What do you want to do?

What are Child Savings Plans?

Child Savings Plans are plans that help build a corpus to fund your child’s education, marriage, and other expenses related to the child. These plans offer the dual benefit of savings and life insurance. In the event of the death of the parent, the child will receive a lump sum amount, which can be utilised to pursue higher education.

There are an array of child savings plans with different features and benefits. You can choose the best saving plan for child with a 10 to 20-year term and with a host of benefits. While choosing a child savings plan, it is recommended to choose a long-term plan and play the premium regularly to keep the policy active.

Why is it Important to Have a Child Savings Plan?

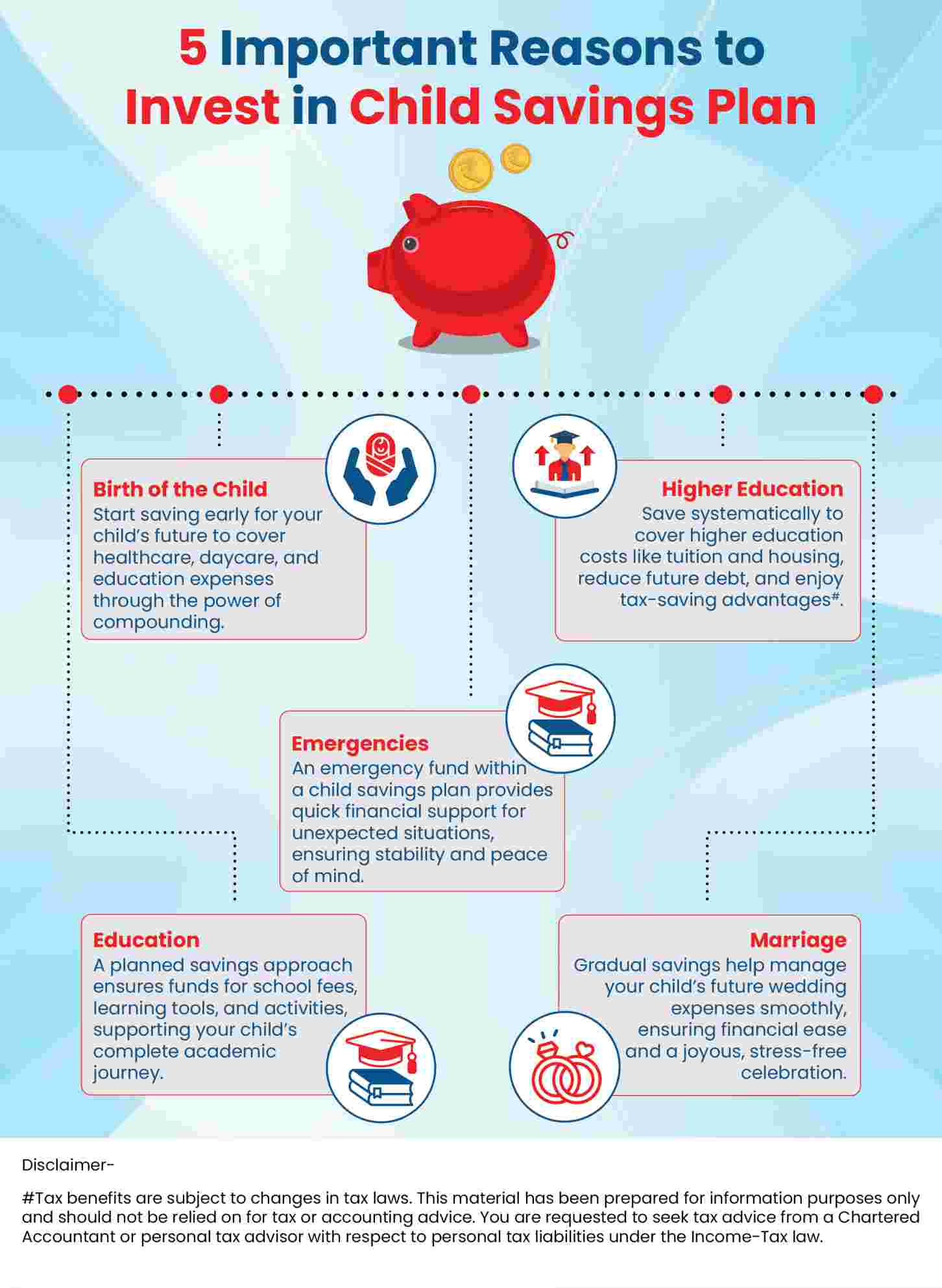

Setting up a child savings plan is one responsible way to safeguard your child's financial future. It guarantees that money will be accessible for significant life events and acts as a safety net in case of unanticipated situations. So, here are a few reasons why it is essential to have a child savings plan:

Birth of the Child

The arrival of a child brings joy and new financial responsibilities. Parents may prepare for future costs like healthcare, day-care, and early education by starting a savings plan from birth. By utilising compound interest, early saving allows a small initial investment to increase significantly over time, reducing future financial worries.

Education

Putting money into a child's education is essential to their growth. A specific savings strategy guarantees that money will be accessible for learning resources, extracurricular activities, and school expenses. Parents may support their child's academic development and possibilities by methodically conserving money so they can afford to provide their child a high-quality education.

Higher Education

Tuition, housing, and other associated fees are just a few of the high costs associated with higher education. A well-designed savings strategy guarantees resources are available when required and provides tax benefits. This proactive strategy lessens possible debt loads and dependence on student loans.

Marriage

Weddings can be costly events. Parents may help with their child's wedding costs by saving ahead of time, guaranteeing a memorable day free from financial stress. Funds may be accumulated gradually with a dedicated savings plan, which makes it simpler to handle such significant expenses later on.

Emergencies

Due to the unpredictability of life, financial emergencies can occur at any time. A kid savings plan serves as a safety net, offering easily accessible money to deal with unanticipated circumstances like urgent needs or medical problems. This preparedness provides peace of mind and financial stability during challenging times.

How Do Child Savings Plans Work?

A child savings plan provides dual benefits. It helps with saving for children's education, marriage, and other major expenses. It is also a financial safety net for your children in case of eventualities. This is how the children savings plan works:

If you purchase a child savings plan and pay the premium regularly throughout the policy term, you can use the maturity amount for your child’s higher education. In case of any eventuality during the policy term, the death benefit ensures that your child can pursue his/her higher education and fulfil his/her dreams.

Key Benefits of Child Savings Plans

The main objective of buying a child savings plan is to fund their future expenses like higher education, marriage, and establishing a start-up. It also provides financial security to your children in your absence. Following are some key benefits of investing towards a child savings plan:

Financial Safety for Your Child

By reserving money for emergencies and other necessities like schooling, a kid savings plan guarantees financial stability. It ensures a secure future by serving as a financial cushion, offering stability and assistance even in unanticipated situations.

...Read More

Saving for the Future

Making regular contributions to a kid savings plan aids in building up a sizable sum for unforeseen costs. Systematic saving lowers stress and financial reliance by ensuring that funds are available when required, whether for marriage, school, or professional prospects.

...Read More

Guaranteed Returns

Over time, consistent growth is ensured by certain kid savings schemes that give guaranteed returns. Better financial planning is made possible by this predictability, which enables parents to create a solid financial foundation for their child's future without being concerned about market or economic volatility.

...Read More

Life Insurance Protection

Certain child savings programs include life insurance benefits, guaranteeing financial stability even in the case of an early death of a parent. This coverage gives parents and guardians peace of mind by ensuring that the child's future financial requirements are satisfied without interruption.

...Read More

Saving with Discipline

By guaranteeing consistent contributions, a structured savings plan promotes sound financial practices. In addition to preventing wasteful spending, this methodical approach fosters long-term financial stability and teaches appropriate money management skills that will benefit parents and kids for the rest of their lives.

...Read More

Tax Benefits

Tax benefits including tax-free withdrawals or contribution deductions are provided by a number of child savings schemes. These advantages make the plan an effective and economical strategy for safeguarding a child's financial future by assisting parents in maximising their savings while lowering taxable income.

