What do you want to do?

Understand the Benefits of Health Insurance in India

Table of Content

India is witnessing a shift in the health landscape with the rising incidence of lifestyle diseases and increasing healthcare expenses. Health plans and insurance are created to lessen the load on patients from payment-making sure medical care can be availed by larger segments of the general population. Thus, when you think about the benefits of health insurance, the introduction of government initiatives like free medical insurance for citizens aged 70 years and above exemplifies the significance of health coverage in the country.

Why is Health Insurance Necessary?

With health concerns generally rising due to lifestyle choices, stress, and pollution, investing in health insurance is paramount for financial security during medical emergencies. By paying a health insurance premium, you can get access to timely treatment and emergency services. It covers expenses like doctor’s visits, hospitalisation, surgeries, prescription medications, etc., and reduces out-of-pocket expenses.

Besides this, it also provides for regular health check-ups. Early diagnosis of health issues enables immediate treatment and reduces long-term healthcare expenses. Without health insurance, you may tend to postpone treatments, resulting in worsened health conditions and financial strain. In brief, considering the benefits of health insurance, it is only wise to invest in one.

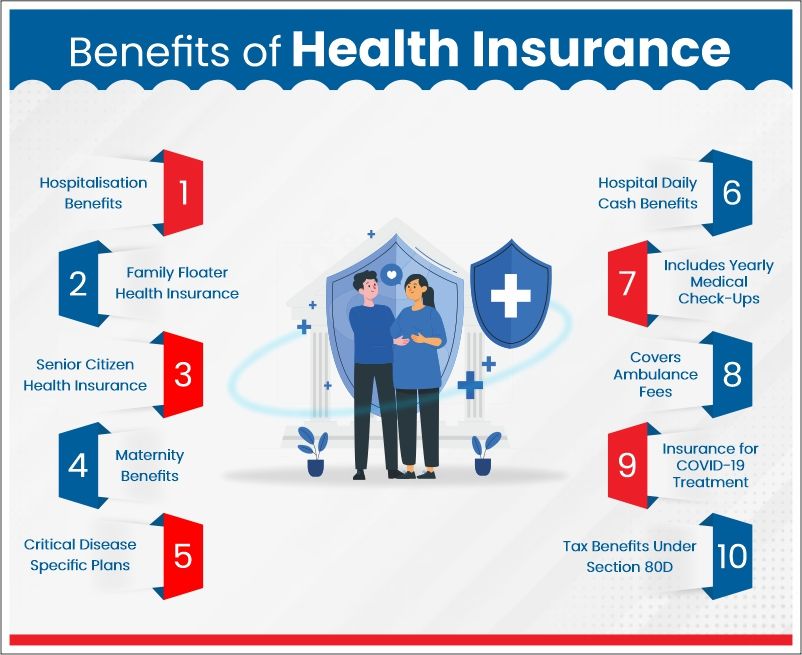

What are the Benefits of Health Insurance?

Health insurance offers a multitude of advantages that cater to diverse healthcare needs. Below are some of the key advantages of health insurance:

Hospitalisation Benefits

Health insurance benefits for hospitalisation cover costs incurred during the hospital stay, such as room rent, doctor fees, medical procedures, surgery fees, and nursing care. The plans often include pre- and post-hospitalisation expenses like diagnostic tests and follow-up consultations. With appropriate riders, coverage can be extended to ICUs wherever required. It also includes emergency services and specialised treatments. These advantages of health insurance ensure comprehensive support during serious medical conditions without any financial strain.Protection from Growing Medical Expenses

Medical expenses in India are rising on several accounts-inflation, advancements in medical technology, and increased demand for healthcare services. A single episode of hospitalization, surgery, or critical illness treatment can stretch the very finances of a middle-class family. It cushions financial ownership, that is, starts from hospital stay coverage and surgery to doctor consultation, diagnostic tests, all the way through post-hospitalization care.

