Contact Us

For NRI Customers

(To Buy a Policy)

(If you're our existing customer)

For Online Policy Purchase

(New and Ongoing Applications)

Branch Locator

For Existing Customers

(Issued Policy)

Fund Performance Check

Login

Customers

Partner

Consultants

Partner Portal-FCWhat do you want to do?

Top Selling Plans by HDFC Life Insurance

The effective way to secure your family’s future

-

Key Features*

HDFC Life Click 2 Protect Supreme Plus NEW

UIN: 101N189V01

A plan that provides you varying cover along with comprehensive protection as per your evolving needs *

UIN: 101N189V01

A plan that provides you varying cover along with comprehensive protection as per your evolving needs *

- Just ₹19/day for peace of mind with HDFC Life. Start early, save more

- 15% Online Discount for Females

- Life Cover with Wellness Benefits

- Just ₹19/day for peace of mind with HDFC Life. Start early, save more

- 15% Online Discount for Females

- Life Cover with Wellness Benefits

Term Plan -

Key Features*

HDFC Life Sanchay Plus TRENDING

UIN: 101N134V26

Looking for safe financial instrument which provides alternate source of income

UIN: 101N134V26

Looking for safe financial instrument which provides alternate source of income

- Guaranteed** Income4 for period of 25 or 30 years

- Get Back Premiums as Guaranteed** Lumpsum Benefit4 on maturity

- Life Cover to protect your family

- Guaranteed1 Income4 for period of 25 or 30 years

- Get Back Premiums as Guaranteed1 Lumpsum Benefit4 on maturity

- Life Cover to protect your family

Savings Plan -

In Unit Linked policies, the investment risk in investment portfolio is borne by the policyholder...

In Unit Linked policies, the investment risk in investment portfolio is borne by the policyholder. The linked insurance products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender or withdraw the monies invested in linked insurance products completely or partially till the end of the fifth year.

Key Features*HDFC Life Sampoorn Nivesh Plus

UIN: 101L180V01

A Unit Linked Non-Participating Individual Life Insurance Savings Plan.

UIN: 101L180V01

A Unit Linked Non-Participating Individual Life Insurance Savings Plan.

- Choose from 13 Funds to optimize your investment returns

- Customize your premium payment options – Single, Limited or Regular

- Choose from 5 convenient Benefit options to customize your payouts

- Choose from 13 Funds to optimize your investment returns

- Customize your premium payment options – Single, Limited or Regular

- Choose from 5 convenient Benefit options to customize your payouts

ULIP Plan -

Key Features*

HDFC Life Smart Pension Plan

UIN: 101L164V08

A Unit Linked, Non-Participating Individual Pension plan that ensures you have a regular income and lead an independent life without compromising the standard of living after you retire.

UIN: 101L164V08

A Unit Linked, Non-Participating Individual Pension plan that ensures you have a regular income and lead an independent life without compromising the standard of living after you retire.

- Avail of Automatic Asset Re-balancing and Systematic Transfer strategies to safeguard your wealth against market volatilities.

- Life insurance cover to the extent of 105% of total Premium(s) paid including top-up premium

- To build a retirement corpus

- Flexibility to alter vesting date and premium payment term

- Loyalty additions15

- Avail of Automatic Asset Re-balancing and Systematic Transfer strategies to safeguard your wealth against market volatilities.

- Life insurance cover to the extent of 105% of total Premium(s) paid including top-up premium

- To build a retirement corpus

- Flexibility to alter vesting date and premium payment term

- Loyalty additions16

New Fund Launch

*T&C Apply.

Life Insurance

Life Insurance is a contract between a life insurance policy holder and an insurance provider. As per the contract the insurance provider promises to pay the beneficiary a sum of money upon the death of the policy holder during a certain period. The contract is applicable only when the policy holder has paid all premiums within the predefined period.

Depending on the contract, the policy holder is also eligible for a sum of money in events of terminal illness or critical illness as per the terms & conditions of the life insurance policy.

Looking to buy a life insurance plan?

- 5 lakh Instant Payout on Claim Intimation36

- Premium Break Benefit29 for up to 12 months

- Special Rates for Salaried & Women28

With so many considerations, let us help you to make easy decisions for your life insurance needs

Need Help to Buy a Right Plan?

Our expert will assist you in buying a right plan for you online.

Reach us between 9 AM - 10 PM IST.

For existing policy related assistance, click here.

A certified expert of HDFC Life will help you.

99.68% Claim Settlement Ratio

For FY 2024-2025

~5 Cr. Number Of Lives Insured

For FY 2024-2025

Disclaimer: By submitting your contact details, you agree to HDFC Life's Privacy Policy and authorize HDFC Life and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase. This will override any HDFC registration made by you. Show Less ...Read More

Thanks for contacting us.

We will get in touch soon.

99.68% Claim Settlement Ratio

For FY 2024-2025

~5 Cr. Number Of Lives Insured

For FY 2024-2025

Types of Life Insurance

Let’s explore the types of life insurance as per your financial needs:

Term Life Insurance

Term insurance is the simplest form of life insurance that provides financial protection against death for a specific period. Since term life insurance is pure life insurance its premiums are affordable. Ideally you should get a term plan as early as possible as its premiums increase with age. Along with your term insurance plan you can avail additional coverage with add-on riders, for example if you want to get critical illness insurance you can get the critical illness rider. You can also opt to get all your premiums back after the term of the policy in case you survive through term insurance with return of premium.

ULIPs

A Unit Linked Insurance Plan (ULIP) is a type of life insurance that combines protection with investment. With a ULIP Plan, you get life coverage and the chance to invest in market-linked options, which can potentially increase your money over time. It also offers tax benefits as per your income tax slab and the flexibility to switch between different investment funds. A ULIP calculator helps you figure out how much coverage you need and how to split your money between insurance and investments.

Endowment Policy

The endowment policy provide guaranteed returns and protection of life insurance. By choosing an endowment plan, you can experience extensive coverage with the opportunity to save regularly. Thus, a policyholder expects to achieve a lump sum once the policy matures. To calculate the final payout of this policy you can use the savings calculator. In case of your sudden death during the policy tenure, your nominee will be eligible for death benefits.

