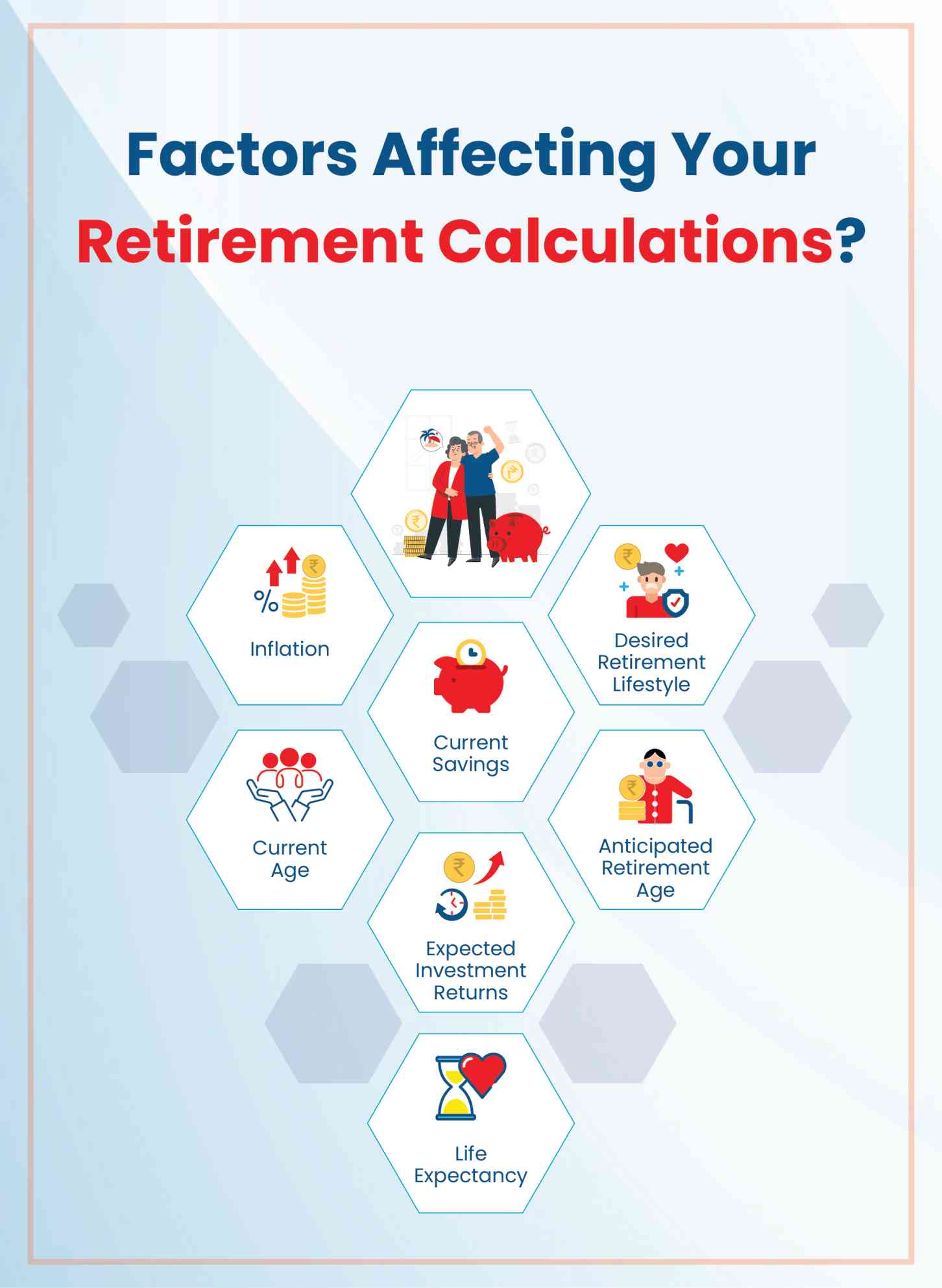

One effective tool for helping people plan for a financially comfortable retirement is a retirement calculator. It calculates the amount of money you must invest and save in order to guarantee that you may continue living the way you want to after retirement. The tool combines various financial variables, such as income, savings, expenses, inflation, and investment returns, to provide a comprehensive retirement plan.

In the section below, we will explore how a retirement corpus calculator works, including the formulas, and methods for calculating your retirement corpus, and how it helps you achieve your retirement goals.

I. Formula of Retirement Calculation

The formula a retirement calculator uses is simple but accounts for different variables. Here is how it works:

- Retirement Corpus: The amount of money you need to accumulate by the time you retire.

- Monthly Expenses: The amount of money you will need each month during retirement to cover your living expenses.

