What do you want to do?

- ULIP

- What are ULIPS?

- How does a ULIP work?

- Benefits of ULIP Plans

- Why Invest in ULIPs?

- ULIP for Investors

- Check ULIP Plans

- How to Maximise Returns from a ULIP?

- ULIP Charges

- Best ULIP Plans in India 2025

- How to Choose the Best ULIP Plans in India?

- Riders Available with ULIP Plans

- ULIP Terminologies

- Ulip Plans - FAQ's

- Talk to an Advisor

- Articles on ULIP's

- Popular Searches

- Disclaimers

What are ULIPs (Unit Linked Insurance Plans)?

A ULIP (Unit Linked Insurance Plan) is a financial product that combines the benefits of life insurance and investment. A portion of your premium is used to provide life insurance coverage for your loved ones, while the rest is invested in market-linked funds of your choice. This dual benefit makes ULIP an ideal way to protect your family's financial future and build long-term wealth to achieve goals like retirement or a child's education, all within one plan.

...Read More

How does a ULIP work?

A ULIP is a unique financial product that provides the dual benefit of life insurance and investment growth. It does this by dividing your single premium payment into two distinct parts.

Premium Allocation:

When you pay your premium towward ULIP, a portion of it goes towards your life insurance cover (also known as the sum assured). The remaining, and major, portion is invested in market-linked funds chosen by you. This is the foundation of a ULIP’s dual benefit.

The Investment Process

The amount allocated for investment is used to buy units in your chosen fund. The price of a single unit is called the Net Asset Value (NAV), which fluctuates daily with market performance.

Your total fund value at any given time is calculated by multiplying the number of units you hold by the current NAV. This value will grow or fall depending on the market’s performance.

The Dual Benefit

As your ULIP policy continues, you receive two simultaneous benefits:

Financial Security: Your family is protected by the life insurance cover. In case of your unfortunate demise, they will receive a death benefit, which is the higher of the sum assured or your total fund value.

Wealth Creation: Your fund value has the potential to grow over the long term, helping you achieve financial goals like a child's education or a comfortable retirement.

A Real-Life Scenario

To better understand how a ULIP works, let's look at a simple example.

Imagine Priya, a 30-year-old, invests in a ULIP for 20 years to save for her daughter's higher education.

Scenario 1: In case of an unfortunate event

In case of an unfortunate event If Priya passes away during the policy term, her daughter will receive a death benefit, which is the higher of the sum assured or the fund value. This ensures her daughter's education is financially secure, regardless of the policy's market performance at that time.

Scenario 2: On maturity

If Priya survives the entire ULIP policy term, she will receive the accumulated fund value. The maturity benefit can then be used to fund her daughter’s education, as originally planned.

