What do you want to do?

- What Is a Life Insurance Policy?

- Differences Between Types of Life Insurance

- Life Insurance Plans for Different Life Stages

- Why is it important to buy a Life Insurance Policy?

- How Does Life Insurance Plans Work?

- Who can purchase a Life Insurance Policy?

- Types of Life Insurance Plan

- Life Insurance Plans are Simple to Understand!

- Tax Benefits of Life Insurance (Section 80C and Section 10(10D))

- How Does A Term Insurance Policy Work?

- Life Insurance Coverage Amount Explained

- Benefits of Life Insurance Plans

- Important Terms About Life Insurance Plans in India

- How To Choose A Life Insurance Policy?

- Factors to Consider Before Choosing the Best Life Insurance Policy in India

- Do’s and Don’ts When Dealing With Life Insurance Policies

- How to Select the Right Life Insurance Plan for Yourself and Your Family?

- How much Life Insurance cover does one need?

- Life Insurance Plans offered by HDFC Life

- What Is Human Life Value, And Why Should You Consider It Before Deciding On Your Life Cover?

- Factors that Impact Life Insurance Premium

- Should One Buy More Than One Life Insurance Policy?

- What Are the Benefits of Buying the Best Life Insurance Policy Online Compared to Offline?

- What Are the Payout Options Available for HDFC Life Insurance Plans?

- Riders in Life Insurance

- Steps to Buy Life Insurance Policy Online

- Documents Required to Buy a Life Insurance Plan in India

- Important Documents to Get Your Life Insurance Claim Amount Smoothly

- How to Save Tax with a Life Insurance Policy?

- How to File a Life Insurance Claim?

- Important Documents to Easily Receive Your Life Insurance Claim

- Claim in Case of Death

- What Types of Death Are Not Covered by Life Insurance?

- What happens if there is no nominee or if the nominee has already passed away at the time of the death claim?

- Claim in Case of Maturity

- How to Avoid Life Insurance Claim Rejection?

- Why Should Women Consider Investing In A Life Insurance Policy?

- Crucial Situations When You Should Consider Reviewing Your Policy

- FAQs on Life Insurance Policy

- Here's all you should know about life insurance

- Popular Searches

- Disclaimer

What Is a Life Insurance Policy?

A life insurance policy is an agreement between an insurance company and an insurance policy policyholder. Here, the insurer promises to pay a significant amount of money in exchange for the premium, upon the sudden demise of the insured individual or after a certain period.

By paying premiums, you can avail all the benefits of a life insurance policy. Thus, it is wise to choose a premium only which is affordable. A life insurance policy works only if a policyholder pays out all premiums regularly.

There are specific types of policies where a policyholder can choose benefits of critical illness or additional protection coverage against any unfortunate accident. The two main types of life insurance policies are savings plans and pure protection plans.

Savings Plan: With a savings plan, you can enjoy dual benefits such as comprehensive life coverage and a disciplined method of savings to reach major financial goals, such as buying a house or meeting expenses for your child's higher education.

Pure Protection Plan: Term insurance is categorised as a pure protection plan designed specifically for securing the future of your family. It provides a substantial payout to cover expenses, including debts or meeting daily needs, in case of your sudden death.

Different life insurance solutions are designed to cater to different financial needs. For those living abroad, Life Insurance for NRI provides essential financial protection for families and dependents in India, ensuring their security even when the policyholder resides abroad.

Differences Between Types of Life Insurance

Here is a detailed overview of the different types of life insurance plans in India:

|

Term Life Insurance Policy |

Endowment Life Insurance Policy |

Money Back Insurance Plan |

Unit Linked Insurance Plans (ULIP) |

Whole Life Insurance Plan |

Overview |

Affordable plan that provides financial protection to your family |

Provides a death benefit upon the policyholder’s death or a maturity benefit |

Provides a return amount periodically along with life coverage benefits |

Policyholders invest in debt funds and diversified equity funds with a lock-in period of 5 years for partial withdrawal |

Provides coverage till 100 years of age and cash value at a fixed rate of interest |

Maturity Benefits |

Nomaturity benefits |

Offers maturity benefits |

Offers maturity benefits |

Offers maturity benefits |

Offers maturity benefits |

Death Benefits |

Offers death benefits |

Offers death benefits |

Offers death benefits |

Offers death benefits |

Offers death benefits |

Purpose |

Provides pure risk cover |

Provides insurance cover plus low-risk savings |

Returns the premium paid plus additional income, bonuses and death benefit |

Provides insurance cover plus investments |

Provides a fixed risk cover over your life |

Life Insurance Plans for Different Life Stages

With the right insurance policy, policyholders can secure financial protection for their loved ones and achieve their future goals. Here are the best plans for different life stages:

Starting Your Career

If you begin to earn, opt for a basic term life insurance policy. This is an affordable way of securing your family’s financial security during times of any unfortunate accident. Check out the premiums applicable for term insurance for young professionals.

...Read More

Getting Married:

After marriage, your financial responsibilities are shared. By opting for a joint life insurance policy, both partners can be protected over the foreseeable future. The coverage applicable for a newly married couple will differs per the policy chosen.

...Read More

Becoming a Parent

When you become a parent, choose a policy offering a combination of protection and savings. These might include a whole life or endowment plan applicable to securing your child's future. Calculate the future costs of education for your child and calculate the required life coverage.

...Read More

Retirement Planning

To experience stress-free days after retirement, choose a plan offering a stable income and financial stability, such as an annuity or pension plan. To lead a hassle-free life post-retirement, compare returns on different retirement plans.

...Read More

Why Is It Important to Buy a Life Insurance Policy?

Buying a life insurance policy is important as it provides financial security to family members during the sudden death of the insurance policyholder. Here are the points to consider to understand the importance of purchasing a life insurance policy:

Financial Security for Loved Ones

A life insurance policy offers financial security to your loved ones. All life insurance plans provide death benefits. Your family members (covered by the plan) will receive the sum assured on your sudden demise. Thus, your family members will be financially secure even in your absence.

...Read More

Income Replacement

Life insurance policies provide financial assurance to your family members for paying the mortgage, covering tuition fees or maintaining a family business. With the death benefit, they can also afford healthcare and other emergencies. Certain insurance plans like endowment policies and ULIPs also let you invest money.

...Read More

Funeral and End of Life Expenses

Proceeds from a life insurance policy can cover funeral costs and end-of-life expenses. Thus, your family members are relieved of financial burden. They can thus concentrate on healing without worrying about immediate financial expenses.

...Read More

Estate Planning and Inheritance

Life insurance provides a tax-free inheritance to your beneficiaries. Thus, assets are distributed equally and provide financial security to your family members after your demise.

...Read More

Tax Benefits

If you have other insurance plans like employer-provided plans or government schemes providing life cover, you do not need an expensive plan. Take the sum assured amount provided by these options when choosing a life insurance policy.

Life insurance premiums for your chosen policy qualify for tax deductions of up to ₹1.5 Lakh deductions under 80C of the Income Tax Act, 19611. The death benefits are exempted from taxes applicable under Section 10(10D). The premiums applicable for medical care riders qualify under section 80D of the Income Tax Act.

...Read More

Business Continuity

Investing in a term plan is essential if you are the owner of a company. Opting for this short-term plan will let you avail low premiums but a high lumpsum amount to provide financial assistance during times of need. This sum assured amount will let your business partner handle all pending accounts seamlessly.

