What do you want to do?

- Term Insurance

- What is Term Insurance?

- How does a Term Insurance Work?

- Why Do I Need Term Insurance?

- Who Should Buy Term Insurance?

- Why Does Term Insurance Premium Increase with Age?

- When Should I Buy a Term Insurance Plan?

- What are the 5 important stages in life to buy a Term life insurance?

- Why Buy Term Life Insurance Online?

- Know more about Term Insurance

- Term Insurance Calculator

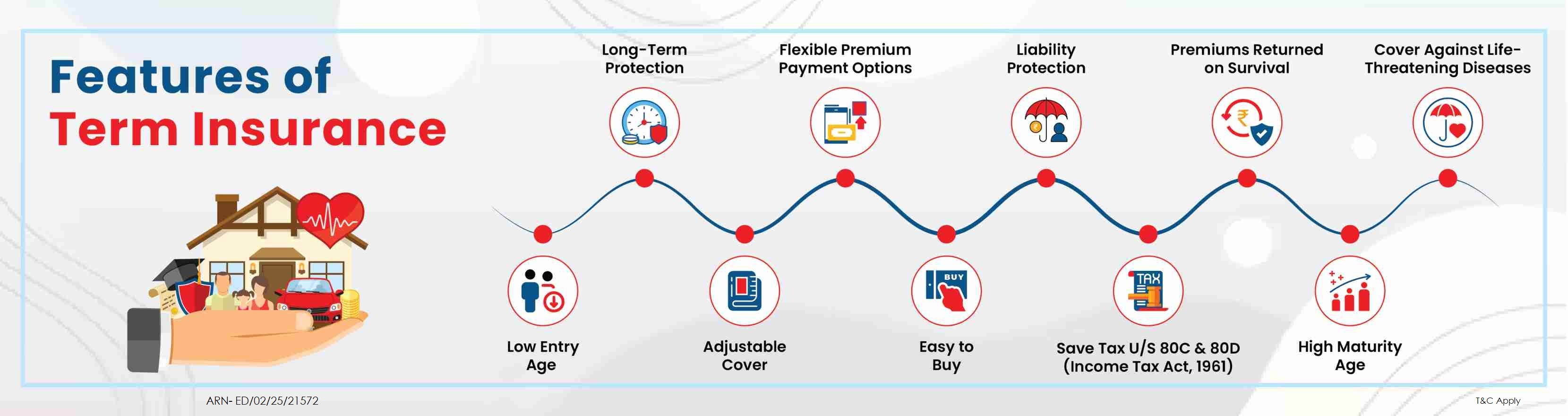

- Features of Term Insurance

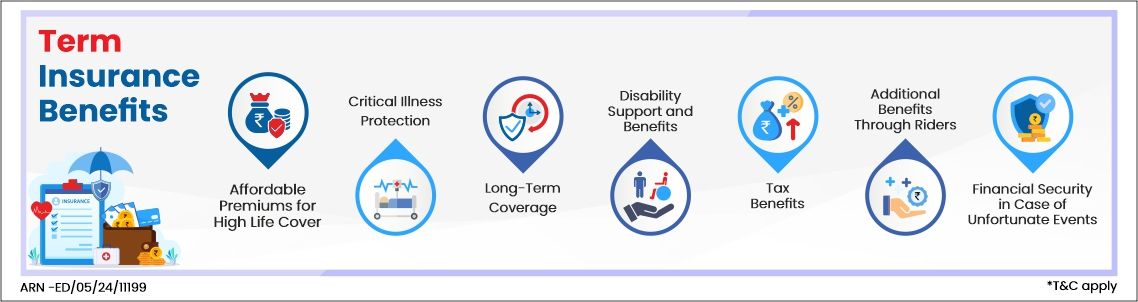

- Term Insurance Benefits

- Experiences of term insurance buyers

- Types of Term Insurance Plans in India 2025

- Top Term Insurance Plans

- Hear from the experts

- What are the best term insurance plans in India 2025?

- Term Life vs. Whole Life Insurance: Key Differences

- Know about Term Insurance Riders

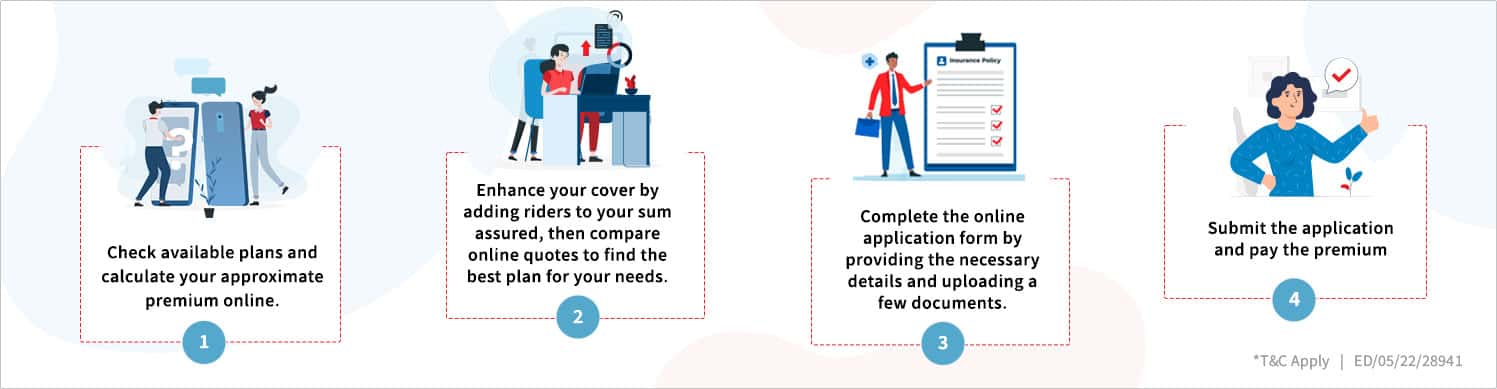

- How to Buy Term Insurance?

- Steps to buy term insurance

- Term Life Insurance Period

- How Much Term Insurance Cover Do You Need?

- How to choose the right duration for your term insurance?

- How to select the Best Term Insurance Plan?

- Importance of sum assured

- How Much Term Insurance Cover Do You Need?

- How long should your Term Life Insurance be?

- How to choose the right duration for your term insurance?

- How to select the Best Term Insurance Plan in India?

- Best Term Insurance Plans in India by HDFC Life

- Choose best term insurance plan

- Which Factors Affect Term Insurance Premiums?

- What is a Term Insurance Rider?

- Why critical illness rider along with term insurance is a necessity?

- 5 Benefits of Adding Riders to Term Insurance Plans

- How to Buy Term Life Insurance?

- Term Insurance Buying Guide

- Common mistakes to avoid while buying Term Insurance

- How term plan secures family future?

- Why Buying Term Insurance

- Why choose HDFC Life Term life insurance plan?

- What is not covered in a Term Insurance?

- Claim Settlement Process

- Documents required to process a term insurance claim

- How Long Does It Take for the Claim Approval?

- How to Avoid Claim Rejection?

- Consistently High Claim Settlement Ratio of HDFC Life Insurance

- Documents Required to File a Death Claim?

- Some Common Queries on Term Insurance Answered

- Eligibility Criteria for Term Insurance

- Documents & Eligibility

- Terms Related To Term Insurance

- FAQs on Term Insurance

- Term Insurance Related Articles

- Key Takeaways

- Customer Reviews

- Talk to an Advisor

- Share your Valuable Feedback

- Submit your Feedback

- Popular Searches

- Disclaimers

What is Term Insurance?

Term Insurance is one of the most basic forms of life insurance that only offers financial cover for a specific number of years. A term insurance plan provides a financial benefit to your nominee in case of your death during the term of the policy.

A term insurance policy is a pure life insurance product that offers financial benefits only in case of the policyholder's death during the term, in return for the premiums paid. It does not return any financial value in case you survive the term of the policy. If you wish to get your premiums back after the term of the policy you can opt for term insurance with return of premium.

You can buy term insurance by paying regular premiums, in exchange for a financial benefit that goes to your nominee in case of your untimely death.

For example, a healthy 25-year-old non-smoker male would have to pay Rs. 780 per month over 30 years for 1 crore term insurance.

...Read More

How does a Term Insurance Work?

