What do you want to do?

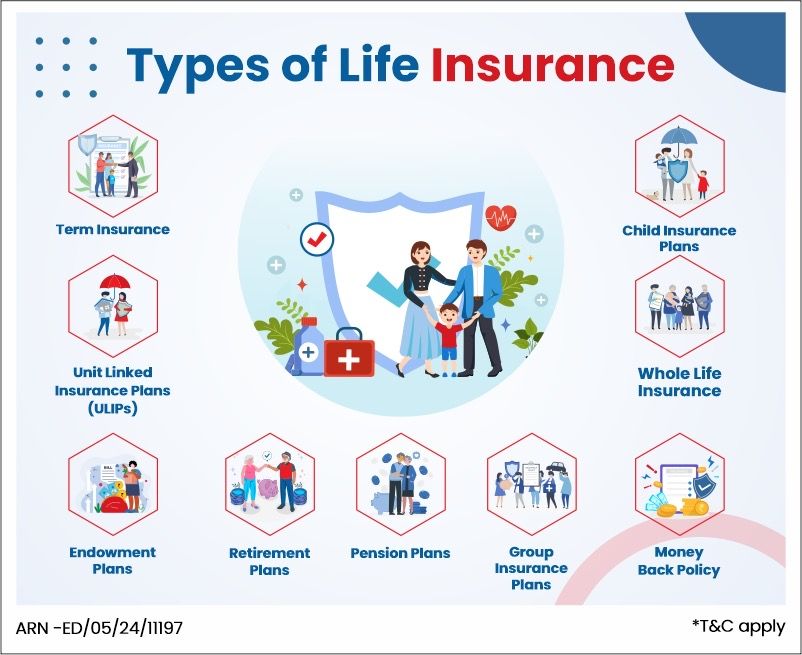

9 Types of Life Insurance

Table of Content

2. Unit Linked Insurance Plans (ULIPs)

10. How to Buy a Life Insurance Policy in India?

11. How to Choose the Right Type of Life Insurance Policy In India?

12. Why Sum Assured is an Important Factor When it Comes to Term Insurance?

13. Tax Benefits on Different Types of Life Insurance in India

14. Conclusion

Term Life Insurance or Term Plan |

Long-term financial protection plan to secure your family’s future |

Unit Linked Insurance Plans (ULIPs) |

Insurance cum investment product that invests in a mix of equity & debt funds with a 5-year lock-in period |

Endowment Plans |

Provides life cover for your loved ones in case of your unfortunate demise, and also grows your money to achieve financial goals. |

Child Insurance Plans |

Financial product that helps parents save and invest money to fund their child's education expenses, besides providing life cover. |

Whole Life Insurance |

Insurance plan that offers coverage for the rest of your lifespan, usually up to 99 years. It safeguards your family’s financial future in your absence. |

Money Back Policy |

A life insurance policy that provides a life cover along with regular income throughout the policy term, besides giving a lump sum amount upon maturity. |

Retirement Plans |

Investment plan that helps build a retirement corpus either through regular or lump sum payments. The accumulated corpus provides steady payments after your retirement, ensuring you have a source of income when you retire. |

Pension Plans |

Investment plans that allow you to systematically save money over the years and then enjoy a steady income through a pension after you retire. |

Group Insurance Plans |

Insurance plan that covers a group of people, such as employees of an organisation or members of an association. The insurance coverage can be either for health insurance, life insurance, personal insurance, etc. |

1. Term Insurance

Term insurance is a type of life insurance that provides coverage in the event of death. You pay premiums for a specific duration, and in case of an unfortunate event, your nominee—who is the person to receive the sum assured—will get the benefits. If you’re unaware about what is a nominee in insurance, so it’s the individual you choose to receive the policy proceeds. Term insurance is the purest form of life insurance, which is why it comes with very affordable premiums. Additionally, term insurance can be availed along with add-on riders such as...

Term Insurance with Critical Illness rider

Term Insurance with return of premium

With nominal incremental premium you have the option to avail a critical illness rider along with your term insurance. In case you are detected with a critical illness you can avail the sum assured under the critical illness insurance for your treatment and the life cover of your base policy continues as is.