...Read More

Best Child Savings Plan in India 2025

The best child savings plan can help you save according to your child’s dreams and aspirations. Here are few of options that you can evaluate:

Sr.no. |

Best Child Savings Plan |

Purpose |

Tax Benefits |

1 |

Child ULIPs |

These plans provide growth in wealth through investment in marked linked avenues and protect your child’s financial future in case of an unfortunate event. |

Under Section 80C (Maximum deduction can be claimed is Rs 1.5 lakhs) and Section 10 (10D) subject to conditions. |

2 |

Sukanya Samriddhi Yojana (SSY) |

This is an investment scheme by the Government aimed to help parents of a girl child to save for her education and marriage. |

Under Section 80C (Maximum investment of Rs 1.5 Lakhs) |

3 |

Systematic Investment Plans (SIPs) |

SIPs are a powerful investment tool that helps you investment money and grow your wealth over a long term. |

Under Section 80C investment in ELSS through SIPs (Maximum deduction can be claimed is Rs 1.5 lakhs) |

4 |

Life Insurance |

Provides guaranteed returns to your investment to fulfill your child’s financial goals along with life cover to protect the financial future |

Under Section 80C. (Maximum deduction that can be claimed is Rs 1.5 lakhs) and Section 10 (10D) subject to conditions |

5 |

Debt Funds |

These are low risk investment avenues that offer stable returns and protection to capital which is suitable for your child’s financial future |

N/A |

6 |

Public Provident Fund (PPF) |

PPF provides stable returns in the long term. It has a lock-in period of 15 years making it ideal for disciplined investment for your child’s goals. |

Under Section 80C (Maximum investment of Rs 1.5 Lakhs) |

7 |

National Savings Certificate (NSC) |

NSC is ideal for those prioritizing safety and stability in their investments, offering fixed returns with minimal risk. Making it suitable for child’s future. |

Under Section 80C (Maximum investment of Rs 1.5 Lakhs) |

8 |

Recurring Deposits |

It is an investment option that provides fixed returns by investing is a disciplined manner to save for your child’s future. |

N/A |

9 |

Gold |

It is a conventional investment avenue where you can get high returns to secure your child’s financial future. |

N/A |

10 |

ELSS |

An Equity linked savings scheme provide you the opportunity to invest in equity in a disciplined manner to secure your child’s goal in the long term. |

Under Section 80C (Maximum investment of Rs 1.5 Lakhs) |

Note – It is essential to note that the total deduction available under section 80C considering all the above investments allowed under this section should not exceed Rs.1,50,000 per year. Individuals and HUFs are both eligible for Section 80C deductions. Taxpayers who opt for the Old Tax Regime of the Income Tax Act, 1961, are eligible to claim deductions and exemptions available. Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions.

Tips to Save Money for Your Children's Future

If you are looking for some tips to save money for the future of your child, read below:

Begin Early

Your savings will have more time to increase through compound interest if you begin saving as soon as your child is born. As significant costs draw near, early saving eases the financial strain and makes long-term objectives more reachable.

Stay Consistent

Even little payments made on a regular basis add up to a sizable sum over time. This regularity may be maintained by setting up automatic transfers, which will guarantee your funds increase steadily.

Check for Extra Benefits

To find extra perks like higher interest rates, matching donations, or educational incentives, investigate different savings programs. The growth potential of your funds might be increased by selecting a plan with additional benefits.

Stay Within Your Budge

Saving for your child's future is vital, but make sure the contributions fit within your overall spending plan. Preventing excessive pressure and encouraging sustainable saving are achieved by striking a balance between savings and existing financial commitments.

How To Choose the Best Child Savings Plan?

Choosing the best child savings plan is essential to secure your child's future. You should consider factors such as insurance coverage, flexibility, the credibility of the insurer, and tax benefits. Here is a summary of the most important factors to consider while choosing the best plan when saving for children

Purpose

Premiums

Flexibility

Insurance Coverage

Credibility of Insurer

Tax Benefits

Before choosing your child's savings plan, find out what you wish to accomplish. Knowing the purpose of saving will also let you reach your goals with ease. Are you planning to save for your child's education, emergency fund or marriage? Choosing the right plan caters to your unique needs. So, list your goals and consider whether they are short or long-term to pick the right child investment plans.

Premiums are the money you pay regularly to keep your plan active. Use a child education planner to estimate how much you’ll need and choose a premium amount that fits your budget. You can go with a fixed premium that stays the same or a flexible one you can adjust as needed.