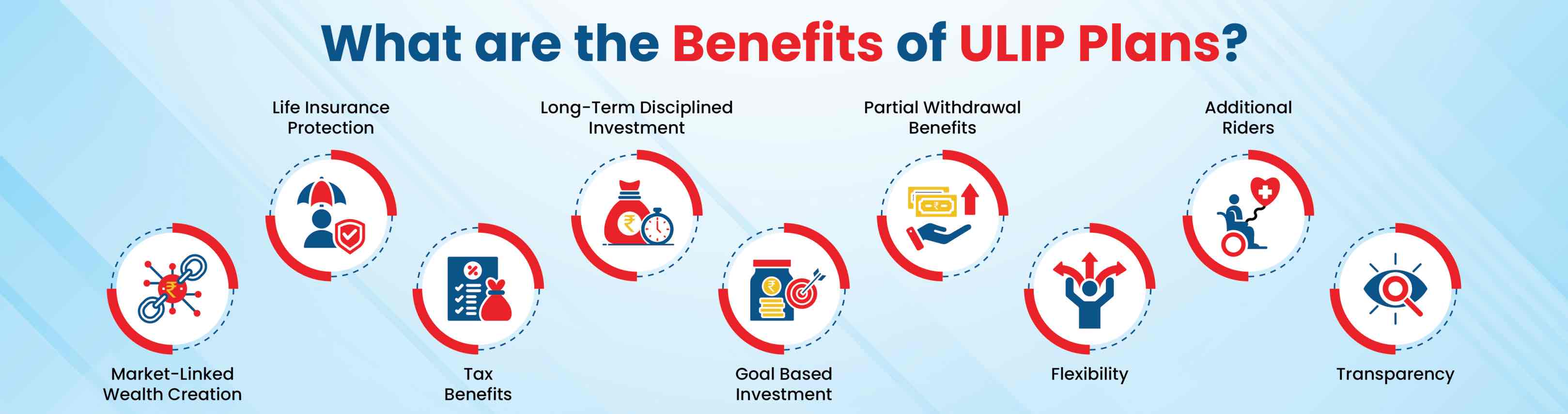

What are the Benefits of ULIP Plans?

Here is the breakdown of the primary benefits of ULIP plans:

Market-linked wealth creation

ULIPs give you the opportunity to invest in different types of funds – equity, debt and hybrid as per your risk appetite and personal financial goals. With ULIPs you can take advantage of the power of compounding to create wealth over time.

Life insurance protection

If the policyholder passes away during the policy term, the beneficiaries receive the sum assured or the fund value, whichever is higher. The family feels financially secure with this payout.

Tax Benefits

ULIPs being a life insurance product helps you save tax on the premiums you have paid under section 80C, get tax-free maturity benefit under Section 10(10D)3 subject to the conditions as prescribed and switch funds tax-free.

Long-term Disciplined Investment

ULIPs are designed for long-term investments with a lock-in period of 5 years. Investing regularly and for a longer time horizon (5+ years) protects your investment from the market ups and downs to eventually generate high returns.

Goal Based Investment

ULIPs are an effective financial instrument to save for your financial goals – child’s education, retirement planning, buying a home etc.

Partial Withdrawal Benefits

ULIPs allow partial withdrawal after the 5-year lock-in period, providing easy access to cash during emergencies. However, there is a cap on the withdrawal based on the fund value or the policy terms and conditions.

Flexibility

ULIP plans offer a wide range of flexibility in terms of – fund switches (to adapt to changing market conditions), premium redirections, top-ups (to increase your contributions). These inherent features make ULIP a very customisable financial product.

Additional Riders

To enhance the financial protection of ULIPs you can choose to opt for riders such as critical illness rider, waiver of premium rider (include for child plans), live well rider etc.

Transparency

You can easily keep track of your fund performance, NAV and other policy details of your ULIP.

Why Invest in ULIPs?

Investing in ULIPs offers a powerful combination of wealth creation and financial security, making them an excellent choice for achieving long-term goals. Here’s why you should consider a ULIP:

Dual Benefits: Life Cover + Investment:

A ULIP is a single plan that combines life insurance and market-linked investment. This means your family is financially protected while your money has the opportunity to grow.

Tax Advantages:

Enjoy benefits under three distinct tax sections with a ULIP. Your premiums may be eligible for deductions under Section 80C, while the maturity amount and death benefit are tax-exempt under Section 10(10D), subject to certain conditions. You can also switch funds within your plan without capital gains tax.

Flexibility:

ULIPs give you control. You can switch between different fund options to adapt to market conditions and your financial goals. After the 5-year lock-in period, you can also make partial withdrawals to meet financial emergencies.

Long-Term Wealth Creation:

With its built-in discipline and compounding potential, a ULIP is designed for long-term growth. It's an ideal instrument for funding major life goals, such as retirement, a child's education, or buying a home.

Transparency:

As a policyholder, you have full transparency. You can regularly track your fund's performance, charges, and Net Asset Value (NAV), empowering you to make informed decisions about your investment.

Who should invest in a ULIP Plan?

ULIPs are a powerful financial instrument, but they are not for everyone. They are best suited for individuals with specific financial goals and a long-term investment mindset.