With term insurance return of premium if you survive the term of your policy then you are entitled to get your premiums back at the end of policy tenure.

2. Unit Linked Insurance Plans (ULIPs)

Unit Linked Insurance Plan (ULIP) is a type of life insurance plan that combines life cover and investment option. ULIP plan allows you the avenue to invest in a variety of asset classes, such as equity, debt, and money market funds, depending on your risk appetite. ULIPs come with a lock-in period of 5 years but since every individual has different financial goals it provides the flexibility to choose your own funds. A unique feature that ULIP provides is the ability to switch funds as per the investor’s choice. Since these are market linked financial products it gives the opportunity to growth your investment but the investment risk in the investment portfolio is borne by the policyholder.

3. Endowment Plans

Endowment plans are life insurance that provides life cover against death or a maturity benefit at the end of the policy tenure. You are paid a lump sum after a specific period called the maturity period. For an endowment policy the insurance company will pay your nominee in case you are no more or will pay you after the maturity period if you survive the policy term.

4. Child Insurance Plans

Child insurance plans are a type of life insurance for securing a child's financial future, especially for education needs. These life insurance plans combine life insurance with savings, where parents have to pay premiums that accumulate into a maturity benefit for their child's education.

5. Whole Life Insurance

Whole life Insurance provides financial protection to you till the age of 99 years. The objective of this type of life insurance is to provide life cover to the policyholder’s nominee/family in case the policyholder passes away before the age of 99 years. Usually the features of a whole life insurance is similar to a life insurance expect for the fact that it covers you till the age of 99 years.

6. Money Back Policy

Money Back Policy is a type of life insurance that offers the benefit of financial cover as well as investments. A money back policy can help you to generate income at regular intervals throughout the policy tenure. With it, a policyholder gets to provide financial security to his or her loved ones in the event of death and on survival the policyholder gets back the maturity amount after the policy term.

7. Retirement Plans

Retirement plans are financial instruments that are designed primarily to build a corpus for your retirement needs. The financial benefit from such type of life insurance helps you in retirement planning by providing an adequate retirement corpus so that you can maintain your standard of living post retirement with any stress.

8. Pension Plans

Pension plans are type of life insurance that is designed to ensure a regular income on specific intervals during your retirement. There are 2 phases in a pension plan - accumulation phase and the distribution phase. During the accumulation phase, the premiums get invested in a fund or asset of your choice for a pre-determined period helping you build your retirement fund. In the Distribution phase you can start receiving your benefits or withdraw the accumulated funds and purchase an annuity plan.

9. Group Insurance Plans

Group Insurance Plans are life insurance solutions designed to provide life cover to collective group of individuals, such as employees of a company, under a single policy. These type life insurance offer uniform benefits to all members of the group, irrespective of individual characteristics.

How to Buy a Life Insurance Policy in India?

You need to do a few things when purchasing different types of life insurance in India to ensure you have the right coverage. An all-inclusive guide is provided here:

- Assess your current and prospective financial obligations and those of your dependents before you buy a life insurance policy. Using a life insurance calculator can help you evaluate your exact insurance needs by factoring in your financial responsibilities, family size, and future goals. This will make it easier to determine how much insurance you need to safeguard your family's financial stability.

- Learn more about different life insurance coverage types offered in India, including term, retirement plans, endowment, ULIP, and money-back policies. Ensure you know what each kind can do and the restrictions on payment for critical illness.

- Determine which insurance providers are the best by looking at their customer service reputation, financial stability, and claim settlement ratio. Choose a reputable insurance company that has been around for a while.

- To calculate premium for term insurance, you may use an online term insurance calculator. The policyholder's age, coverage amount, policy duration, and extra riders influence the premium rates displayed by the online term insurance calculator.

- To calculate the retirement corpus you will be needing for your retirement you can use the retirement calculator.

- Decide on a life insurance plan that best suits your needs. Once you have finalized your life insurance plan, start filling out the application form. It will require you to share some personal information, such as your name, health habits, date of birth, etc. Any information you share must be true and complete.