Term insurance provides financial protection for a specific duration only if premiums are paid at regular intervals. If the policyholder dies, during the policy tenure the beneficiary receives the life cover amount as the payout. To enhance your family’s financial protection, you can choose to purchase riders or add-ons. Here are 6 stages to explain how a term insurance works:

Agreement

Term insurance is a contract between you and an insurance company. The policyholder pays a premium to obtain life coverage for themselves or a family member. The person covered by the policy is called the life assured.

Understanding Your and Your Family’s Needs

In order to choose the best term insurance plan, one needs to assess their and their family’s financial needs. Once you have properly assessed the financial needs, you will be able to decide on the life cover amount, policy term, premium payment frequency, riders, and more. You can make the correct choice out of several types of term insurance available to meet your needs for financial protection.

Filling out the Proposal Form

When buying a term life insurance plan online, a crucial step is to complete the proposal form. This form requires details such as your date of birth, gender, lifestyle habits, income, education, and medical history. It is essential to provide honest and accurate information, as these details determine your eligibility for the term life insurance plan.

Assigning A Nominee

In case of a term insurance plan, it is vital that the policyholder selects a nominee who will receive the sum assured payout if the policyholder is no more.

Calculating Term Insurance Premium

With the help of a simple term insurance premium calculator, you can calculate the premium for your desired sum assured.

Making Premium Payment

After assessing the information you have provided in the proposal form, the insurance company sets your premium rate. You will then need to pay the required premium in a payment mode of your choice.

Why Do I Need Term Insurance?

There are several term insurance benefits that cater to your specific financial protection needs. Here are few of it’s benefits:

To Protect Your Family

As the main provider for your family, it's crucial to protect your spouse, parents, and children. Term insurance plan is a simple way to ensure their financial security if something happens to you. It helps cover their basic needs and gives you peace of mind knowing they'll be taken care of, even if you're not there. Don't wait, take this step to safeguard your family's future today.

To Protect Your Assets

If you have loans for assets like a home or car, term insurance can help protect your family from the burden of these debts after you're gone. This financial support ensures they can keep the assets you worked hard for, without the stress of outstanding payments.

To Cope with New Lifestyle Risks

When a family loses their main earner, it can be very challenging to manage finance. Term insurance provides essential financial support to help your family during this tough time. It ensures that your loved ones can maintain their standard of living and manage daily expenses without the added stress of financial worries. This support is crucial for helping them adjust and move forward without you.

Low Premium and Attractively Large Cover

Term insurance policy is an affordable way to safeguard your family's finances. With low premiums, you can get ample coverage, ensuring your loved ones are financially secure. It's a smart choice that provides peace of mind, knowing you've protected your family without breaking the bank. Choose the best term insurance plan in India today for a worry-free future for your loved ones.

To Be Prepared for Uncertainty

A term life insurance plan’s primary objective is to financially prepare your family for uncertain times. In case of a misfortune with you, the sum assured from the term plan will help your loved ones financially cope from the situation. You can opt for the best term insurance plan for 1 crore to be prepared for any financial uncertainty.

Uncertainty arising due to lifestyle diseases

Lifestyle diseases have been one of the leading causes of deaths in India. Deaths due to heart attacks have increased by 12.5% in 2022 when compared to 2021 (source: National Crime Records Bureau). Although we can take necessary steps to maintain a healthy lifestyle but it is recommended to secure your family’s financial future in case of your demise due to a lifestyle disease.

Who Should Buy Term Insurance?

Term Insurance for Parents

Parents play a crucial role in providing financial support for their children, ensuring they have the resources they need to thrive. From covering school fees and living expenses to saving for hefty university fees, parents are often the primary source of financial assistance throughout their children's lives.

Protect your children's future with our term insurance plan, ensuring financial support for expenses in any parental mishap. With term insurance for parents, rest assured, your children's dreams are secure.

...Read More

Term Insurance for Young Professionals

As young professionals you have limited financial liabilities. If you invest in a term plan now, your premiums will be low and becomes more affordable with every increase in salary, offering the much-needed financial security for loved ones.

...Read More

Term Insurance for Newly Married

Forget short-lived gifts like jewellery or dinner dates; give your spouse the security of term insurance. Unlike roses or chocolates, it's a gift that ensures lasting protection and peace of mind. Term insurance isn't just about temporary happiness; it's about securing your spouse's future. Choose a gift that lasts beyond the moment and invest in their long-term well-being with a term life insurance plan. To find the best fit for your needs, it's advisable to compare HDFC Life Term Insurance Plans.

...Read More

Term Insurance for Women

Today, women are equal partners in managing finances and supporting their families. Term plan is a vital tool to ensure your family's financial security if something happens to you. It guarantees they can maintain their lifestyle and fulfill their goals. It also helps settle any outstanding debts like home or auto loans. Plus, with critical illness riders, you're covered if diagnosed with serious illnesses like breast or cervical cancer. Term insurance for women is tailored to provide reassurance, ensuring your loved ones are safeguarded.

...Read More

Term Insurance for Tax Payers

Term insurance policies come with tax benefits that help you lower your taxes. The money you pay for term insurance can be deducted from your taxable income i.e. deductions under 80C of the Income Tax Act.

...Read More

Term Insurance for Senior Citizens

Having a term insurance plan in your golden years provides financial security to your spouse. In case of your death, the payout from the term insurance for senior citizen will allow them to maintain their standard of living and cover medical costs.

...Read More

Term Insurance for Housewife

Term insurance for housewife is important as it provides her family with financial security in case of her untimely death. A term insurance payout helps cover the costs of running the household, including childcare and other expenses.

...Read More

Term Insurance for Self Employed

Term insurance for self employed lends financial security to the families of the self-employed in case of their death. The policy payout may cover the cost of immediate business overheads as well as everyday household expenses till someone else can take charge.

...Read More

Term Insurance for NRI

NRIs living abroad can take a term insurance plan benefiting their family back in India with financial security in case of their death. The maturity amount of the term insurance for NRI can help offer respite from the high cost of medical care, or the travel expenses etc.

...Read More

Term Insurance for Home buyers

Buying a home is a very important step in your life as it involves a considerable financial outlay. Most of us end up opting for a home loan to purchase our dream home. Unfortunately in case of the primary breadwinner's death the burden of paying home loan EMI is with their family. To avoid any financial burden due to liabilities it is recommended to get a term insurance as the life cover amount will facilitate the payment of the EMIs.

...Read More

Term insurance for diabetics

Having diabetes can make your life difficult. Having diabetes increase your risk of other critical illnesses. Thus, to provide financial protection for your family it is recommended that you take a term life insurance.

...Read More

Term insurance for equity investors

As an equity investor the primary objective for you is to drive growth in your investment. Investing in equity can be risky and since the individual investing in equities tend to have higher appetite for risk. Thus it’s important to cover the risk in your investments by taking a term insurance so that in case of your death the life cover of the term plan helps you protect the financial future of your family.

...Read More

Term Insurance for Retirees

Retirement from service does not stop you from planning for your family's financial security. Apart from your spouse, you may have elderly parents and even children who are financially dependent on you. Even at this stage, It is imperative to have term insurance to ensure that not a single member of your family is economically stressed once you are gone. With a lot of advantages like affordable premiums, limited pay terms, seamless claim settlement, etc., retirees should invest in a term plan to protect their families monetarily.

...Read More

Term Insurance Plan for Freelancers

A freelancer does not have the advantage of employee benefits like employer’s health insurance, employee provident fund, etc. Being employers themselves, they should exercise more care to financially secure their family in case of an eventuality. Investing in a term plan provides advantages such as whole-life cover for a single premium, tax benefits, add-ons like critical illness riders, terminal illness riders, accidental death benefit riders, etc. In a nutshell, freelancers should have a term plan to keep their family economically sound even in their absence and provide financial security in case they are diagnosed with a terminal or critical illness and additional payout to their family if they die in an accident.

...Read More

Why Does Term Insurance Premium Increase with Age?

Age is an important factor that impacts term insurance premiums. Premiums of term plan increase with increase in age. This makes it expensive for older people to start a new term insurance plan.

The reason behind life insurance companies considering age as a prime factor for determining premiums is simple. At a young age, there is less risk of falling ill because of lifestyle diseases that usually occur during the later years of a person’s life. Thus it is recommended that you get a term insurance plan as earlier as possible to avoid high premiums.

When Should I Buy a Term Insurance Plan?