Retirement Plans

A retirement plan or pension plan is an investment plan designed to ensure you’re financially secure when you retire. It lets you invest money while you’re working, building up a savings fund that you can use when you stop working. Investing in a retirement plan is a smart, disciplined way to prepare for a comfortable and worry-free retirement.

Child Plans

Child insurance plan helps secure your child’s financial future by saving for education and marriage costs. Child plans provide maturity benefits when the child turns 18, either as a lump sum or in yearly payments. They also include insurance for parents, offering financial support if the insured parent passes away during the policy period.

Participating Life Insurance Plans

It is a type of savings plans where you invest in a participating plan you will receive dividends and bonuses derived from the profits. These payments are usually made annually. There are several ways in which you can utilize and receive dividends and bonuses if you hold a participating policy:

- When the life insurance company distributes payouts, you will receive them.

- If you have a plan with a due premium amount, use the payouts to pay it.

- Make sure dividends or bonuses are deposited with the insurance company so that interest can be earned on them.

These benefits are in addition to the regular maturity benefits that are guaranteed by the life insurance company. If applicable, some insurers offer terminal bonuses upon maturity along with paid-up additions.

Whole Life Insurance

Whole life insurance offers long-term coverage, providing financial protection for your family up to the age of 100. Often referred to as permanent life insurance, it ensures that your loved ones are financially secure even after you're gone. Additionally, it allows you to plan for your own financial goals. When considering the policy, it's essential to understand the impact of GST on whole life insurance, as it may affect your premiums and overall cost.

Annuity Plans

Annuity plans ensure you get regular income after you retire, helping you build savings for the future. Whether you opt for an immediate annuity plan that starts payments right away or a deferred annuity plan that accumulates value over time, these financial products provide steady payments throughout retirement.

Money back policy

Money Back Policy is a type of life insurance plan that offers both life cover and regular returns during the term of the policy. It combines the benefits of life insurance and investment, providing financial protection along with steady returns at specific intervals.

What are the Benefits of Life Insurance?

Let’s explore the various benefits of life insurance:

Death Benefit

Upon the demise of the life assured the beneficiary of the policy receives a sum of money as the death benefit. Objective of death benefit is to provide financial support to the beneficiary in case of the life assured’s absence.

Tax Saving Benefit

Life insurance is one of the financial tools that offer dual tax benefits. For the premiums you pay, you can avail tax deductions under Section 80C of the Income Tax Act10. Also, the maturity and death benefit are tax-free under Section 10(10D) of the Income Tax Act10. The GST on life insurance premiums has been reduced from 18% to 0%, with the change proposed to be effective from September 22, 2025.

Wealth Creation

There are types of life insurance that help in wealth creation along with financial protection. Unit-linked insurance plans (ULIPs) and endowment plans can help grow your wealth in the long term as per your risk appetite. In the case of ULIPs, returns are linked to the markets and in the case of endowment plans the returns are guaranteed. An investment calculator can help you evaluate the estimated returns of an investment plan like ULIP or endowment plan.

Maturity Benefit

Life insurance plans other than term life insurance offer maturity benefits at the end of the term of the policy. For example, if you get a ULIP for 15 years then at the end of 15 year you will receive the maturity benefit.

Rider Benefit

Riders are add-ons that help enhance the financial protection provided by your base life insurance. You can choose to opt for riders for an additional premium. You can customise your requirements by opting for various riders, such as accidental death rider, waiver of premium rider, accidental disability rider, critical illness rider, etc.

HDFC Life Click 2 Invest

Minimal charges to get the most from your investments

HDFC Life Insurance - Customer Stories!

About HDFC LIFE

HDFC Life is one of India's leading life insurance company offering a range of individual and group insurance solutions that meet your various needs such as Protection, Pension, Savings & Investment, Health and more.