- Depending upon your age and the amount insured, the insurance company ask for some medical tests to be done. Please note that you must complete all tests on time and work with the insurance company's medical staff.

- While applying, make sure that all required documents are attached. Some examples of those documents are birth certificates, utility bills, bank records, driver's licenses and, if needed, medical records.

- Be careful to study the insurance policy papers properly before buying insurance. It also covers the plan's advantages, limitations, payment terms, premium due dates, and the rider (if available).

- Use your chosen payment method (cash, online payment or cheque) to pay the premium. Pay your premiums on time so the policy remains active, and you may continue to get coverage.

- The insurance company will issue the policy paperwork after the papers and payment have been verified. Before putting the paper away, double-check it for accuracy.

- In the event of a claim, share all of the information your life insurance company needs, including your policy number, insurer’s contact details, etc., to process your claim amount.

How to Choose the Right Type of Life Insurance Policy In India?

A right policy is a perspective that varies from person to person depending on individual needs, goals and affordability. It’s thus crucial to choose the plan that best suits these factors. Here are some things that can help you take your pick. For Life Insurance for NRI, additional factors such as currency fluctuations and international coverage may need to be considered when choosing a policy.

Life Goals:

Sum Assured:

Policy Term:

Riders:

Credibility of the insurer:

Determine the life goals you wish to fund with your life insurance benefits.

The life cover or the sum assured should suffice to fund the needs and goals of your family when you are not around. Experts believe the ideal coverage should at least be 10 times your annual income.

Choose a long-term or short-term policy depending on what life goals you want to fund with it.

Enhance your coverage with additional riders like the accident cover and the critical or terminal illness cover to enjoy maximum benefit.

Ascertain whether the insurance company will settle the claims on time. Check for parameters like claim settlement ratio, solvency ratio and exclusions in coverage.

Why Sum Assured is an Important Factor When it Comes to Term Insurance?

Choosing the right sum assured in your term insurance plans is essential for your family's financial security. This sum provides crucial protection in case of unexpected events, giving you peace of mind. A higher sum ensures your loved ones are well-supported, covering debts, education costs, and income replacement. Selecting the right amount is key to ensuring their future is secure. To explore the best term life insurance options and find the ideal sum assured for your needs, click the tabs below.

ARN - ED/02/25/21047

Tax Benefits on Different Types of Life Insurance in India

In addition to safeguarding one's financial future, life insurance plans in India gives tax advantages under specific provisions of the Income Tax Act. Various types of life insurance have varied tax implications, and we've outlined them below:

Section 80C

Section 80D

Section 10(10D)

Tax deductions are allowed for premiums paid for life insurance, up to a maximum of ₹1.5 lakh each financial year as deductions under 80C of the Income Tax Act, 1961.

Premiums paid towards critical illness rider are eligible of tax deductions under section 80D of the Income Tax Act, 1961.

The maturity benefit paid at the end of the policy term is free from taxes under Section 10(10D) of the Income Tax Act, provided that certain conditions are met.

Conclusion

Various life insurance options serve as effective saving schemes, providing financial security, wealth accumulation strategies and substantial tax advantages for individuals with different risk appetites and financial goals. Taking advantage of these tax benefits helps you grow your money without any tax implications and improves the financial stability of your family.

FAQs on types of life insurance

Q. What are the 4 main types of life insurance?

A. There are four primary types of life insurance: term, whole, endowment, and Unit-Linked Insurance Plans (ULIPs).

Q. What are the benefits that different types of life insurance policies offer?

A. Depending on the policy selected, life insurance may provide a variety of advantages, including security, tax advantages, investment possibilities, premium payment flexibility, and wealth growth.

Q. Is it possible to purchase two different types of life insurance policies at the same time?

A. It is possible to get two separate life insurance policy types simultaneously to satisfy different financial commitments and goals. However, remember that insurance companies have requirements that must be fulfilled to be covered.

Q. What type of life insurance is the most popular in India?

A. The majority of Indians choose term life insurance due to its affordable, straightforward coverage for a set duration.