Check out the flexibility of the child savings plan you have chosen. Make sure to choose a policy term and a premium paying term that aligns with your goals and budget. Also, look for a plan that provides flexibility, as this helps you adapt to your financial situation while considering your child's future needs.

Choose the life insurance coverage the plan offers. This enables you to determine the amount your child ought to receive in your sudden demise. The coverage amount, however, should be sufficient to meet their future needs. Opting for a good plan ensures that you will receive both insurance protection and an opportunity for savings.

The credibility of an insurer is an important factor when choosing the right plan. Make sure to conduct thorough research about the insurer, studying the customer reviews and financial stability. Choose only a reputed company with a good track record providing customers with better security and reliable services.

You are eligible to claim tax benefits depending on the premium of the policy under Section 80C of the Income Tax Act. The death benefits are also exempted from taxes under Section 10 (10D) of the Income Tax. This thereby allows you to save money while continuing to invest for your child's future.

Factors To Consider Before Choosing a Child Savings Plan

Here are some factors you should consider before opting for a child savings plan:

Purpose of the Plan

Duration

Flexibility

Returns and Performance

Tax Benefits

Liquidity

Reputation of the Provider

Inflation

Automatic Features

Consultation

Make sure to determine the primary goal or the main purpose of your savings. Are you investing in your child's education, marriage, or some other purpose?

Take into consideration the time horizon till you consider the funds to utilise. If your child is young and you are investing to save for meeting college expenses or marriage, you then will have a comparatively long time frame in comparison to someone whose child is already a teenager.

Before considering a child savings plan, check its flexibility. Find out whether you can adjust the frequency of payment or tenure as per your requirement. Is it possible for you to increase or decrease the contribution amount over time? There are some savings plans which allow you to make lump sum payments. A flexible plan caters to your unique needs.

While deciding to opt for a child savings plan, consider the returns and performance. If your chosen plan is investment-linked, make sure to review its past performance and associated risks. Past results, however, don't guarantee future returns, but they can provide you with an overall idea. This helps you gain a thorough understanding of the potential growth of investment over time.

Several child savings plans offer tax benefits. You can avail these benefits according to the amount you choose to invest, the returns, and other factors. Thus, make sure to check out the tax implications before selecting a plan. Understand the amount you can save on taxes and whether the plan is eligible for deductions.

Find out how easy it is to withdraw money from your chosen savings plan, especially taking into consideration emergency situations.

Before you proceed to choose a child savings plan, conduct a thorough research about the reputation of the provider. Search for any well-known or reputed institution or company holding a strong track record. A reputable provider will be more likely to provide reliable services and make your investment in your child safe and secure.

While choosing a child savings plan, consider the rate of inflation. Due to inflation, the value of your saved money depreciates over time, so your savings might not be enough to cover future costs. Make sure to plan wisely and invest in inflation-beating assets to ensure sufficient growth over time to meet the future needs of your child.

There are many child savings plans with an automatic mode of investment. This might help in ensuring financial discipline. Moreover, these kinds of features also let your savings grow over time. The invested money can also be adjusted with inflation and provide better financial security when looking at your child's future.

Before choosing a child savings plan, consulting with a financial advisor is a must. A financial advisor can guide you to understand your financial goals and objectives for saving for children. This guidance thereby enables you to reach an informed decision making and choose the best plan for the future of your child.

Which Child Savings Plan is Right for You?

Some of the best child savings plan to secure your child’s future are:

Sukanya Samridhi Scheme

Sukanya Samnridhi Scheme is a government-backed scheme designed specially for a girl child. It is a low-risk investment that matures when the child turns 21 and can be used to fulfil her goals.

...Read More

Systematic Investment Plan (SIP)

SIP allows you to invest in a mutual fund scheme of your choice and at the frequency chosen. You can build a corpus for your child’s future over a period.

...Read More

Public Provident Fund (PPF)

It is a government-backed scheme with low risk. With the power of compounding interest in PPF, your investment will grow exponentially in 15 years. The part withdrawal facility after 7 years provides funds to cater to your child’s expenses.

...Read More

Debt Funds

The investment by debt funds is in fixed-income securities like bonds. They are less riskier than equity mutual funds. According to SEBI, there are 16 types of debt funds, and you can choose any.