SUPERBRAND FOR THE 10TH TIME

Superbrand 2026

SUM ASSURED

13.8 lakh crore

New Business

BRANCHES

652

Across in India

ASSETS UNDER MANAGEMENT

3.4 Lakh crore+

In FY 24-25

NUMBER OF LIVES INSURED

~5 crore

In FY 24-25

As per HDFC Life Integrated Annual Report FY 2024 - 2025

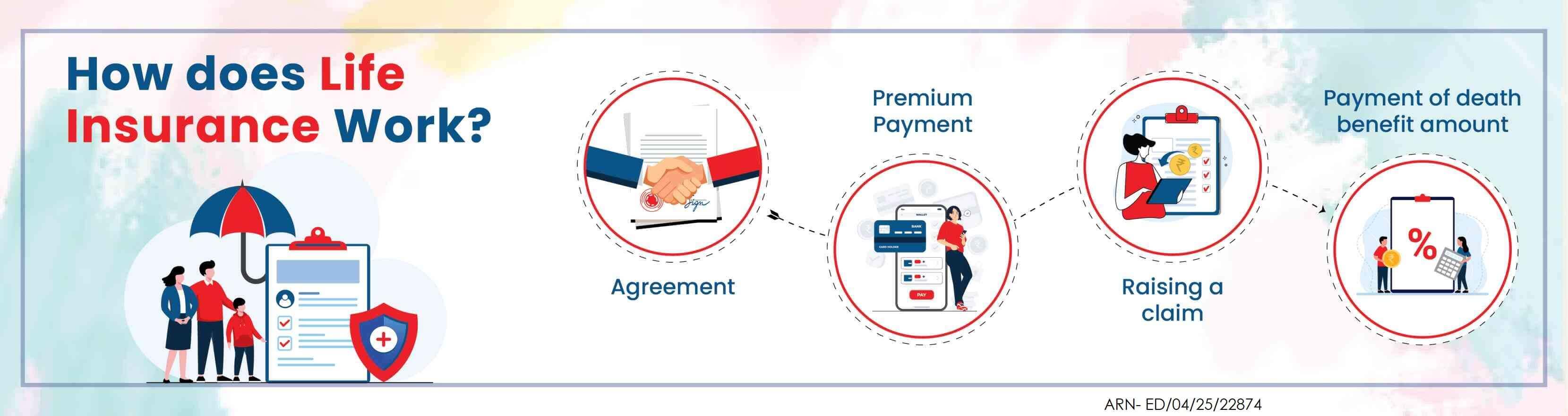

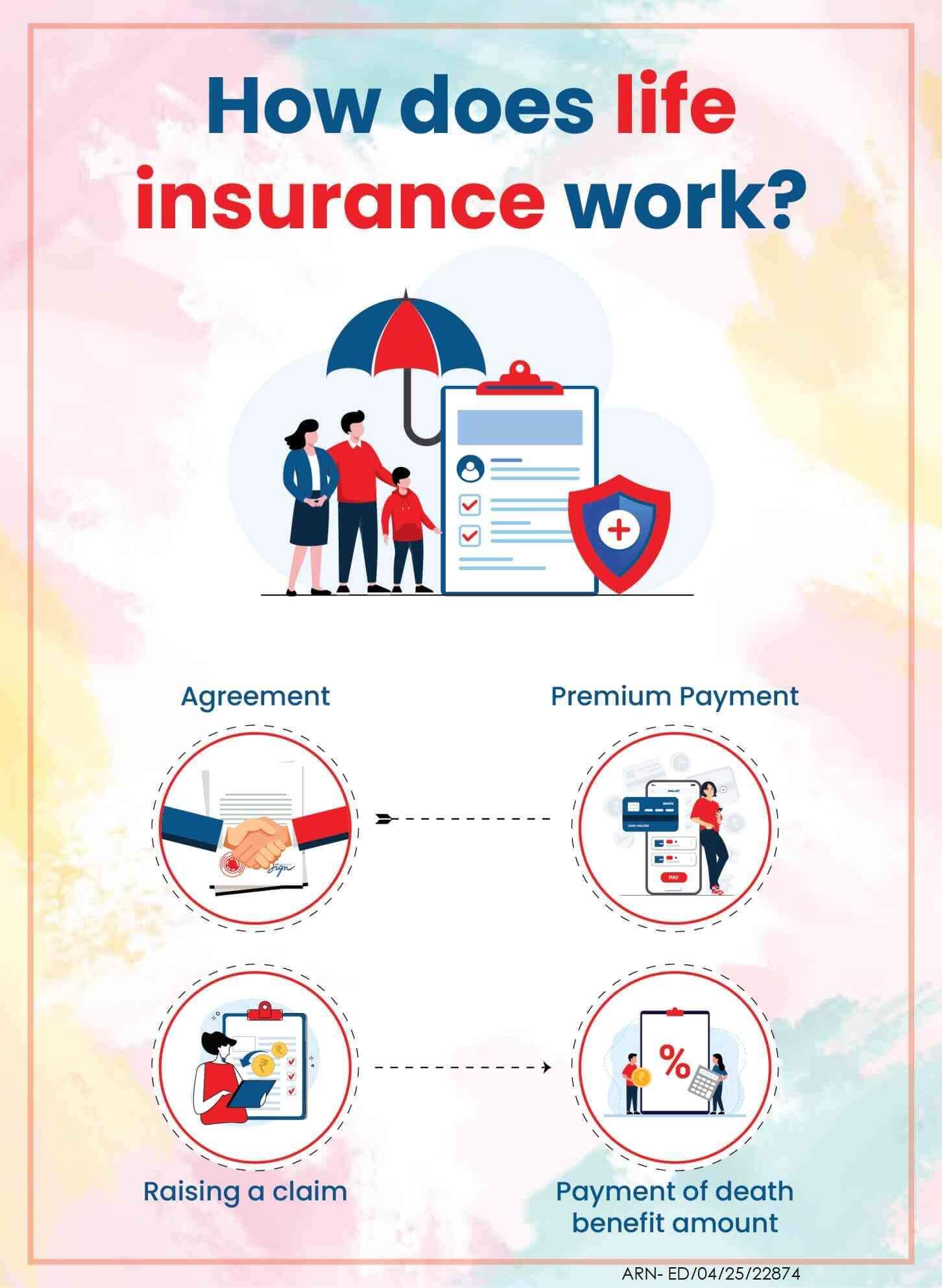

How Does Life Insurance Work?

Life Insurance is a legal contract between the policy holder and the insurer. Here are some aspects that will help you understand life insurance better:

Agreement

Life Insurance is an agreement between the policy holder and an insurance company. The policyholder pays a premium to obtain the desired life cover as per the terms & conditions of the agreement. In case of death of the policyholder the beneficiary receives the death benefit.

...Read More

Premium Payment

The premiums of a life insurance are dependent on a few factors, such as type of life insurance you purchase, term of the policy, premium paying term, your age, your gender, the insurance company selling the policy, and your overall health, wellness, and family history.

...Read More

Raising a claim

As far as the claim is concerned, if the insured passes away during the policy's tenure, a death benefit is paid to the insured's designated nominee in an amount predetermined by the insurer. Making a claim for this is a fairly easy process. A claim can be initiated online, through text message, email, phone at the insurer's call centre, or in person at a branch office. To expedite the claim processing, it is best to notify the insurer as soon as the required paperwork is prepared. Do research on the insurer's claim settlement ratio prior to buying a life insurance policy. This indicates the possibility that your claim will be resolved.

...Read More

Payment of death benefit amount

As per the payout option selected by the policy holder the beneficiary receives the death benefit amount on the demise of the policy holder.

Let’s understand how a life insurance works with the help of an example:

Ravi a 25-year-old health male decides to get a life insurance (HDFC Life Click 2 Protect Supreme Plus (Life option) (UIN:101N189V01)) for a life cover amount of 1 crore till the age of 55 years. As per his age, gender, medical conditions and lifestyle habits the premium amount that he needs to pay is Rs.706 per month for a 1 crore term insurance. In case he dies by the time he turns 60 his wife who is the beneficiary of the life insurance receives the death benefit amount of 1 crore as per the payout option selected at the start of the life insurance.

...Read More

Why should I buy life insurance?

Life insurance is an essential financial instrument as unlike any other investment option it provides a unique benefit of life cover. Let’s deep dive into reasons as to why one should get a life insurance:

Financial security

Life insurance offers an essential benefit of financial security unlike any other investment option. All types of life insurance provide death benefits to the beneficiary in case of death of the policyholder. The death benefit amount helps the beneficiary to take care of the financial needs in the policy holder’s absence.