Starting a term insurance early can save you a lot of money. Since the term insurance premium increases with age, signing up now helps you lock in a lower rate. This is even more advantageous for non-smokers. Get ahead of the curve and ensure financial protection for your loved ones while keeping costs manageable. Don’t wait—take a look at the table below to see how premiums rise over time and make the wise choice to start your term insurance today!

Age |

Base Policy Premium (Life Cover ₹ 1 Crore) |

With Critical Illness Cover (₹ 10 Lakh) |

With Accidental Death Cover (₹ 25 Lakh) |

20 years |

Rs.772 |

Rs.875 |

Rs.895 |

30 years |

Rs.992 |

Rs.1333 |

Rs.1115 |

40 years |

Rs.1951 |

Rs.2890 |

Rs.2074 |

50 years |

Rs.4288 |

Rs.7416 |

Rs.4411 |

Disclaimer – Read More...

What are the 5 important stages in life to buy a Term life insurance?

01 Staring to earn

We you start earning a steady income in form of your salary or from your business it is essential that you get a term life insurance and take the first step towards financial protection for your loved ones. Starting as early as possible also gives you the advantage of lower premiums at a younger age.

02 Starting family

When you get married and start a family, financial responsibilities might increase if you are the sole earner for yourself and your spouse. In case of your untimely death, your spouse might have to undergo financial distress if not protected with a term plan.

03 Becoming Parent

Becoming a parent is a life changing event in most of our lives. Along the joy it also brings responsibilities towards your child. Your little one will be financially dependent on you and thus it is imperative that you protect your child’s financial future with a term insurance policy in case of an unfortunate event.

04 Taking loan/debt

Opting for liabilities such as home loans can bring financial distress on your loved ones in case of your death and they are not financially capable to pay the installments for the home loan. The life cover of the term life insurance plan will help your family pay off the debt in your absence.

05 Moving to a new country

Life as we all know can be really challenging and unpredictable when you move to a new country. To financially secure our loved ones with us in a foreign country and the ones in India it is a necessity to let a term insurance. Life insurers in India provide term insurance for NRIs.

Why Buy Term Life Insurance Online?

Here are some benefits of purchasing an online Term Insurance Plan:

High Protection at Low Premiums

Term insurance is easy to buy and offers significant coverage at low premiums. Buying early means even lower costs. It's accessible online or through other channels. It offers peace of mind while keeping your budget in check. As per your financial needs you can opt for 2 crore term insurance to secure your family’s future.

Add Ons

Term insurance plans often include riders and add-ons to enhance coverage. Some of these add-ons are critical illness riders and accidental disability riders, providing additional protection and financial security in unexpected situations.

Financial Security

Term insurance plan is one of the purest types of life insurance designed to provide quick financial assistance to your loved ones when you're no longer around. It provides a lump sum of money to your loved ones promptly, helping them manage immediate expenses and maintain stability during difficult times. It's a simple way to ensures your family receives timely support when it matters most.

Convenience

Buying an online term plan is convenient and hassle-free compared to buying offline. With no need for multiple visits, the online term plan process is quick and straightforward, making it easy to get covered without any delays.

Affordability

Online term insurance plans are more cost-effective as they bypass intermediaries, resulting in competitive rates and affordable options for policyholders.

Simplicity

Term insurance buying is a straightforward, quick and user-friendly process. Simply go to the insurer's website, fill in your details, choose a suitable term insurance plan, pay, and activate the policy.

Extensive Features

Online term insurance plans offer various features, including death benefits, maturity benefits, tax advantages, and flexible premium payment options. These features ensure extensive coverage, providing financial security and peace of mind for policyholders. An insurance advisor can help you understand these features in detail and guide you in selecting the most suitable plan based on your needs and financial goals.

Multiple Premium Payment Modes

Buying a term insurance policy online gives you the convenience of choosing from multiple premium payment modes like monthly, quarterly, half-yearly, yearly or all at once.

Comparison

Before finalising a policy, devote enough time to research and find a suitable plan that fits your needs. When you choose to purchase a term insurance online, make a comparison of the costs and benefits of various plans. This will enable you to make a quick decision about the plan that suits your needs the best.

Know more about Term Insurance

Here are a few more essential things to know about term insurance policies before you invest in them:

01 How to Choose a Term Insurance Plan?

Follow these steps to purchase the most suitable term plan:

a. Step 1 – Assess the Sum Assured

To understand your sum assured requirement, simply multiply your annual income by 10, and you will get a rough estimate. Do consider your EMIs and other financial liabilities.

b. Step 2 – Factor in Additional Benefits

Understand the following for enhanced protection before purchasing your term plan:

You can select from the critical illness or disability riders.

Choose the payout type - lump sum or monthly installments.

Check maturity benefits if any incase you outlive the term.

c. Step 3 – Pay the Premium

You can finalize the plan by paying the premium. Enter your details and make a secure payment online to purchase the plan.

02 What are the payout options in Term Life Insurance?

Term insurance offers multiple payout options, some of them are as follow:

a. Lump Sum: Here, the entire sum assured is paid as a one-time amount.

b. One-time lump sum payment with fixed monthly payout: A portion of the sum assured is paid one time in lumpsum and the remaining is paid in monthly installments for some years as chosen by the policyholder.

c. One-time lump sum payment with increasing monthly payout: A portion of the sum assured is paid one time in lumpsum and the remaining is paid in monthly installments that keep increasing every year. The term is decided by the policyholder.

03 What are term insurance variants?

Here are the term insurance plan variants you can choose from:

a. Life: provide pure life cover without any rider.

b. Life Plus: Life cover with accelerated death benefit rider

c. Life and Health: Life cover with Critical Illness rider

d. All in-one: Life Cover with accelerated death benefit rider and Critical Illness.

Term Insurance Calculator

Term insurance plans provide financial protection when your loved ones need it most. Use the term insurance calculator to calculate your premiums and get a policy today!

Experiences of term insurance buyers

We spoke to some term insurance plan customers and here is what they had to say13:

Types of Term Insurance Plan in India 2025

There are several types of term insurance plan available to cater to particular needs for financial protection:

Level Premium Term Insurance Plan

In this term insurance plan the basic sum assured or life cover remains same for the entire tenure of the policy against a fixed monthly or annual premium.

...Read More

Year Renewable Term Insurance

This term life insurance needs to be renewed every year and the premium increase every year since your age increase too.

...Read More

Decreasing Death Benefit Term Insurance Plan

The death benefit of this term insurance plan decreases as per a fixed schedule. This term insurance is opt along with a home loan. As the principal amount of the loan decrease with time the life cover of the term life insurance also decreases.

...Read More

Increasing Death Benefit Term Insurance Plan

The death benefit in this term life insurance increases every year for the entire tenure of the policy on account of increasing inflation.

...Read More

Convertible Term Insurance Plan

This type of term insurance plan gives you the option to convert your term life insurance into a permanent insurance during the conversion period. The duration of the conversion period depends of the length of your term insurance plan.

...Read More

Joint Life Term Insurance

As the name suggests, joint life-term insurance covers you and your spouse under a single plan. You, as the primary life assured, and your spouse, as the secondary life assured, both can experience a shared or separate coverage amount.

...Read More

Our Top Term Insurance Plans

Here are some of the best term insurance plans by HDFC Life:

Hear from the expert on Term Life Insurance

What are the best term insurance plans in India 2025?

Indentifying the best term insurance in India out of the various options available can be a challenging task. The easiest way to identify the best term insurance in India is to check for the claim settlement ratio of the insurer, brand trust of the insurer, affordability of the term insurance and ease of claim settlement process. Here are some options for one of the best term insurance plans in India:

Term Plan |

Benefits |

1. Term Insurance |

This policy offers financial security and protection to your dependents and beneficiaries at affordable premium rates, ensuring they’re supported if something happens to you. |

2. Term Insurance with Critical Illness rider |

This policy ensures your family’s financial security if you pass away unexpectedly. The lump sum payout can help cover your family’s financial needs and goals. Additionally, you can add a Critical Illness rider for extra protection against a range of serious illnesses, depending on the plan you select. |

This type of term insurance offers financial security to dependents at a low premium if the policyholder dies. If the policyholder outlives the policy term, all premiums paid are returned. |

|

4. Term Insurance with Waiver of Premium Waiver |

Under this plan, all future premiums are waivered in case there is a covered dismemberment or a critical illness diagnosis. Such a plan eases the stress of financial security in the face of unexpected situations and health concerns. |

5. Term Insurance with Accidental Disability & Death Cover |

In case you avail additional financial protection in form of accidental disability and death cover along with your base term life insurance, your nominee will receive the additional cover in case of your death due to accident |

6. Term Insurance with Monthly Income |

This insurance plan features payout in the form of monthly income to help ensure a regular inflow of money besides the lump sum received as a death benefit. |

This is an insurance plan offered by employers to their employees to lend financial security to their families. It is an affordable insurance cover for death or disability caused by illness or accident. |

|

8. Increasing sum assured plan |

In this plan, the sum assured increases by a certain percentage, typically capped to a multiple of the original sum assured. The premiums are higher than a level plan as the benefit amount increases with each passing year. |

9. Whole life insurance |

It is a type of term insurance that does not have a definite policy term and the policy terminates on death of the life assured or provides coverage at least up to attainment of age 80 years if all premiums are paid as per the premium paying term. |

How is term life insurance different from whole life insurance?

