What do you want to do?

How Does an Investment Calculator Work?

The functioning of an investment calculator is very simple and easy to follow. After entering the amount you are investing, the investment tenure and the rate of returns, this online tool will reflect the value of your investment. Typically, these calculators incorporate some variation of the compound interest formula to determine the future return on investment (ROI).

Compound interest calculation takes into consideration both the initial investment and the rate of interest earned on previous interest payments. The compound interest formula is represented as:

A = P(1+r/n) ^nt

Where, A = amount of money accumulated, including interest

P = Principal amount (initial investment)

R = Rates of interest

N = Number of times your interest is compounded yearly

T = The number of times money is invested for

The compound interest calculator provides you with an accurate estimate of your returns with other essential details to help you reach your desired financial goal.

The important variables involved in any investment calculator include:

- Initial Investment: The amount of money you had invested initially

- Investment Period: The period for which you plan to hold the investment, measured usually in years

- Regular Contributions: Any amount you plan to invest monthly, quarterly or annually

- Compounding Frequency: The frequency of application of compounding to your investment (e.g. Quarterly, annually, semi-annually, daily, monthly)

- Future Value: The amount of money worth of investment after a particular period, given the compounding frequency and the rate of return

- Expected Rate of Return: This is the annual percentage rate at which you expect your investment to grow based on past returns. This can take the form of a historical rate of return. For fixed-income assets, this value will be replaced by the predetermined interest rate.

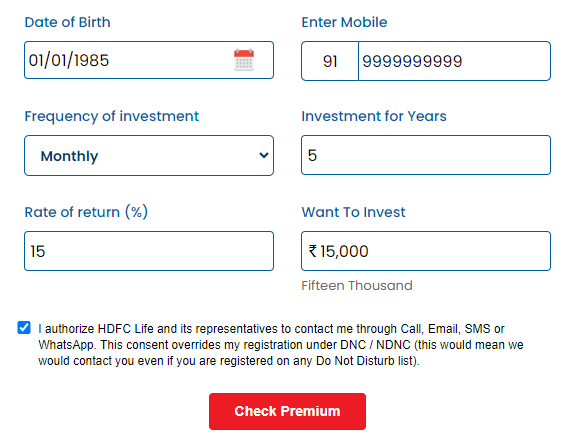

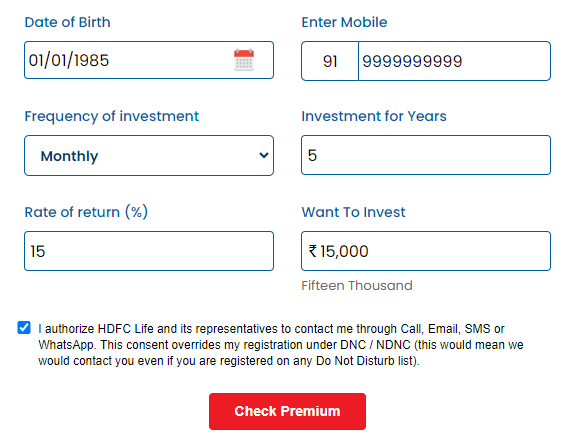

How to Use an Investment Calculator?

Investment calculators are easy and simple to use. With proper use of this simple tool, you can track your savings or make plans to reach your chosen financial goal. Here is a detailed step-by-step guide on how to use any investment calculator for accurate calculation of your investment returns:

Step 1: Consider the type of calculator you need to use and enter the initial investment amount you want to invest monthly or annually.

Step 2: Find out the preferred rate of return. Some policyholders might target a return of 11% to 12%, while others might consider lower but fixed returns.

Step 3: Considering the tenure you wish to hold your money, select the investment tenure in years.

Step 4: If applicable, mention any current investment you have.

Thus, considering all the relevant information you enter in these fields, the investment calculator will calculate the future worth of your investment.