Individuals with a Medium to Long-Term Investment Horizon:

ULIPs have a lock-in period of 5 years, which makes them ideal if you're saving for long-term goals like a child's higher education, a down payment on a house, or retirement. The long-term nature helps your investment grow through compounding while riding out market volatility.

Individuals with Varying Risk Profiles:

ULIPs offer a range of fund options (equity, debt, and hybrid), allowing you to align your investment strategy with your personal risk appetite. This makes ULIPs suitable for investors who are either conservative or aggressive in their approach.

Investors across Different Life Stages:

A ULIP can serve different purposes at different points in your life. A young professional can use it to create a foundational corpus, a parent can use it to save for their child’s future, and a mature individual can use it to build a retirement fund, and all while being protected by life insurance.

How to Maximise Returns from a ULIP?

A ULIP is a long-term investment, and the key to maximising its returns lies in a proactive, disciplined approach. By following these smart strategies, you can significantly enhance your fund's growth over time.

Start Early and Stay Invested:

The earlier you start, the more time your money has to grow. ULIPs are designed for long-term wealth creation. The 5-year lock-in period and the benefit of compounding can help your money multiply exponentially over a 10, 15, or 20-year period. By staying invested for the full term, you allow your funds to ride out short-term market fluctuations and reap the full benefits of long-term growth.

Master the Power of Fund Management:

A major advantage of a ULIP is the control it gives you over your investments. Take advantage of the flexibility to:

Switch Funds: You can move your existing investments between equity, debt, and balanced funds based on your risk appetite and market conditions. For example, you can switch to debt funds during market volatility to protect your gains and move back to equity when the market is favorable.

Redirect Premiums: This feature allows you to change the allocation of your future premiums to a different fund, without touching your existing fund value. This is perfect for adapting your strategy as you age or as market dynamics shift.

Invest consistently and Consider Top-ups:

Regular premium payments are the foundation of a disciplined savings plan. By investing consistently, you benefit from rupee cost averaging, which helps lower the average cost of your units over time. Additionally, most ULIP Plans allow you to make top-up premiums. This feature is perfect for investing any bonus or lump sum you receive, giving your fund a significant boost.

Review Your Portfolio Regularly:

To ensure your ULIP Plan is aligned with your financial goals, it's essential to regularly monitor its performance. Reviewing your fund's NAV and market trends will help you make informed decisions, whether it's switching funds, redirecting premiums, or simply staying the course. This active management is key to maximizing your returns.

What are the Types of Charges in ULIP?

Several charges are associated with ULIP that impact the amount invested and reduce the overall returns.

Premium Allocation Charges

In a ULIP, this charge is collected upfront at the time of policy purchase. For example, if your investment is ₹2.00 lakhs and the premium allocation charges are 3% (₹6,000), then only ₹1.94 lakhs will be invested.

...Read More

Policy Administration Charges

Policy administration charges are collected monthly and deducted from the fund value. Assume the charges are Rs. 500 monthly for a 20-year plan. It will amount to Rs. 1,20,000 over 20 years, and your fund value is reduced to that extent.

...Read More

Fund Management Charges

Fund management charges are currently capped at 1.35% per annum of the fund value. A Rs. 2.00 lakh fund will have fund management charges of Rs. 2700/-, which will be deducted annually from your fund value.

...Read More

Mortality Charges

This fee is for providing life cover and depends on the age of the investor and the sum assured. It is collected monthly from your fund value.

...Read More

Fund Switching Charges

ULIP allow switching between funds. Charges are collected when the investor switches from one fund to another within the same group. These are nominal and deducted from the fund value.

...Read More

Partial Withdrawal Charges

Charges are collected for the premature withdrawal of some units.

...Read More

Since the charges collected reduce the overall returns to a large extent, it is recommended to invest in ULIP plans with nominal changes. Even a 1% charge can lead to lakhs of rupees over 20 years.

