1 Why should I purchase policy online?

Following are few of the benefits of purchasing an online life insurance policy.

- Fast And Convenient : Quick and easy steps towards a protected and prosperous future.

- Minimum Paperwork : Policy issued with minimum paperwork.

- Economical : Buying a term insurance policy online is cost effective compared to other modes.

- Real Time Tracking : You can track the application status through customer portal.

Online Customer portal assistance is available to track policy status and issuance (onlineinsurance.hdfclife.com).

2 What are the products and plans available online?

We have a wide range of products and plans available online.

A few of these are highlighted below

Term Insurance:

- HDFC Life Click 2 Protect Life

Saving and Investment Plans:

- HDFC Life Click 2 Wealth

- HDFC Life Click 2 Invest - ULIP

- HDFC Life Sanchay Plus

Retirement Plans:

- HDFC Life Pension Guaranteed Plan

- HDFC Life Click 2 Retire

Health Plans:

- HDFC Life Cancer Care

- HDFC Life Cardiac Care

- Click 2 Protect Health (Combi Plan)

3 How can I purchase policy online?

Buying a policy is simple, please follow the below steps:

- Click on ‘‘All Plans” in the navigation and select the product you wish to apply for.

- Select ‘‘Calculate Premium” and fill the basic details to generate a quote.

- Select the best-suited quote and make the premium payment.

- Please do check the product/plan brochure carefully before opting for the policy.

For assistance, feel free to contact us on 1800-266-9777 (toll-free) between 10:00 am to 7:00 pm, Monday to Sunday or email us at [email protected].

4 What is the process after payment is done?

- Once the payment is made, you will receive a confirmation email regarding the same.

- There will be a 13-digit application number generated for your proposal.

- You need to then fill and submit the online application form which contains all basic, health, occupation, family, and existing policy details (the questions vary based on the type of policy purchased). This application form is available on our portal onlineinsurance.hdfclife.com.

- Post successful submission of the application form, please submit KYC documents and Income proof (if required for the policy).

- Medical tests will need to be completed (if applicable for your policy).

- Your application will be underwritten by us on the basis of submitted information & documentation.

- Post underwriting, you will be intimated of the decision regarding your life insurance application.

5 How will I know that the payment is successful?

On successful payment, you will receive a premium receipt on your registered email id along with a con rmation mail. You can also download the premium receipt by visiting our customer portal onlineinsurance.hdfclife.com

- Select Email ID or Application number (enter the 13-digit application number)

- Enter registered Mobile number and Date of Birth

6 What if I've made a payment twice by mistake?

In case of multiple payment transactions, please email us at [email protected] along with a copy of your bank statement refecting the transaction details.

7 Is Direct Debit Facility or ECS facility mandatory?

It is important that you activate the Standing Instruction / ECS / Direct Debit mandates at the policy purchase stage itself. This will ensure continuity of your life insurance cover post purchase and timely submission of premiums for savings & investment purposes, where applicable.

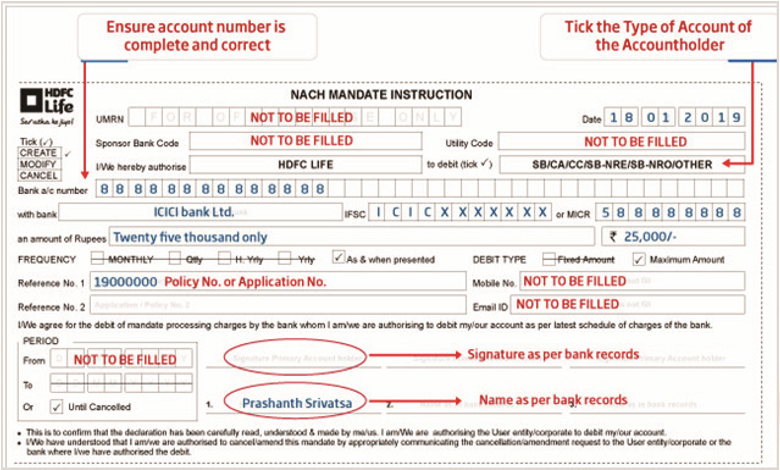

Please fill the NACH (National Automated Clearing House) mandate and send the hard copy to the address given below: HDFC Life, EDM Operations, Closure Desk, Lodha Excelus, 14th Floor, Apollo Mills Compound, N.M.Joshi Marg, Mumbai– 400011.