In addition, while analysing health insurance benefits, other treatments covered in the policies may include those that are exorbitantly expensive, such as chemotherapy, organ transplants, and even dialysis. Without insurance, all these may drain savings empty and dampen financial stability. A health insurance scheme, thus, ensures that current medical expenses are met without the immediate fiscal strain and, in the future, secure financial stability for an individual or family, allowing them to concentrate on regaining good health without a heavy burden posed by medical bills.Low-Cost Premium for Young People

When you try to understand what are the benefits of health insurance, an important factor to consider is that it is always cheaper to buy health insurance when one is younger. An insurer sets its premium based on various risk factors such as age, medical history, and lifestyle factors. Generally, younger people are healthier and less prone to chronic diseases. As a result, they are a lower risk to insurers, translating to lower premium rates.

In addition, by joining in the policy early, one is assured of the lowest premiums for a lifetime, as there would be no steep premium hike when age-related health issues surface. Most insurers also offer cumulative bonuses for claimless years if one is lucky to have none. Plus, to deal with pre-existing conditions that develop later on, you can be sure of seamless coveted cover with no waiting periods and exclusions. This way, one may very well secure oneself low-priced uninterrupted health coverage for the years to come.Maternity Benefits

Maternity benefits in a health insurance plan comprise all pregnancy-related expenses. They cover both normal and C-section delivery costs. Some plans also provide coverage for preand post-natal expenses. If you have a corporate health insurance plan, then you should look for the policy details to check the maternity benefits and coverage.Critical Disease Specific Plans

Critical illness insurance provides coverage against life-threatening health issues like cancer, renal failure, heart attack, etc. The plan provides lump sum coverage that takes care of the expensive treatment costs of the critical illnesses covered under the policy.Hospital Daily Cash Benefits

Hospital daily cash benefits are one of the benefits of health insurance that covers non-medical expenses like transportation and meals incurred during hospitalisation. The cash benefit is determined at the time of purchasing the policy and is paid directly to the insurer. This benefit ensures financial support beyond the medical expenses covered by the primary insurance policy.Includes Yearly Medical Check-Ups

The benefits of health insurance in India include yearly medical check-ups. This helps in the early detection of potential health issues for proper treatment at early stages. The annual medical check-ups include various screenings and tests like blood tests and routine physical examinations. Routine checkups help in early intervention and reduce long-term healthcare costs by ensuring overall well-being.Covers Ambulance Fees

Covering ambulance service for transporting the insured individual to the nearest hospital is one of the benefits of health insurance. Most insurance plans provide this coverage and the amount is predetermined.

The advantage of this benefit is that when a policyholder meets with an accident or has an emergency medical issue like a heart attack, he/she can avail of ambulance service and claim reimbursement of the cost incurred.Extra Coverage Beyond Employer Health Insurance

Another key benefit of health insurance in India is that employer health insurance plans are very lucrative benefits of employment; at the same time, there come certain drawbacks like the lower sum insured provided, limited coverage, and absence of post-retirement benefits. Quite a few group policies do not provide complete coverage against critical illnesses, maternity benefits, or outpatient treatments. Such policies also cease to be valid the moment one leaves the job, lapsing the cover completely.

Opting for an individual health insurance policy provides continuous and enhanced coverage, so that the employer plans are filled by these individual plans. Higher sum insured, flexibility of add-ons such as critical illness or accidental cover, and tax benefits under Section 80D of the Income Tax Act1 are also extended. The combination of personal health insurance with employer health insurance is wise and can prevent financial losses; it provides a comprehensive medical protection for the individual irrespective of his current employment status or future diseases he/she may contract.Tax Benefits Under Section 80D

The benefits of health insurance include tax benefits# under Section 80D. The premiums paid towards the health insurance policy are eligible for tax deduction under Section 80D of the Income Tax Act, 1961. The extent of tax benefit depends on the age group, with a maximum of Rs. 1 lakh. Details of the eligible deduction are given below:

Age Group |

Maximum Deduction in the Income Tax Return |

Total Deduction under Section 80D |

|

For the policyholders, their spouses, and dependant children |

For parents, whether they are dependent or not |

||

Policyholder and parents (<60 years of age) |

Rs. 25000 |

Rs. 25000 |

Rs. 50000 |

Policyholder & family (< 60 years of age) but parents (60 years or above) |

Rs. 25000 |

Rs. 50000 |

Rs. 75000 |

Policyholder,family & parents (60 years or above) |

Rs. 50000 |

Rs. 50000 |

Rs. 1,00,000 |

Besides deductions for premiums paid, benefits of health insurance include a deduction for preventive health checkups up to Rs. 5000

Covers Before and After Hospitalization Expenses

Generally, health insurance should cover not only hospitalization costs but also medical expenses before and after hospital admission. Some of the medical expenses before hospitalization may include medical tests, consultation with doctors, and medicines that are attached to diagnosis and treatment, usually within 30 days before hospitalization. Whereas post-hospitalization expenses include follow-up consultations, rehabilitation, diagnostic tests, and medications prescribed after discharge, generally within 60 days after discharge from the hospital.

For this reason, there are very few members of the public who understand the benefits of health insurance, that is, the policy will provide a comprehensive financial cover during their medical journey. In such cases, certain health insurance policies may cover home-based treatment (domiciliary treatment) in the event that hospitalization becomes impossible. This serves to assist the individual in managing the cost of treatment, assuring continuous care and recovery without much financial burden. The exact details on the cover must always be verified under the terms of the policy.

The financial stability of family can be further increased by including life insurance components in your financial planning. Life insurance gives your dependents financial help in the event of your untimely death, whilst health insurance covers medical costs. By combining the two forms of insurance, you can protect the future of your family in a comprehensive way.

Why Do You Need Health Insurance?

With what are the benefits of health insurance explained, you should also be aware of why you should invest in health insurance. Here are some of the compelling reasons to get health insurance:

Protect your Family

The healthcare plan provides coverage for healthcare emergencies and prepares you for a situation. Medical emergencies come as a surprise. But when prepared for it you can ensure quality treatment for your loved ones.Keep your Savings Safe

Health insurance plans provide safety against rising medical costs. They provide coverage for major treatment costs. Without health insurance, meeting medical expenses means digging into your savings. Investing in a health insurance plan early in life will keep your savings safe and help you meet your financial goals.Feeling Calm and Relaxed

Health insurance plans not only protect your savings but also provide peace of mind. Equipped with the right health insurance policy, your present and future will be secure.Extra Financial Protection Beyond Corporate Insurance Coverage

Corporates offer health insurance coverage to their employees along with other perquisites. The limitation of Corporate Insurance coverage is that it exists as long as you are with the employer. Investing in a personal healthcare plan for additional cover above employer health insurance will help you cope with medical emergencies when you cease to be with the employer.Crucial In Fighting Rising Medical costs

The treatment costs are rising day by day. The rising inflation and the advanced treatment methods are contributors to the rising medical costs. It can be extremely difficult to manage the treatment costs with your savings. With the benefits of health insurance, you can spare yourself from such critical financial situations.

How to Choose the Best Health Insurance Plan?

With a clear picture about what are the benefits of health insurance and why health insurance is important, you should also know how to choose the best health insurance plan. Consider the factors given below for an informed decision:

Requirement For Coverage

Assessing the requirement for health insurance coverage is a prerequisite to choosing the best health insurance plan. This involves assessing medical history, financial situation, and personal health needs. You should consider factors like age, lifestyle, existing medical conditions, and genetics. While evaluating the coverage requirement, you should keep outpatient care, hospitalisation, medications, and preventive checkups in mind. The benefits of health insurance can continue for a long time if you invest in the right plan.Options For Personalization

The rising prices impact the cost of medical treatment as well. Customising plans with riders like critical illness, accidental cover etc. provides extensive cover, additional sum assured and rider protection for life-related uncertainties.Maximum Age for Renewal

When choosing a health insurance plan, you should consider the maximum renewal age. Policy renewal at a later age is one of the advantages of health insurance. Renewal of health insurance is generally permitted up to 65 years. However, some insurance companies offer lifelong renewal options as well.Claim Settlement Ratio

The claim settlement ratio is the percentage of insurance claims settled out of the total claims received. The reliability and trustworthiness of an insurance company are directly related to the claim ratio. A high ratio indicates that the claims are honoured promptly.Additional Policy Terms

Some of the additional policy terms may surprise you when you file for claim settlement. To avoid such a situation, it is necessary to read the additional policy terms like waiting period, deductibles, coverage exclusions, etc. Compare the additional terms of plans from various insurers before investing in a healthcare plan.