Best ULIP Plans in India 2025

Product (UIN) |

Fund Options |

Investment Boosters |

Charges & Fee Highlights |

Protection & Coverage Highlights |

Maturity / Tax Benefits |

Action |

HDFC Life Click 2 Wealth (101L133V03) |

18 funds |

1% of annual premium added to fund (first 5 years) |

No premium allocation or policy admin charges. ROMC (return of mortality charge) on Premium Waiver option |

Premium waiver; Golden Years cover up to 99 yrs |

Tax-free u/s 10(10D) |

|

HDFC Life Sampoorn Nivesh Plus (101L180V01) |

11 funds |

Loyalty Additions from year 10 |

Lower premium allocation for higher investments |

5 coverage benefit options (incl. income & waiver) |

Standard ULIP tax treatment |

|

HDFC Life Click 2 Invest (101L178V01) |

12 funds |

Loyalty Additions every 5 yrs (from year 10) |

Zero Allocation Charges |

Optional waiver of premium; multiple death benefit options |

Tax-free u/s 10(10D) |

|

HDFC Smart Protect Plan (101L175V09) |

12 funds |

Refunds of charges (mortality, allocation, FMC, etc.) |

Charges are refunded partially/fully after certain years |

High cover (up to 100× premium); Decreasing Cover options |

Capital guarantee on maturity |

|

Fund Switching Options:

All HDFC Life ULIP plans offer unlimited free fund switches, allowing you to seamlessly shift between equity, debt, and hybrid funds based on your market outlook and risk appetite.

Premium Payment Options:

Choose a premium payment mode that suits your financial planning. HDFC Life ULIP plans offer:

1. Regular Pay – Pay premiums throughout the policy term

2. Single Pay – One-time lump sum payment

3. Limited Pay – Pay for a fixed period while enjoying full policy benefits

How to Choose the Best ULIP Plans in India?

ULIP plans are popular among individuals who prefer both life cover and investment aspects included in a single plan. With so many plans available in India, you should consider the following factors to choose the best ULIP plan that suits your requirements.

Understanding financial goals and risk appetite

- Define your goal :

Why are you saving/investing? – Wealth creation, child’s education, retirement, tax saving, life cover, or buying your dream home. With a ULIP, defining your goals helps you choose a suitable tenure and the right mix of funds.

- Assess your risk appetite :

You can choose funds basis your risk tolerance:

- Equity fund – High return potential and high risk

- Hybrid fund – Moderate return potential and Moderate risk

- Debt fund – Low return potential and Low risk

Check fund options and performance

Choosing suitable funds is a critical step to invest in ULIPs. ULIPs offer diverse fund choices like equity funds, debt funds and balanced funds. To get a better understanding of the fund’s performance it is recommended to check the funds past 5 and 10 year returns. For example, HDFC Life Discovery Fund (SFIN: ULIP06618/01/18DiscvryFnd101) available with HDFC Life ULIPs has delivered returns of 28.99%** in the past 5 years (as on 29th August,2025). The fund’s performance also depends on the expertise of the fund manger managing the fund, so you can check for the fund managers experience and background.

Low charges and fees

ULIPs come with various charges and fees impacting your returns. You should choose ULIPs with minimal charges. The charges are:

- Premium allocation :

Deducted from your premium before it gets invested. With HDFC Life Sampoorn Nivesh Plus you can reduce your premium allocation charges by investing at least Rs.1lakh (regular & limited pay option)

- Policy administration :

Charged for policy maintenance

- Fund management charges :

This goes towards the management of your funds. It is a certain percentage of your fund value.

- Mortality charges :

Goes towards providing life cover

- Surrender charges :

Charged if your withdraw before the your lock-in period

- Fund switching charges :

Charged for switching funds beyond the permissible number of switches.

- Top-up charges :

Charged in case you want to invest additional amount

How to Buy Best ULIP Plan Online?

To buy ULIP online, follow the steps given below:

-

01

Step 1

Access the official website of the insurer.

-

02

Step 2

Select a plan that aligns with your requirements from the dropdown. -

03

Step 3

Choose the ULIP policy term and the premium amount that fits your pocket.