Let's understand term vs whole life insurance:

Term Life Insurance |

Whole Life Insurance |

When you think of the period of term life insurance, it is intended to protect the insured for a certain period, usually between 5 and 30 years. For instance, a 5-year term life insurance means the policy guarantees coverage for precisely 5 years. As long as the tenure of the policy continues and you pay your premiums on time, you stay covered. |

Whole life insurance is a kind of permanent life insurance, denoting that if the premiums are continuously paid, it is intended to last the insured person till the age of 99/100 years. |

As you think of what is covered in term life insurance, it provides pure life insurance coverage, meaning that it only pays a death benefit if the insured dies during the term of the policy. The primary rule of term life insurance is that it is intended to provide financial protection during a specific period. |

Whole life insurance provides financial coverage just like a pure term insurance but the coverage is extended till the age of 99/100 years of the insured. |

Term life insurance premiums are often less expensive than whole life insurance. This is because term insurance is for a specific period. Term life insurance is an appealing choice for young families or people looking for economical coverage due to its cost-effectiveness. Generally speaking, premiums are fixed during the term, which means they don't change throughout the policy's 10, 20, or 30-year lifespan. |

Whole life insurance premiums might prove to be higher than pure term life insurance since it provides extended coverage till 99/100 years. Thus, a longer policy term leads to higher premiums for whole life insurance. To get a better understanding of how these premiums compare, you can use a life insurance calculator to estimate the costs based on your age, health, and coverage needs. |

In case of a basic term life insurance plan you don’t get any money back on surviving the term of the policy. Only under the circumstance when you have taken a term return of premium rider along with your primary policy you are eligible for getting back your premiums except taxes and levies. |

Whole life insurance usual has very long policy terms extending to 99/100 years of age. In case the insured is still alive beyond the age of 99/100 years they aren’t eligible for any money back. |

Term life insurance is typically not permanent, and not convertible to whole life insurance by default. However, certain term life insurance plans provide a conversion option. |

Since a whole life insurance currently offers life coverage till the age of 99/100 years it does not need to be converted to term life insurance. |

A term life insurance expires once the policy term is over or the policy lapses due to non-payment of premiums. There is no financial cover once a term life insurance expires. This kind of life insurance provides financial cover in case of demise of the insured and provides no financial return if the insured survives the term of the policy. |

Similar to a term life insurance a whole life insurance expires when either the insured lives beyond 99/100 years or hasn’t paid the due premiums. Post expiration a whole life insurance behaves similar to a term life insurance. |

Why Sum Assured is an Important Factor When it Comes to Term Insurance?

Choosing the right sum assured in your term insurance plans is essential for your family's financial security. This sum provides crucial protection in case of unexpected events, giving you peace of mind. A higher sum ensures your loved ones are well-supported, covering debts, education costs, and income replacement. Selecting the right amount is key to ensuring their future is secure. To explore the best term life insurance options and find the ideal sum assured for your needs, click the tabs below.

How Much Term Insurance Cover Do You Need?

In case you have a young family or have parents who are financially dependent it becomes essentially to secure their financial future in case of an uncertainty. To ensure that all their financial needs are taken care of you need to get term insurance with an adequate amount of sum assured. There are some basic rules that people follow to decide on the life cover they would need:

01 Expense Replacement

In this approach you are recommended to add up all your current daily expenses and future expenses of yourself and your family. Once you have calculated the expenditure amount deduct the present value of your saving, investments and any life cover you have. The final value gives an estimation of the amount of life cover you need from your term insurance.

02 Income Replacement

When any family loses its primary breadwinner, a considerable financial gap is left behind and this financial deficit creates a lot of problems for the family. In this approach the idea is to replace the lost income due to the death of the primary breadwinner with the life cover of the term life insurance.

03 10-15X your annual income

One of the simplest ways to determine the adequate sum assured is to multiply your annual income by 10-15. This is a very simple and widely accepted approach to decide on the sum assured of a term life insurance plan.

04 D.I.M.E formula

There is a unique approach based on the 4 fundamental financial needs to calculate the sum assured for your term insurance known as D.I.M.E (Debt, Income, Mortgage and Education).

In this approach you are required to add up your debt, mortgage and college expenses, and your salary for the number of years your family needs financial protection and that’s the life cover you will need. Let’s understand with the help of an example, suppose someone has debt of Rs. 5 lacs, home loan of Rs. 50 lacs estimated education expenses of his children is Rs. 30 lacs and his salary is Rs. 10 lacs per annum. He has assessed and decided that his family needs financial cover till the time his children get a job and that will take another 10 years.

For the above scenario the estimated life cover needed as per the D.I.M.E approach is 5+50+30+ (10X10) = Rs. 1.85 Cr

05 Human Live Value (HLV)

Another popular approach is the HLV philosophy. To calculate your HLV you need simply to multiply a variable to your annual income depending on factors such as current income, working years, age etc. The HLV calculator comes in handy to calculate your HLV and take a decision accordingly. Steps involved in calculating your HLV –

Step 1: Input your current age and desired retirement age

Step 2: Input your annual income

Step 3: Input your monthly expenses

Step 4: Input your existing life insurance

Step 5: Input your liabilities

If the calculation of HLV seems complicated, then you can use the following thumb rule:

Age (in Years) |

Approximate Human Life |

20-30 |

25 times of your annual income |

30-40 |

20 times of your annual income |

40-50 |

15 times of your annual income |

50-60 |

10 times of your annual income |

How long should your Term Life Insurance be?

One of the most important decisions when buying online term insurance is choosing the policy term. Several factors can help you determine the ideal policy term, such as your retirement age, the time needed to pay off liabilities, the age by which you expect to have no financial dependents, or opting for coverage until the age of 99 or 100.

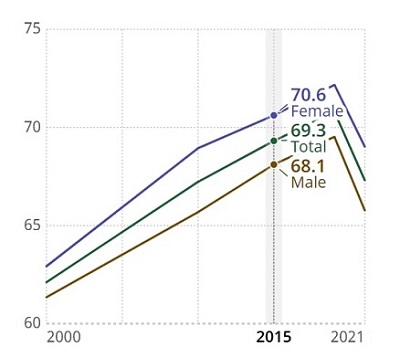

Another aspect that you can consider while deciding on the policy term for your term life insurance is the life expectancy at birth of your country. Life expectancy at birth is basically the average number of years a newborn is expected to live. As per World Health Organization the life expectancy at birth for India stood at 67.3 years in 2021. Refer to the graphical representation of how life expectancy has changed from 2000 to 2021 in India.

Source: World Health Organization;

(https://data.who.int/countries/356)

How to choose the right duration for your term insurance?

In case if you are wondering how long your policy term should be, you can consider the following factors:

Financial independence of your children

Providing for your children financial can be really expensive speacially in the urban world. There are various expenses that your kids incur like education, clothing, food and extra-curriculars. You should consider for how many years are you planning to provide for your kids as the expenses might increase if you are paying for their college.

Time period of your loans and liabilities

Often repayments of our liabilities are a big part of our monthly expenses and thus it becomes imperative that we take a term insurance. Now if you want your term life insurance plan to cover your mortgage, consider the number of years you have left untill you pay off the loans. You would want to avoid the scenario where your term policy expires after 10 years but your liabilities continues for another decade.

Your desired retirement age

Under an ideal scenario you would live off you savings post your retirement. Now if you are getting a term life insurance plan to replace your income, you might not need it post retirement. Once your major expenses like home loan and child’s education are taken care of and you are living your retired life with your savings, you wouldn’t ideally need a term insurance anymore.