...Read More

Peace of Mind

Investing in an insurance plan provides you with peace of mind. Opting for an insurance plan is essential to provide financial security for your family in the future. There are a plethora of options available for you to choose from regarding an insurance policy. There are affordable plans for every individual.

...Read More

Affordable Premiums

The earlier you begin investing in your chosen insurance policy, the more you will benefit. If you are in good health, your premium amount will be lower while the insurance coverage will be higher.

...Read More

Saving for Retirement

Solving for your retirement needs is crucial as you might not have a regular source of income post your retirement. Pension plans can provide you with a sustained regular income that can help you live a stress-free retirement. If you are behind in retirement planning, start with buying a life insurance plan. Investing in a plan at an early age will let you pay lower premiums. So, maintaining a monthly, quarterly, or annual fee, you can begin with an investment plan, thereby gradually contributing to your retirement fund.

...Read More

Risk Management

If you are the sole earner of your family, managing your family financially during any unfortunate incident will be your major concern. Here, life insurance is an ideal solution for risk mitigation. The main objective of life insurance is to mitigate risk and offer financial assistance to your loved ones in your absence.

...Read More

Coverage Options

Opting for the right life insurance, including whole life insurance, term insurance or annuity plan, will provide you with sufficient contingencies based on your needs. Select a plan considering your financial goals and objectives.

...Read More

Debt Repayment

During your working phase of life, you can choose to avail loan for purchasing a house, or a car, meeting your child's higher education expenses or even for debt repayment. In case you die suddenly before paying off the loan, the debt burden falls entirely on your family members. Even if your loved ones are employed, managing due expenses might become difficult for them.

Here, comes the importance of life insurance if you have comprehensive life insurance coverage. It thereby becomes possible for your family members to pay off the debt amount with the assured sum and lead a stable and peaceful financial life independently. For instance, policies opted for under the Married Women's Property Act of 1874 also prevent creditors from staying attached.

...Read More

Future Financial Planning

There are various life insurance policies available which let you choose a plan at every stage of your life. Be it saving to attain a specific goal such as retirement or putting your earnings into a investment plan, for the future of your child, you can continue planning for your desired goals with the right choice of a life insurance plan.

In case you are getting married, choose a life insurance plan safeguarding your spouse's financial future. In case of your sudden demise, your spouse can utilise the life insurance policy and proceed with dignity. On the other hand, if you are planning to start a family, being a parent, you need to withhold financial responsibilities.

Purchasing any life insurance plan for your child can assist you in securing your child's future in your absence. Moreover, by choosing the right child insurance plan, you can proceed to save for your child’s higher educational or marriage expenses.

...Read More

How Does Life Insurance Plans Work?

Life insurance is a contract where an insured individual pays a small amount as a premium to ensure protective coverage. The insurer provides this significant amount to your family members during your sudden untimely demise. Usually, the life insurance remains operational for a limited period.

Thus, if you die within this prescribed period, the life insurer is mandated to pay death benefits, also termed as the sum assured. However, in case you survive the policy tenure, you might receive maturity benefits considering the type of life insurance. Considering the death benefits, you can avail more benefits with whole life insurance plans.

Who Can Purchase a Life Insurance Policy?

Let us look in detail at the different categories who can buy life insurance policy:

Age Group

A life insurance policy is an important financial tool that provides protection and security across all age groups. Irrespective of your age group, life insurance protects your near and dear ones, even in your sudden demise.

For Young Adults: Life insurance is important for young adults. Starting to invest at an early age allows policyholders to pay lower premiums and build a strong financial foundation. Alongside this, it promotes disciplined planning to address any unforeseen situations.

For Families: For families, life insurance offers protection to dependent individuals. Investing in a life insurance plan assures financial support to your family so that they can maintain a decent standard of living even in your absence. The larger your family, the more life insurance coverage you should get.

For Seniors: Through proper retirement planning and estate management, seniors can avail benefits from life insurance. Annuity plans provide a regular source of income after retirement and ensure financial security. Additionally, life insurance provides support in estate planning, thereby allowing seniors to provide financial support to their loved ones.

...Read More

Citizenship

In India, life insurance policies are available to Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs). Both NRIs and OCIs can buy life insurance in India to provide financial protection to their family members. However, there is a need to submit proof of residency and citizenship during the application process.

...Read More

Other Aspects

Here are a few other aspects to consider while deciding who can buy a life insurance plan:

Smokers: Similar to non-smokers, smokers can also purchase a life insurance policy. The rate of premium though can vary across smokers. However, smokers must inform the insurers beforehand about their habit of smoking while they proceed towards purchasing a life insurance policy.

Disabled Individuals: Disabled individuals can also buy the best life insurance policy if they can prove to offer services to their family members. These individuals need to go through various medical tests for the best rate of premium in a life insurance policy considering the degree of risks involved.

People With Existing Health Issues: Insured individuals with existing medical health conditions can also purchase life insurance. To inform the insurance company about pre-existing health conditions, if any, is a must. Failing to disclose about the health issues during purchase of a policy might reject your claim later on.

...Read More

Types of Life Insurance Plan

There are different types of life insurance plans designed specifically to meet the diverse financial needs of policyholders. From providing basic financial protection to offering different investment opportunities, these plans provide financial security for yourself and your loved ones.

Here are the different kinds of life insurance policies explained in detail:

1. Term Insurance Policy

Term insurance plans are one of the simplest and most affordable insurance policies. It lasts for several years before it expires. The premium amounts are pocket-friendly as these plans only provide death benefits. If the policyholder's death occurs within a specific period, the sum assured amount is then paid to the nominee.

2. Savings Plans

Savings plans are a kind of life insurance policy that offers protection with investment. Over time, policyholders can build a substantial corpus with this plan. Alongside, this plan helps policyholders arrange for funding to meet long-term goals such as marriage and education expenses with a monthly payout or lump sum at maturity.

3. ULIP Plans

With ULIP Plans, you can avail flexibility in investment. In this plan, a certain percentage of the premium amount is used to provide life coverage, while the remaining portion is contributed towards investment in the capital market. The policyholder can choose from different funds invested in debts, equities, money market instruments, etc.

4. Retirement Plans

Investing in a Retirement plan, allows you to be worry-free about future finances. Also known as a pension plan or annuity, these are designed specifically to provide a regular source of income to the policyholder after retirement. However, if the policyholder passes away during the policy term, the nominee is provided immediate financial support.

5. Child Insurance Plans

Child insurance plans offer an easy way of securing your child's future. These plans are designed specifically to meet your child's future financial needs. It provides annual instalments, and you can withdraw them once your child reaches adulthood. In case of the parent's unfortunate demise, both death benefits and maturity benefits are paid.

6. Group Insurance Plans

Group Insurance Plans offer financial coverage to a group of individuals, be it employees or members involved in an organisation. These are cost-effective plans offering basic protection and strong financial support during the sudden demise of the policyholder's death.

7. Whole Life Insurance Plans

The Whole Life Insurance policy provides comprehensive coverage till 100 years of age. It provides death benefits and a cash value that provides interest at a fixed rate. Each month, a significant portion of the premium is deposited into the cash value of the policy at a fixed rate of return.

8. Money Back Life Insurance Plans

This life insurance plan provides a return periodically with life insurance coverage benefits. A certain percentage of the sum assured is returned to the policyholder at regular intervals during the entire tenure of the policy. The remaining portion is paid at the end of policy maturity. In case there is a sudden demise of the policyholder, the entire sum is paid to the nominee in addition to the previous payouts.