You can download the NACH mandate from our customer portal onlineinsurance.hdfclife.com.

8 How do I know my application status?

To know your application status or to know the pending requirement for your application, log in to our customer portal onlineinsurance.hdfclife.com.

Select Email ID or Application number (enter the 13-digit application number)

Enter registered Mobile number and DOB

You may either call us on 1800-266-0315 between 10:00 am to 7:00 pm (all days) from your registered contact number only or mail us on [email protected]

9 In how many days will the policy be issued post-purchase?

On successful payment and fulillment of all required documents and medical report (if applicable), your policy will be underwritten by us. Our endeavour will be to share a decision with you within 2 working days of submission of all necessary inputs (premium payment, application form, documentation, medical reports or information as required)

1 I want to assign the policy to my wife under the Married Women's 13 Property Act (MWPA), what are documents required?

MWPA is applicable for life insurance policies. You can read more about it here. Download the MWPA form, fill it and send it to us at [email protected].

2 How should I submit the MWPA form?

You can simply email us the soft copy of completely filled-in MWPA form on [email protected].

3 Whom should I assign as trustee in the MWPA?

The nominee can be the trustee in MWPA.

1 How do I fill the form online or resume application?

The 13 digit number (eg: 1200000000000) is the application number. You can resume your online application form on our Online Insurance Portal onlineinsurance.hdfclife.com.

Select Email ID or Application number

Enter Registered Mobile Number and Date of Birth

Click on Incomplete Proposals - Proposal form

Fill the necessary details asked for

Note: The details are non-editable once the details are saved and submitted.

2 How should I enter my name in the proposal form?

Please enter you first and last name exactly as per the valid ID Proof you will be submitting along with the application.

3 What do I do if I am unable to complete that form due to a technical error? ( For Example: Credential freeze, Form buffering, PIN code acceptance error)

In the event of a technical error, please email us on [email protected] or call us on 1800-266-0315 between 10:00 am to 7:00 pm (all days) from your registered contact number only

4 Should I continue to fill up the application form & submit the same if I have requested for changes or corrections in the earlier fields of the form?

If you have requested for any changes to be done, you can still complete the application form and submit it on our portal onlineinsurance.hdfclife.com.

5 Can I make changes in the application form after completely filling it and submitting it online?

Most details can be changed or corrected without any change in the quote provided earlier. However, a change or correction in some information provided could lead to a change in quotes or the decision. You may email us at [email protected] in the event you wish to make any change or correction.

6 How to fill the application details if I am an occasional smoker or social drinker

If you are an occasional smoker or social drinker, please select “Yes” in the response against the respective question and select the minimum quantity as applicable.

7 How can I access my application proposal form and Illustration?

Once the application form is submitted online, you can download it from our customer portal onlineinsurance.hdfclife.com.

8 What are the requirements if the nominee is below 18 years old?

An appointee will be required if the nominee is below 18 years old. The appointee can be preferably an immediate family member or a legal guardian.

9 What is the list of edits or alterations that can be done in my application before issuance of my policy?

All details can be edited except for the plan option and life assured of the policy.

If changes are to be done related to Sum Assured, Policy Term, Premium Frequency, Addition or Deletion of a Rider i.e. anything related to the illustration, then please generate a new quote illustration with changes required and mail it to us on [email protected].

Note: There may be a change in the premium based on the revised illustration generated.

10 What is the TAT for processing the changes that I have asked for?

It will take around 2 working days from the date the request is raised in the application policy.

11 Why are the changes requested by me not reflecting in the proposal form?

There are certain changes which will not re ect in the application form. For clarification on this, please get in touch with us on 1800-266-0315 between 10:00 am to 7:00 pm (all days) from your registered contact number only or mail us on [email protected].

12 I have not received any status on the alteration or changes requested, what should I do?

Please get in touch with us on 1800-266-0315 between 10:00 am to 7:00 pm (all days) from your registered contact number only or email us on [email protected] for clarification and confirmation.