...Read More

Fulfill financial goals

Along with financial security, life insurance also provides the opportunity to grow your wealth. There are various types of life insurance suitable for every stage of your life. Life insurance can act as an investment plan to fulfill different financial goals such as child’s education, retirement and others.

...Read More

Protection against critical illness

Along with the life cover of your life insurance you can opt for add-on riders such as critical illness to avail additional financial protection in case detected with a critical illness. With a critical illness rider, you can get upfront payout if detected with a critical illness unlike a health insurance where you must claim the cover.

...Read More

Tax savings

If life insurance, you can avail several tax saving benefits under the income tax act, 19611. Premiums paid for life insurance are eligible for tax deductions under section 80C and maturity benefits are tax free under section 10(10D). You claim tax deductions for the premiums paid for critical illness rider under section 80D.

...Read More

Financial protection against liabilities

Liabilities can pose serious financial stress to financial dependents in case of the primary breadwinner’s absence. The death benefit from a life insurance helps the dependents address any liabilities that might come on to them in case of the primary breadwinner’s death.

...Read More

Stress free retirement

Life insurance provides you with the opportunity to invest and build a corpus for your retirement. Pension plans are a type of life insurance that can provide you with a sustained regular income that can help you live a stress-free retirement. If you are behind in retirement planning, start with buying a life insurance plan. Investing in a plan at an early age will let you pay lower premiums. Tools like retirement calculator or pension calculator comes in handy to calculate your monthly pension needs for a stress-free retirement.

Child Plan gives you the opportunity to invest and secure your child’s financial future

...Read More

Important terms related of Life Insurance

An insured is an individual whose life is financially protected with life insurance.

An insurer is an entity that offers financial coverage and bears financial risk in exchange for premium payments. The insurer pays the death benefit in case of the insured’s death

Beneficiary is the person or entity legally designated to receive the insurance benefits, such as the death benefit, upon the insured’s death.

Death benefit is the amount paid to the beneficiary of the life insurance in case of death of the insured.

The premium is the amount the policy holder pays the insurance company in exchange for the life insurance coverage.

Policy tenure is the period during which life insurance offers financial coverage.

Premium paying term is the period for which policy holder pays the premium of the life insurance.

Maturity benefit is the amount an insured receives after the policy tenure.

Riders are additional benefits for enhancing the financial protection of a life insurance.

Claim is the process of intimating the insured’s death to insurer so that the insurer can process the payout of the death benefit to the beneficiary.

Who should buy life insurance?

Life insurance can play a vital role at every stage of your life due to the flexibility it offers in term of benefits:

Young professionals

When you start your first job or early on in your career you have limited financial liabilities and greater risk-taking ability. At this stage with a ULIP you can invest in the market for the long term and grow your investment. Since you are young you should also get a term life insurance for a fixed and affordable premium because at an older age your premiums will be higher.

Parents

Having life insurance to cover your children's expenses in the event of your incapacity is essential if you have young children. ULIPs can help you secure your children's future while also building wealth. The cover includes paying for regular bills, schooling, marriage, and additional costs associated with raising children.

Senior Citizen

Life insurance options like retirement and pension plans help senior citizens build a financial corpus for their post-retirement years. To plan better, individuals can use an annuity calculator to estimate their future payouts. Annuity plans, in particular, offer a steady income stream after retirement, ensuring long-term financial security.

NRI (Non-Resident Indian)

Life insurance for NRI include comprehensive life coverage and assist families with financial support in case of death due to an accident or critical illness. At the same time, life insurance also has benefits of taxes and flexibility in the payment of premiums to policyholders.

Self employed

Life Insurance for self employed lends financial security to the families of the self-employed in case of their death. The death benefit amount covers the cost of immediate business overheads as well as everyday household expenses.

How to select the best life insurance?

Evaluate your financial needs

The first and the most essential step in financial planning is to assess your financial needs that are to be covered with life insurance. Life insurance can cater to multiple financial goals such as financial protection, growth of wealth etc. thus you need to identify the goal that your life insurance will fulfill. For example, if you have considerable financial responsibilities for your dependents then you can consider taking a 2 crore term insurance for enhanced protection.

...Read More

Understand the types of life insurance

Depending on your specific financial need you need to choose the right type of life insurance. Let’s map some of the common financial needs with suitable life insurance:

- Term insurance is for financial protection of your dependents

- ULIP gives you the opportunity to grow your wealth by investing in the markets along with a life cover

- Endowment plan offers you 100% guaranteed** returns on your investment along with a life cover

- Child Plan gives you the opportunity to invest and secure your child’s financial future

- Retirement & pension plan helps you save for your retirement

...Read More

Calculate your premium

Your life insurance premium depends on several factors. Taking all the factors into consideration the insurer decides on the premium amount for the desired life insurance cover. You can use the life insurance calculator to evaluate your life insurance premium.

...Read More

Evaluate the need for riders

To enhance your life insurance cover, you can choose to opt for add-ons or riders catering to specific needs when you buy term insurance. For example, you can choose a critical illness rider along with your base life insurance so that you are covered against critical illnesses.

...Read More

Evaluate life insurance providers

There are several life insurance providers in India and selecting the best life insurance plan be challenging. While selecting you can check the life insurance provider’s reputation and other aspects that help you build trust.

...Read More

Check claim settlement ratio

Life insurance company’s individual death claim settlement ratio tells you how likely they are to settle your nominee’s claim. You can check a company’s Individual Death Claim Settlement Ratio online. HDFC Life has an Individual Death Claim Settlement Ratio (CSR) of 99.68%.##

...Read More

Claim Track Record - FY 2024-2025

We have honoured 99.68% Individual Claims!*

At HDFC Life, we ensure a hassle-free and uniquely sensitive claim experience. We are always doing our utmost to enable faster settlement of claims, with our Claim Settlement Ratio reflecting this assurance.

Same Day Claims Processing

Individual claims processed within 24 business hours for all claims over 3 years from the date of inception**.

*Individual death claim settlement ratio by number of policies as per audited annual statistics for FY 2024-25.

