What do you want to do?

Absolute Returns in ULIPs: Everything You Need to Know

Table of Content

In this policy, the investment risks in the investment portfolio is borne by the policyholder

ULIPs or unit linked insurance plans constitute long-term investment plus insurance schemes offering dual perks of market-linked gains as well as life insurance cover. With any insurance scheme, there is a premium involved which policyholders have to pay for buying and maintaining the insurance. In a ULIP, part of your premium is allocated to life cover and the other part to investment. This investment is usually in market securities. This is connected to market performance, so a ULIP generates returns over a set period. These returns are referred to as absolute returns in ULIPs.

What are Absolute Returns in ULIPs?

Another term for absolute returns is total returns. This is due to the fact that these returns actually refer to assets and their value that is gained over a period - the horizon of the investment in question. The value of the asset can appreciate or depreciate, based on the market performance. Furthermore, the asset could be a blend of debt funds and stocks. From the point of view of an investor, the absolute returns in ULIPs are either the profits or losses from a ULIP taken on a yearly basis.

How to Calculate Absolute Returns?

Absolute returns are computed on any ULIP’s net asset value. Absolute returns are expressed as percentages of initial net asset values or NAVs. For instance, if you bought a ULIP with an NAV equal to Rs. 50, increasing to Rs. 100 by the close of the year (financial year), 50% would be the absolute return. Therefore, the absolute return refers to a measure of the way the ULIP has performed. Such a method helps you to determine your gains according to the capital you have invested.

While you should know all about absolute returns in ULIPs, you should also be aware of the types of returns in ULIPs. Essentially, there are two types. You already know about absolute returns. The other type of return in a ULIP is referred to as the compound annual growth rate. This translates to the mean of the annual rate of growth of a ULIP taken over a particular period, lasting above a year. The returns which are generated are subject to several charges like mortality charges and fund management fees, administrative fees, premium allocation fees, etc.

Benefits of ULIPs

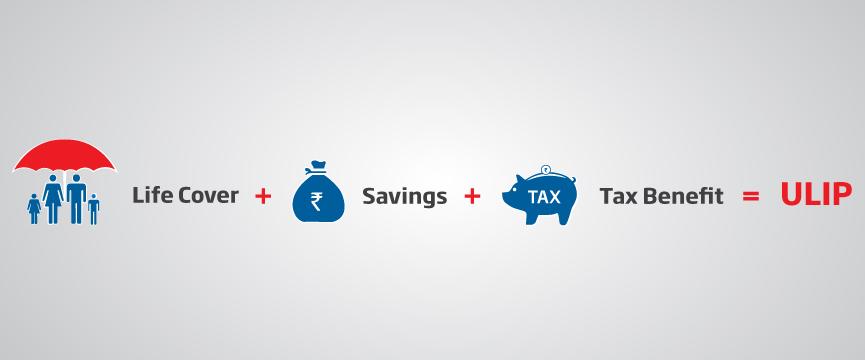

ULIPs are well-liked as investment plans go. This is largely because of their dual nature of investment and insurance in a single scheme. They offer investors great benefits and these are highlighted below:

Dual Advantages

ULIPs provide life insurance with the advantages of investment in market-related instruments.

Financial Protection

ULIPs offer financial security to beneficiaries in the event of the unpredictable demise of the holder of the ULIP policy.

Tax Benefits

Premiums which are paid towards ULIPs are eligible for deductions of tax based on Section 80C/Section 10(10D) of the Indian Income Tax Act (1961)#.

Long-Term Investment

ULIPs aid you in achieving your goals in the long run.

Absolute Returns in ULIPs

ULIP investments give absolute returns and are subject to the effects of compounding. Hence, you get high returns in the long run.

Flexible Schemes

ULIPs give investors the flexibility to switch funds, changing between equity and debt funds.

Conclusion

To cut a long story short, a ULIP is a great investment. It has the ability to generate higher returns compared to traditional instruments like fixed deposits, PPF and NPS, and is less risky than mutual funds. When you invest, the idea is to start your investment early in your life so you have a longer time span to accumulate wealth. ULIPs give investors the power to compound wealth, especially if ULIPs are opted for as long-term investments. A ULIP not only gives you the benefits of long-term goal-based investing, but also comprehensive insurance cover so you don’t have to be concerned about your loved ones in the case of your untimely demise.

Related Articles

- What is ULIP Plan

- Benefits of ULIPS

- Understanding ULIPs and their Benefits

- 6 Tips to Maximize your Gains from ULIP

ARN – ED/10/22/30043

Term Plan Articles

Term Plan Articles

Investment Articles

Investment Articles

Savings Articles

Savings Articles

Life Insurance Articles

Life Insurance Articles

Tax Articles

Tax Articles

Retirement Articles

Retirement Articles

ULIP Articles

ULIP Articles

Subscribe to get the latest articles directly in your inbox

Health Plans Articles

Health Plans Articles

Child Plans Articles

Child Plans Articles

Popular Calculators

Popular Calculators

Here's all you should know about life insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

#Subject to conditions specified u/s 80C of the Income tax Act, 1961.

Subject to conditions specified u/s 10(10D) of the Income tax Act, 1961.

Tax benefits are subject to change in tax laws. Also, the customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

The Unit Linked Insurance products do not offer any liquidity during the first five years of the contract. The policyholders will not be able to surrender or withdraw the monies invested in Unit Linked Insurance Products completely or partially till the end of fifth year.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. HDFC Life Insurance Company Limited is only the name of the Insurance Company, The name of the company, name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns.

Popular Searches

- Term Insurance Calculator

- Investment Plans

- Investment Calculator

- Investment for Beginners

- Best Short Term Investments

- Best Long Term Investments

- 5 year Investment Plan

- savings plan

- ulip plan

- retirement plans

- health plans

- child insurance plans

- group insurance plans

- income tax calculator

- bmi calculator

- compound interest calculator

- income tax slab

- Income Tax Return

- what is term insurance

- Ulip vs SIP

- tax planning for salaried employees

- HRA Calculator

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- nps vs ppf

- short term investment plans

- safest investment options

- one time investment plans

- types of investments

- best investment options

- best investment options in India

- Term Insurance for Housewife

- Money Back Policy

- 1 Crore Term Insurance

- life Insurance policy

- NPS Calculator

- Savings Calculator

- life Insurance

- Gratuity Calculator

- Zero Cost Term Insurance

- critical illness insurance

- itc claim

- deductions under 80C

- section 80d

- Whole Life Insurance

- benefits of term insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Best Term Insurance Plan for 1 Crore

- personal accident insurance

- Annuity Calculator

- Life Insurance Calculator