Compound Interest Calculation

Compound interest is an innovative way of earning interest on interest. In other words, the money you invest will generate returns from both the initial principal amount and accrued earnings from the previous compounding period. As your investment grows faster with each passing year, it is known as the power of compounding.

Thus, your wealth keeps on increasing as you invest, enabling you to achieve your desired financial goals and objectives. With a proper understanding of the impact of compound interest, you can earn high returns on your savings and investments and reach an informed decision making.

How Does Compound Interest Calculator Work?

The compound Interest calculator works following the below-mentioned formula:

A = P(1 + r/n)^(nt)

Where A = future value of investment

P = the principal amount

N = the number of times interest is compounded each year

R = the interest rate annually

T = the number of years

This formula, however, considers both the principal amount initially and the accumulated interest over time, depending on the compounding frequency.

Types of Investment Calculators

There are several kinds of investment calculators, each carrying their purpose and applications. These calculators are simple and easy-to-use tools. Let's explore the different types of investment calculators:

General Investment Return Calculator

The general investment return calculator is a handy financial instrument that allows you to find out the amount of money you can earn from a business. Simply put, this calculator reflects the potential earnings and costs and the percentage of profits you might get. Accordingly, you can analyse whether it's a smart investment.

SIP (Systematic Investment Plan) Calculator

Systematic Investment Plans, or SIPs, are a systematic method of investing in mutual funds to reach your long-term financial goals. The SIP calculator is an easy-to-use tool that allows investors to estimate the future value of mutual fund investments through SIPs.

Enter the SIP amount, interval (daily, weekly, monthly), tenure of investment and expected rate of return. Now, the calculator will provide you with the estimated amount at maturity. Thus, you can make an informed decision and evaluate the growth of your SIP investments over time.

Compound Interest Calculator

A compound interest calculator is an online tool that lets investors calculate how much wealth they can generate after investing a certain amount of money for some time with the compounding of returns.

With compound interest, an investor can earn passive income on the invested amount; this effect is named 'Power of Compounding'. Many banks and financial institutions offer compound interest on invested amounts.

Lump sum Investment Calculator

A lump sum investment calculator also known as One Time Investment Calculator is a handy online tool for calculating the future value of a single, one time investment over a period of time. After entering the invested amount, expected rate of return and the investment duration, you will get the future value of your investment.

This tool is ideal for investors planning for savings to reach future goals. However, a lump sum investment calculator sets a fixed rate of return, whereas actual returns can be influenced by market fluctuations.

Monthly Investment Calculator

With a monthly investment calculator, you can plan your regular savings by showing the amount of money you can grow over time with consistent investments. To find out the value of your investment, enter the investment tenure, expected rates of interest, and monthly investment amount. This financial tool serves the purpose of reaching desired financial goals such as education, repairing a house or post-retirement planning.

With regular savings, an investor can stay disciplined and benefit from the effect of compound interest. Overall, your saving strategies are simplified greatly, and you can meet your financial objectives.

How can an Investment Calculator help me?

The Online Investment Return Calculator helps users see how their investments can grow over time. It shows how much money needs to be invested now to reach specific goals in 10 or 20 years. The calculator breaks down expected returns, providing clear insights for 1, 5, and 10 years.

With the Investment Return Calculator, planning for future expenses and creating a savings plan is easy. Just a few clicks provide a clear view of the financial journey, empowering smart choices to achieve financial goals.

Let's explore examples of some commonly mentioned scenarios below:

- Education Fund: With proper estimation of your savings, make an investment plan to meet your child’s education fees.

- Retirement Planning: Invest regularly to yield high returns in post-retirement days. Thus, calculate how much you can invest monthly or daily to accumulate a retirement fund.

Thus, by providing the correct details, an investment calculator can help you plan and track your financial goals. Be it for education or retirement, this tool allows you to invest the right amount and fulfil your financial objectives.