...Read More

Gold

Investment in gold offers high liquidity, and the funds are immediately available during emergencies. The investment can be in gold coins, gold bonds, gold jewellery or in gold Exchange Traded Funds (ETFs).

...Read More

Term Insurance Plans

A term insurance plan is a common plan chosen for securing a child’s future. Look for a plan with life cover for financial security.

...Read More

FAQs on Child Savings Plan

What is the child savings policy?

A child savings policy is a savings plan that helps fund the goals of your child at different life stages.

How do I plan savings for my child?

Determine the goals and budget your savings accordingly. Start early so that you can invest less for higher returns.

What are the documents required while buying a savings plan for children?

You would require submitting a duly filled Proposal form along with KYC of the child and the parent/guardian. You might need to submit other documents, only on specific request, during the application process.

Here are some of the documents you might have to submit:

- Proposal form

- Identity proof (passport, voter ID card, Aadhaar, driving Licence)

- Address proof (Voter ID card, Aadhaar, Passport, Utility bills, Driving Licence)

- Age proof

- Income proof

What are the tax benefits associated with Child Savings Plans in India?

The premium payments have tax benefits under Section 80C3, and the maturity/death payout has tax benefits under Section 10(10D)3.

What is the minimum amount for investing in a Child Savings Plan?

The minimum amount for investing in a child savings plan is Rs. 250/-

What is the expected tenure period for a plan to receive its maximum value?

The maximum tenure for a plan to receive maximum value is 5 years but can vary with the institution.

Do children's savings plans provide partial withdrawal?

Yes. Children's savings plans provide partial withdrawal.

Can a minor be a nominee in a savings plan for children?

Yes. A minor can be a nominee in a savings plan for children but should be represented by a guardian.

What is the right time to start investing in a Child Savings Plan?

It is recommended to start early, as long-term investments provide higher returns.

What is the government savings plan for children?

The Sukanya Samriddhi Yojana is a popular government savings plan for a girl child. This plan is designed exclusively for girl children up to the age of 10 years.

Here's all you should know about Child Savings.

We help you to make informed insurance decisions for a lifetime.

Popular Searches

- term insurance plan

- Investment Plans

- savings plan

- ulip plan

- Pension Plan

- health insurance plans

- child insurance plans

- group insurance plans

- fixed maturity plan

- bmi calculator

- compound interest calculator

- term insurance calculator

- short term saving plans

- Investment Calculator

- investment plan for 5 years

- investment plan for 10 years

- Financial Planning in Your 30s

- 10 lakhs investment plan

- Financial Planning in Your 50s

- 1 Crore Investment Plan

- 35 lakh Investment Plan

- 2 crore term insurance

- 1 crore term insurance

- guaranteed returns plans

- sanchay plans

- 10 year term insurance

- ULIP Returns in 5 Years

- Capital Guarantee Solution Plans

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- What is Investment

- nps vs ppf

- short term investment plans

- safest investment options

- one time investment plans

- types of investments

- Best Investment Plans

- Money Back Policy

- life Insurance plans

- Savings Calculator

- life Insurance

- Gratuity Calculator

- Zero Cost Term Insurance

- critical illness insurance

- Whole Life Insurance

- benefits of term insurance

- types of life insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- child savings plan

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Saving Schemes

- Child Education Planner

1. Provided all due premiums have been paid and the policy is in force.

3. The above tax benefits are subject to conditions specified u/s 80C and u/s 10(10D) of the Income tax Act, 1961. The afore stated views are based on the current Income-tax law. Tax Laws are also subject to change from time to time. The customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

HDFC SL YoungStar Super Premium (Form No. P 501 UIN : 101L068V03) is a Unit Linked Non Participating Life Insurance Plan. Life Insurance Coverage is available in this product.

HDFC Life YoungStar Udaan (101N099V04) is a Non-Linked, Participating, Life Insurance Plan. Life Insurance Coverage is available in this product

^ Save 46,800 on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are a Regular Individual, Fall under 30% income tax slab having taxable income less than Rs. 50 lakh and Opt for Old tax regime.

#Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions.

Tax Laws are subject to change from time to time.

Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

ARN – ED/03/25/22734