Check last 5 years claims trend.**Provided we have received all the relevant and required documents and no further investigation is required. Claim settlement process would be completed within stipulated timelines once the claim request is approved.

Know MoreClaim Settlement Ratio

( Percentage and average claim settlement time )

Average Claim settlement time: 2 days

Settled Claim Amount: 2,060.27 Cr

Average Claim settlement time: 3 days

Settled Claim Amount: 1,584.00 Cr

Average Claim settlement time: 2 days

Settled Claim Amount: 1,389.90 Cr

Average Claim settlement time: 4 days

Settled Claim Amount: 2,608.22 Cr

Average Claim settlement time: 6 days

Settled Claim Amount: 1,037.23 Cr

Average TAT for all Individual death claims settled for the financial Year

One Day Claim Settlement

is available for the following

- Cumulative claim amount on all policies up to ₹2 crores

- 1 day claim settlement is exclusively available for policies bought online

- Claim does not require field investigation

- All requisite documents # submitted by the nominee before 3 PM on a working day at HDFC Life branches. Intimations beyond 3 PM will be taken up the next business day

- HDFC Life will pay an interest on your death claim amount for every day of delay beyond one working day

T&C Apply

1. For all claims fulfilling above mentioned conditions, provided we receive all the required documents, the claim will be processed within one working day and decision will be communicated accordingly.

2. Investigation / Open title / Rival / Court involved Claims are excluded.

3. Policy duration at the time of event is at least >=3 years.

4. Saturday, Sunday, public festivals and non-NAV days (for ULIP) are excluded (not treated as a working day) ^Interest rate would be at 6.25%per annum.

#Documentation Details

Claim form, Nominee photograph, Pan card copy, Identity and Address proof of nominee. (If nominee is minor, documents of appointee to be submitted). Death certificate issued by competent authority for death registrations. Medical cause of death certificate. Cancelled cheque/copy with the name of nominee/appointee mentioned on it as per the passbook of the nominee/appointee. Past & current complete medical records including discharge/death summary, indoor case papers, investigation reports, consultation notes. In case of an accidental death, additional documents will be required. Post Mortem Report, Panchnama, Police Inquest report, First/Final Information report, Viscera/Chemical Analysis report.

How much life insurance do I need?

There are several ways to assess the amount of life insurance you need. Here’s a simple and easy to remember method know as D.I.M.E. that can be applied by all to assess amount of life insurance:

Debt

First you need to account for debt that you have incurred and haven’t yet paid off. These can include auto loans, personal loans, credit card payment, and any other loans. The death benefit for your life insurance needs to cover your debts so that these don’t become a burden for your family in your absence.

...Read More

Income

In case you are the primary earning member of your family then their livelihood is dependent on your income. In case of the death of the primary earning member the family can come under tremendous financial distress. As a thumb rule you should opt for a life insurance with a death benefit of 10-15 times of your annual income so that it can cover for your family’s living expenses.

...Read More

Mortgage

Payment towards mortgages or home loans is a significant portion of monthly expenses. In the case of absence of the primary earner the burden of paying off a large number of mortgages can cause financial distress on dependents. Thus, the death benefit opted for should be enough to cover of the loan amount.

...Read More

Education

As parents we don’t want to compromise on our child’s education and want to provide the best for them. With rising education inflation, child education proves to be a major expense. In the event of your absence and a lack of life insurance your child’s goals might get compromised. Avoid such a scenario you should let a life insurance with a death benefit enough to cover your child’s goals.

...Read More

What are the factors that affect life insurance premiums?

Life cover amount

The premium amount depends on the life cover amount you have opted for. The higher the life cover amount, the higher will be your premium.

Age

It is always advised that you should get life insurance as soon as you can since premiums increase with age. The older you are the higher the risk of covering you leading to a higher premium.

Gender

Men and women are biologically different, have different life expectancies and have different risks associated thus the premiums are different for men and women.

Policy term

The longer you decide to financially cover yourself with life insurance the higher will be its premium.

Premium paying term

The time for which you decide to pay your premium also plays a factor in the premium amount. There are options such as limited pay making it possible to pay your entire premium before the term of the policy ends.

Lifestyle

Your lifestyle choices, such as smoking or drinking, can also impact your life insurance premiums. Prasad is a 25 years old male who doesn't smoke and decides to purchase a Rs. 50 Lakh term insurance26 from HDFC Life for 30 years at a monthly premium of Rs.50625. If you are a smoker, your premium will certainly be higher, influenced by several factors.

Medical history

Your medical history gives an indication as to how risky it is to financially cover you which in turn impacts the life insurance premium amount.

Occupation

Some of our occupations tend to be riskier to financial cover than others thus impact life insurance premiums.

How to buy life insurance?

Buying a life insurance primarily consist of 4 steps -

Estimate your needs and budget

The first step is to identify the financial need you want to address such as financial protection, child’s education, build your retirement corpus etc. Then you need to evaluate the amount required to meet your financial need and finally the estimate the premium amount that you will be able to pay for your desired life insurance.

...Read More

Choose a suitable type of life insurance

As per your financial goals you need to choose the life insurance:

- Term insurance: Financial protection of your dependents

- ULIP: Grow your wealth along with a life cover

- Endowment plan: Guaranteed returns along with a life cover

- Child Plan: Secure your child’s financial future

- Retirement & pension plan: Build your retirement corpus

...Read More

Compare quotes from life insurance companies

You can generate quotes from multiple life insurance companies and then decide as per what suits you the best. You can get in touch with our insurance advisor for better understanding of our products and offering and choose the one that suits your financial needs.

...Read More

Complete the application process

Once you have decided the type of life insurance and the company you need to –

- Provide the required information accurately

- If needed undergo medical examination

- Submit necessary documents

- Review your life insurance details

- Make the payment

...Read More

What are the documents required to buy life insurance?

To buy a life insurance you will need to submit the following documents:

Proof of Identity

Proof of Residence

Birth Certificate

PAN Card

Income Tax Returns

Medical Records from the Past

Why should I buy life insurance online?

Buying life insurance online is easy and here is why you should opt to buy life insurance online:

Exclusive discounts

By buying digital life insurance online you might be eligible for additional online discounts on your premiums.