13 How to make any changes in the policy after successful policy issuance?

You can contact our customer service team on [email protected] for any further assistance related to the policy after the policy is issued.

14 Can I edit the top-up option after the policy has been issued for my HDFC Life Click 2 Protect Life policy? (from Yes to No or No to Yes)

We cannot add the top-up option post issuance of the policy. However, it can be removed from the top-up details post issuance.

1 What are the Valid Age proof, ID proof, and Address proof documents?

Below is the list of most commonly available documents that can be used for Age ID, ID proof and Address proof, provided the details match with the proposal form :

- Aadhar card with complete date of birth in DDMMYYYY format

- Passport

- Driving License

With reference to the recent regulatory changes, PAN or Form 60 (if PAN is not available) has been made mandatory irrespective of the premium amount.

Please refer to the table given below for a quick guide on the acceptable document list:

Sr.No |

List of officially Valid Documents ( OVD ) |

Identity Proofs |

Address Proofs |

1 |

Aadhaar Card |

Y |

Y |

2 |

Pan Card |

Y |

- |

3 |

Passport |

Y |

Y |

4 |

Voter’s Identity Card Issued by Election Commission of India |

Y |

Y |

5 |

Permanent Driving License |

Y |

Y |

6 |

Identity card with applicant’s photograph issued by central / State Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercials bank, Public finance institutions |

Y |

- |

7 |

Letter issued by gazetted officer not more than six months old, mentioning the address along with a duly attested photograph of the person |

Y |

Y |

8 |

Bank account statement/ Passbook not older than six months as on date of acceptance (if it contains photograph) |

Y |

Y |

9 |

Documents (not more than 3 months old) Issued by Government departments of foreign jurisdiction and letter issued by Foreign Embassy or Mission in India (if it contains photograph) |

Y |

Y |

10 |

Central KYC Identifier (can be accepted, if there is no change in the current address of the client) |

Y |

Y |

‘Y’ stands for the document being acceptable in the particular category.

2 What are the Valid Income proof documents?

Salaried:

- Form 16 filed for last 3 assessment years

- Salary slip for last 3 months

- Bank statement reflecting the salary credits for preceding 6 months

Self Employed:

- ITR filed for last 3 assessment year along with Computation of Income

- Audited Company accounts led for last 3 assessment years

Agriculture:

- Mandi Receipt / Form J issued in last 1 year and agriculture records.

- ITR / Form 16 / Assessment Orders / Computation of Income issued in last 3 years

- Bank statement which establishes the source of fund / bank statement (Preceding 6 months)

Please refer to the table given below for a quick guide on the acceptable document list:

Document |

Validity |

Salary slip |

Last 3 Months |

Bank statement |

6 months transactions |

Form 16 |

Filed for Last 2 assessment years |

Income Tax Return (ITR) |

Filed for Last 3 assessment years |

Audited company accounts |

Filed for Last 3 assessment years |

Audited firm Account along with Partnership Deed |

Filed for Last 3 assessment years |

Chartered Accountant's certificate |

Filed for Last 3 assessment years |

Fixed deposits liquidation entries in bank statement/mutual fund redemption entries in bank statement". Also validity will not be applicable for this point since, the source of fund will be established based on liquidation entries |

Recent redemption transactions details |

Rent receipt (issued in last 3 months)with a valid agreement |

Last 3 Months |

Mandi receipt/Form J/Agriculture records |

Current Financial Year |

Foreign Bank statement of specific countries showing credits (Preceding 6 Months) |

6 Months transactions |

Bank statements reflecting cash credit transactions, where individual transaction value per instance and on a particular transaction date do not exceed ₹ 1,00,000/- |

6 Months transactions |

3 Is Aadhar card an accepted proof of document?

Aadhar card with complete date of birth in DDMMYYYY format is an acceptable age proof, Id proof and address proof. If the Date of Birth is 01/01/YYYY, then an alternate age proof / affidavit document would be required.