Life Insurance Plans are Simple to Understand!

Yes, life insurance plans are simple and quite easy to understand. Being an insured individual, you must have a sum assured amount in mind that you want your life insurance policy to cover. This amount should be adequate to provide financial support to your family members in case of any unfortunate incident.

Because of the availability of a wide range of life insurance policies, policyholders are confused at times. But in most cases, life insurance policies function similarly, making it easier for policyholders to understand them.

...Read More

Tax Benefits of Life Insurance (Section 80C and Section 10(10D))

Purchasing life insurance will allow you to be eligible for tax deductions of up to ₹1.5 Lakh under Section 80C of the Income Tax Act, 19611. The amount you receive upon maturity will not be subjected to taxes as per the conditions laid out in Section 10(10D) of the Income Tax Act, 19611. Tax laws, however, can be amended from time to time.

How Does A Term Insurance Policy Work?

A term insurance policy lends coverage for a specific period, which could vary from person to person. If the policyholder passes away within this term, the beneficiaries receive the death benefit. For example, Raj, a 30-year-old, buys a 20-year term policy with a ₹1 crore death benefit. He pays an annual premium of ₹10,000 to keep the policy active. If Raj passes away at 40, his beneficiaries receive the said ₹1 Crore. The same amount will be paid if Raj expires at 35 or 45 years. The death benefit amount remains the same, irrespective of the total premium paid by the policyholder. However, this applies only if the policyholder has died within the covered term. Now, if Raj survives the 20-year term, the coverage ends, and no payout is made unless he has opted for a return of premium rider.

Life Insurance Plans Coverage Amount Explained

Here is the list of things to consider while looking into the amount of coverage in a life insurance plan:

Current and Future Income

Choosing the best life insurance policy with a good payout option is ideal for covering both your current and future income. This will let your family members maintain their standard of living and meet financial obligations in your absence.

Thus, keep paying the premiums on time to keep your chosen policy going. Choose a life insurance cover that enables you to support this expense every year with your current income. Consider your other expenses and liabilities when choosing the coverage amount.

...Read More

Loans and Debts

Closing all pending loans and debts is important for living worry-free. If you have pending automobile loans, credit card debt, student loans or mortgages, you will need enough life insurance coverage to repay them. This lets the family members stay less worried, knowing all debts will be paid off through death benefits. Moreover, it lets them avoid the loss of pledged property.

...Read More

Financial Goals

Policyholders should consider their financial goals, including saving for post-retirement days, covering educational expenses, medical treatment costs for older parents, and so on. These goals and the coverage amount help to determine the insurance coverage needed.

...Read More

End of Life Expenses

Make sure to take into consideration the end-of-life expenses that include funeral and burial, treatment costs, and others. Hospital care is one of the largest financial factors when considering end-of-life expenses. Alongside, memory care, nursing home care, and in-home care are other categories of care that may need expense coverage.

...Read More

Other Coverage

If you have other insurance plans like employer-provided plans or government schemes providing life cover, you do not need an expensive plan. Take the sum assured amount provided by these options when choosing a life insurance policy.

...Read More

Benefits of Life Insurance Plans

Let us gain a thorough understanding of the several benefits of life insurance plans:

Financial Support

One of the main benefits of life insurance plans is the financial support it provides to your family. Investing in a proper life insurance policy at an early age will provide a lump sum amount in case of any unfortunate incident. Without any life insurance, your family may remain financially worried and struggle to maintain the standard of living and pay off existing debts in your absence.

...Read More

Loan Collateral and EMI Payments

Life insurance can serve as loan collateral, and thereby allow policyholders to secure loans against the value of policy. This enables individuals to access funds during emergencies without liquidation of other assets. In case of the sudden demise of a policyholder, the payout amount of insurance can help dependents settle outstanding loans and thereby ensure financial stability. Thus, life insurance offers a dual advantage – acts as prime security for loans and safeguards the closed one from the burden of unpaid debts.

...Read More

Tax Benefits

Choosing the right life insurance plan provides you with dual tax benefits. With payment of premiums, you can avail tax deductions under Section 80C of the Income Tax Act1. This implies that for payment of premiums of up to Rs. 1.5 Lakh, taxes are deducted from your gross income, thereby reducing your tax outgo. Additionally, the maturity insurance plans might be tax-free completely. However, you can avail these tax benefits under Section 10(10D) of the Income Tax Act1.

...Read More

Additional Benefits

During the sudden demise of the policyholder, it is the nominee who receives the entire assured sum amount as long as you are paying your premiums in full. Further, the nominee can use the received sum from term insurance to cover a wide range of expenses from clearing out routine bills to paying back loans, meeting the educational expenses of children and other expenses.

...Read More

Important Terms about Life Insurance Plans in India

Here are the important terms you should know about while availing life insurance plans in India:

Terms |

Meaning |

Sum Assured |

Sum assured is the guaranteed2 income a nominee receives upon the sudden demise of the policyholder during the term of the policy. The policyholder decides this amount during the time of buying the policy. |

Life Assured |

The insured individual is called the life assured. In the event of the life assured’s death or accident, the nominee receives the coverage amount. |

Death Benefit |

Death benefit implies the amount a nominee received from the life insurance company upon the sudden demise of the insurance policyholder within the prescribed tenure. Make sure to keep in mind that the terms death benefit and sum guaranteed are different. Because the death benefit might exceed the sum guaranteed and might consist of rider and other additional benefits. |

Maturity Benefit |

Maturity benefit is the amount a policyholder receives once a policy matures upon completion of tenure if he/she survives the policy term. |

Riders |

Riders are additional benefits for enhancing your financial protection against the sudden demise of a policyholder. |

Free Look Period |

The free look period is the period that provides a policyholder 30 days after the issuing date of the policy to examine its terms and conditions and cancel it without penalties. |

Lapsed Policy |

If any policyholder fails to pay premiums within the due date, it results in the cancellation of insurance. Lapsed policy refers to the scenario when a policyholder fails to pay the due premium amount even after the grace period. However, certain life insurance companies renew a lapsed policy if a policyholder manages to pay the due premiums within the prescribed period. |

Grace Period |

The extension provided to the policyholder after the due date of premium payment is called the grace period. |

Revival Period |

Failing to pay a premium during the grace period causes your policy to lapse. However, if you are willing to continue with the policy, you can re-activate the lapsed policy within the grace period. This particular period is called the revival period. |

Claim Process |

Claiming process is another important service an insurance company provides to its customers. Insurance companies manage to settle claims without delay. However, for settling claims, you need to fill out a claim form and contact the financial advisor from whom the policy is bought. |

Exclusions |

A life insurance policy doesn't cover certain things. If a policyholder’s claim is not covered under the terms of the policy, the provider doesn’t pay you any benefit. Suicide is a common exclusion of an insurance plan. |

Policy |

Policy means the life insurance policy a policy owner holds. It is a legally binding contract that exists between a policyholder and the insurance company. The policyholder is an individual who purchases the insurance and pays out regular premiums. The tenure of policy opted for however varies from one policy to another and usually ranges between a year to a lifetime. |

Policy Tenure |

Policy tenure is the period during which the life insurance policy offers insurance coverage. In other words, it is the period for which the policy is purchased. |

How to Choose a Life Insurance Policy?