Start Investing |

Age 30 |

Age 40 |

Investment Amount |

Rs. 10,000 |

Rs. 30,000 |

Investment Period |

15 Years |

5 Years |

Total Investment |

Rs. 18.00 Lakhs |

Rs. 19.00 Lakhs |

Returns at the Age of 45 |

||

Returns |

Rs. 50.46 Lakhs |

Rs. 24.75 Lakhs |

Advanced Features and Considerations

Basic investment calculators offer you straightforward calculations. But there are also calculators whose features are more complex and enhance your financial planning:

Assessing Risk

Some advanced investment calculators assist you with assessing the risk level of investment options. Thus, considering your risk tolerance, you can learn to choose between effective strategies.

...Read More

Adjustment of Inflation

Inflation lowers the purchasing power of your future savings. Here comes the importance of an inflation investment calculator. This online tool adjusts your returns and provides a clearer picture of how much your investment will be worth in real terms over a certain period.

...Read More

Conversion of Currency

If you are investing internationally, the feature of currency conversion is of utmost importance. It assists you with estimating the returns of the money you have invested. Thus, you can analyse those returns in different currencies.

...Read More

Implications of Taxes

Some investment calculators have advanced features of tax accountability. This feature thereby helps policyholders estimate how taxes on returns create an impact on the final invested amount, thereby providing a clearer picture of their earnings.

...Read More

Investment Plans Based on Financial Goals

Investment plans should be structured according to your financial goals, irrespective of whether they are short-term or long-term. If you go for short-term investment, it will focus mostly on easy and quick returns, while long-term investments focus on building wealth over time.

For proper retirement planning, you should use an investment calculator to estimate how much to save regularly. Make necessary adjustments in providing details such as the investment amount, expected returns, and time horizon to reach your desired goals. Proper use of these calculators allows you to create a clear plan to reach the desired financial goals and objectives.

Investment plans as per your financial goals

You can explore the below options in details as per your desired financial goals –

Popular Investment Options in India

Investing in the right instrument helps your money grow and fulfil your life goals. There are several investment options available in India, and thus, choosing the right one is crucial. Investments can be broadly divided into two specific categories, depending on your financial goal and time horizon – long-term investment and short-term investment.

Let’s explore some popular types of investment in India:

Stocks

Stocks mean the share of ownership in a company. If you are a long-term investor aiming to earn high returns, you can invest in stocks. However, since stocks are market-linked instruments, there is a high risk of loss of capital.

A stock returns calculator thereby helps estimate future value by considering the share price, dividends, and performance of shares.

Bonds

Bonds are debt-based instruments that provide fixed income. With the purchase of bonds, you lend money to the issuer, and you keep on receiving interest at a predetermined rate. Once a bond matures, the amount invested is then returned to you. Opt to invest in bonds directly or through debt mutual funds.

Fixed Deposits

If you are a risk-averse individual with expectations of decent returns on your deposited money, the fixed deposit option is for you. This investment instrument provides guaranteed returns. Even investors with high-risk appetites can choose a fixed deposit to stabilise their portfolios.

Fixed Deposit calculators help estimate amounts upon maturity by considering the amount deposited, tenure, and rates of interest.

Certificate of Deposit

Among the different types of investment in India, the certificate of deposit is a well-known money market instrument. It is issued against the funds an investor deposits. The Reserve Bank of India is the main regulatory body for certificates of deposit.

Mutual Funds

Mutual funds are an important investment instrument managed by fund managers. Here, the invested amount of investors are invested in a variety of assets, including stocks, bonds, government securities, money market instruments, gold, real estate, etc., to yield attractive returns. Even with depositing a small amount initially, an investor can yield attractive returns.

The SIP calculator and lump sum calculator can be used to calculate the future value of mutual fund investments.

Public Provident Fund

Public Provident Fund (PPF) is one of the trusted long-term retirement schemes in India. Here, the interest earned, the invested amount and the amount on maturity are all exempted from taxes. With a lock-in period of 15 years, you can withdraw funds from the Public Provident Fund partially at regular intervals.