Convenient

You can buy life insurance from the comfort and convenience of your home. You can use easy to use calculators like the term insurance calculator to get an estimate of your premium amount.

Safe and secured

Any information regarding your life insurance is available online on the life insurance company’s website and mobile app. Also, the entire process till the payment is on the official company platform making it secure.

What are the payout options available with HDFC Life Insurance?

HDFC Life Insurance provides flexible payout options catering to the needs of respective policyholders. Here are the different payout options:

Income

This payout option offers a monthly payout in installments to take care of the monthly financial needs of the family.

Lump sum

Under this option, comprehensive life coverage is paid out in fixed amounts to the nominee during the sudden demise of the policyholder at unexpected times. You can use a lumpsum calculator to estimate the payout amount.

Increasing Income

This option is like the income option except that the monthly installment keeps increasing by a fixed amount every year.

Lump Sum Plus Income

This option is a combination of the income and lump sum options.

How to file a life insurance claim?

Filing a claim can be challenging considering the emotional distress the beneficiary could be in due to the loss of the insured. Here are the steps to file a claim:

Inform the life insurance company

The beneficiary should reach out to the life insurance provider and provide necessary information through official modes of communication.

...Read More

Obtain and complete the claim form

To officially raise a claim the beneficiary will need to obtain the claim form from the life insurance company’s website or branch. Then the form should be completely filled with the required information.

...Read More

Submit and track the claim

The claim form along with the required documents needs to be submitted to the life insurance company to process the claim. Post submission the status of the claim can be tracked through official modes of communication.

...Read More

What are the documents required to file a life insurance claim?

Submitting the following documents along with the claim form is a vital step in the claim settlement process:

Photo Identification Proof

Address Proof

Details of Your Bank Account

Death Certificate

Policy Documents

Proof of Legal Title to Claim Proceeds

Medical Records

Bank Discharge Form

FAQ's about Life Insurance

How to choose the right sum assured under life insurance?

It can be done by forecasting future earnings, making a note of future annual expenses, calculating the future costs of financial goals such as children's education and marriage, and adding liabilities. Or you can also multiply your annual income by 10 for a rough idea.

What are life insurance quotes?

You can find out the estimated cost of a potential policy with an insurance quote. It also contains other important details regarding the policy and the things that are covered.

Using the information on your insurance quote, you can determine that policy offers the best value by comparing it to quotes from other policies for the same or comparable coverage. If the policy is term life insurance, the term limits and coverage limits are usually included in life insurance quotes.

Who needs life insurance the most?

Anyone who has dependents to support and is an income earner for the household needs Life Insurance. Your loved ones who depend on your income would be negatively impacted by your untimely passing and the subsequent loss of income. A life insurance policy makes sure their financial future is protected through the payouts by the insurer in case of the insured person's death.

If you own a business, it helps to have life cover so that the business is not negatively impacted by your passing. It can help to sustain it by covering expenses and paying debts till your successor finds their feet in the business.

If you have taken loans during your lifetime, having a life cover will help your family to pay off your debts with the help of the payouts received against the insurance claim.

What are the types of life insurance plans?

In India, we have a variety of insurance plans to suit every need.

The simplest plans are Term insurance plans, in which there is a death benefit but no maturity benefits. In Term Insurance, the insurer promises to pay the beneficiaries a lump sum amount in the event of the insured person's death. Some Term insurance plans nowadays also offer to give back the premiums you pay on surviving the policy period; these are called Term insurance with return of premium plans.

Other life insurance plans in India include Endowment Insurance plans, Unit Linked Insurance Plans (ULIPs), Moneyback Insurance plans, Whole life insurance plans, Group life insurance, Child Insurance Plans and Retirement Insurance Plans.

What are the factors that affect life insurance premium?

The main factor influencing the life insurance premiums of a policyholder is their age. Younger persons are generally considered healthy and unlikely to contract illnesses or pass away suddenly; hence younger people attract lower insurance premiums.

Gender is another factor that determines the premium amount as proven scientific and statistical evidence points to women likely to live an average of 5 years more than men. Consequently, since women are perceived to avail of policies for a longer tenure, they can avail of lower premiums.

Medical records play a crucial factor in deciding the premium as well, since life insurance policies typically come with an underwriting process that includes a thorough medical exam of the policyholder. Any red flags concerning physical health and potential illnesses can have an impact on the amount of premium to be paid.

Family history is important as certain hereditary diseases could be passed on to the policyholder. The family's medical history plays a part in revealing these patterns and can influence the amount of premium.

Smoking and drinking, which are considered harmful to health and can impact your longevity, also influence the amount of premium to be paid. Professions and lifestyles can also impact the life insurance premium. Persons working in professions considered dangerous like mining, oil and gas and fisheries, and indulging in risk taking activities like mountaineering can attract higher premiums.

What types of death are not covered by life insurance?

While deaths due to accidents are covered by life insurance, there are certain exceptions. Accidental death if the insured is involved in any criminal activity or if death occurs due to intoxication or drugs are not covered by term life insurance plans. Accidental deaths while the insured was engaged in adventure sports like sky diving and bungee jumping are also not covered by such plans.

Death benefits for suicide are generally made at the discretion of insurance companies. Usually, beneficiaries are entitled to 80 per cent of amount accumulated from premiums paid in case of a non-linked plan, and 100 per cent in the case of a linked plan, if the insured dies by suicide within the initial 12 months.

Term insurance plans do not cover death occurring from self-inflicted injuries, or due to illnesses like sexually transmitted diseases like HIV/AIDS.

Death due to alcohol or drug abuse is also not covered by term plans, nor is homicide where the policy holder is murdered by the nominee for money. Death due to an existing illness that has not been disclosed at the time of purchasing the plan is also not covered by term life insurance plans. Death caused by natural disasters like tsunami, earthquake, floods etc is not covered by term insurance, unless the policy holder has opted for riders for that purpose.

What are the uses of life insurance?

It offers benefits like tax benefits, financial security, financial coverage for families, wealth creation, retirement planning, the accomplishment of future goals, and much more.

Learn more about Life Insurance Products

What are the 3 benefits of term insurance?

The benefits of term insurance are affordable premiums, financial protection for your loved ones and tax exemptions.