Choosing the right kind of life insurance policy requires consideration of certain key factors. Here are the important points you should consider for further evaluation:

Assess Your Financial Needs

First, take a good look at your financial situation. Think about your family's daily living expenses, any outstanding debts, future education costs for your kids, and other financial commitments. People's financial situations vary, and so do their life insurance needs. For example, term policies are ideal for basic life insurance coverage, while ULIPs are best for long-term investments.

Check and Compare Different Types of Life Insurance Policies

Before opting for an insurance plan, make sure to check, compare, and familiarise yourself with the terms and conditions of different policy plans. There are many types of life insurance policies available in India that have unique benefits. The right choice completely depends on how much life coverage you need.

Check the Provider’s Reputation

While choosing an insurance provider, go for an insurance policy with a good reputation for reliability and financial stability. Choosing a reputable insurer will ensure the financial protection of your family members in your absence. A stable life insurance company with a high claim settlement ratio will likely pay out claims without delay.

Read Reviews

Finally, read the reviews and testimonials from current policyholders. Customer testimonials provide valuable insights into the service quality and reliability of insurers. Overall, it builds trust in policy and showcases the impact of positive reviews.

Solvency Ratio

Solvency Ratio demonstrates the financial position of the insurance company. It shows whether the insurer is in a position to honour its commitments financially or not. Second, a high solvency ratio indicates whether the company is good and less risky or is less likely to be unable to meet its obligations. Search for insurance companies that have a solvency ratio greater than the minimum admitted by the regulatory authority.

Claim Settlement Ratio

Settlement of claims is a core business of any insurance company and the claim settlement ratio describes how fast the company is paying off claims. It is the ratio of claims resolved to total claims they received in a given year. It means that the higher value of the ratio reflects the fact that the insurer is trustworthy. Therefore, select a company that has a claim settlement ratio of an impressive 95% or higher so that your family can have relatively hassle-free claim processing when the time comes.

Premium

Premiums are the amount paid for your chosen insurance policy. Make a thorough comparison of policies from different insurance companies. Ensure that your chosen premium aligns with your budgetary requirements without compromising coverage. There are many online tools available for premium calculation. Also, find out if the policy provides flexible options for payment.

Factors to Consider Before Choosing the Best Life Insurance Policy in India

Here are some important factors to consider before you proceed towards choosing the best life insurance policy in India:

Goals

Before you proceed to purchase life insurance coverage, make sure to note down your goals. Each individual has different goals in life. As an insured individual, you might need a life insurance plan to protect your family while some others might find ways of investing for their retirement. Thus, assessing your future goals is necessary and accordingly picks up a plan that benefits you the most.

Age

While planning to purchase a life insurance policy, your age and health condition play a vital role. The premium amount you ought to pay and the insurance coverage are two prime factors. The younger you are, the more it will be easier to purchase life insurance as the health condition would be relatively better. Alongside this, at a younger age, you can also opt for a low premium amount. Considering these advantages, make sure to buy a life insurance policy at an early age.

Debts

Looking into repayment of debts is another crucial factor to consider. During your sudden demise, the entire responsibility of paying back your debt along with other liabilities might fall on your loved ones. Thus, if you have any loan due pending, make sure to consider them while deciding the life insurance coverage amount. Choosing a sufficient assured sum is mandatory, to let your family clear the dues on time without any hassles. This thereby will also ensure your loved ones lead a stress-free life.

Stable Income

Choosing the right life insurance policy provides a stable and secure source of income for your beneficiary. This money is a substitute for your income and allows you to cover daily expenses as well as any unexpected medical emergencies. Life insurance plans are designed specifically to provide a regular source of income to both self-employed and salaried individuals' family members.

Remaining Employment Tenure

Make sure to consider an estimate of your remaining tenure of employment. This will thereby provide you with a clear idea of how much you can invest. Alongside, it also allows you to decide the adequate sum for meeting the requirements of your family members. Moreover, if you are planning to continue investing in life insurance retirement plans, choose wisely your investment decisions putting your retirement age into preference.

Do’s and Don’ts When Dealing With Life Insurance Policies

In this section, we have segregated the discussion regarding the do's and don'ts of dealing with life insurance plans:

Do’s of Life Insurance Policies Here are the list of things you should do while opting for life insurance policies: |

Don’ts of Life Insurance Policies Let’s explore the list of things a policyholder should not do while purchasing life insurance policies: |

Purchase Insurance Earlyon: Purchasing life insurance at an early age allows you to enjoy comprehensive bigger coverage at much lower premiums comparatively. Not only this, but it also provides financial protection for your family members during unexpected times if opted for insurance at an early stage. |

Do not miss out on premium payments: Make sure to pay your insurance premiums on time. Missing to pay premiums or delaying can cause lapses in your insurance coverage. |

Go Through the Policy Document Carefully: Make sure to devote enough time to read and understand the policy document thoroughly. Following this will enable you to reach an informed decision making and know your coverage. |

Avoid Providing False Information: During the entire application process, refrain from providing any false or incorrect information. This can thereby lead to rejection of claims and further cancellation of the policy opted for. |

Compare Policies: Conducting a thorough comparison of insurance companies and their policies will let you find the one offering an affordable premium, the best coverage and better customer service. Alongside, you can also compare the assets under management, claim settlement ratio and number of individuals covered by insurance companies. This data however can vary from one insurance company to another. |

Do not Delay to Purchase Insurance: Do not procrastinate in purchasing life insurance. The delay in the buying process can make your loved ones financially unstable during any unfortunate incident. |

Add Riders: To further enhance your life insurance coverage, consider adding riders to your policy. Adding riders can assist you in providing additional financial assistance during times of need. |

|

How to Select the Right Life Insurance Plan for Yourself and Your Family?

Choosing the right kind of insurance plan provides financial assistance for you and your family. It safeguards your loved ones, looks after their financial needs and provides peace of mind during uncertain times.

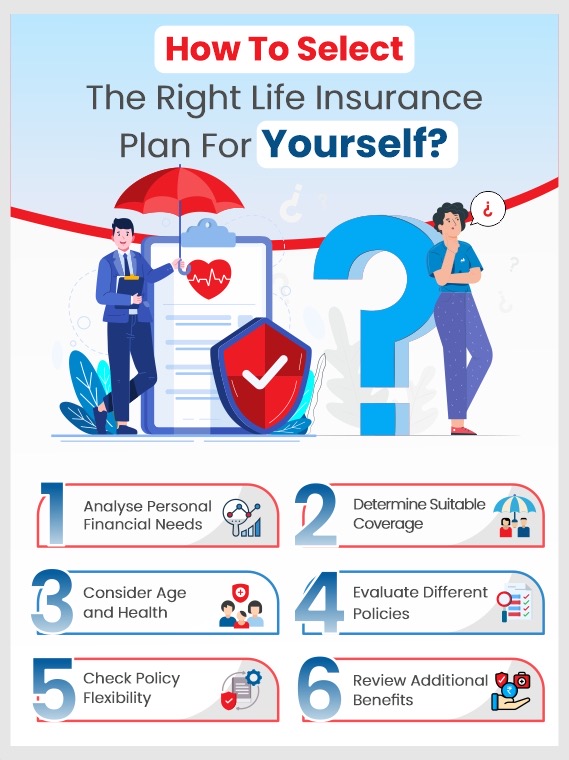

How To Select The Right Life Insurance Plan For Yourself?