Unit Linked Insurance Plans (ULIPs)

Unit Linked Insurance Plans (ULIPs) are an ideal investment plan if you are a long-term policyholder and are willing to experience the dual benefits of investment and life insurance. With ULIP, you can avail comprehensive life coverage protection for your family members during any unfortunate incident. To ensure you have the right life coverage, you can use a life insurance calculator to estimate the appropriate amount of life insurance you need based on your goals and family requirements. Moreover, ULIP calculator enable you to make a thorough comparison of potential returns and insurance coverage.

ULIP investment allows for a tax deduction of ₹1.5 Lakh under Section 80C of the Income Tax Act, 1961. The returns from investment are also exempt from taxes, subject to certain limits.*

Real Estate

The real estate sector is rapidly growing in India. Purchasing a flat or plot is the best financial instrument among several other investment options in India. The prices of property rise every six months, and thus, there is much less risk associated. You can also invest in the real estate sector without owning a property via REIT (real estate investment trusts).

National Pension System (NPS)

The National Pension System is another useful investment option that provides pension. It usually invests funds in bonds, stocks, government securities, and other types of securities. However, this scheme doesn't mature unless the investor reaches the age of 60.

What is a Savings Calculator?

A savings calculator is a great tool that can help you understand how your savings could grow over time making it easier to plan for different financial goals based on your needs The calculation depends on the investment duration, investment period, intervals and the rate of returns to figure out your savings returns.

You can use a savings calculator to determine the time and investments required to reach your financial goals such as saving for a vacation, post-retirement days or any other goal that you have.

How Does Savings Calculator Work?

So, here is how a Savings Calculator work. We will try and understand this with an example. Let’s assume you need an amount of Rs. 15 Lakh in fifteen years from now. We will assume an annual return rate of 8% and let’s assume you have not saved any money towards this particular financial goal till now.

We can use the PMT function in the savings calculator where the rate of return would be 7% i.e 7/100. Now, we need to convert it to monthly rate so the rate = 7/100/12

We will also convert the investment period of 10 years into months which would be 15*12 = 180 months.

Since you have not saved anything till now for this particular goal, the present value will be 0 and the Future value would be Rs. 15,00,000.

The savings calculator calculates the monthly investment necessary to achieve the financial objective, which will be Rs 4,500.

Systematic Investment Plan (SIP) Investments in Detail

Systematic Investment Plan (SIP) is an innovative method of investing money in mutual funds. In this approach, a fixed amount is invested regularly. Instead of investing a lumpsum amount, this kind of investing helps investors grow their wealth with small but regular contributions.

How Does SIP Work?

With an SIP calculator, you can determine the regular invested amount with ease. This amount is then further deducted from your respective bank account to purchase fund units. Over time, these kinds of investments grow with the power of compounding. The two main principles following which SIP works are the power of compounding and rupee cost averaging.

How to Use a Systematic Investment Plan Calculator?

A SIP calculator is easy and simple to use. Here is a detailed step-by-step guide on how you can use the SIP calculator:

Step 1: Navigate to the SIP calculator of your preferred website.

Step 2: Provide the investment tenure in years, the desired SIP amount, SIP interval (monthly, yearly, etc.) and expected rate of returns. Here, the current value for returns can be used as the expected rate.

Step 3: As and when these details are entered into the SIP calculator, it displays the total maturity value, invested amount and the total guaranteed returns

Using the Calculator for SIP & Lumpsum Investments

SIP investment calls for regular investment, thereby minimising market risks for investors. Meanwhile, a lumpsum investment requires a one-time investment, which benefits investors from market fluctuations. Using investment calculators for both these approaches highlights the importance of SIP and how it offers steady growth over the years, even during market fluctuations.