Is it good to have a term insurance plan?

It is possible for a family to achieve their financial goals as well as meet their day-to-day expenses by purchasing a term insurance policy. The dependants of the insured do not suffer financially if a term insurance of adequate life cover is in place. You can opt for the best term insurance plan for 1 crore, like HDFC Life Click 2 Protect Supreme Plus to ensure your family’s future against any uncertainty.

Is accidental death covered in term insurance?

Accidental death is covered by a term insurance policy. The sum assured on a term insurance policy will pay out no matter what the cause of death is, whether it is a result of a health issue or an accident.

What happens at the end of a term life insurance policy?

When a term life insurance policy expires, the policyholder does not have to take any action. A policyholder will be notified that the policy is no longer in effect; no premiums are payable, and no death benefits would be paid out.

What are the Death Benefits under Term life Insurance?

Death Benefits are paid to your dependents in a lump sum payment if you die unexpectedly. But few term insurance policies do provide a monthly income along with a lump sum amount to assist with regular expenses.

What is Term Insurance Premium?

This is the sum of money you pay the insurance company in exchange for financial security. A monthly, semi-annual, or annual premium payment can be made.

- Savings

- ULIP

- Retirement

- Child

What is a savings insurance plan?

A savings insurance plan is a type of insurance policy that allows you to invest for a financially secure future. These plans help you develop a disciplined habit of saving and aid to achieve your future goals. Crucially, they offer life coverage for the policyholder, securing the family’s financial future.

Why should you invest in a savings insurance plan?

If you are risk-averse but want to build a corpus for your future financial goals, a savings insurance plan like the HDFC Life Guaranteed Income Insurance Plan8 could be ideal. These policies offer life coverage, protecting your loved ones and providing them with financial support at a difficult time. Additionally, it helps you develop a disciplined saving scheme and builds up funds for your future.

What are the benefits of a savings insurance plan?

When you purchase a savings insurance policy like HDFC Life Sanchay Par Advantage9, you benefit from financial stability as it provides guaranteed returns to help you meet future expenses. The plan also offers life coverage for the policyholder, providing your loved ones with a financial safety net if anything happens to you. These plans are also eligible for tax savings under the Income Tax Act of 1961#.

What are the tax benefits of a savings insurance plan?

Savings insurance plans offer tax benefits under Section 80C# and Section 10(10D)# of the Income Tax Act. The premium amount is eligible for a deduction of up to Rs. 1, 50,000 per year from your taxable income under Section 80C#. Your premium should be less than 10% of the sum assured to be eligible for the tax benefit. Under Section 10(10D), the maturity and insurance benefits payable when the policy ends are tax-free.

Should I pick a long-term or short-term savings investment plan?

The savings investment plan term you select should depend on your goal. If you’re saving up for a short-term goal, such as a holiday abroad or home renovations, you can opt for a short-term plan. However, if you’re saving up to send your child to college, purchase a home, or for retirement, you should opt for a long-term plan.

Why choose a savings plan from HDFC Life?

HDFC Life offers steady returns and a competitive individual death claim settlement ratio, providing financial security to you and your loved ones. We offer multiple plans and customisable options, enabling you to find the ideal savings plan for your financial needs.

Is ULIP tax-free?

Section 80C provides an income-tax deduction for ULIPs, and Section 10(10D) of the Income Tax Act exempts returns from income tax upon maturity. This policy offers a dual benefit.

How much return does ULIP give?

Investing in ULIP can generate high returns if you stay invested for 10 years or more.

Who should invest in ULIP?

ULIPs are best suited for people who have a long-term financial plan that includes both wealth creation and insurance.

What are the common features of ULIPs?

ULIPs share four common features:

Option for Partial Withdrawal

Option for switching funds

Lock-in period required

An alternative long-term investment

What are the different types of ULIPs?

Type |

Risk |

Type of Returns |

Bond funds |

Medium |

Low to medium |

Equity funds |

High |

High |

Cash funds |

Low |

Low |

Balanced |

Medium |

High |

How is ULIP different from traditional plans?

ULIPs have a minimum lock-in period of three to five years, whereas traditional insurance plans are locked in until maturity. In addition, when you only want to insure, you must choose a traditional insurance plan. However, with a ULIP, you can get insurance while also increasing your capital.

Why is a retirement plan important?

Retirement planning not only ensures an additional source of income, but also assists in dealing with medical emergencies, fulfilling life goals, and becoming financially independent. Using a retirement calculator can help you estimate how much you need to save to achieve these goals.

When should I buy a retirement plan?

The answer is simple: as soon as possible. Your twenties are a good time to start saving when you complete your education, start working and earn a pay check. This gives your money more time to grow.

What is annuity?

An annuity is a contract you enter into with an insurance company in which you pay a lump sum or series of payments in exchange for regular payments. The goal is to have a constant source of income, typically during retirement.

What are the types of Pension Plans?

Pension plans can be classified into three types: Defined contribution pensions, Defined benefit pensions, or State pensions.

How is a Pension Plan different from a Term Plan?

Life insurance that provides financial security to your family in your absence is termed term insurance. A pension plan, on the other hand, can replace lost income after 60 or if you retire early.

What are the tax benefits of Pension Plans?

The Income Tax Act, Section 80CCC#, encourages people to invest in pension plans. Pension investments can then be deducted from gross income, and saving taxes.

How much life insurance do you need for a child?

A good life insurance policy should enable parents to build a solid financial corpus that will help secure their child's financial future, such as their child's education, marriage, goals, and so on, in instalments or all at once, as needed.

What is the minimum age for life insurance?

The age range for policyholders to purchase term insurance is 18 to 65. Life cover up to age 99 is also available for those 65 and older.

Is it good to invest in a child plan?

It is good to invest in a child plan as it helps you to meet your children’s goals of higher education by building up a corpus over the years. A plan that matures after a certain period helps children meet their life goals without any worries. A child plan also serves as a blanket that provides financial protection to children in the event of the parent’s death.

What are the types of child plans?

A child plan is a customised investment and insurance option designed to meet a child's financial needs. A child plan has two components: insurance to provide financial protection for the child in the event of the parent's death and investment to meet financial milestones by investing in various instruments.