Here are the factors to consider for choosing the right kind of life insurance for yourself:

a) Analyse Personal Financial Needs: Gain a thorough understanding of your financial goals and responsibilities. Make sure to assess your needs and other expenses relating to loans, education and daily needs. The chosen plan should provide enough support to meet these requirements. Choose a plan wisely.

b) Determine Suitable Coverage: Considering your financial requirements, decide your coverage. The coverage amount however should be adequate for protecting your loved ones during any unforeseen circumstances.

c) Consider Age and Health: Both age and health play a vital role in assisting you in choosing the right plan. Opting for insurance at a younger age allows you to pay less premiums. However, if you have worse health conditions, choose plans as per your pre-existing conditions.

d) Evaluate Different Policies: Make a thorough comparison of life insurance policies to choose the one that fits your needs. Consider whole-life policies, term plans or ULIPs. Consider other comparison tools available online to reach an informed decision making.

e) Check Policy Flexibility: Make sure your chosen plan provides flexibility. Search for options where you can change your coverage or policy tenure as per the change in your needs. There are some plans also which allow partial withdrawals during emergencies.

f) Review Additional Benefits: Choose policies that offer riders or add-ons such as accidental death benefits, critical illness coverage or waiver of premium. By availing of these benefits, you can experience additional financial security in specific situations.

Following the above-mentioned factors, you can select a life insurance plan for yourself that aligns with your financial goals and ensures maintaining financial safety.

How To Select The Right Life Insurance Plan For Your Family?

Choosing the right kind of life insurance plan ensures maintaining financial security for your family. Let’s look into those factors you should consider while choosing the right plan and make an informed decision:

a) Assess Family Financial Needs: Understand the current and future expenses of your family. Make sure to consider their medical needs, repayment of loan criteria, costs of living, educational expenses and others. Considering these factors let you choose a policy providing you support for financial well-being.

b) Determine Coverage Amount: Determine the coverage amount considering the income and financial needs of your family. The sum assured considers all essential expenses for years. According to several experts, choose an insurance coverage which is approximately about 10 to 15 times your annual income.

c) Consider Future Goals: Consider the long-term goals of your family including your child's marriage, educational expenses or purchasing a house. Ensure you receive sufficient funds from your chosen policy to meet the desired goals and make it easier for your family members to manage even when you are not around.

d) Evaluate Policy Types: Make a thorough comparison of the different types of policies such as whole life insurance, term plans and endowment plans. Opting for a term plan, you can avail high coverage at affordable premiums. While endowment plans combine both savings and insurance. Thus, consider a policy that suits the needs of your family considering their budget requirements.

e) Review Policy Features: Go through the policy features such as the premium options of payment, increasing the insurance coverage and add-ons. Opt for the rider to avail of additional protection. Riders include additional benefits of death and critical illness coverage. Make sure your chosen policy allows you to withdraw funds partially during emergencies.

Through careful evaluation of the needs of your family and coverage options, choose a plan that provides peace of mind and financial security.

How much Life Insurance cover does one need?

To examine the life insurance coverage of your chosen insurance policy, let’s consider the following factors:

Number of working years

In the current years of your employment, you might have made retirement plans to be able to spend some time with your family without worrying about future expenses. Determining the coverage amount enables you to choose a premium for easy handling of expenses during these years of life.

Keeping this in mind, you can choose a limited pay option where you will get the option of paying premiums early. Or else, you can plan to pay monthly premiums and include coverage under different insurance policies.

Regular Expenses

Before determining the life coverage, make sure to consider all your fixed and necessary expenses. This includes grocery bills, fuel expenses, clothes, water bills, and other expenses. Provide coverage about 10 to 12 times the income earned yearly.

Landmark Stages in Your Family’s Life

Consider the goals your family might want to meet in the future, including retirement, weddings, and college education. You may need to uphold different responsibilities during different stages of your life.

For example, at 25 years of age, you might have fewer responsibilities. But at 40 years of age, you might have a spouse or kid and thus want to purchase a whole life plan that provides comprehensive coverage for your whole life.

Life Insurance Plans offered by HDFC Life

Let’s look into the different life insurance plans offered by HDFC Life:

Life Insurance Plan |

Description |

HDFC Life Click 2 Protect Super |

A comprehensive term insurance plan offering financial protection to your loved ones at affordable premiums. |

HDFC Life Sanchay Plus |

A savings cum insurance plan that provides guaranteed2 returns and financial security for your family's future. |

HDFC Life Click 2 Wealth |

A unit-linked insurance plan (ULIP) that offers the dual benefits of life insurance coverage and investment opportunities to help you achieve your long-term financial goals. |

HDFC Life Guaranteed Pension Plan |

A retirement plan designed to provide a regular income stream and financial stability during your golden years. |

HDFC Life YoungStar Udaan |

A child insurance plan that secures your child's future by providing funds for education, marriage, or other milestones, even in your absence. |

What Is Human Life Value, and Why Should You consider it Before Deciding On Your Life Cover?

Human Life Value is a financial concept that determines the current value of your liabilities, expenses, and investments. This indicator helps you estimate the amount necessary to provide financial security to your family during your sudden demise or any unfortunate incident. For an accurate calculation, take the help of the Human Life Value (HLV) calculator.

Why Consider HLV Before Deciding on Your Life Cover?

Let’s consider the factors behind considering HLV:

a) Financial Planning: With proper financial planning, you can achieve financial stability. Using the HLV calculator, you can assess the economic value of an individual's life.

b) Estate Planning: The HLV calculator provides a clear image of an individual's financial condition. This thereby helps in distributing wealth among heirs.

c) Insurance Coverage: HLV is important to calculate when determining life insurance coverage. Life insurance is instrumental in building a solid financial foundation.

d) Business and Partnership Valuation: HLV is important to calculate to determine each partner's contribution to business. Upon the untimely demise of a business partner, the HLV assists the deceased partner's family members.

Factors that Impact Life Insurance Premium

Here are the factors to consider that impact the life insurance premium. Let us understand those factors in detail below:

Sum Assured

The sum assured is one of the most significant factors in determining the premium. Generally, the higher the sum assured, the higher the premium. When using an online insurance calculator, you'll notice that as the life coverage increases, so does the premium. It’s essential to choose a sum assured based on your liabilities, income, and financial needs to ensure you get adequate coverage without overpaying.

Age

Age plays a crucial role in determining the premium. As you age, the likelihood of health issues increases, leading to higher premiums. Starting your term insurance at a younger age can help you lock in a lower premium, as younger individuals tend to have fewer health risks compared to older individuals. Therefore, purchasing insurance early is more cost-effective.

Gender

In India, women generally pay lower premiums compared to men. This is due to the higher life expectancy of women, allowing them to continue their policies for longer, leading to lower premiums. However, as a woman’s age increases, her premium may rise accordingly.

Medical History

A person’s health is one of the most critical factors in determining insurance premiums. Most insurers require a medical examination to assess your health status, including any existing conditions or illnesses. If you have chronic or serious health issues, your premium is likely to be higher compared to someone in good health.

Lifestyle

Your lifestyle choices, such as smoking or drinking, can also impact your premium. A history of smoking or regular alcohol consumption raises the risk of health problems, leading to higher premiums. Conversely, maintaining a healthy lifestyle can help keep premiums lower.

Occupation

Although less significant, your occupation can influence your premium. Jobs that involve higher risk, such as construction or mining, may result in higher premiums due to the increased risk of injury or death. The impact of occupation on premiums can vary between insurers.