Investment Calculators in Comprehensive Financial Planning

Investment calculators are essential tools for creating a detailed financial plan. They help you estimate future returns by factoring in variables such as monthly or periodic investments, interest rates, and more. If you're considering where to invest 20 lakhs, an investment calculator can assist in evaluating how your substantial amount could grow over time. Thus, you get an idea of how much your savings can grow and how much time it will take approximately to reach your desired financial goals.

When you are planning your goals, like buying a house, meeting expenses for your child, retirement, etc., an investment calculator simplifies complex financial calculations. Entering data on the tenure of investment, amount invested, and expected returns will provide you with an accurate estimate of the final value. This provides a clear picture of whether you are on the right track of meeting your financial goals.

Investment calculators are useful but have certain limitations as the market fluctuates with changes in rates of interest. For accurate financial planning, make sure to consult with a financial advisor. In short, investment calculators let you make informed decisions by looking at the long-term perspective.

FAQ's on Investment Calculator

1 How can I calculate investment?

You can use a simple interest or compound interest formula to calculate the return on your investment. The return depends on your investment amount, frequency, tenure, and interest rate. Additionally, you can use an online investment return calculator to understand the future value of your investment.

2 When should I use an Investment Calculator?

You should use the investment calculator whenever forecasting returns on investment over a certain period. This calculator is helpful when comparing different investment options and making informed decisions.

3 What will be the return on an SIP investment of Rs. 10,000 for 20 years?

For example if you individual who invests Rs. 10,000 every month for 20 years with an estimated rate of return of 12% will earn Rs. 1.01 crore on maturity.

4 How can I get Rs. 1 crore by investing Rs. 5,000 monthly?

For example if you invest Rs. 5,000 each month and hope to grow your money to Rs. 1 crore on maturity you can stay invested in a fund that offers at least 17% returns for 20 years. Or, if you have more time, you can invest in a policy or fund offering returns at 12% for at least 26 years.

5 What could happen if I invest money without using an investment calculator?

If you invest money without using an investment calculator, it will lead to uninformed decisions. Moreover, it might lead to disappointment with maximisation of returns on investment.

6 How can I use an investment calculator to plan for retirement?

To plan for retirement using an investment calculator, make sure to enter your current savings, age of retirement, and expected rate of return to analyse the growth of your investment over the period. This will also help you determine if strategies for savings align with your set financial goals.

7 What information do I need to use an investment calculator effectively?

To use an investment calculator effectively, financial information on the expected rate of return, initial investment, and expected annual contributions is required. Maintaining accuracy of this information will help you reach an informed investment decision.

8 Are there specific investment calculators for mutual funds and stocks in India?

Yes, there are specific investment calculators for mutual funds and stocks in India that consider expense ratios, historical performances, and implications of tax for easy calculation. A prominent example is the SIP calculator.

9 Should I invest or save money for the future?

Yes, you should save or invest money for the future to build financial security and achieve your goals. Saving ensures you have funds for emergencies, while investing can help grow your wealth over time.

10 What is a ULIP Calculator?

A ULIP Calculator is an online tool that helps you estimate the potential returns from a Unit Linked Insurance Plan based on your premium, investment tenure, and expected rate of return.

11 What is a Savings Calculator?

A Savings Calculator is a tool that helps you project the future value of your savings by inputting factors like initial deposit, regular contributions, interest rate, and time period.

12 Are returns guaranteed under ULIPs?

No, returns under ULIPs are not guaranteed as they are linked to market performance. The value of your investment may fluctuate based on the performance of the underlying funds.

13 Is it possible to withdraw ULIP?

Yes, you can make partial withdrawals from your ULIP after the mandatory lock-in period, usually five years. Withdrawal terms and conditions may vary by policy.

14 What is the formula for SIP?

The formula to calculate the future value of a SIP investment is:

FV = P × [ (1 + r)^n – 1 ] / r × (1 + r)

FV: Future Value

P: SIP installment amount

r: Periodic rate of return

n: Number of installments

15 How to start SIP?

To start a Systematic Investment Plan (SIP), select an investment product that offers SIP options, decide on your investment amount and frequency, complete any required documentation and KYC formalities, and set up automatic payments from your bank account.