-

04

Step 4

You will be directed to the payments page.

-

05

Step 5

Choose the payment mode.

-

06

Step 6

Make the payment to complete the transaction.

Riders Available with ULIP Plans

Riders add more bang for your buck.

HDFC Life Income Benefit on Accidental Disability Rider – Linked

UIN: 101A038V01

A Linked, Non-Participating Pure Risk Premium, Individual Life rider where you can get additional income benefits over and above your Sum Assured in the event of total permanent disability due to an accident.

HDFC Life Protect Plus Rider – Linked

UIN: 101A037V01

A Linked, Non-Participating Pure Risk Premium, Individual Life/Health rider where you can get protected with a proportion of Rider Sum Assured in case of accidental death or partial/total disability due to accident or diagnosed with Cancer.

HDFC Life Health Plus Rider – Linked

UIN: 101A034V01

A Linked, Non-Participating Savings/Pure Risk Premium, Individual Health rider where you can get lump sum benefit equivalent to Rider Sum Assured on diagnosis of any of the covered 60 Critical Illnesses or benefit as a proportionate of the Rider Sum Assured on diagnosis of Early Stage Cancer / Major Cancer depending on the plan option chosen.

HDFC Life Waiver of Premium Rider – Linked

UIN: 101A035V01

A Linked, Non-Participating, Individual Pure Risk Premium, Life/Health rider where you can get Waiver of Premium for the base policy premium and premiums of any other additional riders, in case of death, disability or diagnosis of any listed critical illnesses of the Rider Life Assured. Enjoy continued policy benefits even in case of life's eventualities.

Term Related to Unit Linked Insurance Plans

The ULIP fund value lets you know how much your investment is worth at any given time. You can calculate the amount the multiplying the number of units owned by the Net Asset Value (NAV) or monetary value of each unit.

The sum assured refers to the life insurance payout. The beneficiary receives the sum assured on the policyholder's unfortunate demise during the policy term.

ULIPs allow partial withdrawals from the collected corpus in certain circumstances after the lock-in period. The policyholder can withdraw a small amount from the fund to deal with certain financial situations.

A fund switch allows you, the investor, to make changes to your investment allocation as part of your plan. The number of ULIP funds allowed per year depends on your policy.

A top-up is an additional amount you can pay, over and above the regular premium, to increase the investment in your ULIP.

Your policy document is a contract between you, the policyholder, and your insurance company. You agree to make premium payments, and the insurance company agrees to invest your money and provide life insurance coverage.

Some ULIPs only require one investment at the start, so they are single-premium contracts.

Most ULIPs require you to make monthly, quarterly, biannual or annual payments towards your plan, making them regular-premium contracts.

You can give up your ULIP plan before maturity in contract surrender.

The surrender value refers to the amount the insurance company owes you on contract surrender.

Maturity benefits refer to the funds payable to you by your insurance company on maturity.

On the policyholder's unfortunate demise, the beneficiary receives the sum assured, which is the death benefit.

The survival benefit refers to the periodic benefits the ULIP plan provides the policyholder while the plan is active.

Every insurance company levies certain costs on their ULIPs, such as administrative charges, mortality charges, fund allocation charges and more.

Ulip Plans - FAQ's

What is the full form of ULIP?

ULIP stands for Unit-Linked Insurance Plans. It offers both insurance and investment avenues.

What are different types of funds that ULIP plans would invest in?

Depending on one's financial goals and risk appetite, investors can choose between equity, debt and/or other instruments to invest in. Funds under ULIP plan include a number of instruments. The ratio of debt to equity held is different for every fund. A ULIP has multiple such funds to choose from.

How much return is guaranteed in ULIPs?

The returns on ULIP plans can vary because the investor gets to choose the combination of equity, debt, hybrid funds in their investment. ULIPs with less risk exposure tend to offer lower returns compared to high-risk equity ULIPs.

How units are allotted under a ULIP plan?