Current Age

You should take your current age into considerable while deciding the adequate length of your term insurance policy. Depending on your age and current financial situation you will be able to decide on how long you should take a term plan for.

Financial support for spouse

Financial protection of your spouse is one of the key responsibilities when your spouse is financially dependent on you. In case of your death the policy tenure along with the life cover of your term insurance plan should be adequate enough to ensure your spouse’s financial security.

Extent of financial dependency

In case if you have financial dependents like your parents, siblings, spouse and children it comes essential that your term life insurance tenure is adequate enough to ensure their financial protection in case of your death.

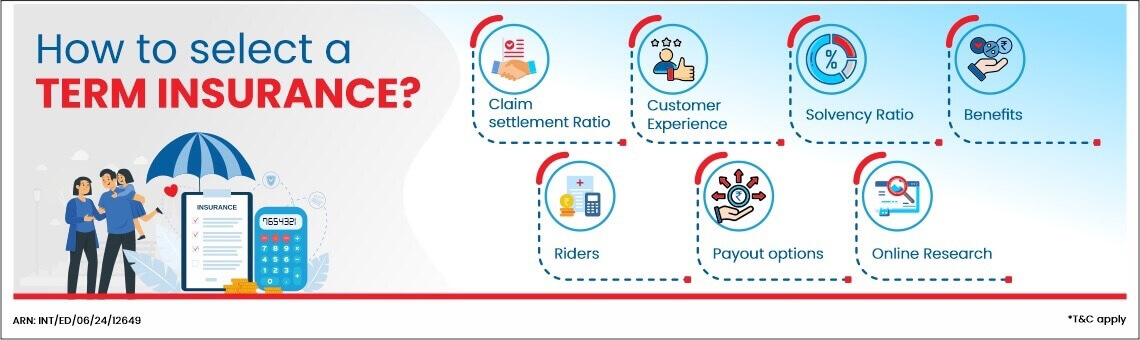

How to select the Best Term Insurance Plan in India?

To ensure you choose the best term insurance in India, you should:

Evaluate your and your family’s financial needs

While selecting a term insurance plan it is essential that you map the benefits of the plan to the financial needs of your family in your absence. The term plan should be able to help your family maintain a health standard of living, cover all liabilities and future expenses.

Look at the Claim-Settlement Ratio

An insurance company’s Individual Death Claim Settlement Ratio tells you how likely they are to settle your nominee’s claim. You can check a company’s Individual Death Claim Settlement Ratio online. HDFC Life has a Individual Death Claim Settlement Ratio (CSR) of 99.50%##

Understand the Customer Experience

Ask people you trust about their experience with the insurance company you prefer. You can also check online reviews from customers to understand whether individuals enjoy a pleasant experience with the company or not. Remember, your term plan could continue for the rest of your life, so you need to build a lasting relationship with the company.

Check the Solvency Ratio

The solvency ratio refers to a company’s ability to financially fulfill the insurance obligations. The IRDAI mandates that all insurance companies should have a ratio of at least 1.5. You can check the solvency ratio of companies online.

Consider the Benefits

Not all term insurance plans are equal. You should look for policies that offer higher benefits than others. Try and find policies that offer maturity benefits as well as flexible payment and payout options.

Choose Riders

Term plans offer more than just life cover. You can opt for riders that provide coverage for critical illnesses and accidental disability as well. The payouts from these add-ons can go a long way in offering financial stability to you and your loved ones at a difficult time.

Find Flexible Payout Options

When you purchase a term plan, you often have specific financial goals in mind. Most term insurance plans offer lump-sum payouts to nominees. Often, these individuals get overwhelmed by the large sum and do not know how to manage it. You should consider policies that offer monthly payouts instead. Your nominee will be better equipped to deal with smaller amounts every month that can help them with immediate financial needs.

Research Online Availability

Before you make a decision, you must check whether your insurer is available to you online and offline. Most companies today have 24x7 chat features on their website so you can get quick answers to your queries. You should also look for companies that offer online filing of claims for quick processing.

Best Term Insurance Plans in India by HDFC Life

Here are the best term insurance plans offered by HDFC Life:

HDFC Life Term Plans |

Features |

Customer profile |

Policy term (in years) |

Premium paying term (in years) |

Death benefit (in Rs.) |

Monthly premium amount (in Rs.)9 |

HDFC Life Click 2 Protect Super (Life option) 10 (UIN:101N145V07) |

Term plan with a bouquet of benefits like - Increasing/decreasing life cover, Smart Exit, Spouse cover, Parents secure option. |

25 years, Male |

20 |

20 |

1 crore |

Rs.7438 |

HDFC Life Click 2 Protect Elite Plus11 (UIN:101N182V01) |

A pure term life insurance created specifically for the Salaried segment |

25 years, Male |

20 |

15 |

2 crore |

Rs.11538 |

HDFC Life Sanchay Legacy (Life option)12 |

Unique term plan catering to the maturing HNI segment with additional process simplification |

40 years, Male (Minimum age is 40 years) |

Whole life |

10 |

1.2 crore |

Rs.1,00,0008 |

Choose the best term insurance plan as per your needs

Below are the important factors of choosing the best term insurance plan in India for your family’s financial security.

Term Insurance Plan as Per Policy Term

One of the important factors while buying a term insurance is to decide on the correct term of your policy. Below are some of the commonly availed policy terms that you can explore in details –

...Read More

Term Insurance Plan as per your Age

Age is an essential factor that is taken into consideration while calculating your term insurance premium. Also, depending on age your life cover amount might change basis your financial needs. The more your age the will be your term insurance premiums. You can explore term insurance plans basis your age in details -

...Read More

Term Insurance Plan basis your Salary

Your income or salary is an important factor to decide the amount of sum assured you would need in case of a term insurance. Here are few term insurance plans which you can explore basis on salaries -

...Read More

Term Insurance Plan for All

Term insurance needs might vary based on your residential status, family and age. You can explore the below term insurance options to identify the best term insurance plan in India that answers your needs –

...Read More

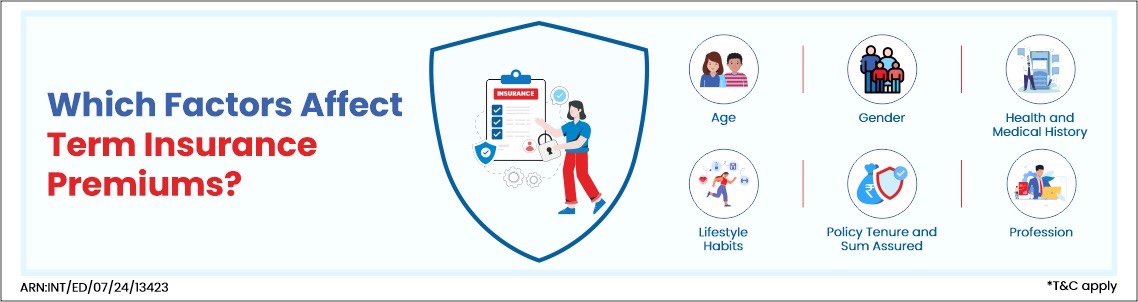

Which Factors Affect Term Insurance Premiums?

Your term insurance premium depends on several factors, including:

Age

In term insurance plans, younger and healthier individuals usually pay lower premiums because they’re considered lower risk. On the other hand, older individuals often face higher premiums due to potential health concerns.

Gender

Research indicates that women tend to live longer than men on average. As a result, insurance companies often offer women more favorable premium rates in term plans, since they’re likely to be insured for a longer period. It’s a way to reflect the longer life expectancy!

Health and Medical History

When you buy a term plan, you’ll need to share some details about your health and your family's medical history. Certain conditions, like heart disease or kidney issues, can run in families. If you or your family have a history of these health problems, it might affect your premium, potentially increasing it. But don’t worry—being open about your health can help you find the right coverage for your needs!

Lifestyle Habits

If you enjoy adventure sports, drink alcohol regularly, or smoke, you might be considered a higher risk for insurance companies. This can lead to a higher premium on your coverage. It's important to be honest about these habits when applying for term insurance. Being transparent helps ensure that your nominee won’t face issues when making a claim later on. It’s all about protecting your loved ones!

Profession

Certain individuals have jobs that place them in risky situations every day. People like sailors and pilots or those who work with hazardous materials may have to pay higher premiums for their term insurance plan than their friends with less dangerous jobs.