How to Purchase Health Insurance Online?

Having understood the benefits of health insurance in India, you should know how to purchase health insurance online.

- Access the official website of the insurance company of your choice.

- Navigate to the health insurance section.

- Enter your details like name, age, gender, mobile number, email ID, etc.

- Choose a suitable plan from the drop-down.

- Select the add-on riders for additional coverage.

- Proceed to the payment section and make the payment.

- The policy document will be sent to your registered email ID.

Summary

With the rising cost of medical treatments, investing in a health insurance plan is a necessity. It will keep you equipped for any medical emergencies. The health insurance benefits are manifold. The plans ensure that you and your loved ones get quality treatment without going through any financial strain. Consider the factors mentioned in the article and invest in the best health insurance plan.

FAQs on Benefits of Health Insurance

Q. What is the main benefit of health insurance?

The main benefit of health insurance is providing quality treatment without financial strain. The policy covers expenses like doctor’s fees, nursing care, room rent, surgery charges, prescription medicines, etc, during the hospital stay. It also covers pre and post-hospitalisation expenses, annual health checkups, etc.

Q. Which insurance is best for health?

Evaluation of the best health insurance plan depends on coverage provided, options for personalisation, claim settlement ratio, and additional policy terms.

Q. How many types of health insurance are there?

There are 4 types of health insurance plans available in India:

- Individual Health Insurance Plan

- Senior Citizen Health Insurance Plan

- Family Floater Insurance Plan

- Critical Illness Insurance Plan

Q. How does health insurance work?

Both public and private insurance companies offer health insurance plans. The individuals pay a premium to the insurance company and get medical coverage for a specified amount. If the policyholder incurs any medical expenses, the insurance company reimburses the expenses subject to policy terms.

Q. What are the 2 most common health insurance plans?

In India, the two most common types of health insurance plans are:

Individual Health Insurance Plans - These are insurance policies meant for individual members and meet their respective health needs. The sum insured is wholly set apart for the policyholder's medical expenses in furtherance of broader individual coverage.

Family Floater Health Insurance Plans - These policies provide coverage to the whole lot through a single sum insured. The amount is shared between family members and proves convenient and will be perceived to be cheaper, most often, than individual covers.

Q. How many years should one pay for health insurance?

Most health insurance policies are annual contracts in India and must be renewed after each lapse of one year; however, most insurers do provide for multi-year policy options within which a cover is bought for two to three years and premiums are paid for these years upfront. These multiyear modes create scopes for discounts and shielding on the basis of premiums on yearly hikes. It entirely depends on circumstances to evaluate what tenure would suit best for an individual in consideration of his health and financing situation.

Not sure which insurance to buy?

Talk to an

Advisor right away

Advisor right away

We help you to choose best insurance plan based on your needs

Here's all you should know about Health Insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- term insurance

- Health Insurance Plans

- What is Health Insurance

- Benefits of Health Plans

- BMI Calculator

- Human Life Value Calculator

- HDFC Life Cardiac Care

- Savings Plans

- ULIP Plans

- Group Insurance Plans

- Child Insurance Plans

- Pension Calculator

- ULIP for Health Benefits

- Compound Interest Calculator

- Easy Health Plan

- How to Choose Best Child Insurance Plan

- Fixed Maturity Plan

- ULIP Vs SIP

- Financial Planning for your 50s

- Zero Cost Term Insurance

- critical illness insurance

- Whole Life Insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- child savings plan

- life insurance

- life insurance policy

1. Annual Premium amount ₹ 1869 for Male aged 35 years, Base Benefit, 10 years term, Regular Pay option, Sum Assured=10 lakhs, excluding Taxes & levies as applicable.

# Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions. Tax Laws are subject to change from time to time. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

ARN - ED/02/25/20998