Insurance providers collect policyholders’ capital and invest it in funds of their choice. After the amount is invested, the total is divided into 'units' of a specific value. These 'units' are allocated to the investor according to the amount invested by them.

How can I track my ULIP’s fund value?

Fund value simply is the net asset value or NAV of a fund on the given day, multiplied by the number of units held by the investor.

For example, if a fund's NAV is ₹ 50 and an investor holds 3000 units of the fund, the fund value for the investor will be ₹ 50 x 3000 = ₹ 1,50,000.

Comparing the initial and current NAV shows a fund’s progress and returns earned.

What are the main benefits of ULIP plan?

The main feature of ULIPs is that they are insurance plans that help build long-term wealth with their market-linked investment options. They offer a high return potential while also providing dual tax benefits, both on premium payments and on payouts/sum received after maturity.

As per Income Tax Act, 1961. Tax benefits are subject to changes in tax law.

Can we increase the premiums for a ULIP plan?

Investors that have been regular in their premium payments can opt for paying ‘top-up’ premiums, which are additional investments towards the plan. Investors can tap into the potential of a ULIP with good performance history and good returns with these extra premiums.

Can we purchase a ULIP with only a single payment?

Yes. Policyholders can opt for a single premium ULIP plan which requires a one-time payment at the time of purchase of the policy, instead of regular premiums. After the maturity period, the policyholder receives the sum assured. Top-up premiums for these ULIPs may not be available during the first 5 years.

Can I cancel/surrender my ULIP plan?

Yes, you can. The lock-in period for ULIPs is 5 years. If you plan to cancel/surrender the plan after 5 years, you will get the accumulated funds till the date of surrender. If you surrender before the lock-in period then discontinuance charges will be deducted and the balance amount will be paid to the policyholder after the completion of the 5 years lock-in period.

Can we partially withdraw from the ULIP amount?

Most ULIP plans have a lock-in period of 5 years after which the policyholder can choose to withdraw a part of their fund, if the need arises. This is done by ‘cancelling’ some of the units held. There is a limit to the amount that can be withdrawn and it may vary across plans.

Can we surrender a ULIP plan at any time?

The entire fund value is paid to the policyholder if a ULIP plan is surrendered after the 5-year lock-in period. However, the process of surrendering the policy before 5 years is different. The amount will be paid to the policyholder only after the end of 5 years. However, the insurance provider will deduct discontinuance charges from the fund value. The balance is transferred to a Discontinued Policy (DP) fund and a fund management charge of not more than 0.5% is applied. The DP fund will earn interest over time to provide the minimum return guaranteed by the provider.

What is the meaning of fund value?

The fund value refers to the total value of the units a policyholder owns. In ULIP, investors can choose from a variety of schemes as per their risk appetite and financial goals. Fund value on a particular day can be calculated by multiplying the Net Asset Value (NAV) of a unit on that day to the number of units owned by a policyholder.

What is the expiry date of the lock-in period?

The time for which a policyholder cannot withdraw or liquidate the accumulated funds is called the lock-in period.

How Can I Reduce Risk on my ULIP Investment?

ULIP plans provide a variety of fund options for an investor to choose from. Ranging from aggressive to conservative ULIP plans, you can choose as per the market scenarios and your risk-taking ability. If you are risk-averse then you can choose conservative ULIP plans that invest in the debt market.

Is interest on ULIP taxable?

Interest earned on ULIPs is exempt from taxes if the annual premium is up to INR 2,50,000 per year. For annual premiums over the amount, the interest will attract Long-Term Capital Gains (LTCG) tax of 10%.

As per Income Tax Act, 1961. Tax benefits are subject to changes in tax law.

Is ULIP a good plan?

ULIPs provide both insurance and investment, making them a good financial tool to have in your portfolio. They allow flexible investment and give you control over fund allocation, enabling you to decide how and where money gets invested.

What is the difference between ULIP plan, Mutual Funds and SIP?