Why is beneficiary or nominee important in a child plan?

If a policyholder dies while the policy is in effect, the nominee will be entitled to death benefits. These death benefits can be used to cover the expenses of the child or nominee in the absence of the parent.

How can a child insurance policy secure your kid’s future?

A child insurance plan not only protects your child's dreams but also provides you with the financial assistance you need to help them achieve their goals. It's a way to save money for your children's future education costs without having to financially burden yourself.

Here's all you should know about Life Insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- term insurance

- Investment Plans

- savings plan

- ULIP

- retirement plans

- health insurance plans

- child insurance plans

- group insurance plans

- bmi calculator

- compound interest calculator

- term insurance calculator

- what is term insurance

- 2 crore term insurance

- 50 lakhs term insurance

- 5 crore term insurance

- investment plan for 5 years

- investment plan for 10 years

- get pension of 30000 per month

- get pension of 50000 per month

- ULIP Returns in 10 Years

- ULIP Returns in 5 Years

- Investment Calculator

- annuity plans

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- ULIP Calculator

- best investment options

- best investment options in India

- One time investment

- Types of investment

- Safest investment

- Short term investment

- What is investment

- PPF Calculator

- Term Insurance for Housewife

- Money Back Policy

- life Insurance policy

- Zero Cost Term Insurance

- NFO

- critical illness insurance

- Whole Life Insurance

- benefits of term insurance

- types of life insurance

- types of term insurance

- Endowment Policy

- Benefits of Life Insurance

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Saving Schemes

- Ulip for NRI

- Life Insurance for NRI

- Investment Plans for NRI

- Health Insurance of smokers

- Health Insurance of Self employed

- Types of health insurance

- Health Insurance for Women

- Savings Calculator

- what is nominee in insurance

- features of life insurance

- Retirement Planning

- Best Term Insurance Plan for 1 Crore

- features of term insurance

- personal accident insurance

- Annuity Calculator

- Life Insurance Calculator

- Obituary

- Insurance Agent

- Child Education Planner

T&C*

1. Tax benefits are subject to conditions under Section 10 and other provisions of the Income Tax Act, 1961. Tax Laws are subject to change from time to time.

2. This option can be exercised in any policy year greater than 30, but not during the last 5 policy years. This feature is not available if Life Goal or Return of Premium option is selected.

3. Discount is applicable for first year premium only of HDFC Life Click 2 Protect Supreme Plus. 7% discount consists of 5% online discount, 2% existing customer discount.

4. Guaranteed Benefit is paid on survival during policy term provided all due premiums are paid during the premium payment term.

7. Available under Level Cover with Capital Guarantee and Decreasing Cover with Capital Guarantee plan options.

8. HDFC Life Guaranteed Income Insurance Plan UIN: 101N146V05. A Non-Linked, Non-Participating Individual Life Insurance Savings Plan.

9. HDFC Life Sanchay Par Advantage (UIN: 101N136V04), A Non-Linked Participating, Life Insurance Plan coverage is available in this product.

10. Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions. Tax Laws are subject to change from time to time. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

11. 1 to 10% Simple Interest per annum, depending upon the increasing income percentage chosen. Applicable for Early income and income structure.

12. This applies to Income Variant, whereby guaranteed income is paid on survival of Life Assured during the policy term, provided all due premiums are paid during the premium payment term

13. Applicable on choosing a policy term as (100 - age at entry) years.

14. The above premium rates are for a non-smoker healthy male, age is 25, Policy Term 20 year & Premium Paying Term is 20 year. inclusive of 5% online discount (applicable only for 1st year premium) and exclusive of taxes & levies as applicable. HDFC Life Click 2 Protect Supreme Plus (UIN:101N189V01) is a Non-Linked, Non-Participating, Individual, Pure Risk Premium/ Savings Life Insurance Plan. Life Insurance Coverage is available in this product.

15.Loyalty addition would be added to the fund starting from 10 policy anniversary for the other than ‘Single Premium’ policies paying annualized premium of ₹ 1,00,000 at least and for all the Single Premium paying policies.

**Provided all due premiums have been paid and the policy is in force.

*. For more details on other plans, please visit product category page on the website:- www.hdfclife.com

25. The premium amount is exclusive of taxes & levies.

26. HDFC Life Click 2 Protect Supreme Plus (UIN: 101N189V01) is a Non-Linked, Non-Participating, Individual, Pure Risk Premium/ Savings Life Insurance Plan. Life Insurance Coverage is available in this product

##Individual claim settlement ratio by number of policies as per audited annual statistics for FY 24-25

28. HDFC Life Click 2 Protect Supreme Plus (UIN:101N189V01) is a Non-Linked, Non-Participating, Individual, Pure Risk Premium/ Savings Life Insurance Plan. Life Insurance Coverage is available in this product: 10% discount on first year premium would be applicable for only Salaried customers, under Regular Pay & Limited Pay. A 15% discount on the base premium rates will be applicable for female lives.

29. Applicable under HDFC Life Click 2 Protect Supreme Plus if the policy has completed at least five (5) policy years from the risk commencement date and all the due premiums have been received in full and the policy is in force. If the premium break benefit has been exercised in the last 5 policy years, then the next premium break benefit shall not be allowed. The premium break benefit shall not be available during the last policy year of the premium payment term.

36. Applicable for all in force policies after a waiting period of 1 year. Please refer to policy documents for Terms & Conditions

ARN - DM/03/25/22704

get a free quote

get a free quote

get a free quote

get a free quote

Get a Call Back

This service is available between 9 AM - 10 PM IST

Interested in buying insurance plans, then fill the form below to help us call you back. This form is only for exploring insurance plans provided by HDFC Life, for Customer Service queries, please click - Customer Service Queries

Thanks for contacting us.

We will get in touch soon.

Your call is scheduled for , between . You will receive a call from 8291890XXXX. Kindly attend the call. We respect your privacy. We do not spam.

Your call is rescheduled for , between . You will receive a call from 8291890XXXX. Kindly attend the call. We respect your privacy. We do not spam.

Your call is already scheduled for , between . Incase you want to reschedule the call; you can do it using the form above.

We're sorry, but you have reached the maximum number of rescheduling attempts allowed.