Considering these factors when choosing your term insurance plan will help you make informed decisions and find the best policy for your needs.

Should One Buy More Than One Life Insurance Policy?

This decision completely depends upon your present financial health and future needs and goals. Whether you should have multiple policies depends on how much coverage you are seeking. More policies, on the one hand, can widen the coverage, but on the other, they can be a financial burden in your present circumstances.

Having multiple policies works for those seeking to reduce risk and ensure that they have another policy to bank upon in case of delayed or rejected claim settlement from one.

Still, managing multiple policies can be challenging, with risks of delayed or missed premium payments, leading to coverage lapses. Hence, it is best to assess the risks and rewards of this decision before going ahead with multiple policies.

What Are the Benefits of Buying the Best Life Insurance Policy Online Compared to Offline?

There are many benefits of purchasing life insurance online including convenience, cost and freedom. It makes it quicker and cheaper and provides splendid customer care that makes it easier to use than offline methods.

The benefits of applying for the best life insurance policy online are as follows:

Cost Efficiency

Purchasing a life insurance policy online is more cost-effective than offline mode. Moreover, by opting for online policies, you need to pay low premiums because there exsist no intermediaries. There are even many insurers who offer exclusive online discounts on the chosen policy. With a thorough comparison of plans on online platforms, you can select the best plan aligning with your budget. Thus, online purchase becomes a transparent option and meets your affordability.

...Read More

Convenience

The primary benefit of purchasing an online life insurance policy is its convenience. You can proceed to apply for life insurance from the comfort of your home or office. There is no need to visit the office of an insurance agent. Fill up the available application form online and upload all relevant details. This thereby helps you to save a lot of time and effort.

...Read More

Customisation

It is easy for people to get their life insurance policies adapted online nowadays. The coverage can be modified to include employees or exclude some temporarily or you can also alter the term and include certain options available depending on your organisation’s needs. There are many websites offering tools to estimate the premiums as well as main and additional riders for extra coverage. Such flexibility guarantees that the policy being sold to you suits your pocket. Customisation through internet methods is comparatively faster and easier than that done through offline techniques.

...Read More

Customer Support

There is always customer support available through online chat, emails or through a phone call on insurance websites. This means you do not need to wait for an agent so that you can address your concerns which can be responded to immediately. Most platforms also provide elaborate sections where they explain policies to enhance your understanding. It makes customer support online highly reliable by guaranteeing an easy buying process for clients.

...Read More

What Are the Payout Options Available for HDFC Life Insurance Plans?

HDFC Life Insurance Plan provides flexible payout options catering to the needs of respective policyholders. Here are the four different payout options HDFC offers:

Income:

This payout option offers a claim payout monthly in instalments to take care of the monthly financial needs of the family.

Lump sum:

Under this option, comprehensive life coverage is paid out in fixed amounts to the nominee during the sudden demise of the policyholder at unexpected times

- Increasing Income

- Lump Sum Plus Income

Riders in Life Insurance

Here is a detailed explanation of the different types of riders available in life insurance plans:

01 Accidental Death Benefit Rider

Accidental death benefit rider provides policyholders financial assistance for reducing stress and managing finances efficiently. In case, there is a sudden demise of a policyholder because of an accident, this death benefit rider provides financial compensation over the sum assured.

Generally, these kinds of riders in insurance offer additional benefits equal to the assured sum. This thereby increases the benefits of total insurance. Opting for this rider plan is beneficial for families with only a source of income.

02 Waiver of Premium Rider

Waiver of Premium Rider is ideal for disabled individuals and their inability to work. In this scenario, this rider assists in paying your premium amount and enables your policy to continue working. The eligibility criteria for this rider vary from one insurer to another, so make sure to research the eligibility conditions mentioned in your chosen place.

03 Critical Illness Rider

If any insurance policyholder gets diagnosed with a life-threatening disease, opting for a critical illness rider will provide you additional coverage benefits. The compensated amount provided is on the basic assured sum, thereby making it a preferred rider type in insurance.

Examples of severe illnesses covered in critical illness riders include kidney failure, cancer, heart attack, major organ transplantation, stroke, paralysis and more.

04 Term Conversion Rider

By opting for a term conversion rider, you can proceed to convert a term life insurance policy into a whole life insurance policy at the end of the term. This can also appear in the form of a "term conversion provision" statement mentioned in your policy. Choosing this rider might be more affordable for accessing permanent coverage in life. This is because, as you grow old, buying any new brand will become more expensive.

05 Child Term Rider

A child term rider is another optional feature that you can add to the term life insurance policy of a parent or any other insurance policy for adding security and safety for children. This rider policy is designed specifically to meet the interests of children. It also provides death benefits upon sudden and unexpected death of a child. The death benefit takes into consideration several expenses such as medical bills, costs of funeral or any outstanding debts.

06 Accelerated Death Benefit Rider

In cases where the life insured is found to be suffering from an illness that reduces their life span, the accelerated death benefit rider provides financial compensation in advance. The insurance provider in this scenario might consider withdrawing the amount with interest from compensation assigned to the beneficiary.

07 Long-Term Care Rider

By opting for the long-term care rider, you can avail payments every month if the insured individual needs home care or a stay at a nursing home. Many insurers are providing stand-alone long-term care policies. Considering your requirements and looking at your long-term costs of treatment, you can select riders.

Steps to Buy Life Insurance Policy Online

Purchasing a life insurance policy online is simple and hassle-free. Let's explore a step-by-step guide to purchasing a digital life insurance policy online.:

Make a selection of the insurance plan catering for your needs by thorough comparison of premium amounts, coverage, costs and terms offered in India

...Read More

Consult an online calculator for estimation of your premium amount

...Read More

Provide all relevant information in the application form before submission. These details include your name, age, gender, occupation, with other important information

...Read More

Scan copies of your documents such as age, income, domicile document, identity proof, etc. and upload it

...Read More

If your health calls for a certain medical examination, you might need to do so

...Read More

Go through the entire document of policy and read the small prints before proceeding to make any payment

...Read More

Make payment of the premium amount online through debit/credit card, digital wallet, net banking and others

...Read More

After successful verification of documents and upon receiving approval of your application form, you will receive the relevant documents delivered to you either through courier or email

...Read More

Go through those documents before uploading them for future reference

...Read More

Documents Required to Buy a Life Insurance Plan in India

While buying a life insurance plan in India, make sure to present the following documents for easy approval. Here are the mandatory documents:

-

![key points key points]()

Proof of Residence

-

![key points key points]()

Birth Certificate

-

![key points key points]()

PAN Card

-

![key points key points]()

Income Tax Returns

-

![key points key points]()

Medical Records from the Past

Important Documents to Get Your Life Insurance Claim Amount Smoothly

Presenting the following documents is essential to get your life insurance claim amount smoothly:

Photo Identification Proof

...Read More

Address Proof

...Read More

Details of Your Bank Account

...Read More

Death Certificate

...Read More

Policy Documents

...Read More

Proof of Legal Title to Claim Proceeds

...Read More

Medical Records

...Read More

Bank Discharge Form

...Read More

How to Save Tax with a Life Insurance Policy?

Choosing a life insurance coverage allows you to avail tax benefits apart from providing financial security. Let's explore this in detail further.

Deductions Under Section 80C

Deductions under 80C of the Income Tax Act1 Premiums paid towards life insurance policies are eligible for tax deductions. There is a maximum deduction of ₹1.5 lakh per financial year.