Rider Benefits

The type of benefits you are opting for through a rider along with your term life insurance impacts the final premium amount you need to pay. Rider benefits such as cover against critical illness or accidental death are available at a nominal increase in premium of your base term plan.

Tobacco or alcohol consumption

Consumption of tobacco or alcohol as we all know impacts our health adversely and increases the chances of developing serious illnesses. Due to the increased risk of diseases that you might incur because of consumption of tobacco or alcohol, your premiums will be higher than usual for a term insurance plan.

Life cover or Sum assured

The life cover or sum assured amount you choose in your term insurance plays a crucial role in determining the term insurance premium. It should be financially adequate to support your loved ones in your absence, as a higher sum assured will lead to a higher premium, keeping all other factors constant.

Policy Term

The tenure of your term insurance plan is also a crucial factor considered while calculating the premium. Of course deciding on the term of the policy should be a personal choice depending on your financial situation. Among term insurance buyers the most commonly opted policy term is till the age of 85 years. Higher the policy term higher will be the premium keeping all other factors constant.

Premium Paying Term

There are several options available to pay your premium for a term insurance plan. You have the option to opt for a one time premium payment, limited term premium payment or a regular term premium payment. Of course the premium amount will be different in the 3 scenarios and should be selected as per your convenience.

What is a Term Insurance Rider?

A term insurance rider is an extra feature you can add to your life insurance policy for added benefits. Here’s how they work:

Accidental Death Rider:

Disability Rider:

Critical Illness Rider:

Premium Waiver Rider:

Provides extra money if you pass away due to an accident.

Offers additional support if you become disabled.

Pays a lump sum if you’re diagnosed with a covered serious illness.

Covers future premiums if you’re diagnosed with a critical illness or face other specified situations.

These riders enhance your coverage and offer extra protection based on your needs.

Our top riders14 with Term Insurance plan

They help you deal with those additional risks life brings.

HDFC Life Income Benefit on Accidental Disability Rider – Non Linked

UIN: 101B041V01

Get additional income benefits over and above your Sum Assured in the event of total permanent disability due to an accident.

HDFC Life Critical Illness Plus Rider

UIN: 101B014V02

We pay a lump sum amount equal to Rider Sum Assured upfront if diagnosed with of any of the specified critical illnesses.

HDFC Life Protect Plus Rider – Non Linked

UIN: 101B040V01

Get protected with a proportion of Rider Sum Assured in case of accidental death or partial/total disability due to accident or diagnosed with Cancer

HDFC Life Health Plus Rider – Non Linked

UIN: 101B031V02

Get lump sum benefit equivalent to Rider Sum Assured on diagnosis of any of the covered 60 Critical Illnesses or benefit as a proportionate of the Rider Sum Assured on diagnosis of Early Stage Cancer / Major Cancer depending on the plan option chosen.

Why critical illness rider along with term insurance is a necessity?

Did you know?

In the period of 2018-2022 heart attack cases saw a jump of 26%.There were 32,457 incidents of heart attacks in India in 2022*.

*As per the annual report of ‘Accidental Deaths and Suicides in India’, the National Crime Records Bureau (NCRB).

...Read More

Did you know?

The estimated number of cancer cases in India saw a rise by 25% from 2013-2022. There were 14.61 lakh cancer cases in India in 2022*. It is projected that the number of cases will increase further to 15.7 lakh by 2025*.

*Cancer incidence estimates for 2022 & projection for 2025: Result from National Cancer Registry Programme, India December 2022 by The Indian Journal of Medical Research 156(4)

...Read More

5 Benefits of Adding Riders to Term Insurance Plans

Adding riders to the term insurance plans help you get extensive financial protection. Here are few benefits of adding rider to your term life insurance:

Enhanced Financial Cover

Add-on provides you with extensive financial protection against an array of risks. You can opt for additional cover to include the risks like critical illness, accidental death, permanent disability and others.

...Read More

Customization

Basis your financial protection needs you can select the suitable riders that fulfill your requirements. For example if you drive your vehicle on a frequent basis then you can consider option for an accidental death benefit rider or suppose you have a possibility of getting any hereditary critical illness you can choose to opt for a critical illness rider.

...Read More

Affordable

One advantage of riders is that you can get an adequate additional cover for either critical illness or accidental death at a very nominal premium along with your base term insurance, making the combination of a term life insurance and a rider affordable.

...Read More

Additional tax benefit

The premiums that you pay for the rider is exempted from your income tax under section 80D~. Thus buying a rider along with term insurance plans help you save tax under 80D and 80C~.

...Read More

Peace of Mind

Life is uncertain and these uncertain can impact your financials in various way. Opting for a rider ensures that you get financial cover against unfortunate situations like a critical illness, death due to accident, permanent disability etc.

...Read More

Extra Protection with | Term Insurance Riders

Discover the power of Extra Protection with HDFC Life Riders

How to Buy Term Life Insurance?

Purchasing a term life insurance plan is a quick and easy process. Let’s see how you can get the cover you need:

Estimate Your Sum Assured

Think about your current financial situation. Do you have any debts or family members who depend on you? If something were to happen to you in the next 20 or 30 years, how much would they need to maintain their lifestyle? Decide how much insurance you need to support your loved ones and look for term insurance plans that provide that coverage.

Enhance Your Cover

If you want to increase your coverage, consider adding riders to your policy. Once you have a clear idea of what you need, you can easily get online quotes and compare different plans.

Fill Up the Application Form

Select the term insurance plan you want to purchase and fill up the online application form. You have to provide details about your age, medical history and lifestyle habits. You have to upload a few documents for verification. After that, our team will schedule a medical test for term insurance.

Pay the Premium and Rest Easy

Submit the application and pay the premium amount to enjoy life cover and peace of mind.

Term Insurance Buying Guide

Here is a detailed guide that you can follow while buying your term insurance plan:

Always compare

Different people and households that have different financial needs and goals. Therefore, it is important to compare the options available when looking for a term insurance plan. This will help you find the plan that offers the best financial security for your family, keeping future needs, health conditions, medical requirements, debts, loans, liabilities, and more in mind. And it is also important to know the difference between a term insurance plan vs. life insurance plan to help you make the best choice.

Check the Claims Settlement Ratio

Every life insurance provider maintains a claims-paid ratio or the claim settlement record. It is a critical piece of information for a customer who can assess the company’s claim clearance track record before making a final decision. It indicates how easily your dependents will get the claim benefit as per the plan you choose. HDFC Life has an Individual Death Claim Settlement Ratio (CSR) of 99.50%##.

Check the Persistency Ratio

Read up online about how other customers feel about the company and your selected product. Other’s experiences and complaints, if any, provide insight into whether the plan and the company’s customer service, policy and experience. The annual persistency ratio is a good indicator of the insurer’s service capabilities.

Check the Solvency Ratio

The solvency ratio of an insurer is a representation of their financial situation in accordance with the solvency norms. It is the size of their capital with respect to the risks taken. By checking this ratio, you know if the company has sufficient funds to settle the claims in the short or long run. Usually a solvency ratio of 150% is acceptable.

Understand the specific benefits of the policy

If you are unclear about the benefits your policy offers, you can make wrong decisions when buying. It can also leave the beneficiaries confused while filing a claim. Make sure that the benefits offered under the policy are a good or close match to your financial requirements. This careful analysis will help you select a policy best suited to you.

Carefully Select the Insurance Riders

As a policyholder, understand that you need cover not only for death but also for critical illness, disability and accident. Incidences of cancer cases are estimated to increase by 12.8 per cent in 2025 as compared to 2020 (source: National Cancer Registry Programme Report 2020). Of course we can ensure to lead a healthy life but the occurrence of such diseases is unpredictable and can severely impact the financial health of your family, it is only wise to add suitable riders to your term plan for enhanced financial backup.

Decide between Lump Sum and Regular Income Payout

Your term insurance plan offers a choice in the payout. You can opt for a total lump sum payout or a combination where a part payment is made in a lump sum, and the remaining goes out as regular monthly income. This helps the beneficiaries meet their immediate needs and sustains them for months. The lump sum can be reinvested for future financial needs.

Check Online Availability

In today’s digital era, it is important to have an insurance provider who is available online and offers faster resolution to queries. Check for online contact options and customer support numbers. You can try reaching out to check how fast your query is resolved and whether the support team is equipped to handle online queries satisfactorily Their responsiveness will matter in the long run.

