What do you want to do?

How Does Smoking Impact My Life Insurance Premium?

Table of Content

Every responsible adult understands the importance of having a term life insurance plan. These policies provide financial security and stability to your loved ones in your absence. Purchasing life insurance in our digital world has become much easier. You can visit your insurance company’s website to identify the ideal policy for your needs. Once you decide to buy a policy, you have to complete a quick document verification and medical checkup before getting the policy delivered to your inbox. One question your insurance company will ask is whether you are a smoker or not. Let’s understand how smoking impacts your term life insurance premium.

Who Is Considered a Smoker?

Insurance companies identify any individual who consumes nicotine and tobacco as a smoker. The insurance company will consider you a smoker if you smoke cigarettes, cigars, beedis or vapes. Individuals who consume gutka or pan masala and use nicotine patches and chewing gums also fall into the same category. Remember, insurance companies do not differentiate between occasional smokers and daily smokers.

How Does Smoking Impact My Life Insurance Premium?

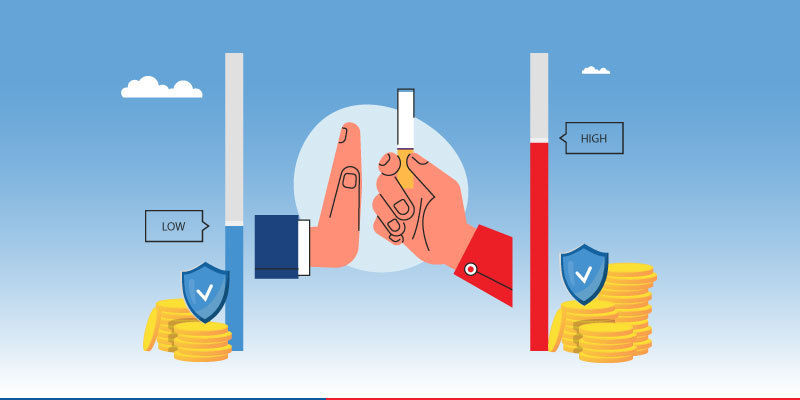

Medical research shows that long-term smoking can increase a person’s risk of developing various conditions like cancer, respiratory disease, stroke, and heart conditions. Since individuals who smoke have a higher chance of developing a life-threatening condition, life insurance companies view them as high-risk individuals. To offset the risk factor, insurance companies charge smokers and tobacco users a higher premium for their term life insurance policies. We can understand this better with an example.

Example/Illustration:

Aditya is a 30-year-old man who lives in Mumbai. He lives a healthy lifestyle, eating nutritious foods and exercising regularly. Aditya does not consume any nicotine products. He purchases a term plan with a sum assured of Rs. 1 crore for an annual premium of Rs. 8,000.

His friend Rajesh is also 30. However, Rajesh smokes heavily. When he purchased a term life insurance policy, the insurance company charged him an annual premium of Rs. 11,500 for a sum assured of Rs. 1 crore.

What Happens If I Lie on the Insurance Application?

Many people understand that habits like smoking and drinking can increase their insurance premiums. So, they may lie on their insurance application form. However, this is very risky since the insurance company will thoroughly investigate every claim request. The company will likely discover that the policyholder was a smoker. In such situations, they reject the claim request, which leaves the beneficiary without any financial protection during a difficult time.

The Impact of Quitting Smoking

Quitting smoking has a positive impact on your overall health. After staying off nicotine and tobacco for a number of years, you have to apply for a new policy as a non-smoker. However, you must remember that your age and other health concerns can work against you. Additionally, the insurance company will complete a new medical and financial evaluation before approving your request. While quitting smoking doesn’t instantly mean lower premiums, it does help boost your overall health.

Smoking has a profound impact on the premiums of your life insurance policy. Insurance companies consider smokers as high-risk individuals. So, they charge them higher premiums.

Quitting smoking can help you save on insurance premiums and enjoy a healthier life!

Related Articles

- Single Premium Term Insurance: Things you need to know

- All You Need to Know About Insurance Types, Portability & Its Benefits

- Why it’s important for women to buy life insurance

- Term Insurance Plans for Single Women

- How Does BMI Affect Your Term Insurance Premium?

- The Impact of Inflation on Your Term Insurance Coverage Amount

ARN - ED/11/23/6236

Term Plan Articles

Term Plan Articles

Investment Articles

Investment Articles

Savings Articles

Savings Articles

Life Insurance Articles

Life Insurance Articles

Tax Articles

Tax Articles

Retirement Articles

Retirement Articles

ULIP Articles

ULIP Articles

Subscribe to get the latest articles directly in your inbox

Health Plans Articles

Health Plans Articles

Child Plans Articles

Child Plans Articles

Popular Calculators

Popular Calculators

Here's all you should know about life insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

HDFC Life does not promote alcohol drinking. The content is not intended to provide health advice to individuals about their drinking habits

Popular Searches

- Term Insurance Calculator

- Investment Plans

- Investment Calculator

- Investment for Beginners

- Best Short Term Investments

- Best Long Term Investments

- 5 year Investment Plan

- savings plan

- ulip plan

- retirement plans

- health plans

- child insurance plans

- group insurance plans

- income tax calculator

- bmi calculator

- compound interest calculator

- income tax slab

- Income Tax Return

- what is term insurance

- Ulip vs SIP

- tax planning for salaried employees

- HRA Calculator

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- nps vs ppf

- short term investment plans

- safest investment options

- one time investment plans

- types of investments

- best investment options

- best investment options in India

- Term Insurance for Housewife

- Money Back Policy

- 1 Crore Term Insurance

- life Insurance policy

- NPS Calculator

- Savings Calculator

- life Insurance

- Gratuity Calculator

- Zero Cost Term Insurance

- critical illness insurance

- itc claim

- deductions under 80C

- section 80d

- Whole Life Insurance

- benefits of term insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Best Term Insurance Plan for 1 Crore

- personal accident insurance

- Annuity Calculator

- Life Insurance Calculator