What do you want to do?

Top ULIP Myths That You Must Stop Believing In

Table of Content

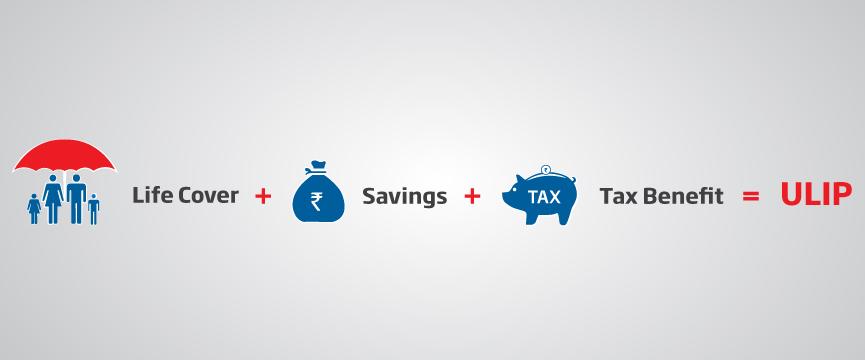

Unit Linked Insurance Plans (ULIPs) offer you the unique, dual benefit of investment and insurance in a single product. However, there are several misconceptions surrounding these products due to lack of proper understanding of product features & benefits. Here, we've addressed some of the common myths associated with ULIPs. We hope this will help you make more informed decisions.

Myth 1: ULIPs have high costs

Reality: Do you believe that ULIPs are very expensive? Let us start by understanding the structure of a ULIP. Every time you pay premium towards a ULIP to a life insurance company, the premium is invested in funds of your choice after deducting charges for services provided such as life insurance cover, fund management, etc.

Effective September 1,2010 the Insurance Regulatory and Development Authority of India (IRDAI) capped charges (excluding life insurance cover charges) that a life insurance company can charge on a ULIP at 2.25% if a customer stays in the product for more than 10 years1.

In addition, to these caps the emergence of online plans such as HDFC Life Click 2 Invest ULIP means that the costs of buying ULIPs online is even lower than ever before.

Myth 2: ULIPs are risky instruments as they offer market-linked returns

Reality: The life insurance cover that you buy stays fixed in a ULIP. A typical ULIP will offer you multiple fund options. At the time of purchasing the policy, you can make a choice of the fund you wish to invest in. Depending on the level of risk you are willing to take, you can opt among other choices for equity, debt funds or a balanced fund that is a mix of equity and debt. For example HDFC Life Click 2 Invest ULIP provides you with 8 fund choices. You also have the facility to switch your corpus between funds or to direct future premiums to new funds. All this is possible in a single ULIP without the need for buying another product.

Myth 3: ULIPs do not provide good returns

Reality: In ULIPs, the return is determined by the nature of movement of underlying asset class - equity, debt etc and choice of fund. A good selection of funds and sensible switching at the right time can get you optimal returns from the market. Most importantly, ULIPs provide you with not only an opportunity to invest and build funds, but also insurance cover. If you take this into consideration while considering the overall benefits, you will realise that the returns that ULIPs provide are quite competitive.

Myth 4: It is not easy to exit a ULIP once it has been purchased

Reality: It is important that you purchase a ULIP only medium to long term goals. To encourage disciplined savings for these goals, ULIPs come with a lock-in period of five years after which you have the option to surrender your existing policy. If you make a full withdrawal before the policy matures, you will not incur any surrender or exit load charges; rather, you will be paid your fund value. However, it's not a good idea to surrender the policy midway unless you have no other source of funds. ULIPs require you to remain invested for the long-term if you want to reap maximum returns through capital appreciation. In fact, the power of compounding will typically kick in only if you stay invested in a ULIP in line with your life goals defined at the time of purchasing of policy.

Myth 5: ULIP life cover decreases if the market dips

Reality: Just because ULIPs are generally linked to the equity market, it does not mean that the life cover will decrease if the market plunges. The life cover does not get affected by market fluctuations at all. If you are no more, your existing ULIP policy will either pay the total life cover or the fund value, whichever is higher, to your beneficiaries.

Myth 6: ULIPs do not allow investment of surplus funds

Reality: You can top-up your existing ULIP policy-over and above your premium-using any surplus funds available with you and get tax benefits just as you would in case of regular premiums. You can pay the top-up premiums as many times you wish during the tenure of the policy.

ULIPs from HDFC Life are ideal for achieving your long-term financial goals. Plans such as HDFC Life Click2Invest - ULIP serves as wealth creation solution over the long term. As a policyholder, you are also entitled to life cover, which means assured financial protection for your family in case you are no more.

Source:

Related Articles

- Unit Linked Insurance Plan (ULIP) - An Introduction

- https://www.hdfclife.com/insurance-knowledge-centre/investment-for-future-planning/click2invest-superulip

Term Plan Articles

Term Plan Articles

Investment Articles

Investment Articles

Savings Articles

Savings Articles

Life Insurance Articles

Life Insurance Articles

Tax Articles

Tax Articles

Retirement Articles

Retirement Articles

ULIP Articles

ULIP Articles

Subscribe to get the latest articles directly in your inbox

Health Plans Articles

Health Plans Articles

Child Plans Articles

Child Plans Articles

Popular Calculators

Popular Calculators

Here's all you should know about life insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- Term Insurance Calculator

- Investment Plans

- Investment Calculator

- Investment for Beginners

- Best Short Term Investments

- Best Long Term Investments

- 5 year Investment Plan

- savings plan

- ulip plan

- retirement plans

- health plans

- child insurance plans

- group insurance plans

- income tax calculator

- bmi calculator

- compound interest calculator

- income tax slab

- Income Tax Return

- what is term insurance

- Ulip vs SIP

- tax planning for salaried employees

- HRA Calculator

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- nps vs ppf

- short term investment plans

- safest investment options

- one time investment plans

- types of investments

- best investment options

- best investment options in India

- Term Insurance for Housewife

- Money Back Policy

- 1 Crore Term Insurance

- life Insurance policy

- NPS Calculator

- Savings Calculator

- life Insurance

- Gratuity Calculator

- Zero Cost Term Insurance

- critical illness insurance

- itc claim

- deductions under 80C

- section 80d

- Whole Life Insurance

- benefits of term insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Best Term Insurance Plan for 1 Crore

- personal accident insurance

- Annuity Calculator

- Life Insurance Calculator