4 How do I send the documents?

You can upload the documents directly on online insurance portal or email it to us on [email protected]

5 Is PAN Card mandatory?

Yes, PAN Card is mandatory however, if the customer does not hold a PAN, then Form 60 needs to be submitted.

6 I am an existing customer of HDFC Life; do I have to re-submit the documents?

Yes, if there is any change in information previously provided or if your existing policy was issued prior to 5 years, then you need to re-submit the documents.

7 How will I get the questionnaires and forms required for the applications?

All the questionnaires and forms/mandates are available on our customer portal. Log in to the application manager and click on the "Download Questionnaires"

8 How to fill the FATCA form?

Read more about how to fill the FATCA form here

9 What are the documents required to process the application of an NRI?

For NRI policyholders, the KYC and other documents remain the same i.e. Photo, ID proof, Address Proof, Age Proof and Income Proof (if raised).

FATCA form is a mandatory document that needs to be filled and submitted.

NRI Questionnaire is also a mandatory questionnaire to be duly filled and submitted.

If a NRI customer does not hold a PAN then a Declaration in lieu of PAN needs to be submitted

1 How do I schedule my medical appointment online?

Scheduling medicals is easy, all you have to do is visit our online portal, log in with your credentials and schedule your medicals in the View Medical Details section.

- Click on the link available for the medical schedule.

- Select the option for application number, enter your application number and mobile number and click on track.

- Click on Schedule. Fill up all required details i.e. appointment date, timing, sales/agent details or State, City, Locality and select a diagnostic centre that is the nearest.

Note: Some investigations might require fasting/additional preparations; therefore, we request you to check the medical appointment confirmation email for details on this. These details are mailed to your registered email ID.

2 What will be the medical tests that are raised for my policy?

The list of medical tests required for the application will be raised based on the Sum Assured and the age of the life assured. You will be informed about the list of medical tests while they are being scheduled.

- Please carry a Photo Identity Proof

- Carry a copy of the appointment scheduled which you received on your registered email id.

3 If the diagnostic center has not received any email confirmation of my medical schedule, then how should I proceed with the medical tests?

1.Confirmation Email/SMS can be produced at the diagnostic center and on basis of the confirmation communication, diagnostic center will conduct the medicals.

2. In case you and diagnostic center have not received the appointment confirmation SMS/Email, you can contact us on Toll Free number 1800-266-0315 between 10.00 am to 7.00 pm (all days) from your registered contact number only.

4 How do I know for which tests fasting will be required?

Fasting is required for certain medicals, we request you to check the medical appointment confirmation mail for details on this. The details are mailed to your registered email ID.

5 How do I schedule medicals abroad as I am an NRI?

To schedule your medical appointment, please contact us on [email protected].

Note: Please note that the cost of the medical tests completed abroad needs to be borne by the policyholder/life assured.

6 Can the medical examination be conducted at my home?

This service is currently available only in select locations only & for certain medical tests. To check if this is available for your application, please contact us on [email protected] or call us on 1800-266-0315 between 10:00 am to 7:00 pm (all days) from your registered contact number only.

7 I am an existing customer of HDFC Life, do I have to undergo a medical test?

Medicals may or may not be required post assessment of your application.

8 Why are additional documents or medicals being raised for my application?

In select cases, additional documentation regarding your medical history may be called for or additional medical tests may be required to be conducted. This is typically done after a first level underwriting is done and su cient information may not be available for the company to provide you with a decision regarding your application.

9 Why are medicals not being raised for my application?

Applications are assessed basis the disclosures made in the proposal form. Basis company’s special risk assessment guidelines in certain scenarios routine medicals may not be triggered. The final decision would be given basis the information available in the application form and other documents provided.

10 Why are tele-medicals being raised for my application?

Applications are assessed basis the disclosures made in the proposal form. Basis company’s special risk assessment guidelines, a request for Tele medicals may get raised to better understand you medical history. Physical medical examination may or may not be needed.

11 Do I have to bear the cost of medicals raised?

For routine medicals, wherever required, the company will bear the costs for tests conducted in India. In the event additional medical tests are called for or the tests are conducted outside of India, the cost of the same is borne by the customer

12 Why is a medical questionnaire being raised and where are the questionnaires available?

Based on your personal medical history disclosed in the application form or during a medical examination, the medical questionnaire may be raised. This helps to provide additional information and clarity, which enables the team to provide better terms to the client based on the company’s underwriting guidelines.