This tax deduction is available for premiums paid towards insurance policies for spouse, dependents, self and dependent parents. Life insurance premium tax benefits are applicable to whole life insurance plans, endowment plans, term plans, Money Back Policy, and Unit Linked Insurance Plans (ULIPs).

Maturity Proceeds

The maturity proceeds from life insurance policies are tax-exempt under Section 10(10D) of the Income Tax Act1. However, the premium must not exceed 10% of the sum assured in any year during the policy term. Furthermore, the total premium amount you pay in a year cannot be above ₹5,00,000.

Rider Premiums

Premiums paid to riders are also eligible for section 80D. Section 80D of the Income Tax Act1 allows you to avail a tax deduction on the premiums paid while opting for a critical illness rider with your chosen health insurance plan. You can get deductions of up to ₹25,000 per year and ₹1,00,000 for senior citizens.

Tax-Free Death Benefits

According to Section 10(10D) of the Income Tax Act1, the death benefit received by the nominee/legal heir is tax-free. Here, the amount you receive is fully exempted from income taxes, subject to suitable terms and conditions. The tax exemption is applicable for the bonus, maturity value, assured sum, surrender value, and death benefit.

Tax-Free Surrender Value

When a policyholder surrenders the policy before its maturity date, the surrender value/amount received is tax-free under Section 10(10D) (although conditions apply here).

Pension Plans

Premiums paid towards life insurance pension plans are eligible for tax deductions under Section 80CCC1. However, there is an overall limit of INR 1.5 lakh on these under Section 80C.

Exemption for HUF

Life insurance premiums paid for members of a HUF are also tax-benefited under Section 80C, subject to the overall limit.

How to File a Life Insurance Claim?

Filing a life insurance claim is essential to secure the financial benefits. The insurance company provides information on the policyholder's death and submits necessary documents. Here are the ways to follow for filing a life insurance claim:

Online claim

To easily submit your claim online, go to the HDFC Life Claims section on the official website page. To begin the claim process, make sure to provide relevant details of the policyholder and nominee and submit it.

Claim At Branch

Download the claim form from the official website and submit it after filling it out with the correct details. Submit the other supporting documents at your nearest HDFC branch.

Claim Via Phone

Call the Claim helpline number to initiate the claim settlement process via phone.

Important Documents to Easily Receive Your Life Insurance Claim

The documents to present for availing your life insurance claim are easy. It also calls for easy approval. Have a look at the following documents you need to keep ready:

- Birth Certificate

- Proof of Residence

- PAN Card

- Income Tax Returns

- Records of medical history from the past

All the above documents are required along with KYC.

Claim in Case of Death

If there is a sudden demise of the insured individual, the nominee can then continue following the below-mentioned steps for raising a life insurance policy claim:

- Inform immediately the insurer about the unexpected event taking place through call, website, email or in-person

- Keep all relevant documents ready and submit them. These documents include documents relating to hospitalisation, death certificates and others. KYC proofs should also be attached including an Aadhaar card, PAN card and other necessary documents. Alongside this, make sure to FIR papers if there is any accidental death or suicide or present a cancellation cheque.

- The documents are further reviewed and a settlement is issued from the respective insurance company.

What Types of Death Are Not Covered by Life Insurance?

To minimise the risk of rejection of death claims, let us look into the deaths that are excluded from life insurance coverage:

- Suicide

The majority of life insurance companies in India do not include death by suicide during the initial years of term insurance policy. Thus, make sure to check out the inclusions and exclusions of the death insurance policy through the brochure of the plan you have opted for.

From the date of opting for a term life policy, if the insured individual dies by suicide within 12 months, the insurance provider doesn't accept this claim. In other words, death caused by suicide is exempted from the insurance coverage during the first 12 months of purchasing the policy.

However, if the policyholder dies by suicide during the exclusion period of insurance purchase, 80% of the paid premiums are then further returned to the nominee. Whereas, if the insured individual dies due to suicide after 12 months of purchase of the policy, the benefits of death are then further paid out to beneficiaries.

Homicide Involving the Nominee

Death claim is subjected to rejection if a policyholder is murdered and the nominee remains involved in the crime. Individual policyholders can only avail death benefits if the murder-related charges are dropped or if the nominee is surrendered.

On the other hand, if the insured individual dies because of involvement in any criminal activity, there are no death benefits offered. However, if a criminal background check is conducted for the policyholder who dies due to some natural causes, then the death claim is passed on to the nominee.

What happens if there is no nominee or if the nominee has already passed away at the time of the death claim?

In case, if there is no nominee or if there is a sudden demise of the nominee during the time of death claim, proof of title or succession certificate is mandatory to issue from the court. The name of the person mentioned in the proof would then receive the claim amount. This kind of condition is often termed an 'Open Title' situation.

If the claim is accepted but waiting for issuance of a certificate or proof, then the money is further kept on hold till submission of proof and payment.

Claim in Case of Maturity

To claim for the maturity of your life insurance plan, follow the detailed steps below:

- Contact with the insurer following any of the methods – call, email, website or in-person

- Submit all relevant details including PAN card, Aadhaar card, life insurance policy certificate and other documents with a cancellation cheque.

- The insurance company further goes through your submitted documents, reviews them and issues the settlement.

How to Avoid Life Insurance Claim Rejection?

Here are the things you must know to get your life insurance policy claim settled hassle-free:

Do Not Hide Information

On-Time Premium Payment

Keep Nominee Information Up to Date

Do Not Avoid Medical Tests

Do not avoid undergoing medical tests, as they provide insurers with an idea of your medical history and smoothen your insurance claim settlements.

Hiding information while choosing a life insurance plan is the most common reason for claim rejection. Some of the details you must not hide include the details of pre-existing diseases, age, occupation, consumption of alcohol, smoking habits, and others.

Failing to pay your premium on time causes your policy to lapse. Even if you missed paying the premium by the due date, pay it within the grace period.

Make sure to keep the information regarding the nominee updated as and when required. If you are single, mention your parent's name as a nominee. If you are married, you can add your spouse's or child’s name as a nominee.

Why Should Women Consider Investing in a Life Insurance Policy?

Women should invest in a life insurance policy to provide financial security to their families during times of need. Let’s look into the factors in detail below:

01 Protection for Children

Choose a life insurance plan that provides coverage for your child. This lets you pay a single premium that offers a comprehensive package for you and your child. This way, both generations can stay protected under a single policy while making it easy to manage payments.

02 Protection for Spouse

Investing in the right life insurance plan protects both spouses (the wife and husband) under a single policy. If the death of one of the policyholders occurs, the term insurance plan pays out the benefits to the survivor.

03 Leave a Legacy

A whole life insurance plan is an effective mode of wealth accumulation for not only the next generation but also after that. Because the term is extendable up to the age of 100 years, it ensures your grandchildren also receive the sum assured from your life coverage.

04 Income Replacement and Financial Security

If a woman is not the sole breadwinner of the family, life insurance policies such as ULIPs and money back are quite crucial. Opting for a life insurance plan with guaranteed payouts helps a woman build her wealth to be financially independent and secure.