A Unit-Linked Insurance Plan is a type of investment plan that also provides an insurance component.

Mutual funds are investments that pool together resources from several investors. They do not have an insurance component.

A SIP or Systematic Investment Plan refers to a method of investment in mutual funds.

What happens if I can’t continue ULIPs after five years?

If you discontinue your policy after five years, you will receive the policy's surrender value.

What is sum assured in a Unit-Linked Insurance Plan?

The sum assured refers to the life insurance payout the policyholder’s beneficiary receives as the death benefit.

Can I withdraw the ULIP after five years?

Yes, ULIPs today have a lock-in period of five years, so policyholders are free to withdraw their ULIP plan after this time, though it is not encouraged. You can make a partial withdrawal during some financial emergencies as long as the amount you withdraw does not exceed a percentage of the total premiums paid.

Can I withdraw the ULIP after three years?

No, you cannot withdraw your ULIP plan before the five-year lock-in period. If you surrender it after three years, you will not receive any of the funds payable until after the lock-in period ends.

Is ULIP tax free after five years?

If you surrender your ULIP plan after five years, the surrender value does not attract any taxes, subject to prevailing tax laws.

Is ULIP tax-free on maturity?

The maturity benefit of a ULIP plan is tax-free only if the total premiums paid per year do not exceed INR 2,50,000. If the premiums exceed INR 2,50,000, the maturity amount will attract a 10% LTGC tax3

What is the average return on ULIPs?

ULIPs are market-linked products, so the returns vary depending on market fluctuations, the plan tenure, and your selected funds. You must decide on the best investment avenues based on previous performance, projected returns, and personal financial goals.

Can I surrender my ULIP before five years?

Yes, it is possible to surrender a ULIP plan before the five-year lock-in period ends, but it is not advisable. You will not receive any payouts until after the lock-in period ends if you surrender your ULIP before five years. Additionally, you could have to pay a surrender fee and tax on the investment amount.

Is ULIP better than FD?

A ULIP can be better than an FD if you have a higher risk tolerance and the aim of getting market-linked returns. ULIP ensures the safety of money by providing comprehensive life coverage. It also provides chances of earning high returns through investing.

How to make money through ULIPs?

With a systematic investment plan and market-linked returns, you can make money through ULIPs. With ULIP, you can generate wealth to achieve your long-term goals of meeting your child's expenses, owning a dream house, and more.

Not sure which insurance to buy?

Talk to an

Advisor right away

We help you to choose best insurance plan based on your needs

Here's all you should know about ULIP insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- what is ulip

- ULIP

- ULIP Calculator

- ulip tax benefits

- types of ulip

- why to invest in ulip

- Ulip Vs SIP

- elss vs ulip

- ulip lock in period

- term insurance plan

- savings plan

- retirement plans

- health insurance plans

- child insurance plans

- group insurance plans

- bmi calculator

- compound interest calculator

- Understanding ULIP Insurance

- ULIP Charges

- ULIP Returns in 10 Years

- ULIP for Wealth Creation

- ULIP for Retirement

- ULIP for Health Benefits

- ULIP for Child Education

- Capital Guarantee Solution Plans

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- What is Investment

- nps vs ppf

- short term investment plans

- safest investment options

- one time investment plans

- types of investments

- Best Investment Plans

- Money Back Policy

- life Insurance plans

- life Insurance

- Zero Cost Term Insurance

- critical illness insurance

- Whole Life Insurance

- benefits of term insurance

- types of term insurance

- Endowment Policy

- Benefits of Life Insurance

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Saving Schemes

- Ulip for NRI

- Savings Calculator

- Retirement Planning

- Best Term Insurance Plan for 1 Crore

- features of term insurance

- personal accident insurance

- Insurance Advisor

- Child Education Planner

In unit linked policies, the investment risk in the investment portfolio is borne by the policyholder. The Unit Linked Insurance products do not offer any liquidity during the first five years of the contract. The policyholders will not be able to surrender/withdraw the monies invested in Unit Linked Insurance Products completely or partially till the end of fifth year.