13 Can I submit my personal medical reports?

- We would like you to complete the necessary medical examinations at one of our empaneled diagnostic centers. However, we encourage you to submit your personal medical reports, if you have undergone a medical examination in the previous 6 months, along with the reasons for having undergone the medical examination.

- On submission, these reports would be reviewed by the underwriting team. You will then be advised about the subsequent course of action to be followed.

- Please note that the company may seek additional tests or require you to have a medical examination conducted at its empaneled diagnostic centers.

1 The decision on your application may take one of the following courses

| Decsion | Your Application Status Post Assessement |

| Proposal Accepted | The application is accepted & the policy is issued |

| Proposal Rated Up (”Counter-Offer”) | There is a revision in terms of acceptance for your application which resulted in change in risk cover and/or premium. You can check the details in application manager and accept or decline the same. |

| Proposal Postponed | We are currently not able to consider your application for insurance basis the assessment undertaken. It has been deferred for a certain period and can be reviewed post that. You will receive a detailed communication to that effect. |

| Proposal Declined | We are not able to consider your application forinsurance based on the assessment undertaken. You will receive a detailed communication to that effect. |

2 What is a counter-offer or a rate up and why do I have it in my application?

The life insurance premium quote generated prior to the submission of application assumes the life assured having standard health conditions. On the basis of information provided in the application form, history of medical conditions provided and/or tele-medicals/medical examination conducted by the company, a detailed risk assessment is conducted and proposal is underwritten.

A counter-offer or a rate up is typically for an additional premium and is initiated post an underwriting evaluation. Other variants may include offering a lower life insurance for the premium already paid or putting an upper limit on the life insurance that we can offer you. You will find the reason for the counter-offer raised in your application in the rate-up letter uploaded in the application manager. You have the right to accept or to decline the counter-offer made to you by us.

3 How to accept or decline counter-offer or a rate up?

You need to simply log in to application manager, onlineinsurance.hdfclife.com and give your consent of rate up by accepting or declining the counter-offer.

4 How can I pay the counter-offer or a rate up premium?

Post accepting the rate up on the online insurance portal, you need to pay the additional premium online. You can make the payment as per the online payment offer options available.

5 How can I get the medical reports?

Medical reports will be updated on “My Account” portal on our website after successful policy issuance. Once the policy is issued, a copy of the reports will be shared with you on your registered email id.

6 What are the options to reduce Sum Assured/adjust the premium, if the rate of premium is very high?

The options are

- Adjust sum assured within the paid premium

- Can remove riders if any to adjust/reduce the premium

- Can change frequency or term (Policy term or premium paying term)

7 What is the next step if I do not accept the counter- offer or rate up?

Counter-offer has been raised after a thorough review of your details. However, if you still do not wish to accept it, you can reject the counter-offer by visiting our customer portal.

Log in to application manager on onlineinsurance.hdfclife.com. Select the "reject" option raised against the counter-offer

1 By when will the policy document be shared?

Policy EFDF will be credited in your (e-IA) account as well as you will receive the soft copy on your registered email ID within 3-5 working days from the policy Issuance date.

2 Can I link my term plan to my home loan or any loan?

Yes, you can, if you are the primary borrower of the loan, then you can assign the policy to the lending bank. Request you to get in touch with our customer service team and your respective bank for more details on this. The customer service team can be contacted on [email protected].

3 What is e-IA - Electronic Insurance Account?

e-IA stands for e-Insurance Account or Electronic Insurance Account, which will safeguard the insurance policy documents of policyholders in electronic format. This e-Insurance account will facilitate the policyholder by providing access to the insurance portfolio at a click of a button through the internet.

Each e-Insurance Account will have a unique account number and each account holder will be granted a unique Login ID and Password to access the electronic policies online.

4 How will I receive the login credentials and welcome kit for an e-IA account?

You will receive the login credentials and welcome kit through email from the Insurance Repository.