Common mistakes to avoid while buying Term Insurance

Buying a term insurance is a crucial financial decision and thus we should be aware of some of the common mistakes to avoid while buying a term insurance:

Starting late

A term insurance premium keeps on increasing with your age. Often people make the mistake of delaying the purchase of a term life insurance to their late 30s or early 40s. The premium amount in your late 30s or early 40s can be considerable higher than the premium amounts in your early 20s. It’s recommended that you buy a term plan as soon as you have a steady income to pay the premiums.

Inadequate life cover

People often commit the mistake of taking a life cover that is being sold to them instead of evaluating their financial situation and then taking a decision. There are several ways to conclude on the life cover amount but it is an individualistic decision so it is recommended to access you and your family’s financial needs before taking the decision.

Ignoring riders

Term insurance plans come along with riders that provide a extensive financial cover for a nominal increase in premiums of base plan. There are various riders available to cover against different mishaps. People often end up ignoring riders perhaps due to lack of understanding of their purpose. Riders such and critical illness rider and accidental death benefit riders help you get a well rounded financial protection in case of unfortunate events.

Sharing inaccurate information

While buying a term plan people might end up providing inaccurate of incomplete information in order to save on premiums. It is highly recommended that you provide accurate and complete information to your life insurance provider others wise this might lead to rejection of claim. Insurers have very robust and stringent processes in place to identify inaccurate of incomplete information.

Opting for a short policy term

One common mistake is selecting shorter policy tenure in order to save on premiums. The decision on policy term should be to be taken on the basis of how long you want to financially protect your financial dependents in case you are not there. Suppose for example you believe that all your liabilities will be over, children will be financially independent and your spouse will have adequate savings to survive in case of your demise at a particular age then you should opt the term plan till that particular age.

Not buying term life insurance online

Not buying a term insurance online has few disadvantages such as not able to calculate and compare premiums easily and not gets discounts that some insurers provide to online customers. Buying term life insurance now a day is really convenient.

How Does a Term Plan Secure Your Family’s Future?

A term insurance plan offers death benefits to the beneficiaries for a specific period. Even in your absence, your family gets financial assistance during the policy tenure if you have opted for a term plan.

Let's look into details about how a term plan can assist in securing the future of your family:

...Read More

Education Expenses

If there is a sudden death of a primary breadwinner, meeting educational expenses becomes quite difficult. The costs of tuition are rising, and meeting educational expenses in this scenario can create a massive financial burden for families.

A term plan will let you meet your child's educational expenses without facing any financial constraints. Whether it is the college fees, school fees, or meeting higher education, the payout received from the term plan enables your child to meet these expenses with ease.

Funeral and Final Expenses

Funeral and cremation expenses are unexpectedly high. However, with a term insurance plan, these expenses can be lowered without worrying about the financial burden. The term insurance payout helps to cover medical bills, costs of funerals, and other outstanding debts, allowing your family to remain stress-free.

Business Continuity

If you are the owner of a business, your sudden death can cause your family members to face financial constraints. By opting for a term insurance plan, business continuity can be maintained by providing funds for managing operational costs and paying off bills, thereby facilitating a smooth transfer of your business.

Estate Planning

A term insurance plan plays an important role in estate planning, ensuring your financial assets are transferred to your beneficiaries without financial constraints. This insurance plan also assists in covering estate-related taxes and other costs, thereby eliminating the need for your family to sell off valuable assets to reach their desired financial goals and objectives.

By receiving the lump sum amount, you can manage your expenditure with ease and keep your loved and dear ones stress-free from financial obligations.

Debt Repayment

Nowadays, many people have several loans, such as car loans, personal loans, home loans, and others. These liabilities can become a great burden on families when the borrower is not around. Receiving the death benefits from a term insurance plan can assist your loved ones in settling these loans and prevent them from taking on additional debt burden.

Income Replacement

By losing a family member, it results in a loss of income. The lost income can be replaced through payouts from a term plan. This ensures a decent standard of living for the surviving family members and meets their respective financial goals even when the primary breadwinner is not around.

Death Benefits

The main objective of a term insurance plan is that it provides death benefits to your family members during your sudden demise. With this lump sum amount, your family can cover different financial obligations that include outstanding loans, daily expenses, rent payments, outstanding loans, and educational expenses and meet other financial goals and objectives.

Why buying term insurance is a must for COVID?

- Term insurance plan are the most basic life insurance product available in the market. They provide life cover at affordable premiums. They are ideal for individuals who have certain financial obligations and do not wish to leave their family members with any kind of debt if something were to happen to them. During the COVID-19 pandemic, it became more crucial than ever to buy term insurance.

- Many individuals succumbed to the disease after long stays in the hospital. This left their families with broken hearts and mounting hospital bills that they might not have been able to afford. The payout from a term insurance policy could help these individuals pay off outstanding medical expenses and other debts.

- A term plan can provide your loved ones with financial stability during an incredibly difficult time.

Why choose HDFC Life Term life insurance plan?

Multiple Customisations

Pick from three plan options and riders to customize your cover and receive policy benefits based on your needs.

Accelerated Payout Option

If the policyholder gets diagnosed with a covered terminal illness, they receive the sum assured payout earlier. They can use the money to pay for medical treatments.

Increasing Death Benefit

Choose to increase your sum assured amount, up to 200% of the plan value, under the policy’s Life variant.

Critical Illness Benefit

Enhance your cover with the Critical Illness Plus Rider and receive the sum assured payout upfront after covered critical illness diagnosis.

Accidental Death and Disability Benefits

Receive an additional financial safety net with the HDFC Life Protect Plus rider2 after an accident leaves the insured permanently disabled or becomes fatal.

Maturity Benefits

Receive a maturity benefit equivalent to all premiums paid over the policy tenure when you choose the return of premium plan option and survive the policy term.

Cover for Your Spouse

The policy allows you to get additional coverage for your spouse, ensuring that your children remain financially secure, regardless of what happens.

Smart Cancellation Benefits

If you cancel your policy, you can use the Smart Exit option to receive an amount equivalent to all base premiums paid at the time of cancellation.

Waiver of Premium Benefits

Future premiums of term insurance plans get waived after the diagnosis of a covered critical illness or after total and permanent disability.

High Claim Settlement Ratio

Claim settlement ratio is an important factor to decide on which term insurance plan you should go for. HDFC Life Insurance claim settlement ratio for FY24-25 was 99.50%.

What is not covered in a term insurance?

Under the following scenarios term insurance benefit will not be paid:

Suicide exclusion

In case of death due to suicide within 12 months of the effective date of coverage the nominee will be paid at least 80% of the paid premiums or surrender value, whichever is higher provided the term insurance plan is in force.

...Read More

Misrepresentation of information

If you have concealed or misrepresented any information during the application process, you won’t be eligible for any benefits of the term insurance.

...Read More

Claim Settlement Process

The claim settlement process includes these steps:

Report Claim

Reporting the claim is the first step. You can do it either by visiting the insurance company online through their website or by sending an Email or SMS to the insurance company’s customer care helpline.

...Read More

Process

The insurance company’s claim care team will process the claim and contact you if they need any additional information or documents.

...Read More

Settle

The company settled the claim on receiving all the documents and required information.

...Read More

Documents required to process a term insurance claim

For a claim settlement, presenting the relevant documents is mandatory. Here are the documents a nominee should submit while filing a term insurance claim:

1 For Natural Death

- Original Claim Form

- Original document of policy

- Application from claimant

- Other relevant documents

- Medical report (applicable for cases of death due to illness)

- Summary of discharge from hospital (applicable if death occurs due to illness)

2 For Accidental Death

- Original claim form

- FIR report

- Post Mortem report

- Claim form

- Statement of attending doctor

- Certificate of attendance in medical terms

- Other relevant documents

How Long Does It Take for the Claim Approval?

The actual period it takes to claim term insurance depends on several factors, including the verification of documents submitted and the particular procedures of the concerned insurance provider.

Verification and Investigation

After the successful submission of documents, the insurance company carries out a thorough verification process. This might include an investigation to confirm the authenticity of a claim. This procedure takes around a few days to a few weeks, considering the complexity of the policy chosen.

Claim Processing

Once verification is completed, the insurance company processes the claim. It is mandatory for insurers to settle claims within 15 days from the date of intimation of claim, as mandated by the Insurance Regulatory and Development Authority of India (IRDAI).

However, if there is a need for further investigation, it is the insurer's responsibility to accept or reject the claim within 45 days.