Life Insurance Coverage is available in this product. The unit linked insurance products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender/withdraw the monies invested in unit linked insurance products completely or partially till the end of fifth year. Unit Linked Funds are subject to market risks and there is no assurance or guarantee that the objective of the investment fund will be achieved. The premium shall be adjusted on the due date even if it has been received on advance.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. The name of the company, name of the brand and name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your insurance agent or the intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns.

1. Opt for Settlement Option to receive maturity benefit in periodical installments.

2. As per Income Tax Act, 1961. Tax benefits are subject to changes in tax laws

3. Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions. Tax Laws are subject to change from time to time. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

8. Assured maturity benefit will be paid only on policy maturity provided all due premiums have been paid and will not apply on death or surrender.

10. Save 46,800 on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are a Regular Individual, Fall under 30% income tax slab having taxable income less than Rs. 50 lakh and Opt for Old tax regime

13. This is subject to underwriting norms.

## Individual death claim settlement ratio by number of policies as per audited annual statistics for FY 2024-25.

* Online Premium for HDFC Life Sampoorn Nivesh Plus policy (UIN: 101L180V01) under the Classic Plus Benefits Plan assume an 8% annualized return over a 20-year policy term with a 20-year premium-paying period; please note that these assumed returns are not guaranteed and do not represent minimum or maximum outcomes, as actual performance will depend on various factors including future investment performance. Some benefits under this plan are guaranteed, while others are variable and contingent on the insurer’s future performance in the life insurance business, and the calculations vary based on the selected death benefit amount: for a benefit of Rs. 1,000,000, the the death benefit value is Rs. 11,52,960; for benefits of Rs. 2,000,000, Rs. 3,000,000, or Rs. 5,000,000, the death benefit value is Rs. 21,12,960; and for benefits of Rs. 8,000,000 or Rs. 10,000,000, the the death benefit value is Rs. 96,00,000. Premiums are paid on a regular, monthly basis and are exclusive of applicable taxes and levies, with an example monthly premium of Rs. 2,601 equating to approximately Rs. 86.70 per day. These illustrations are provided for informational purposes only and do not guarantee future performance.The calculations will differ for the remaining illustrations.

** The returns mentioned is the 5-year benchmark return percentage of Nifty 500 Multifactor MQVLv 50 Index data as of August 29, 2025, and is not indicative returns of Top 500 Multifactor 50 Fund (ULIF08219/09/25TopMF500Fd101).

# Tax benefits & exemptions are subject to the conditions of the Income Tax Act, 1961 and its provisions. Tax Laws are subject to change from time to time. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

The Unit Linked Insurance products do not offer any liquidity during the first five years of the contract. The policyholders will not be able to surrender or withdraw the monies invested in Unit Linked Insurance Products completely or partially till the end of fifth year.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. HDFC Life Insurance Company Limited is only the name of the Insurance Company, The name of the company, name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns.

HDFC Life Smart Protect Plan (UIN: 101L175V09) is a Unit Linked Non-Participating Individual Life Insurance Savings Plan, Life Insurance Coverage is available in this product.

HDFC Life Sampoorn Nivesh Plus (UIN No: 101L180V01) is a Unit Linked Non-Participating Individual Life Insurance Savings Plan, Life Insurance Coverage is available in this product.

HDFC Life Click 2 Wealth (UIN-101L133V03) is a Unit Linked Non-Participating Individual Life Insurance Savings Plan, Life Insurance Coverage is available in this product.

HDFC Life Click 2 Invest (UIN: 101L178V01) is a Unit Linked Non-Participating Individual Life Insurance Savings Plan, Life Insurance Coverage is available in this product.

^https://www.hdfclife.com/content/dam/hdfclifeinsurancecompany/about-us/pdf/investor-relations/financial-information/Quarterly-financial-results/HDFC-Life-12M-FY2025-Press-Release.pdf

ARN - PP/09/25/26700