5 If I have not received the email for e-IA account login details, then whom should I contact?

You may get in touch with the relevant Insurance Repository at the undermentioned email IDs. You can also email your query to us at [email protected]

1) NSDL Database Management Ltd - [email protected]

2) Central Insurance Repository Limited - [email protected]

3) Karvy Insurance Repository Limited - [email protected]

4) CAMS Repository Services Limited – [email protected]

6 What are the benefits of Electronic Insurance Account?

Below are the benefits of e-IA:

- Eliminates multiple KYC

- Lacunae relating to physical documents is eliminated

- Policies in electronic format

- Single view for all policies

- Portfolio tracking for insurance policies

- Platform based on internet

- Access based on unique Login ID and Password

- Eliminates Loss Due to Theft/Natural Disaster

- Consolidated insurance statement on an annual basis

- Online payment for Renewal Premium

- Alerts and messages

- Alerts on transactions/modification

- Eliminates communication to different insurance companies separately for updations

- User-friendly navigation

- All insurance policies under one umbrella

7 What are the benefits of Electronic Insurance Account? Is the demat account of share trading same with that e-IA account of insurance?

No, both are two different accounts. A Demat account of shares is governed by SEBI and e-Insurance Account is governed by IRDAI

8 How can I log in to an e-IA account?

You will receive the e-IA account details and login credentials on your registered email ID.

1 What is the procedure for application cancellation?

We would not want you to discontinue your relationship with us. However, if you still wish to cancel the application, then call us on 1800-266-0315 between 10:00 am to 7:00 pm (all days) from your registered contact number only, with the cancellation request or email us on [email protected] with the reason for cancellation.

2 Will I get a complete refund of the premium paid?

Refund will be processed after deduction of medical charges (if undergone).

3 By when will I get my refund?

Refund will be received within 15 days from the application cancellation date.

4 Are additional documents needed for a refund?

Refund is processed via online mode only and the amount will be credited to the same account used to make the payment. However, in some cases you may be required to submit NEFT mandate along with a personalized cancelled cheque or bank account statement reflecting your name, account number and IFSC details.

5 Is there any cancellation charge?

No, there are no cancellation charges. However, medical charges will be deducted if the same has been undergone

6 Why is my refund delayed?

- The turnaround time to process a refund is 15 days from the date of policy cancellation.

- If the refund is still not received, request you to check your registered email ID for any email received for any requirement, i. e. NEFT mandate and cancelled cheque etc.

- Or you can contact us on 1800-266-0315 between 10:00 am to 7:00 pm (all days) from your registered contact number only or email us on [email protected] for clarification and confirmation.

1 How do I make the renewal premium payment online?

- You can pay the premium online by visiting: https://onlinepayments.hdfclife.com/HDFCLife/quick_pay.html

- Just enter your policy number and Date of birth in DD/MM/YYYY format and proceed for a quick hassle-free payment

2 What are the other options to pay renewal premium?

We also have the below options to make the renewal premium payment:

- Pay at nearest HDFC Life Insurance branch.

- Pay at nearest HDFC Bank

- You can drop cheques and demand drafts drawn in favour of HDFC Life Policy No. XXXXXXXX into any of our drop boxes installed at various locations in various cities.

- For more information, please visit our website at this link: https://www.hdfclife.com/customer-service/pay-premium

1 What are the customer care contact details before the issuance of my policy?

Prior to policy issuance: Toll-free number on 1800-266-0315 between 10:00 am to 7:00 pm (all days) from your registered contact number only.

Email us on [email protected]

2 How do I get in touch as I am currently abroad and my policy is not active?

You can email us on [email protected] for any query or request.

3 What is the complaint escalation matrix prior to policy issuance?

Write to us with your 13-digit application number at [email protected]. The escalation matrix is available on our online insurance portal. You can visit the link given below for details on the same.

“https://onlineinsurance.hdfclife.com/customer-service/escalation-matrix”.

4 What is the contact point after successful policy issuance?

Call us on 1860-267-9999 between 10:00 am to 7:00 pm, Monday to Saturday.

Email at [email protected] or [email protected]

(for NRI customers only)

ARN: EU/07/21/24772