- Life Expectancy: The number of years you expect to live after retirement.

- Inflation Rate: The percentage by which expenses are expected to increase each year.

- Expected Rate of Return: The average annual return you expect to earn on your investments during the saving phase.

The formula to calculate a retirement corpus is as follows:

FV = PV*(1+r)^n

Here, FV = Future Value, PV= Present Value, r= Expected Inflation, n= Time to Retirement

Let us consider an example to understand how a retirement calculator works.

For instance, you require a monthly income of Rs. 45,000 in retirement. You are currently 40 years old and plan to retire at 60 years of age. What is the retirement corpus you need if you invest your retirement savings in a bank FD offering an 8% yield? (Assume inflation at 6%)

Step 1: Calculate Future Monthly Expenses

The formula to calculate the future value of monthly expenses by adjusting inflation is -

FV = PV x (1+r) ^n

In this case, FV stands for future value or the monthly expense at the time of retirement

PV or present value is Rs. 45,000

R is the inflation rate, that is, 6% or 0.06

N is time to retirement, that is, 20 years (60 years- 40 years)

Hence, FV = 45000 x (1 + 0.06) ^ 20 = 45000 x 3.207) = Rs. 1, 44,315

Thus, at the age of 60, that is, at the time of retirement, the required monthly expenses are Rs. 1, 44,315.

Step 2: Convert Monthly Income to Annual Income

Annual Income Required = Rs. 1, 44,315 * 12 months = Rs. 17,31,780

Step 3: Calculate Retirement Corpus

Now we need to calculate the retirement corpus necessary for generating an annual income of Rs. 17, 31,780. Let us assume the retirement period to be 25 years, that is, from age 60 to 85.

The rate of return on retirement corpus is 8%, with 6% inflation. For adjusting the rate of return for inflation, the formula to apply is -

Inflation-adjusted Rate of Return = [(1 + Rate of Return) / (1 + Inflation Rate)] - 1

= [(1+0.08) / (1+0.06)] – 1 = 1.885

Now, let us calculate the corpus required using the Excel PV function. We use the following inputs:

PMT = Rs. 17, 31,780 (Annual income required), nper = 25 years, rate = 1.885% annually (inflation-adjusted rate of return), Type = 1 (payment is made at the beginning of the period)

The retirement corpus needed to generate an annual income of Rs. 17, 31,780 is Rs. 3, 72,89,600.

Step 4: Calculate Monthly Savings

Now, let us calculate how much you need to save every month to accumulate Rs. 3,72,89,600 by the time you retire at 60. We use the Excel PMT function for this calculation:

PV = Rs. 0 (current savings), FV = Rs. 3, 72, 89,600 (required retirement corpus), n = 20 years (from age 40 to 60), rate = 8% annually (rate of return)

Using the PMT function, you find that the monthly savings required to reach Rs. 3,72,89,600 is Rs. 32,836.

Hence, to accumulate the necessary retirement corpus of Rs. 3,72,89,600 by age 60, you need to invest Rs. 32,836 every month in a bank FD offering an 8% return. This will provide you with an annual income of Rs. 17,31,780 for 25 years after retirement.

II. Calculating Retirement Benefits Using the Retirement Calculator

A retirement planning calculator takes into account the following factors when calculating retirement benefits, such as pension or annuity payouts:

Expected Retirement Corpus: The total amount you'll have saved when you retire.

Payout Period: The number of years you expect to receive the benefits, such as 25 years post-retirement.

Expected Rate of Return: Certain retirement calculators make the assumption that your funds will continue to generate income in retirement, extending the lifespan of your corpus.

The calculator may calculate your monthly retirement income (annuity or pension) based on these parameters. The calculator will estimate how long your corpus will last based on predicted returns. For instance, if you have Rs. 5 crore and intend to withdraw Rs. 1.5 lakh monthly over 25 years.

III. How Does a Retirement Planning Calculator Help You?

A retirement calculator helps you in the following ways:

Clear Financial Objectives: It assists you in establishing retirement objectives that are reasonable and achievable given your income and lifestyle.

Flexibility in Planning: The calculator is a dynamic tool for long-term planning since it lets you make modifications in the event that your income, spending, or retirement plans change.

Customized Savings Strategy: The calculator creates a personalized savings strategy that includes the monthly investments required to meet your corpus target.

Encouragement to Save: It encourages you to adhere to your financial plan and helps you reach your retirement objectives by displaying the precise amount you must save and invest.

Adjustments for Inflation and Investment Returns: It provides a more accurate and realistic estimate of how much you need to save by accounting for inflation and anticipated investment returns.