What do you want to do?

1 Why should I purchase policy online?

Following are few of the benefits of purchasing an online life insurance policy.

- Fast And Convenient : Quick and easy steps towards a protected and prosperous future.

- Minimum Paperwork : Policy issued with minimum paperwork.

- Economical : Buying a term insurance policy online is cost effective compared to other modes.

- Real Time Tracking : You can track the application status through customer portal.

Online Customer portal assistance is available to track policy status and issuance (onlineinsurance.hdfclife.com).

2 What are the products and plans available online?

We have a wide range of products and plans available online.

A few of these are highlighted below

Term Insurance:

- HDFC Life Click 2 Protect Life

Saving and Investment Plans:

- HDFC Life Click 2 Wealth

- HDFC Life Click 2 Invest - ULIP

- HDFC Life Sanchay Plus

Retirement Plans:

- HDFC Life Pension Guaranteed Plan

- HDFC Life Click 2 Retire

Health Plans:

- HDFC Life Cancer Care

- HDFC Life Cardiac Care

- Click 2 Protect Health (Combi Plan)

3 How can I purchase policy online?

Buying a policy is simple, please follow the below steps:

- Click on ‘‘All Plans” in the navigation and select the product you wish to apply for.

- Select ‘‘Calculate Premium” and fill the basic details to generate a quote.

- Select the best-suited quote and make the premium payment.

- Please do check the product/plan brochure carefully before opting for the policy.

For assistance, feel free to contact us on 1800-266-9777 (toll-free) between 10:00 am to 7:00 pm, Monday to Sunday or email us at buyonline@hdfclife.in.

4 What is the process after payment is done?

- Once the payment is made, you will receive a confirmation email regarding the same.

- There will be a 13-digit application number generated for your proposal.

- You need to then fill and submit the online application form which contains all basic, health, occupation, family, and existing policy details (the questions vary based on the type of policy purchased). This application form is available on our portal onlineinsurance.hdfclife.com.

- Post successful submission of the application form, please submit KYC documents and Income proof (if required for the policy).

- Medical tests will need to be completed (if applicable for your policy).

- Your application will be underwritten by us on the basis of submitted information & documentation.

- Post underwriting, you will be intimated of the decision regarding your life insurance application.

5 How will I know that the payment is successful?

On successful payment, you will receive a premium receipt on your registered email id along with a con rmation mail. You can also download the premium receipt by visiting our customer portal onlineinsurance.hdfclife.com

- Select Email ID or Application number (enter the 13-digit application number)

- Enter registered Mobile number and Date of Birth

6 What if I've made a payment twice by mistake?

In case of multiple payment transactions, please email us at onlinequery@hdfclife.in along with a copy of your bank statement refecting the transaction details.

7 Is Direct Debit Facility or ECS facility mandatory?

It is important that you activate the Standing Instruction / ECS / Direct Debit mandates at the policy purchase stage itself. This will ensure continuity of your life insurance cover post purchase and timely submission of premiums for savings & investment purposes, where applicable.

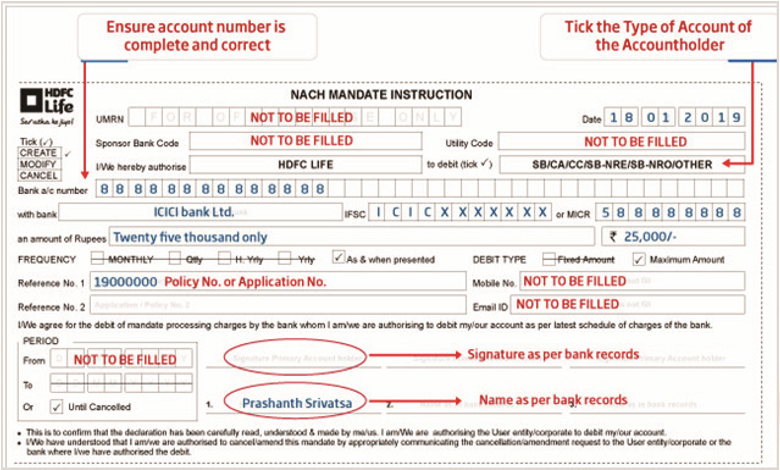

Please fill the NACH (National Automated Clearing House) mandate and send the hard copy to the address given below: HDFC Life, EDM Operations, Closure Desk, Lodha Excelus, 14th Floor, Apollo Mills Compound, N.M.Joshi Marg, Mumbai– 400011.

You can download the NACH mandate from our customer portal onlineinsurance.hdfclife.com.

8 How do I know my application status?

To know your application status or to know the pending requirement for your application, log in to our customer portal onlineinsurance.hdfclife.com.

Select Email ID or Application number (enter the 13-digit application number)

Enter registered Mobile number and DOB

You may either call us on 1800-266-0315 between 10:00 am to 7:00 pm (all days) from your registered contact number only or mail us on onlinequery@hdfclife.in

9 In how many days will the policy be issued post-purchase?

On successful payment and fulillment of all required documents and medical report (if applicable), your policy will be underwritten by us. Our endeavour will be to share a decision with you within 2 working days of submission of all necessary inputs (premium payment, application form, documentation, medical reports or information as required)

ARN: EU/07/21/24772