Approval and Payout

Upon successful approval of the claim process, the nominee receives payment following the terms and conditions of the policy. The entire process, from claim intimation to payout, takes around 15 to 45 days.

If there are discrepancies or missing documents, the insurance company might take longer to complete the process. Thus, it is beneficial to stay in touch with the insurance company and provide the information they need immediately.

How to Avoid Claim Rejection?

There are several factors to consider to avoid claim rejection. Knowing these factors beforehand can let you stay prepared before you apply:

Participation in Hazardous Activities

If you are a participant in any high-risk-related activities such as motor racing, skydiving, scuba diving, and others, insurers can then choose to reject your application or charge higher premiums because of the associated risk.

...Read More

Suicide

The majority of the insurance policies have a suicide exclusion clause which states that if the policyholder commits suicide, his/her death benefit claims will be unpaid. This is applicable if the suicide takes place within the first one to two years of purchasing the policy.

...Read More

Self-Caused Injuries

Coverage is often excluded if death is caused due to self-caused injuries. If there is enough evidence that the policyholder has a history of attempted suicide, the insurer can then deny coverage.

...Read More

Criminal Activities

Death caused due to any criminal activities is not usually covered. As a policyholder, if you have a record of criminal activities, insurers can then reject your application because of the high risks involved.

...Read More

Substance Abuse

Consuming drugs, alcohol, or other substances raises your health risk along with the chances of occurrence of premature death. Thus, if you hold a history of substance abuse, insurers can choose to decline your coverage.

...Read More

War and Terrorism

If your profession involves a high risk of war and terrorism, the insurer might deny coverage to avoid large potential claims.

...Read More

Pre-existing Medical Conditions

If you have numerous pre-existing medical conditions such as heart disease, diabetes, or cancer, you are more prone to risk for insurers. In this scenario, insurers might reject your application for a set period or charge a higher premium amount.

...Read More

Involvement in Aviation Activities

If you are engaged in any aviation activity, the risk of accidents automatically increases. Under this scenario, insurers can reject your application or increase your premium amount.

...Read More

Consistently High Claim Settlement Ratio of HDFC Life Insurance

Claim settlement ratio of a term insurance provider is a crucial factor to be considered while buying a term insurance. A consistent claim settlement ratio signifies that the insurer has been doing well when it comes to settling claims. Here’s a glimpse of the claim settlement ratio for HDFC Life in the past 5 years:

Sr. No. |

Annual Year |

Claim Settlement Ratio* |

1 |

2024 |

99.50% |

2 |

2023 |

99.30% |

3 |

2022 |

98.70% |

4 |

2021 |

98% |

5 |

2020 |

99.10% |

*Source: Individual claim settlement ratio as per HDFC Life annual report FY 19-20, FY 20-21, FY 21-22, FY 22-23, and FY 23-24

What our financial advisors had to say about term life insurance?

Financial Consultant Testimonials | HDFC Life

Documents Required to File a Death Claim?

For filing a death claim, presenting relevant documents is crucial. Here is a detailed overview of documents a policyholder must present:

Original Copy of Policy Document:

This is the original document of the term insurance policy one must submit to the insurerDeath Certificate:

An attested and original copy of the policyholder's death certificate issued by the local municipal authorityClaim Form

A claim form with duly filled to be provided to the respective insurance companyDetails of Bank:

For transference of the claim amount, presenting a cancelled cheque and NEFT is mandatoryNominee Identity Proof:

This includes documents such as passport, voter ID, Aadhaar card and PAN cardMedical Records:

If the death of a policyholder occurs because of a medical condition, presenting documents such as proof of treatment, statement provided by a physician, and a burial or funeral certificate is a mustPolice Reports:

This includes presenting documents such as the postmortem report, police investigation report, and a certified copy of the First Information Report (FIR)

Some Common Queries on Term Insurance Answered

01 What is term life insurance?

Term life insurance plan is a type of life insurance plan that provides extensive financial protection to your loved ones in case of your absence. Since this is the purest form of life insurance as it provides only life cover it is available at affordable rates. You can create term insurance quotes to find out the premium for the required sum assured.

Vipul Rana | Visakhapatnam

02 Do we get money back in term insurance?

No, you cannot cash out a term life insurance policy in India. However, there are other options available that may help you save money or provide more security. For instance, you can lower your premium payments by increasing the policy's term length or by changing the frequency of premium payments. You can also convert your term life insurance policy into a permanent policy, such as a whole life insurance policy, which will provide coverage throughout your entire life and may provide cash value or other benefits.

Arush Mehta | Mumbai

03 Can I have 2 term insurance policies?

Yes, you can have 2 term insurance policies. In India, most insurance providers allow customers to buy multiple policies from them. The advantage of having multiple policies is that it allows you to diversify your risk and get multiple benefits. However, it is important to remember that the premiums for multiple policies can add up quickly, so it is important to consider your financial resources and goals before taking on multiple policies. Additionally, you should read the terms and conditions carefully to ensure that the policies meet your needs.

Parijat | Bhubaneswar

04 Does term life insurance cover all deaths?

No, life insurance does not cover all deaths. Life insurance policies typically cover death due to natural causes, such as illness, and accidental death, such as death due to accidents or violence. However, some life insurance policies in India do not cover deaths due to suicide or other self-inflicted injuries. Additionally, some policies may have age restrictions or other exclusions in coverage like death due to risky activities, such as mountaineering, sky diving, or other extreme sports. It is important to read the policy thoroughly and understand the terms and conditions before purchasing a life insurance policy in India.

Rohit Ghosh | Kolkata

05 What are the exclusions in term insurance?

In India, term insurance policies typically exclude death or disability due to pre-existing conditions, suicide, self-inflicted injuries, and any other cause of death determined to be beyond the control of the insurer. Additionally, most policies also exclude any death or disability caused by war, military service, nuclear accidents, or participation in dangerous activities. In addition, if any medical tests are not completed or the policyholder does not disclose important information, the policy may be rendered void.

Krishnendu Kundu | Mumbai

06 Does Term Insurance Cover Accidental Death?

Yes, term insurance does cover accidental death for customers in India. The coverage will depend on the policy you choose. Most policies will provide a lump sum payment in the event of accidental death, which can help to provide financial security for your family. Some policies may also provide additional benefits, such as funeral expenses. It's important to read through the policy carefully and make sure you understand the coverage before signing up.

Rayan | Delhi

07 What is the biggest advantage of term insurance?

The biggest advantage of term insurance for Indian customers is its affordability. Term insurance plans offer customers large coverage at a very low premium. The premiums are fixed for the entire policy term, so customers can easily budget and plan for their long-term financial needs. In addition, term insurance plans offer a tax benefit under Section 80C of the Income Tax Act. This makes term insurance a great way to save money for the future while also providing financial security for the family.

Sweta Jhadav | Vadodara

08 Can a Senior Citizen Get Term Life Insurance Plan?

It’s always recommended to buy a term life insurance plan at a young age to avail lower premiums. A term insurance can ordinarily be availed between the ages of 18-65 years. Now the sum assured will primarily depend on the income and retirement age of senior citizen. The term insurance cover will provide financial protection to the dependents of the senior citizen in case of an unfortunate event.

Ramesh Singh | Gurugram

09 What Happens Once You Make a Claim?

In a claim for term life insurance, following 6 steps are involved:

1. Your nominee should inform your insurance provider through online or offline channels

2. Provide details such as policy number, insured’s name, other required details and cause of death

3. Download the claim request form and necessary documents

4. Submit the filled in claim request form and documents to the your insurance provider

5. The details shared by you will be reviewed by your insurance provider

6. Post verification the insurer processes the claim and transfers the death benefit to your nominee’s account

Eligibility Criteria for Term Insurance

Eligibility Criteria |

Details |

Entry Age |

Click 2 Protect Super term insurance is available at a minimum entry age of 18 years old and maximum entry age of 84 years for Life variant and 65 years for Life Plus and Life Goal variant of the term plan |

Maturity age |

Click 2 Protect Super term insurance is available at a minimum maturity age of 18 years old for Life and Life Plus variant and 23 years for Life Goal variant and maximum maturity age of 85 years for all variants of the term plan |

Policy Term |

Minimum policy term for Life and Life Plus variant is 1 month, 2 years and 3 years for single pay, regular pay and limited pay options respectively. Minimum policy term for Life Goal variant is 5 years and 7 years for single pay and limited pay options respectively. |

Basic Sum Assured |