Crucial Situations When You Should Consider Reviewing Your Policy

Here are some situations when you need to consider reviewing your life insurance policy:

Situation |

Reason To Review Your Policy |

Getting married |

Marriage introduces new financial responsibilities and dependents. Therefore, it is a must to reassess coverage to ensure adequacy. |

Having children |

With parenthood, your financial obligations increase. This makes it important to ensure adequate coverage for your kids’ future. |

Taking a loan |

When you take a large loan, it is wise to take additional coverage to protect against financial burdens. |

Dependents facing medical conditions |

Medical issues among dependents can increase financial strain. It requires enhanced coverage for financial security. |

FAQs on Life Insurance Policy

1 What is life insurance policy?

A life insurance policy is a contract/agreement between the policyholder and the insurance company. Under this policy, the insured commits to paying premiums for a pre-determined period to the insurer. In exchange, the insurer guarantees to pay a certain sum as a death benefit to the insured’s beneficiaries.

2 What are the 4 main types of life insurance?

The four main types of life insurance are whole insurance, term insurance, endowment plans, and Unit Linked Insurance plans.

3 Why is life insurance plan useful?

Life insurance is useful as it offers financial protection to your loved ones in the event of your death. It ensures that your dependents are financially secure. The benefits help them maintain their standard of living even after you are not there. Additionally, life insurance can help cover expenses such as funeral costs, outstanding debts, loan payments. It also helps with future financial needs like education or retirement funding.

4 How much does life insurance policy cost?

The cost of life insurance varies based on several factors. These include - age, health, lifestyle, coverage amount, type of policy, and term length. Generally, younger and healthier individuals pay lower premiums compared to older or less healthy individuals.

5 What are the different options available for premium payments?

Insurance companies offer various options for premium payments. Some of the most common ones include - annual, semi-annual, quarterly, and monthly payments.

6 What are the consequences of non-payment of premium?

Non-payment of premiums has serious consequences on your life insurance policy. If you miss premium payments, your policy may lapse. As a result you lose coverage and any accumulated cash value. Some policies offer a grace period during which you can make late payments to avoid lapsing. However, if you fail to pay within the grace period, your policy may terminate.

7 How can I file the claim in case of insured person's demise?

A death claim can be filed online or at the nearest branch. In case of natural death following needs to be provided:

Mandatory documents

Original policy document (Not necessary in case of dematerialised policy document)

Death Claim Form

Death certificate issued by local authority

Claimant's passport size photograph

Personalized Cancelled Cheque or Bank Passbook (with Printed A/c no, IFSC & Name account holder)

Claimant's Valid Identity Proof

Claimant's Valid Address Proof

Claimant's PAN CARD/Form 60 (if PAN Card not available)

Employer’s certificate (Form) for Life Assured, if employed (not required for pension/ annuity plans)

Additional Documents

Medical cause of death certificate

Medical records for all the treatments taken in the past. (Admission notes, History / Progress sheet, Discharge /Death summary, Test reports, etc.)

Note:

Self-Attestation is required on any photocopies of the KYC or any other document copies submitted by the Claimant.

HDFC Life may call for documents apart from the above (case specific).

8 What is a 5 year life insurance policy?

A 5-year life insurance policy is a short term insurance that keeps the insurer covered for five years. It offers tax benefits and death benefits, but there is no cash out in this case. If the policyholder passes away while the policy is valid, the death benefit amount is paid out to the beneficiaries.

9 When can I start to pay the life insurance premiums?

You must pay your first premium to activate your life insurance policy. The premium payment activates your cover. You may pay your premium monthly, quarterly, semiannually, or annually, depending on the policy's terms and your choice.

10 Will I have to pay tax on my life insurance policy's maturity benefit?

According to Section 10(10D) of the Income Tax Act, 19611, the maturity benefit from a life insurance policy is non-taxable if the premium you paid is either not more than 5 lakh a year or does not exceed 10% of the sum assured.

11 What do you mean by paid-up value in life insurance?

The value of the sum assured after premium payment has been stopped by the policyholder (before the maturity date) is called the paid-up value. In such a case, the policy will remain in force with a reduced death benefit. This benefit amount is then based on the premiums paid and the length of time the policy has been active.

12 Which type of life insurance plan is the most affordable?

A term life insurance plan is the most affordable type of life insurance plan. It offers coverage for a specific period, say, 10 years or 20, or 30 years. There is a death benefit if the policyholder dies within the term. Premiums for term insurance are lower compared to whole life insurance.

13 How long does life insurance take to payout?

Life insurance payouts typically take between 15 to 60 days after a claim is filed. The variation in timelines comes from various factors including the insurance company's processes and the completeness of the submitted documentation. Delays can also take place if there is any investigation required or if the necessary paperwork is incomplete.

14 What happens if I outlive my life insurance policy term?

If you outlive the term of your life insurance policy, the outcome depends on the type of policy you have. If it is a Term Life Insurance, the cover ends without any payout unless the policy has a return of premium feature. In the case of Whole Life Insurance and universal life insurance, as long as you pay the premiums, the policy cover is maintained, and the accumulated cash value provides a health benefit whenever the insurer passes away. If yours is an endowment policy, you receive a sum assured plus bonuses, if any, when the policy matures.

15 How to benefit from life insurance?

Well-designed life insurance provides tax benefits, death benefits, and income replacement at affordable premiums to benefit financially during urgent times.

Here's all you should know about life insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance solutions - protection, pension, savings, investment, annuity and health.

Popular Searches

- term insurance plan

- term insurance calculator

- Investment Plans

- savings plan

- ulip plan

- retirement plans

- health plans

- child insurance plans

- group insurance plans

- saral jeevan bima yojana

- income tax calculator

- bmi calculator

- compound interest calculator

- income tax slab

- Income Tax Return

- benefits of term insurance calculator

- what is term insurance

- why to invest in life insurance

- Ulip vs SIP

- tax planning for salaried employees

- how to choose best child insurance plan

- Retirement Planning

- 1 crore term insurance

- HRA Calculator

- Annuity From NPS

- 2 crore term insurance

- 5 crore term insurance

- 1.5 crore term insurance

- Retirement Calculator

- Pension Calculator

- What is Investment

- Best Investment Plans

- benefits of term insurance

- types of life insurance

- types of term insurance

- Endowment Policy

- Benefits of Life Insurance

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- life insurance

- life insurance policy

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Saving Schemes

- Ulip for NRI

- Life Insurance for NRI

- Investment Plans for NRI

- what is nominee in insurance

- features of life insurance

- Best Term Insurance Plan for 1 Crore

- features of term insurance

- personal accident insurance

- Life Insurance Calculator

1. Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions. Tax Laws are subject to change from time to time. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

2. Provided all due premiums have been paid and the policy is in force.

***Online Premium for Life Option for HDFC Life Click 2 Protect Super (UIN: 101N145V07), Male Life Assured, Non-Smoker, 20 years of age, Policy term of 25 years, Regular pay, Annual frequency, exclusive of taxes and levies as applicable. (Monthly Premium of 622/30=20.7).

^ Available under Life & Life Plus plan options

#Provided we have received all the relevant and required documents and no further investigation is required. Claim settlement process would be completed within stipulated timelines once the claim request is approved

##Individual claim settlement ratio by number of policies as per audited annual statistics for FY 23-24

15. HDFC Life Click 2 Protect Ultimate(UIN: 101N179V01) A Non-Linked, Non-Participating, Individual, Pure Risk Premium/Savings Life Insurance Plan. The policy must be in force on the date of death, with all premiums fully paid, except for the exclusion clauses mentioned in Part F of the policy document.

@As per integrated annual report FY23-24, available on www.hdfclife.com. As of May 2024

ARN - DM/01/25/20492