ALL CALCULATORS

-

Retirement Calculator

-

Income Tax Calculator

-

Pension Calculator

-

ULIP Calculator

-

Human Life Value Calculator

-

Cost Of Delay Calculator

-

Compound Interest Calculator

-

BMI Calculator

-

Investment Calculator

-

Child Education Planner

-

Marriage Expense Calculator

-

Term Insurance Calculator

-

SIP calculator

-

PPF Calculator

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- Best Investment Plan

- 1 crore investment plan

- ULIP

- Best Savings Plan

- Best Retirement Plan

- Compound Interest Calculator

- ULIP Calculator

- Income Tax Calculator

- Investment for beginners

- 5 year Investment Plan

- 10 year Investment Plan

- 20 year Investment Plan

- Child Insurance Plan

- ULIP vs. SIP

- Insurance vs. Investment

- Retirement Calculator

- Pension Calculator

- nps vs ppf

- safest investment options

- one time investment plans

- types of investments

- health insurance plans

- Best Term Insurance

- Money Back Policy

- Short Term Investment Plan

- Long Term Investment Plan

- life Insurance policy

- life Insurance

- critical illness insurance

- Whole Life Insurance

- term insurance plan

- benefits of term insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Saving Schemes

- Life Insurance for NRI

- Investment Plans for NRI

This interactive does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. HDFC Life Insurance Company Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information reported by the interactive.

The information being provided through this interactive is provided for your assistance/ information only and is not intended to be and must not alone be taken as the basis for an investment decision (“Information”). The recipient/ user assume the entire risk of any use made of this Information. Each recipient /user of this interactive should make such investigation as it deems necessary to arrive at an independent decision while making an investment and should consult his own advisors to determine the merits and risks of such investment. The investment discussed or views expressed may not be suitable for all investors. HDFC Life Insurance Company Limited and its affiliates, group companies, sales staff, financial consultants, officers, directors, and employees may have potential conflict of interest with respect to any recommendation, related information or opinions.

This Information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This Information is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject HDFC Life Insurance Company Limited and its affiliates/ group companies to any registration or licensing requirements within such jurisdiction. The distribution of this Information in certain jurisdictions may be restricted by law, and persons in whose possession this Information comes, should inform themselves about and observe, any such restrictions. The Information given in this interactive is as of the date of this report and there can be no assurance that future results or events will be consistent with this Information. This Information is subject to change without any prior notice. HDFC Life Insurance Company Limited reserves the right to make modifications and alterations to this statement as may be required from time to time. However, HDFC Life Insurance Company Limited is under no obligation to update or keep the Information current.

Neither HDFC Life Insurance Company Limited nor any of its affiliates, group companies, directors, employees, sales staff, financial consultants or representatives shall be liable for any damages whether direct, indirect, special or consequential including health, physical well being, lost revenue or lost profits that may arise from or in connection with the use of the Information. Past performance is not necessarily a guide to future performance.

This material has been prepared for information purposes only, should not be relied on for financial advice. You should consult your own financial consultant for any financial advice.

18. Save 46,800 on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are a Regular Individual, Fall under 30% income tax slab having taxable income less than Rs. 50 lakh and Opt for Old tax regime.

For more details on risk factors, associated terms and conditions and exclusions please read the sales brochure carefully before concluding a sale.

*Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions. Tax Laws are subject to change from time to time. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

** The past 5 year fund performance of HDFC Life Discovery Fund (SFIN: ULIF06618/01/18DiscvryFnd101) as on 30th November 2024. The benchmark taken into consideration here is is Nifty Mid Cap 100 which as a return of 26.77% as on 30th November 2024. HDFC Life Discovery Fund is available with HDFC Life ULIPs which comes with a life cover. Please note past fund performance is not indicative of future performance.

ARN - MC/09/24/15697