Q. Are riders a type of life insurance policy?

A. Types of life insurance policy that are considered whole life do not have an end date or specified term, but rather are designed to cover the insured for their whole lifetime.

Q. What is the right age to buy life insurance?

A. Although individual circumstances may dictate otherwise, it is generally recommended that policyholders acquire whichever life insurance types in India suits them when they are young and in excellent health in order to take advantage of the most affordable rates.

Q. Which type of life insurance policy is best for married couples?

When it comes to life insurance, married couples have a few options. One is a joint policy that covers both partners. Another is term insurance with riders that protect spouses.

Q. Which type of life insurance policy is best for single individuals?

A. For individuals living independently, term or Unit-Linked Insurance Plans (ULIPs) provide affordable coverage, flexible monthly payments, and the chance to build their investments.

Q. Which type of life insurance policy never expires?

A. Permanent life insurance is a type of insurance that never expires. It features a savings component along with a death benefit. Whole life insurance and universal life insurance are two names for permanent life insurance.

Not sure which insurance to buy?

Talk to an

Advisor right away

Advisor right away

We help you to choose best insurance plan based on your needs

Here's all you should know about life insurance.

We help you to make informed insurance decisions for a life time.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- Term Insurance Calculator

- Investment Plans

- Investment Calculator

- Investment for Beginners

- Best Short Term Investments

- Best Long Term Investments

- 5 year Investment Plan

- savings plan

- ulip plan

- retirement plans

- health plans

- child insurance plans

- group insurance plans

- income tax calculator

- bmi calculator

- compound interest calculator

- income tax slab

- Income Tax Return

- what is term insurance

- Ulip vs SIP

- tax planning for salaried employees

- HRA Calculator

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- nps vs ppf

- short term investment plans

- safest investment options

- one time investment plans

- types of investments

- best investment options

- best investment options in India

- Term Insurance for Housewife

- Money Back Policy

- 1 Crore Term Insurance

- life Insurance policy

- NPS Calculator

- Savings Calculator

- life Insurance

- Gratuity Calculator

- Zero Cost Term Insurance

- critical illness insurance

- itc claim

- deductions under 80C

- deductions under 80D

- Whole Life Insurance

- benefits of term insurance

- features of life insurance

- term life insurance plan

- what is nominee in insurance

*Tax benefits are subject to conditions under Sections 80C, & Section 10(10D) and other provisions of the Income Tax Act, 1961. Tax Laws are subject to change from time to time.

#Provided we have received all the relevant and required documents and no further investigation is required. Claim settlement process would be completed within stipulated timelines once the claim request is approved.

In unit linked policies, the investment risk in the investment portfolio is borne by the policyholder. The Unit Linked Insurance products do not offer any liquidity during the first five years of the contract. The policyholders will not be able to surrender/withdraw the monies invested in Unit Linked Insurance Products completely or partially till the end of fifth year.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. The name of the company, name of the brand and name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your insurance agent or the intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns.

**7% online discount available on 1st year premium only

***Online Premium for Life Option for HDFC Life Click 2 Protect Super (UIN: 101N145V07), Male Life Assured, Non-Smoker, 20 years of age, Policy term of 25 years, Regular pay, Annual frequency, exclusive of taxes and levies as applicable. (Monthly Premium of 622/30=20.7).

^ Available under Life & Life Plus plan options

@As per integrated annual report FY23-24, available on www.hdfclife.com. As of May 2024

##Individual claim settlement ratio by number of policies as per audited annual statistics for FY 23-24

~Tax benefits of ₹ 54,600 (₹ 46,800 u/s 80C & ₹ 7,800 u/s 80D) is calculated at highest tax slab rate of 30% on life insurance premium u/s 80C of ₹ 1,50,000 and health premium (Critical illness rider) u/s 80D of ₹ 25,000. Tax benefits are subject to conditions under section 80C, 80D, 10(10D) as per Income Tax Act, 1961. Please consult your tax advisor for more information.

*Online Premium for Life Option, Male Life Assured, Non-Smoker, 20 years of age, Policy term of 40 years, Regular pay, Monthly frequency, exclusive of taxes and levies as applicable.

ARN - ED/03/24/10433